Original | Odaily Planet Daily (@OdailyChina)

The cryptocurrency market starts December with a "flash crash."

According to OKX market data, BTC briefly fell below $85,000 last night, reaching a low of $83,833, and has since slightly rebounded to $86,300, down 2.45% in the last 24 hours; ETH also declined, hitting a low of $2,718, with a 24-hour drop of nearly 4%, currently at $2,790; ZEC experienced a more severe decline, with a daily low of $321, down nearly 14%, currently at $346.

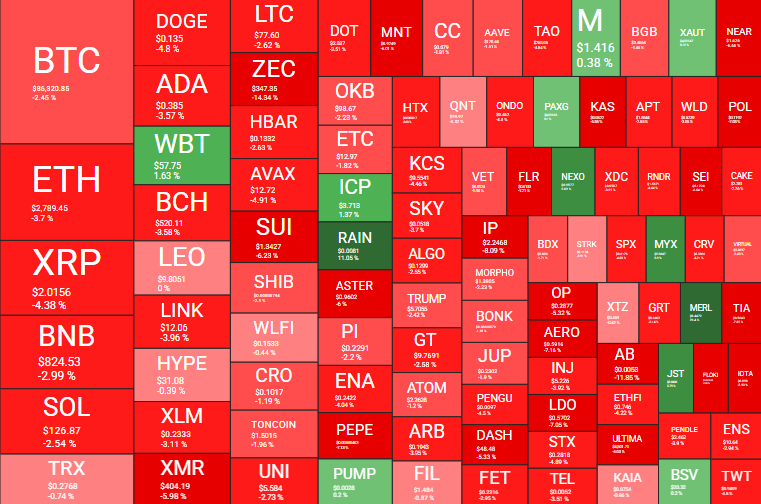

In addition to mainstream cryptocurrencies, the altcoin market is also generally under pressure. According to Quantifycrypto data, nearly 90% of the top 100 cryptocurrencies by market capitalization recorded declines in the past 24 hours.

24H price fluctuation data of the top 100 cryptocurrencies

In the derivatives market, according to Coinglass data, the total liquidation amount across the network in the past 24 hours reached $658 million, with long positions liquidated amounting to $536 million. BTC and ETH were the hardest hit, with liquidations of $296 million and $146 million, respectively.

Cryptocurrency derivatives market liquidation data

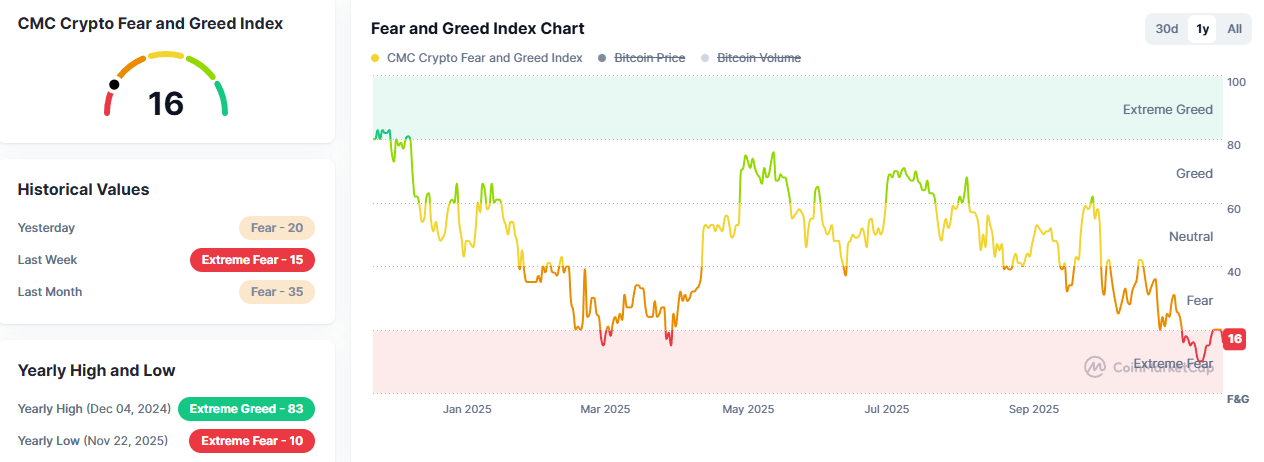

According to CoinMarketCap data, although the fear and greed index has slightly risen, it has remained in a state of "extreme fear" for over half a month, and market sentiment is still at a freezing point.

Fear and greed index

Reasons for the decline: Expectations of interest rate hikes by the Bank of Japan + tightening domestic regulations

The recent decline in Bitcoin is driven by two key factors: on one hand, global liquidity is tightening due to a shift in Japan's monetary policy; on the other hand, domestic regulations on cryptocurrencies are once again signaling a stricter stance, suppressing market sentiment.

The "cheap yen" disappears

Arthur Hayes, founder of BitMex, pointed out that Bitcoin's recent decline is closely related to the Bank of Japan's potential interest rate hike in December. As the USD/JPY exchange rate rises to the 155–160 range, the Bank of Japan is forced to adopt a more hawkish stance, which directly tightens global liquidity and puts short-term pressure on Bitcoin.

Yesterday, the yield on Japan's 2-year government bonds rose above 1% for the first time since 2008, marking Japan's official farewell to over a decade of zero interest rates, negative interest rates, and yield curve control (YCC). For more than a decade, nearly zero-cost yen funds have continuously flowed out, becoming a significant driver of the rise in global risk assets. Now that interest rates have risen to 1%, it means that this long-term channel for providing cheap liquidity is gradually closing.

