Economic data unexpectedly declined, market expectations surged, and the Federal Reserve once again stands at a crossroads. A disappointing employment report not only revealed subtle changes in the U.S. economy but also prompted global capital to begin repositioning.

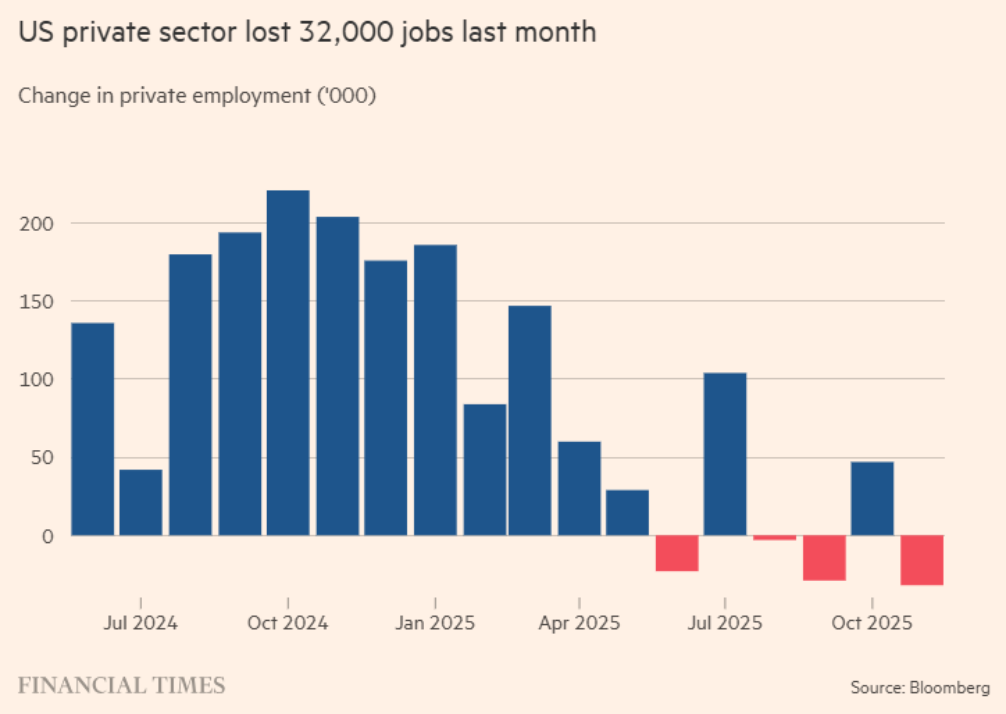

The U.S. ADP employment data released on the evening of December 3, Eastern Time, showed that the U.S. private sector lost 32,000 jobs in November, far below the market expectation of an increase of 10,000, marking the largest decline since March 2023.

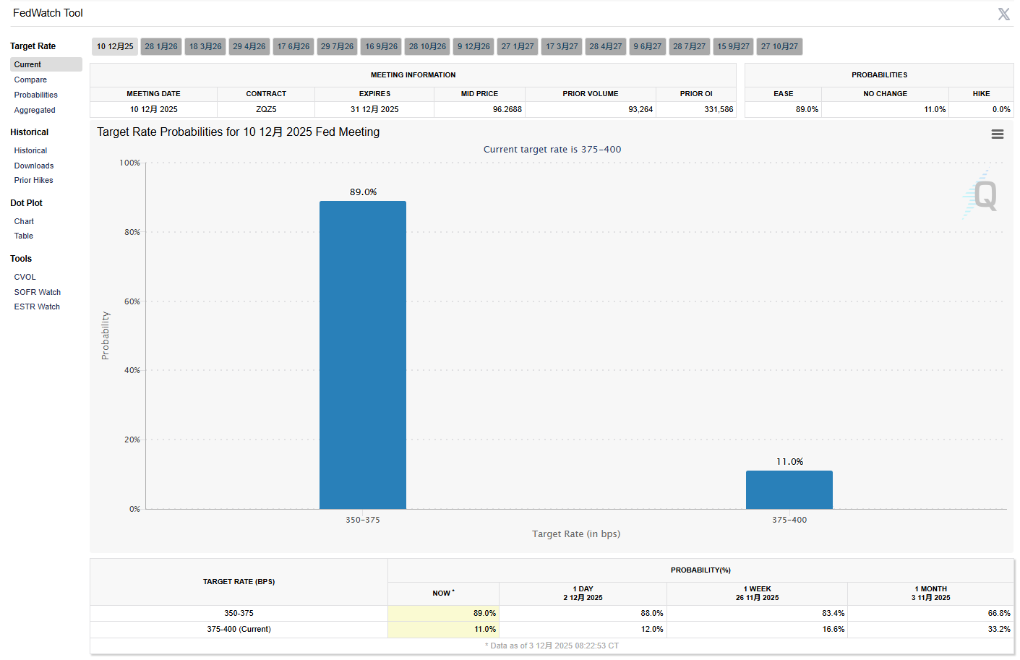

The market reacted swiftly, with the CME Group's "FedWatch" tool indicating that the probability of a Fed rate cut in December has surged from about 86% a week ago to nearly 89%.

