12月3日,比特币价格一度突破93,000美元关口,24H涨幅超6%,市值重回1.8万亿美元以上。这一波上涨并非偶然,而是多重利好因素叠加的结果。在全球经济不确定性加剧的背景下,先锋集团(Vanguard)解除加密ETF禁令、BlackRock的IBIT ETF交易量爆表、美国银行体系对加密资产的支持、MicroStrategy的坚定持有策略,以及行业领袖对未来新高的乐观预测,正合力重塑市场信心。这些事件不仅刺激了短期交易热情,还为比特币的长期价值锚定提供了制度性支撑。

先锋集团政策转向

先锋集团作为全球第二大资产管理公司,管理资产规模逾11万亿美元,其对加密资产的态度长期以来被视为行业风向标。2025年12月1日,先锋宣布重大政策逆转:从12月2日起,其经纪平台将允许客户交易持有比特币、以太坊、XRP和Solana等主流加密货币的ETF和共同基金。这标志着先锋结束了长达近两年的“加密禁令”,此前该公司甚至在2024年1月比特币现货ETF获批时,明确禁止客户通过其平台购买此类产品。

这一转变的背景是机构需求的持续高涨。自比特币ETF推出以来,该类产品已累计吸纳数百亿美元资金。先锋的让步并非孤立,而是响应零售和机构投资者的呼声——其超过5,000万经纪客户中,许多人已通过其他渠道表达了对数字资产的兴趣。政策调整后,先锋强调将仅支持符合监管标准的加密基金,并将其视为“非核心资产类”对待。

先锋的入场意义深远。它不仅为保守型投资者提供了低门槛的比特币暴露渠道,还可能引发多米诺效应。分析人士指出,先锋的客户群以中产阶级和退休基金为主,其平台开放将进一步桥接传统金融与加密世界,预计2026年将为比特币ETF注入至少500亿美元新增资金。这一事件凸显了监管环境的渐进友好:从SEC的ETF批准,到如今巨头平台的包容,比特币正从边缘资产向主流储备转型。

机构资金洪流涌入

BlackRock的iShares Bitcoin Trust(IBIT)ETF即见证历史性一刻:开盘后仅30分钟,交易量即飙升至10亿美元。这一数字相当于IBIT平日全天交易量的两倍有余,直接推动比特币价格反弹。IBIT作为全球最大比特币ETF,自2024年1月推出以来,已累计资产规模突破700亿美元,平均日交易量逾7,600万股。

这一爆表交易量并非巧合,而是先锋禁令解除的即时反馈。Bloomberg ETF分析师Eric Balchunas评论道:“先锋的客户显然迫不及待,他们甚至比我们想象中更‘冒险’。” 此前,IBIT的交易高峰出现在2024年11月特朗普胜选后,当时20分钟内即达10亿美元,但此次事件更具象征性——它标志着比特币ETF从“高风险玩具”向“标配投资工具”的跃迁。数据显示,12月2日IBIT交易股份近3,200万股,价值逾10.4亿美元,远超其他比特币ETF如Fidelity的FBTC(4.64亿美元)。

