December Week 1 Bitcoin On-Chain Data Summary — Investors Continue to Buy, Sentiment Stable with No Panic Selling

At this stage, I prefer to look at simple data, especially the exchange inventory data, which I focus on daily. Although the price trend of $BTC has not been good in the past two weeks, it is evident that many investors are still buying the dips.

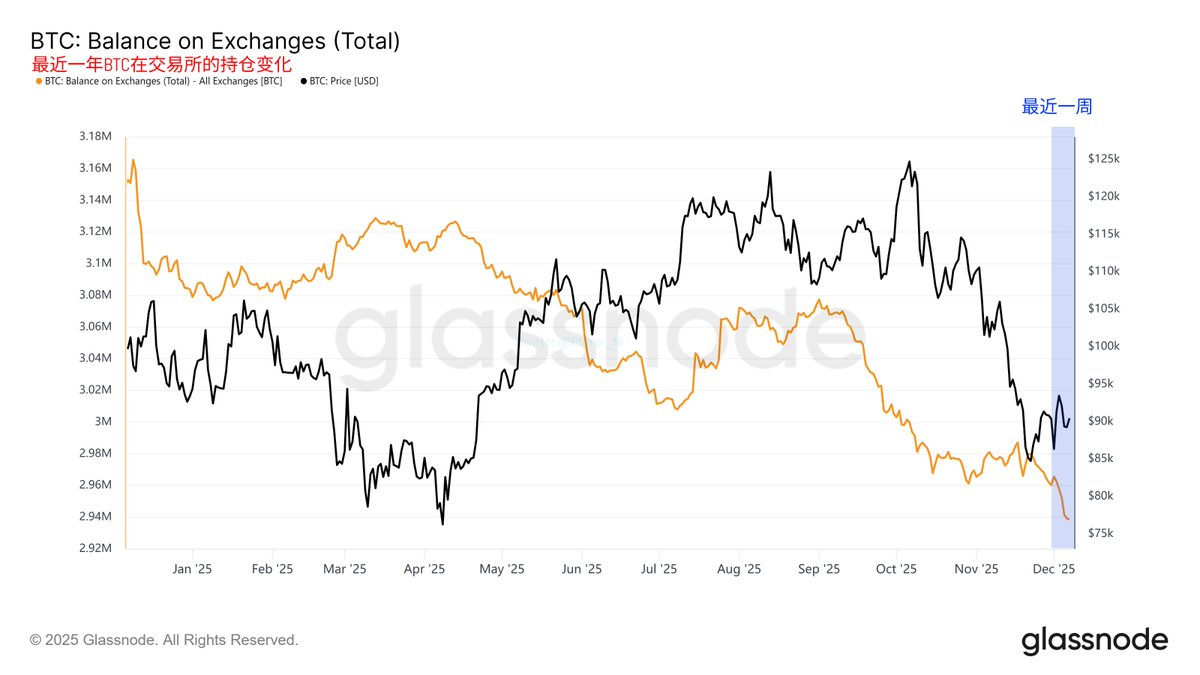

Recent Year Exchange Inventory of Bitcoin

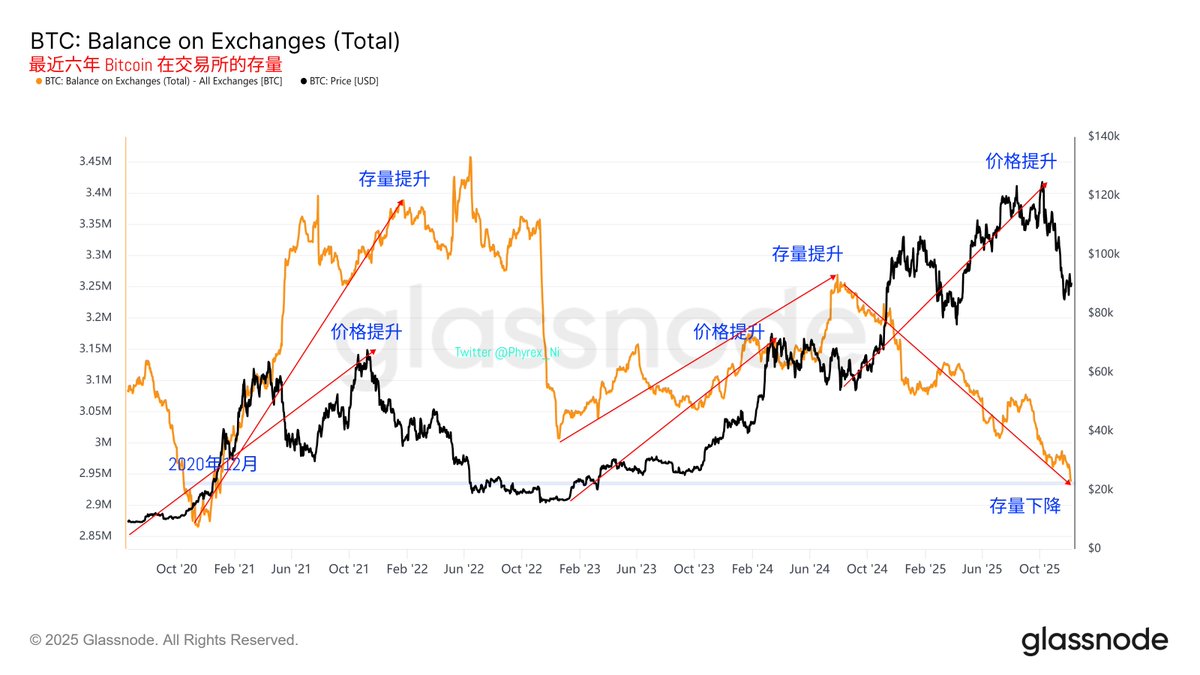

Moreover, if we extend the time frame, we can see that the current exchange inventory is at its lowest point in the last five years. What does this mean? In the previous cycle, as the price of Bitcoin increased, more BTC was transferred to exchanges. Not only that, but during downturns, many investors also transferred BTC to exchanges out of panic, hoping to sell at a better price.

Recent Five Years Exchange Inventory of Bitcoin

This situation is expected to continue until October 2024, with more investors treating BTC as a short-term investment. However, after October, the scenario will be completely different. Especially now, regardless of whether the BTC price is rising or falling, more investors are buying.

This is because an increasing number of investors have regarded BTC as a long-term investment. Short-term price fluctuations only encourage more investors to buy the dips rather than panic sell. This is a significant shift, which may be due to ETFs increasing their investment in Bitcoin or the efforts of high-net-worth individuals and long-term holders.

