Original Author: BEOSIN

On December 1, 2025, Huione Group's Huione Pay suddenly announced the suspension of operations and the postponement of payments. The headquarters of Huione Pay issued a statement saying, "Due to external market conditions, operational difficulties, and tight cash flow, the company is unable to make payments on time," and outlined its delayed payment plan.

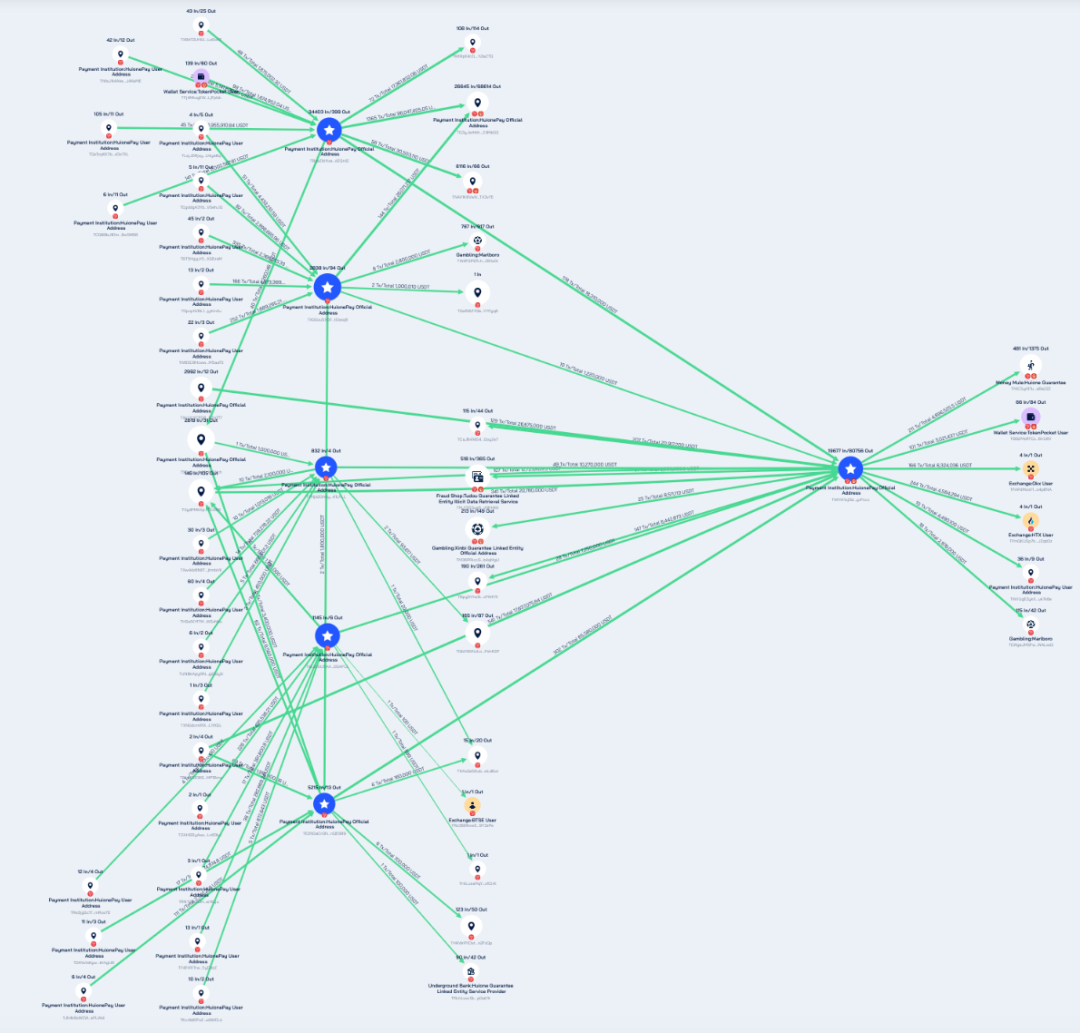

In response to the news of Huione Pay's suspension of operations and withdrawals, the Beosin team conducted statistical analysis of transaction data related to its business addresses using the blockchain tracking and analysis tool BeosinTrace and the anti-money laundering analysis platform Beosin KYT, and shared the results as follows:

Huione Pay: Reduced to a Tool for Money Laundering in the Black and Gray Markets

Huione Group owns several business platforms, including Huione Pay (Huione Pay/H-Pay), the virtual asset exchange "Huione Crypto," and the guarantee platform "Huione Guarantee." Among them, Huione Pay has a dedicated payment app, with services including daily life consumption/transfers (Cambodia), cross-border payments, and cryptocurrency payments.