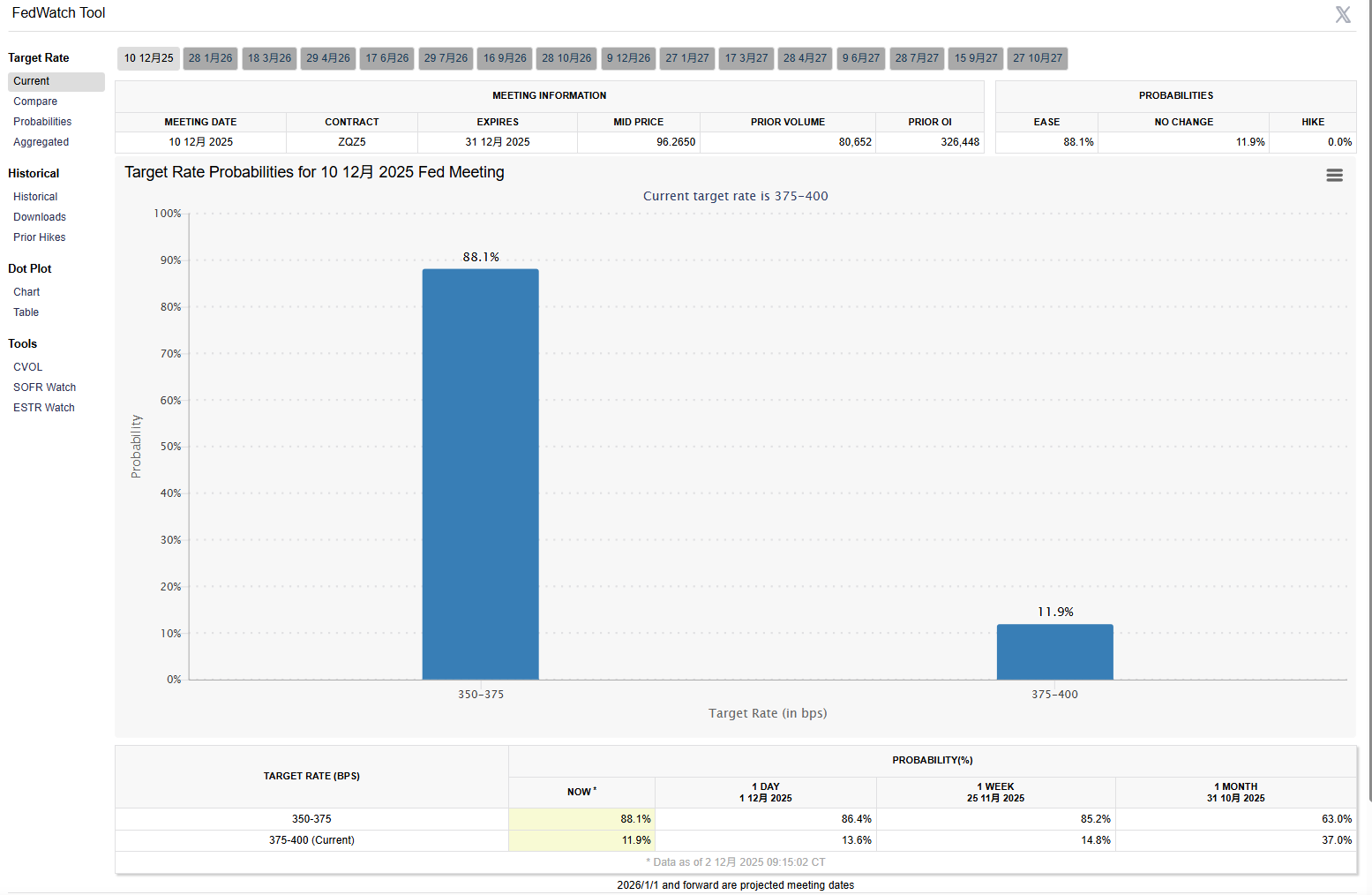

BlackRock CEO Larry Fink曾表示,比特币ETF已成为公司顶级收入来源,资产规模已逼近1,000亿美元。IBIT的成功不仅源于其低费用(0.25%年费)和品牌效应,还得益于比特币作为“数字黄金”的叙事强化。在美联储12月FOMC会议前夕,市场预期进一步降息将刺激风险资产配置。

监管绿灯点亮合规路径

比特币反弹的另一大推手,是美国银行业对加密资产的日益支持。2025年已成为转折之年,多项监管举措为银行提供了清晰的合规框架,避免了以往的“灰色地带”风险。

货币监理署(OCC)于11月18日发布第1186号解释函,明确国家银行可作为主要持有一定量加密资产,用于支付区块链网络费用。这一规定允许银行在资产负债表上保留“合理预见性”量的加密货币,以支持交易处理和平台测试,同时强调风险评估和控制要求。此前,银行若无此类持有,将面临服务中断风险;如今,这一“de minimis”豁免为机构级加密运营铺平道路。

U.S. Bank于9月3日重启比特币托管服务,扩展至比特币ETF,针对机构投资经理提供安全存储解决方案。该服务由NYDIG子托管,标志着传统银行从观望转向主动布局。

银行的支持降低了比特币的“非法资产”印象,提升了其作为支付和储备工具的合法性。预计2026年,美国银行加密托管资产将超1万亿美元,推动比特币从投机向实用转型。

企业级持有铸就信心支柱

MicroStrategy以其激进的比特币持有策略脱颖而出。该公司目前持有650,000枚比特币,价值约590亿美元,平均购入价74,431美元/枚,总成本逾480亿美元。

创始人Michael Saylor视比特币为“数字财产”,其策略核心是通过股权融资和低息债务积累BTC,形成“比特币国库”。尽管比特币从10月高点回调,Strategy市值一度跌破其BTC持仓价值,公司仍未动摇。Saylor强调,储备是“数字信贷”战略的延伸,旨在强化公司作为比特币代理的地位。

Strategy的持仓占比特币总供应3.1%,其每笔购买(如11月17日的8,178枚)均放大市场信号。2025年,该公司已累计购入逾10万枚BTC,收益率达24.6%。在反弹中,Strategy股价同步上涨,证明企业持有已成为比特币价格的“稳定器”。

未来:更多新高在望

币安创始人赵长鹏(CZ)虽未近期发声,但其长期观点一贯强调比特币的周期性上涨潜力,预测2025年底前将再创数次新高,与Saylor的“21年内达2100万美元”叙事呼应。 更广义上,市场共识指向美联储降息和特朗普政府的亲加密政策,将推动比特币重返10万美元以上。

加入我们的社区,一起来讨论,一起变得更强吧!

官方电报(Telegram)社群:https://t.me/aicoincn

AiCoin中文推特:https://x.com/AiCoinzh

OKX 福利群:https://aicoin.com/link/chat?cid=l61eM4owQ

币安福利群:https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。