Master Discusses Hot Topics:

Thanksgiving is here, the US stock market is closed, and there’s no news. Whether we can survive in the crypto circle these days depends entirely on Bitcoin's own performance. Waking up today, I see Bitcoin and Ethereum are both in the green, as if the market has handed everyone a piece of candy.

In reality, this candy is meant to lower your guard; once you’ve eaten it, you’ll surely get hit with a surprise. Because the overall trend is still downward, if you really think a few green candles can reverse the trend, you might be taking it too seriously.

The current market feels hollow, liquidity is still dry. In the past, it was a competition of who made more money; now it’s a contest of who loses less. The US market drops when it’s closed, continues to drop when it opens, drops when interest rates are cut, and still drops when they aren’t cut.

The US stock market being closed for a few days is indeed a vacuum period. Without the US market setting the pace, Bitcoin can only rely on itself to push upward. Either take this time to attract some funds and push hard, or if it falls below 89.4K, it will continue to roll in the muddy waters of volatility.

It’s normal for the US stock market to be closed without news, but if suddenly a negative piece of news comes out, Bitcoin and Ethereum will have to bear the brunt without any room for negotiation.

Back to the market, this rebound has already reversed 10,000 points, to be honest, that’s quite generous. But the medium to long-term trend is still a complete downward trend, and the bullish volume isn’t strong enough; don’t expect a quick return to bullishness.

I can’t help but laugh when I hear this; this wave was clearly pushed up by spot buying, with hardly any contracts involved. Can’t you see this is a typical rebound during a downtrend? The bears haven’t even started to exert their strength, and there aren’t any massive sell orders on the order book that could break through.

Although this rebound has entered its fifth day, 93.4K is still a key point. If it can’t break through, there’s no way to continue pushing up; only if it breaks through can it be considered a reversal of the 4-hour structure; otherwise, a pullback could happen at any time. If the price can hold above 85.3K, it can indeed continue to push up, and this has already been validated by the market.

But don’t forget, after the bulls broke through 89.1K, they have already entered the 4-hour pressure zone. Once Bitcoin pulls back to the upper Bollinger band at 96.K on the 12-hour chart, it could start the next wave of downward movement at any time. A pullback of 27,000 to 69.2K is reasonable, just touching the previous bull market high.

Let’s take a look at the drop from Bitcoin’s 107.4K to 80.6K; the rebound to the 0.382, 0.5, and 0.618 levels corresponds to 90.8K, 94K, and 97.2K respectively. This morning’s rise to 91.8K is already quite good, and the probability of pushing up to 98K is very low.

As for Ethereum, I won’t bother discussing it today; the thoughts I shared yesterday are still relevant. The rebound follows Bitcoin’s lead, lacking its own opinion. If you want to follow, then follow; if not, just lie low.

Master Looks at Trends:

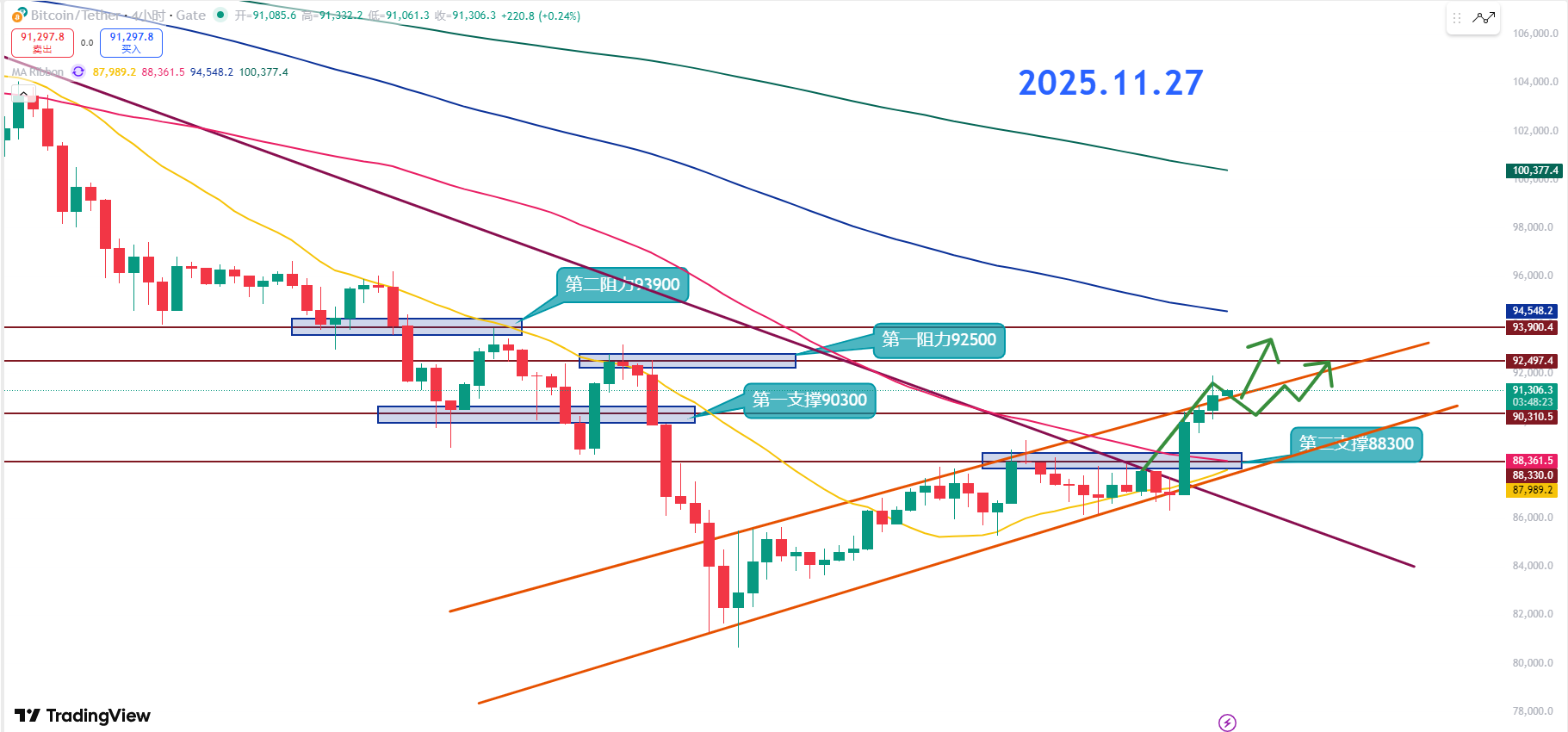

Resistance Levels Reference:

Second Resistance Level: 93900

First Resistance Level: 92500

Support Levels Reference:

First Support Level: 90300

Second Support Level: 88300

Currently, breaking through and stabilizing above 90K is the foundation for a short-term rise. Just pushing up isn’t enough; it needs to hold steady. After breaking through the upper channel, if it can hold on a pullback, then we can look further up.

If there’s a pullback, returning to 90.3K is completely normal. In fact, a slight drop could be a good thing, solidifying 90K before pushing up again. A truly healthy rise must first endure a setback.

90 to 90.3K is a key support zone; as long as it doesn’t break here, the short-term trend remains bullish. The RSI index is at 67, not far from overheating; chasing after a rise at this point is like giving away money.

The first support at 90.3K, if the short-term bulls can hold here, they can continue to look up a bit. The second support at 88.K is the bottom line for this round of adjustment; if it breaks, we continue to look bearish.

Currently, 90.3K has already turned from a resistance level into a support level. As long as it can consolidate in the 90 to 90.3K range, the probability of continuing to rebound will be greater.

88.3K is the last dignity of the bulls; if it holds, there’s still hope for the market. If it drops below, the rebound is basically declared dead. The first resistance is at 92.5K; if it breaks through 92.5K, the bulls can pull back and take another shot.

Bitcoin reclaiming 90K is already quite generous, and the rebound structure is much more solid than before. The short-term strategy for the day is clear; it’s fine to look for rebounds, but don’t impulsively chase highs. As long as it stabilizes within the pullback range, continue to follow the rebound logic.

11.27 Master’s Wave Strategy:

Long Entry Reference: 88300-89000 range, Target: 90300

Short Entry Reference: 92000-92500 range, Target: 90300

If you truly want to learn something from a blogger, you need to keep following them, rather than making hasty conclusions after just a few market observations. This market is filled with performers; today they show screenshots of long positions, tomorrow they summarize short positions, making it seem like they “always catch the tops and bottoms,” but in reality, it’s all hindsight. A truly worthy blogger will have a trading logic that is consistent, coherent, and withstands scrutiny, rather than jumping in only when the market moves. Don’t be blinded by flashy data and out-of-context screenshots; long-term observation and deep understanding are necessary to discern who is a thinker and who is a dreamer!

This article is exclusively planned and published by Master Chen (WeChat public account: Coin Master Chen). For more real-time investment strategies, solutions, spot trading, short, medium, and long-term contract trading techniques, operational skills, and knowledge about candlesticks, you can join Master Chen for learning and communication. A free experience group for fans has been opened, along with community live broadcasts and other quality experience projects!

Warm reminder: This article is only written by Master Chen on the official account (as shown above); other advertisements at the end of the article and in the comments are unrelated to the author!! Please be cautious in distinguishing between true and false, thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。