Through its various business platforms, Huione Group has built an efficient and automated underground fund circulation system, with Huione Pay being an important part of it. The various fiat currencies, cryptocurrencies, and life services aggregated by Huione Pay are used for the payment, receipt, transfer, and laundering of illegal funds.

According to disclosures from the U.S. Department of Justice, from August 2021 to January 2025, Huione laundered at least $4 billion in illegal proceeds. FinCEN found that of this $4 billion in illegal proceeds, at least $37 million was laundered from virtual assets stolen by North Korean hackers, at least $36 million from virtual assets obtained through investment fraud, and $300 million from virtual assets obtained through other online scams.

U.S. Sanctions May Trigger a Panic Run

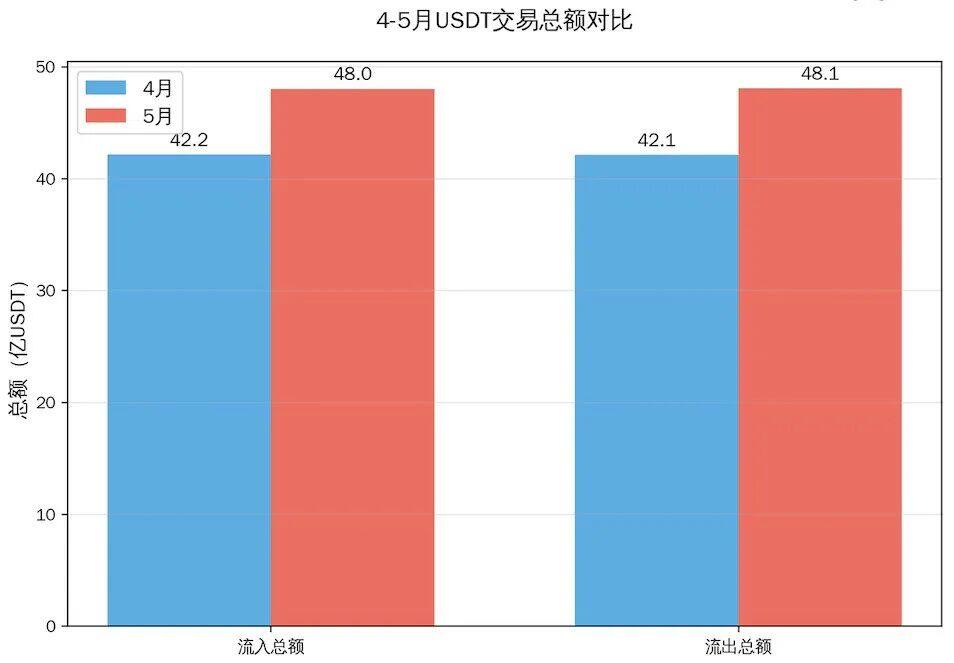

On May 1 of this year, the U.S. Financial Crimes Enforcement Network (FinCEN) issued a proposed rulemaking notice under Section 311 of the USA PATRIOT Act, designating Huione Group, headquartered in Cambodia, as a primary money laundering concern. Although the rule was not finalized at that time, the U.S. financial system typically reacts immediately to Section 311 proposals, often severing ties immediately after the announcement to avoid regulatory risks—however, based on Beosin KYT's on-chain transaction data statistics for its related business addresses, its operational scale in May actually increased.