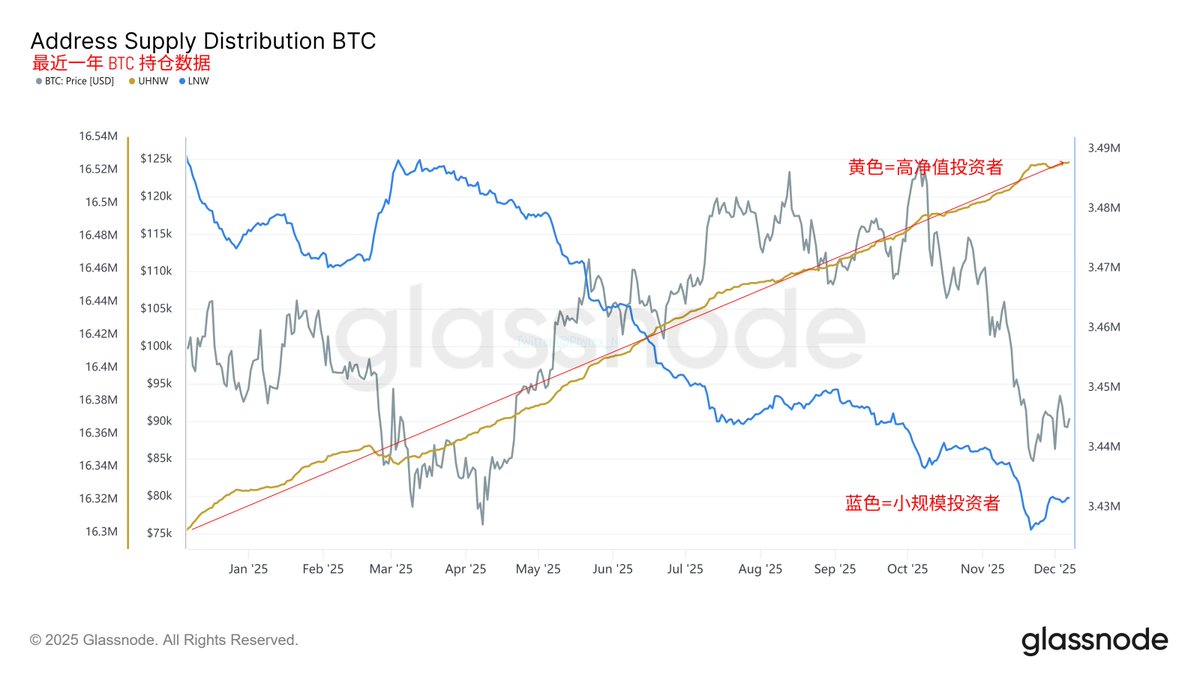

Recent Year Bitcoin Holding Distribution

For instance, from the recent year's holding distribution, we can see that investors holding more than 10 BTC have consistently increased their holdings throughout the year. Especially since we know that the exchange inventory is declining, this increase is likely not from exchange wallets but rather from high-net-worth investors buying in, who are almost insensitive to price changes, maintaining a steady line.

In contrast, small-scale investors are significantly affected by price changes. Looking at the trend over the year, small-scale investors holding less than 10 BTC have been selling continuously. As of now, high-net-worth investors hold a total of 16.524 million BTC, while small-scale investors hold 3.431 million BTC.

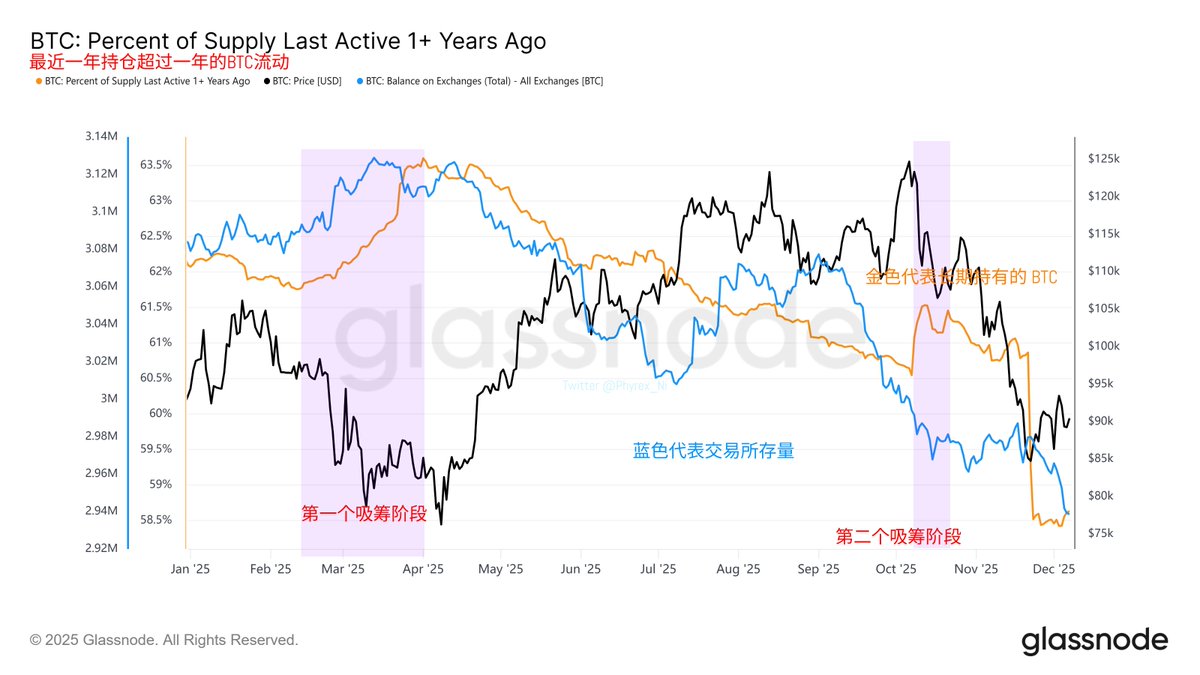

Recent Year Change in BTC Holdings Over One Year

Additionally, looking at the data for BTC holdings over one year, there has been a continuous decline in the past year. Many may think this is due to long-term holders selling, but I analyzed the counterpart of the exchange inventory and found a strong similarity. While we cannot say that all reductions from long-term holders come from exchanges, the decline in exchange inventory is indeed one reason for long-term holders' sell-offs.

As of the first week of December, investors are still buying regardless of price, and the exchange inventory continues to decline, indicating that the sentiment of most investors is very stable, choosing to buy the dips rather than panic sell when prices drop.

Bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。