1. Data Signals

● This ADP employment report, referred to by the market as the "little non-farm," is an important leading indicator of the health of the U.S. labor market. The loss of 32,000 jobs stands in stark contrast to the market expectation of a gain of 10,000. Following the data release, the market immediately reacted, with participants beginning to reassess the actual state of the U.S. economy.

● Notably, job losses were primarily concentrated in small businesses. Companies with fewer than 50 employees collectively cut 120,000 jobs in November, while large companies continued to add jobs. This structural imbalance suggests that current economic pressures may not be evenly distributed, hitting smaller economic participants first.

● Wage growth also showed signs of slowing. The report indicated that wages for retained employees grew by 4.4% year-on-year, a deceleration; meanwhile, wage growth for job switchers also declined.

These data collectively paint a picture of a gradually cooling U.S. labor market, providing data support for a shift in the Fed's monetary policy.

2. Market Reaction

Changes in economic data quickly transformed into a reshaping of market expectations. Following the ADP data release, the market's expectation of a Fed rate cut in December sharply climbed to nearly 90%, reflecting strong anticipation among market participants for a shift in Fed policy.

● In the foreign exchange market, the U.S. dollar index fell for several consecutive trading days, dipping nearly 0.5% intraday to a low of 98.88, close to its lowest level since October. Meanwhile, U.S. Treasury yields continued to decline, with the 10-year Treasury yield briefly falling below the critical psychological level of 4%.

● The stock market presented a complex situation. Although some tech stocks faced pressure, the overall index maintained a moderate upward trend. At the same time, the cryptocurrency market performed strongly, with Bitcoin prices breaking the $92,000 mark.

● Financial institutions have begun to adjust their strategies. The United Ratings Research Center stated that the Fed's continued buying will provide stable demand for short-term U.S. Treasuries, helping to absorb the increased issuance of short-term bonds by the U.S. Treasury.

3. Decision Dilemma

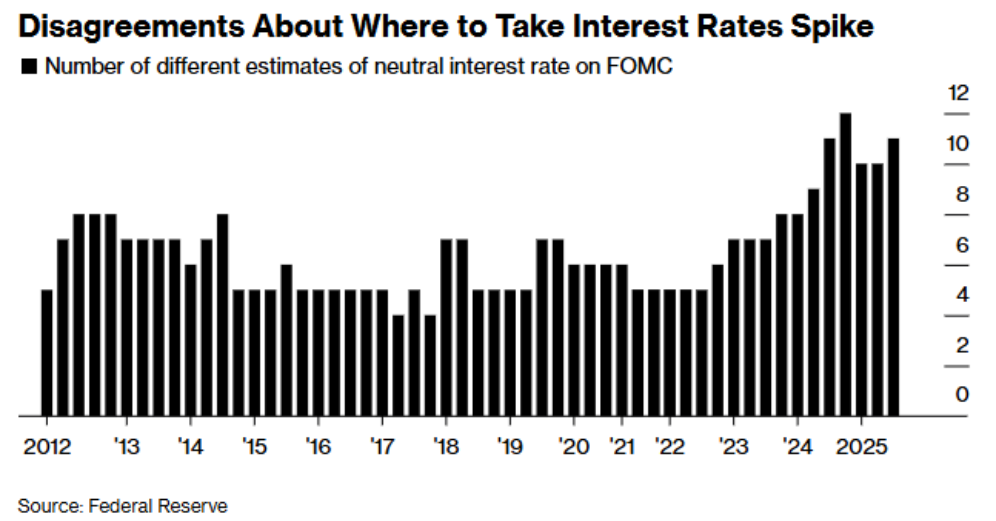

While the market widely expects the Fed to take action, the Fed itself faces unprecedented policy divisions.