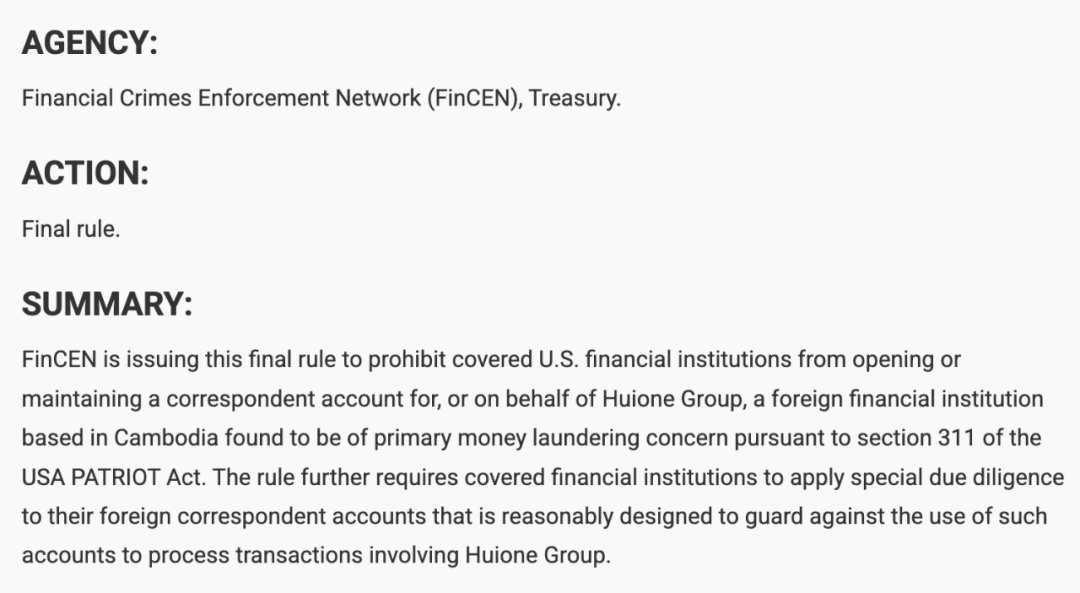

On October 14, the U.S. Department of the Treasury's Office of Foreign Assets Control (OFAC) and FinCEN, along with the UK Foreign, Commonwealth & Development Office (FCDO), took the largest sanctions action in history against Southeast Asian online scam groups. As part of this sanctions action, FinCEN finalized the regulations it issued in May, officially severing Huione Group's ties with the U.S. financial system.

https://www.federalregister.gov/documents/2025/10/16/2025-19571/imposition-of-special-measure-regarding-huione-group-as-a-foreign-financial-institution-of-primary#footnote-20-p48297

With the final implementation of this rule, regulated financial institutions are prohibited from opening or maintaining correspondent accounts for Huione Group and are required to take reasonable measures to avoid processing transactions involving correspondent accounts of foreign banking institutions related to Huione Group in the U.S., thereby preventing Huione Group from indirectly entering the U.S. financial system.

