Why would you hold USDT instead of USDC?

For trading some markets? Sure.

Maybe occasional higher yield on lending?

But there's no point being a stablecoin maxi: neither USDT nor USDC pass down the yield to holders.

No equity exposure to Tether either.

You get 100% of the risk but no upside (only temporary escape from crypto volatility).

There's also no need for CT to get defensive on S&P's latest downgrade risk for USDT to 'weak'.

That was my first though.

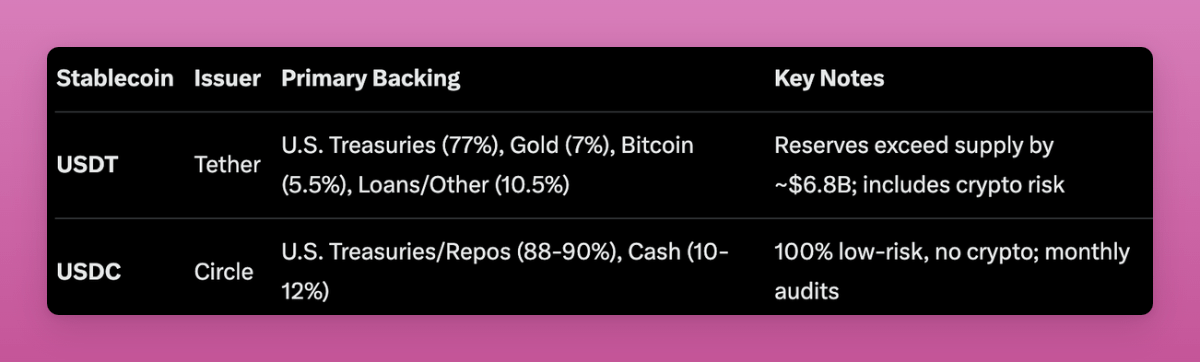

On the second thought, Tether is buying BTC (5.5% of backing) that helps pump its price.

Kinda based? Circle just holds US treasuries and cash-equivalent assets.

But we've got Strategy for pure BTC proxy-trade. And Strategy pumps when BTC does well, why USDT has no upside...

Oh, but Tether also buys gold for their backing. Now at 7%... Ok... Why not buy more BTC instead of gold? Are their bearish on BTC?

Anyway, 10.5% of the backing is a salad of loans to 3rd-party non-affiliated entities like crypto trading firms, mining operations, etc.*

I get flashbacks to 2021 when Tether lent $1b USDT to Celsius (backed by BTC) as part of "secured loans" category in their reserves.

At that time loans like this were 8% to 10% of USDT reserves.

Now, ~23% of USDT's backing are volatile assets (what S&P calls high-risk assets). Up from 17% a year ago.

Why not climb to 50% in 5 years? Their profits pump. Although I get nothing out of it.

I think I better stop FUDding Tether as USDT collapse would rekt my portfolio as it would leave an exodus of capital from crypto.

At the end of they day, I don't and won't hold USDT (As EU's MICA protects me from it and Binance won't allow me trading USDT markets).

So I won't say anything besides 'Tether good': they pump my BTC bags. So that's that.

*Tether doesn't disclose borrower identities or loan terms for privacy reasons, but BDO checks a sample for collateral and overcollateralization.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。