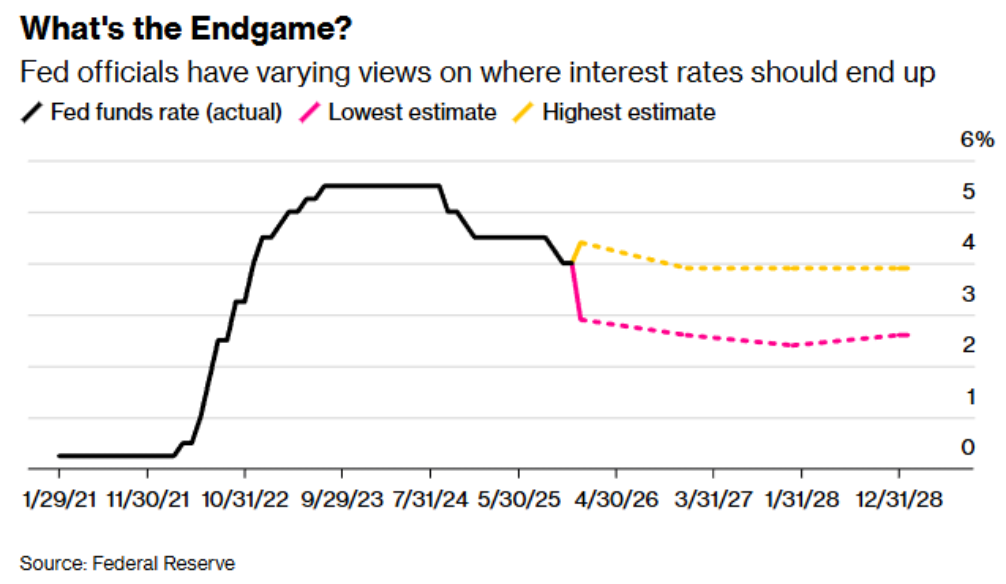

● The latest forecasts released in September showed that 19 Fed officials provided 11 different predictions for the neutral interest rate, ranging from 2.6% to 3.9%. This level of divergence is at least the highest since the Fed began releasing such forecasts in 2012.

● Some officials are concerned about the risk of a deteriorating labor market and advocate for further rate cuts to support the economy. In contrast, another group of officials is wary that rate cuts could reignite inflation, arguing for policy stability.

● Fed Governor Christopher Waller recently pointed out that the market might see "one of the least collective-minded meetings in a long time."

● This internal rift is reflected not only in interest rate predictions but also in specific policy stances. According to Reuters, among the 12 voting members of the Federal Open Market Committee, as many as five hold reservations or oppose further rate cuts.

4. Data Fog

● Unusually, the upcoming Fed meeting will occur against the backdrop of missing key economic data. Due to the longest government shutdown in U.S. history, the official non-farm employment report for November, originally scheduled for release on December 5, has been postponed to December 16.

● This means that when making the December rate decision, Fed officials will lack an official, comprehensive assessment of the labor market situation. The unemployment rate for October also cannot be released, as the government shutdown has prevented the collection of household survey data used to calculate the unemployment rate.

● Although the market has priced in expectations for a rate cut in December, the Fed may find it challenging to release unexpectedly dovish signals during this data vacuum. Wang Xinjie indicated that this data delay could lead the Fed to adopt a more wait-and-see stance in the December meeting.

5. Global Resonance

The shift in Fed policy expectations is triggering a chain reaction in global markets. The weakening dollar benefits other major currencies, with the euro rising about 0.4% against the dollar to 1.1675.

● Meanwhile, the "December rate hike" signal released by the Bank of Japan sharply contrasts with the Fed's rate cut expectations, pushing the dollar-yen exchange rate down to 155.002. The market generally believes that if the yen approaches 160, intervention by Japanese authorities is almost inevitable.

● For the global bond market, Standard Chartered's Chief Investment Strategist Wang Xinjie suggests that investors should rebalance their allocations towards 5 to 7-year bonds, as this maturity range offers the best balance between yield and fiscal and inflation risks.

● Emerging markets are also feeling this change. As expectations for a Fed rate cut rise, emerging market assets may see inflows. Additionally, a weaker dollar will alleviate the debt repayment pressure on emerging market countries.

● The cryptocurrency market is experiencing a strong recovery, with Bitcoin prices breaking the $92,000 mark, and bulls are now targeting the $100,000 level. Market expectations for a shift in Fed policy may lead to a more abundant liquidity environment.

The dollar index has continued to decline under rate cut expectations, and U.S. Treasury yields have fallen below critical psychological levels, indicating that global capital has begun to reposition. The only certainty is that Fed Chair Powell will have to navigate a narrow policy path that stabilizes the economy without reigniting inflation amid a series of uncertainties and pressures.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。