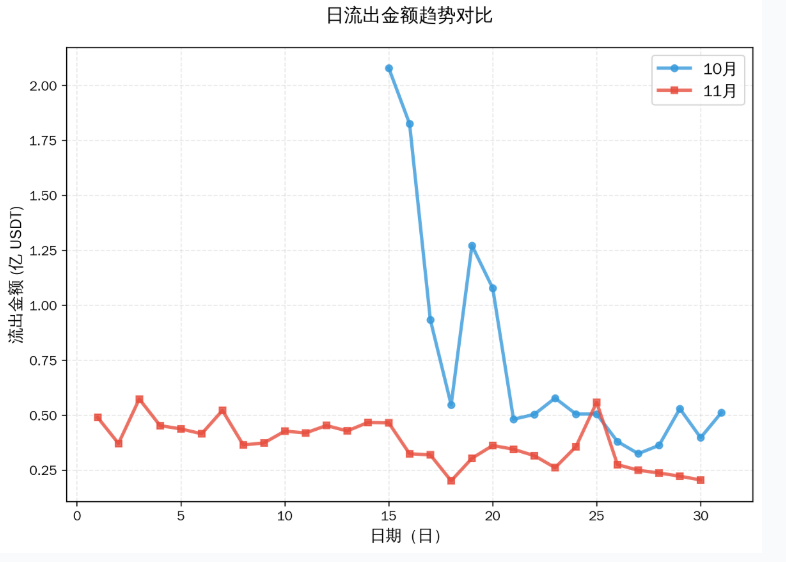

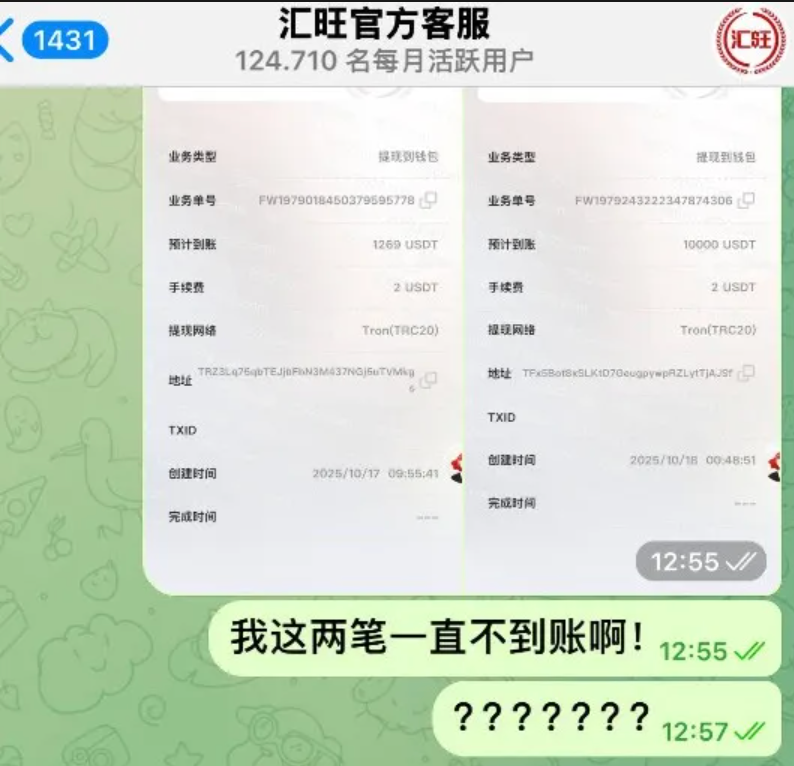

Following the announcement of these sanctions, Huione's customer base began to withdraw funds out of concern for their financial safety. According to Cambodian media reports, starting from October 17, many Huione offline stores in Phnom Penh and Sihanoukville experienced massive queues for withdrawals; Beosin's analysis of its on-chain business addresses also confirmed this:

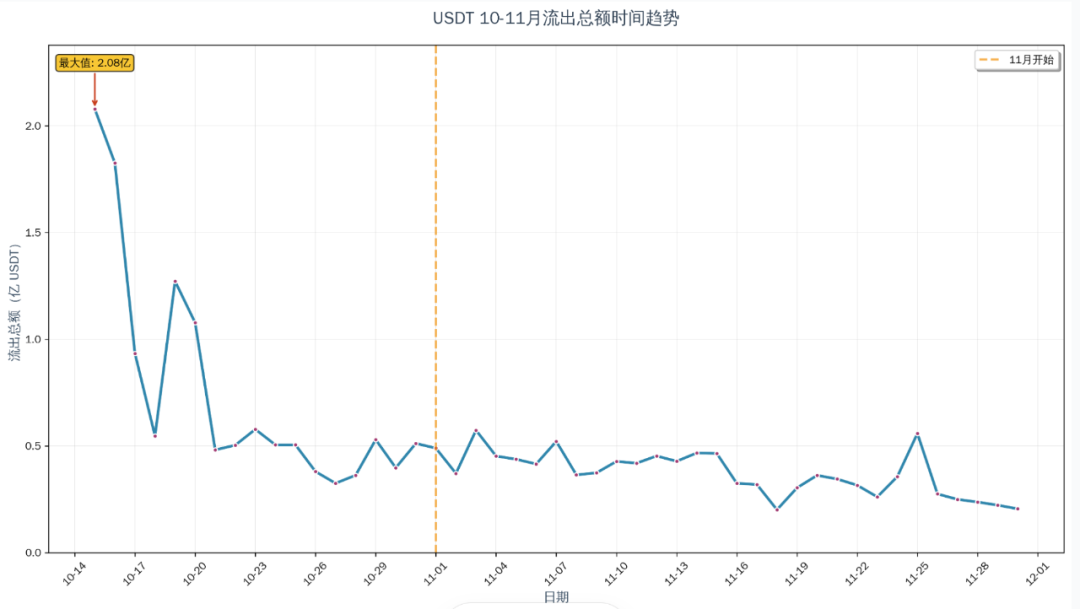

From October 15 to 17, in response to a large number of user withdrawal requests, over 483 million USDT flowed out from its business addresses. From October 19 to 20, approximately 235 million USDT flowed out, during which there were multiple instances of online withdrawal delays.