In the new interest rate environment, institutions find it difficult to continue borrowing yen at nearly zero cost to allocate to U.S. Treasuries, Asia-Pacific stock markets, gold, or Bitcoin. As the interest rate differential between Japan and the U.S. narrows and the yen strengthens, arbitrage positions are forced to close, and funds begin to flow back to Japan, tightening global liquidity simultaneously. Over the past decade, part of the gains in U.S. stocks, Asian stock markets, and even Bitcoin have been driven by "cheap Japanese funds," and this implicit support is now withdrawing.

As a globally sensitive risk asset to liquidity, Bitcoin often reacts first during the tightening of liquidity. The retreat of arbitrage funds triggered by expectations of yen interest rate hikes makes Bitcoin the first to bear the brunt.

China's regulatory tightening on the cryptocurrency market

At the same time, the regulatory efforts on the Chinese cryptocurrency market have been strengthened again, further affecting market sentiment.

The People's Bank of China held a meeting on November 28 to coordinate efforts to combat virtual currency trading speculation, noting that recent speculation in virtual currencies has risen, and related illegal activities still occur from time to time. The meeting reiterated that virtual currencies do not have legal compensation and specifically emphasized that stablecoins, as a form of virtual currency, currently have deficiencies in customer identity verification and anti-money laundering, which may be used for money laundering, fraud, and illegal cross-border fund transfers. Various departments will continue to adhere to the "prohibitive policy" on virtual currencies and will continue to crack down on related illegal financial activities around key areas such as information flow and capital flow.

This joint regulatory reinforcement by multiple departments, which explicitly includes stablecoins in the scope of virtual currency regulation and warns of their related risks, has once again undermined the already fragile confidence in the cryptocurrency market.

Future trends in the cryptocurrency market

VC: "The October 11 liquidation event and macro headwinds are jointly pressuring the cryptocurrency market, which is in a stage of 'preliminary stabilization but not reversal.'"

Several VCs interviewed stated that the ongoing correction in the cryptocurrency market is mainly driven by two factors: the concentrated liquidation event on October 10 and a tighter macro environment. Dragonfly partner Rob Hadick pointed out that low liquidity, insufficient risk management, and flaws in oracle or leverage design have led to large-scale deleveraging, causing market uncertainty; Tribe Capital partner Boris Revsin also referred to this event as "leverage washing," which has had a chain reaction across the entire market.

At the same time, macro factors such as cooling short-term interest rate expectations, sticky inflation, weakening employment data, rising geopolitical risks, and consumer fatigue have put overall pressure on risk assets over the past two months. Robot Ventures partner Anirudh Pai pointed out that some leading economic indicators in the U.S. have begun to decline, a similar trend that was also observed during the previous "recession concerns" phase, making it difficult to determine whether it will worsen into a full-blown recession.

At this stage, VCs generally believe the market has entered a "preliminary stabilization period," but it is not enough to declare that a bottom has formed. Bitcoin has rebounded from around $80,000, and ETF inflows have slightly improved, but overall it remains sensitive to interest rates, inflation, and AI earnings reports.

Tom Lee: Current BTC and ETH risk-reward is more attractive

Tom Lee, chairman and CEO of BitMine, stated that although the cryptocurrency market prices have continued to decline recently, the fundamentals are still improving in terms of wallet numbers, on-chain activity, fees, and asset tokenization. He believes that against the backdrop of price corrections and fundamental progress diverging, the risk-reward levels of BTC and ETH are becoming more attractive.

Bitfinex report: BTC is close to a local bottom and has the foundation to enter a stabilization phase

The Bitfinex Alpha report pointed out that from a timing perspective, the market is approaching a local bottom, although it remains to be seen whether prices have bottomed out. However, given the significant decrease in leverage, the selling off of short-term holders, and signs of exhausted selling pressure, the market currently has the foundation to enter a stabilization phase. Additionally, the rise in spot prices while open contracts continue to shrink indicates short covering rather than new speculative risk-taking, which may establish a sustained recovery foundation in the fourth quarter.

Greeks.live: Traders closely monitor the $80,000 key support level for Bitcoin

Greeks.live released a Chinese community briefing, indicating that the group is generally bearish, believing the market has entered a bear market rhythm. Traders are closely watching the $80,000 key support level for Bitcoin, with most members believing this level is about to be breached and expecting BTC to potentially drop to the $65,000-$74,000 range. There is a clear division in the market: some members believe there should be a rebound to short positions, while a few traders attempted to bottom-fish at the $86,900 level but were immediately questioned.

Bernstein: Despite the weak market trend, the fundamentals of cryptocurrency companies remain strong

The analyst team led by Gautam Chhugani at Bernstein stated that although the cryptocurrency market remains weak and is still searching for a bottom, cryptocurrency companies are executing "transformative" changes that were not seen in previous adjustments, such as Coinbase's continuously expanding product line, token issuance activities, and emerging consumer applications, all of which are examples of these business model shifts. The operational performance of the entire industry stands in stark contrast to market prices, and they point out that ongoing business model reforms and favorable regulations are evidence of its potential resilience. Analysts believe that the industry is entering a new phase, with companies executing strategies previously constrained by regulatory uncertainty and expanding their businesses beyond cyclical trading revenues.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。