原创 | Odaily 星球日报(@OdailyChina)

作者|Azuma(@azuma_eth)

今晚,Solana 生态暗池 DEX 项目HumidiFi将正式在 Jupiter 新推出的打新平台启动公募。公募将分三轮进行:前两轮分别面向HumidiFi 社区白名单地址以及 JUP 质押地址,FDV 估值为 5000 万美元;最后一轮面向公众开放,FDV 估值为 6900 万美元。

HumidiFi 定位

HumidiFi 的自定位是互联网资本市场(即 Solana 的自定位)上的流动性引擎。

与传统自动化做市商(AMM)不同,HumidiFi 是一种“专业做市商 AMM”(prop AMM),它将链上执行与机构级做市逻辑相结合,以实现更窄的点差、更深的流动性,以及超越 DEX 和 CEX 竞争对手的执行质量。

具体而言,HumidiFi 通过引入主动流动性框架解决了持续困扰传统 AMM 模型的多个问题:

- 预测性报价:报价基于实时市场数据和内部风险指标生成,而非仅依赖公式化曲线;

- 动态库存管理:持续调整风险敞口以规避过时报错和错误定价风险,最大化资本效率;

- 链上结算,链下智能:复杂计算在链下进行,而资产托管、结算和记账完全保留在 Solana 链上;

- 散户/用户优先:区分散户用户与套利或信息优势机器人,从而为前者提供更优点差和更低拥堵。

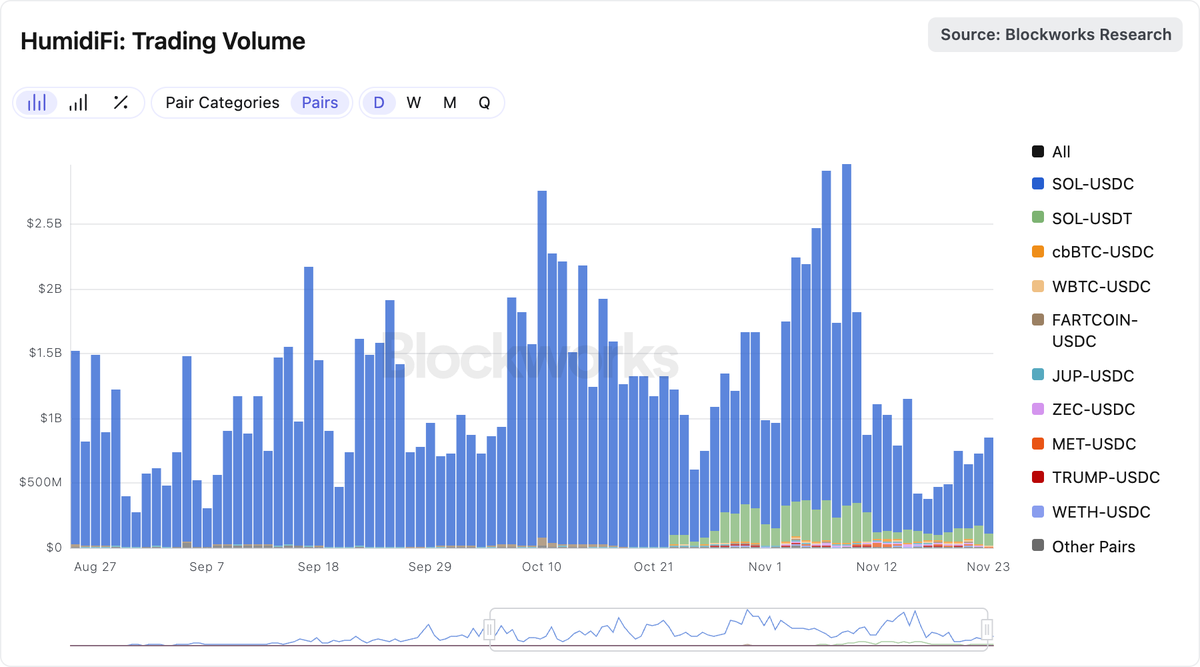

目前,HumidiFi 已成为了 Solana 链上实际交易量最大的去中心化交易所(DEX),日均处理交易额超 10 亿美元 —— 约占 Solana 全部现货 DEX 交易活动的35%,Solana 每日收入的约 4% 都来自这些交易。

Blockworks 数据分析师 Sharples 表示则给出了一个更为夸张的数据 ——HumidiFi 结算了全球 SOL-USD 现货交易量的 30-40% 左右, 最近 SOL-USD 每周现货交易量更是超过了币安。目前,HumidiFi 约 95% 的现货交易量来自 SOL-USD,但近期已开始扩展至 BTC、ETH 和 ZEC。

代币经济模型

昨日,HumidiFi 正式公布了其代币 WET 的经济模型。WET 总供应量 10 亿枚,具体分配如下:

- 10% 分配给 Jupiter DFT 平台的预售活动,无锁仓限制;

- 40% 分配给基金会,其中 8% 将在 TGE 时解锁,剩余部分在 24 个月内分期解锁,每 6 个月解锁一次;

- 25% 分配给生态系统,其中 5% 将在 TGE 时解锁,剩余部分在 24 个月内分期解锁,每 6 个月解锁一次;

- 25% 分配给团队(Labs),TGE 时无代币解锁,之后在 24 个月内分期解锁,每 6 个月解锁一次。

在最受关注的 10% 预售份额中,面向 HumidiFi 生态的白名单将分配 6%(包括HumidiFi 用户、活跃且有贡献的 HumidiFi 参与者、HumidiFi Discord 社区成员),JUP 质押用户将分配 2%,公开发售将分配 2%。

打新规则及效益评估

早在 10 月底,Jupiter 就已确认其新推出的打新平台 DTF 上的首个项目将是 HumidiFi。从数据上看,HumidiFi 其实与 Jupiter 绑定颇深 ——HumidiFi 超过 90% 的订单流来自 Jupiter,前者也是后者当下最倚赖的订单执行路径。

今日早间,Jupiter 已开放了本次公募的专属界面(https://dtf.jup.ag/launch/wet)。如下图所示,公募分为三轮进行,用户可连接地址查询是否符合各轮资格。

- 白名单轮(今晚 11:00 开放):FDV 估值为 5000 万美元(1 WET = 0.05 USDC),计划筹资 300 万美元,额度先到先得。

- JUP 质押用户轮(明日上午 11:00 开放):FDV 估值为 5000 万美元(1 WET = 0.05 USDC),计划筹资 100 万美元,额度先到先得。

- 公众轮(明晚 11:00 开放):FDV 估值为 6900 万美元(1 WET = 0.069 USDC),计划筹资 140 万美元,额度先到先得。

今日早间,Coinbase 已宣布将 Humidifi(WET)列入上币路线图,或将利好 WET 上线后的价格走势。

综合来说,相较于项目当前的数据表现及讨论热度,Humidifi 本次公募的估值并不算高,增值空间应该是有的,此外本次公募并未设锁仓限制,不存在资金占用问题,因此相对会倾向于参与。不过,本次公募的总体额度并不算高,且由于采用了先到先得机制,目测竞争会比较大 ——相较于是否值得参与,可能抢不抢得到才是真的问题。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。