On November 27, Huione Pay began to limit withdrawal amounts and ultimately announced the suspension of operations and withdrawals on December 1. The trend of its daily USDT outflow is shown in the following chart:

After the announcement of the delayed payment, we tracked and analyzed its platform addresses through Beosin Trace and found that Huione Pay's related hot wallet addresses had a USDT balance exceeding 8.17 million.

After the announcement, Huione Pay quickly activated a batch of new wallet addresses, and currently, related addresses still have funds flowing on-chain.

How Can Cryptocurrency Payment Providers and Users Ensure Fund Safety?

Huione Pay was reduced to a channel for money laundering and illegal transactions, ultimately leading to U.S. sanctions. The run on its platform funds and the subsequent decision to suspend operations and withdrawals serve as a warning for the cryptocurrency payment industry.

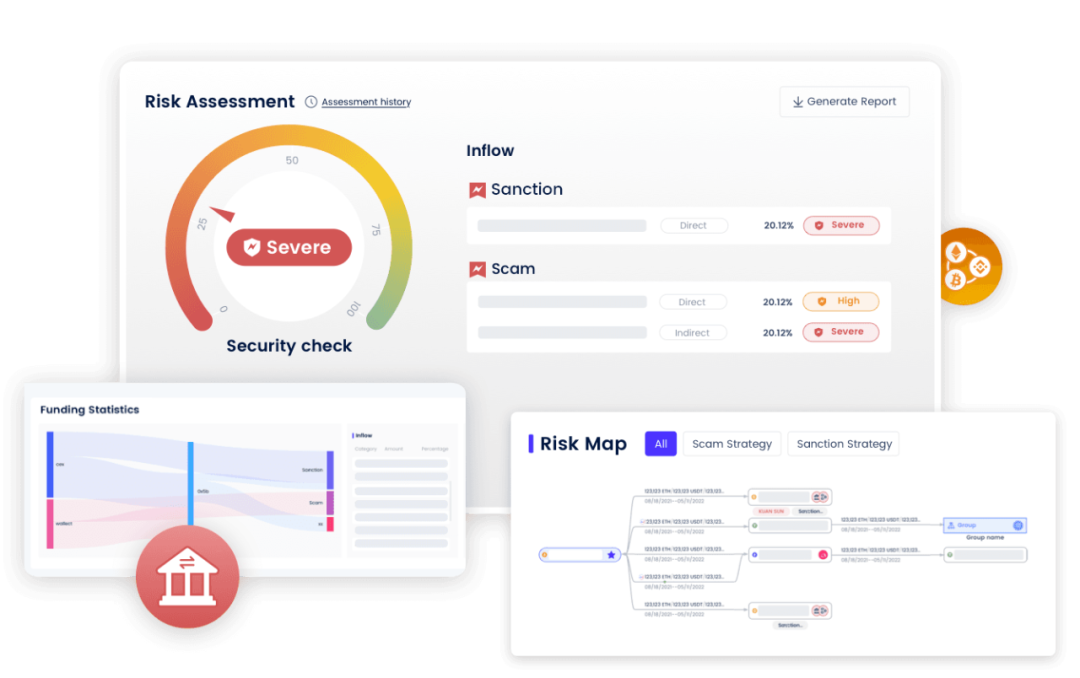

For payment companies, compliance and security are the core foundations of payment services. In the increasingly stringent global anti-money laundering and compliance environment, cryptocurrency payment service providers need to accelerate the establishment of anti-money laundering systems for cryptocurrency assets, conduct anti-money laundering compliance screening for businesses involving cryptocurrency assets, and identify addresses associated with high-risk funds.

For users, being able to trace the complete flow path of transactions with counterparties, avoiding high-risk transactions, and being alerted to suspicious activities on platforms are key capabilities to ensure the safety of their assets.

Beosin KYT: https://beosin.com/solutions/kyt

Beosin KYA Lite: https://kya.beosin.com/

News Links:

https://cc-times.com/posts/30428

https://tw.theblockbeats.news/flash/316781

https://jinbiannews.com/archives/5246

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。