The unreachable wealth gap and the weakening of class mobility have led people to no longer firmly believe in linear wealth accumulation.

Modern market participants, especially retail investors dreaming of crossing class barriers, are eagerly pursuing high-leverage exposure. However, traditional financial instruments appear arrogant and inefficient in the face of this primal desire.

In the United States, futures dominate the commodity and index trading markets, but single stock futures have been absent. Behind this is the obsession of two institutions over regulatory authority.

The CFTC was established in 1975, leading to intense conflict with the SEC over jurisdiction over financial derivatives. Neither side would back down. In 1981, the chairmen of the two agencies signed the famous "Shad-Johnson Agreement," which directly prohibited single stock futures in the U.S. This ban lasted for twenty years. It wasn't until the Commodity Futures Modernization Act of 2000 that it was "legalized," but unfortunately, constrained by a harsh dual regulatory framework, this market never truly developed.

Thus, when retail investors want to gain leveraged exposure to individual stocks, they ultimately have to turn to the options market, which is also under SEC jurisdiction.

Traders desiring simple leverage must search for liquidity among thousands of options contracts scattered across different strike prices and expiration dates. Worse still, they have to endure those incomprehensible Greek letters.

The "great invention" of the crypto market, perpetual contracts, offers an elegant solution. It eliminates the hidden trading costs and operational risks associated with "rollover" in traditional futures, and more importantly, it consolidates the liquidity that was originally dispersed across thousands of contracts into a single order book, providing the purest and most efficient form of leverage.

Authur Hayes first introduced perpetual contracts to the cryptocurrency market in 2016.

This financial instrument, validated in the crypto market, is attempting to conquer the world's largest speculative market—U.S. stocks.

However, stock assets have clear physical attributes. They are limited by fixed trading hours and have corporate governance actions such as dividends.

This is fundamentally different from the characteristics of native crypto assets like Bitcoin, which trade around the clock and have no cash flow, making it no easy task to fit the vast and mature U.S. stock market into perpetual contracts.

trade.xyz is the first HIP-3 trading platform deployed by the Unit team on Hyperliquid and is currently the largest on-chain trading venue for stock perpetual contracts.

This article will take trade.xyz as an example to dissect the design game behind this financial experiment.

Design Challenge 1: Pricing During Market Closure

The lifeline of perpetual contracts lies in the pricing provided by oracles, but the spot trading of U.S. stocks is limited by trading hours.

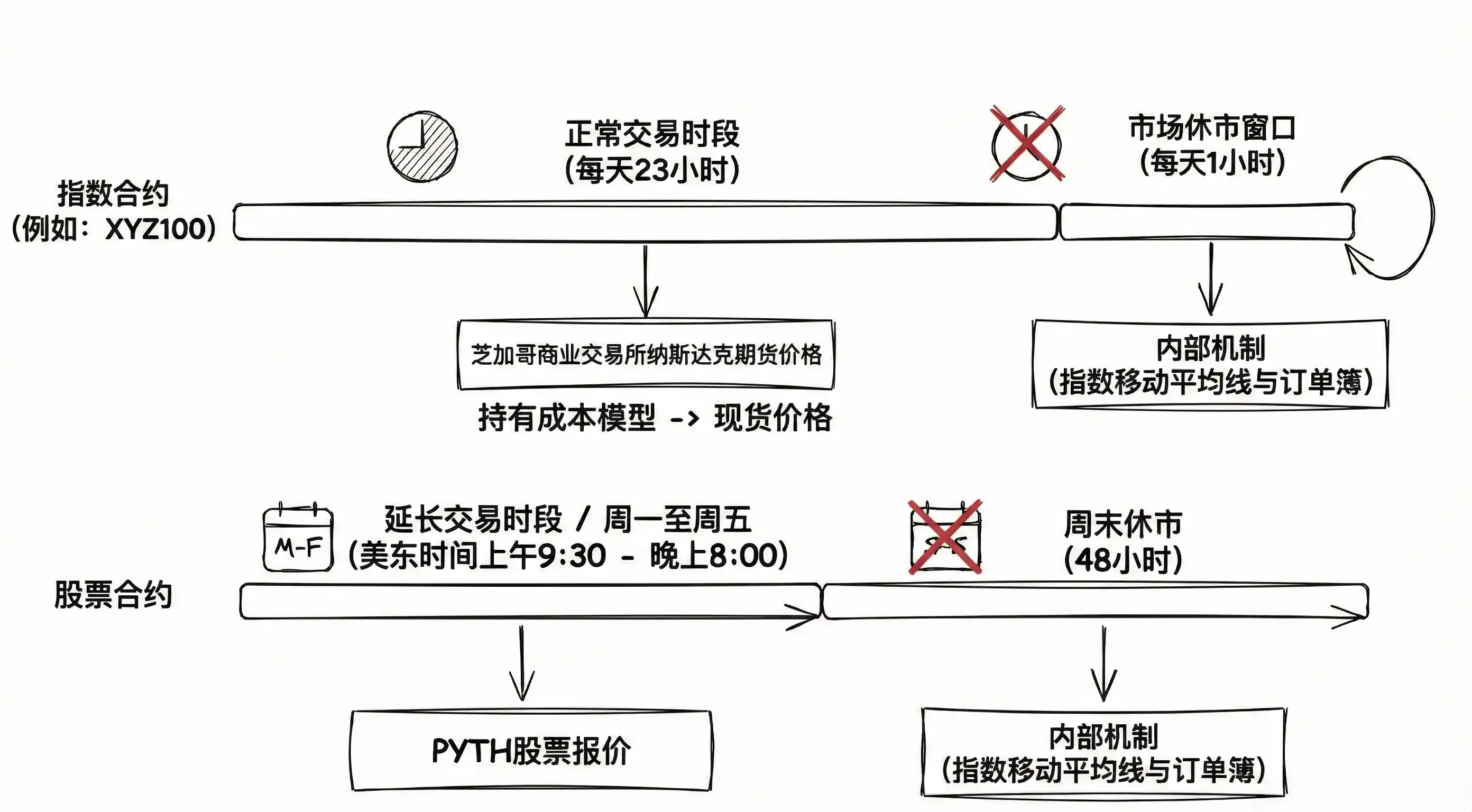

trade.xyz employs differentiated strategies for different asset types:

For index contracts like XYZ100 (tracking the Nasdaq), trade.xyz uses the longer trading hours of CME NQ futures prices (trading 23 hours a day) to reverse-engineer the spot price through a cost-holding model.

For stock contracts, it uses stock quotes provided by Pyth, covering U.S. stock trading hours, after-hours, and overnight periods (Monday to Friday 9:30 AM - 8:00 PM ET).

When external inputs are unavailable (futures have a 1-hour daily market closure window, and single stocks have a 48-hour weekend closure), the oracle activates an internal pricing mechanism: it adjusts the impact price spread through a continuous time exponential moving average (EMA, time constant of 8 hours), with the impact price spread calculated based on the depth of the order book's buy and sell sides, reflecting market supply and demand pressure.

This design allows the oracle to self-adjust based on the on-chain order book when external data is lacking, maintaining responsiveness to market supply and demand. When external data is restored, the oracle will immediately revert to external prices.

Design Challenge 2: Dividends Are Not a Free Lunch for Short Sellers

Compared to Bitcoin, which does not generate cash flow, U.S. stocks have regular dividend payouts. In traditional markets, stock prices automatically drop on ex-dividend dates, which seems to provide a perfect arbitrage opportunity for short sellers: as long as they short before the ex-dividend date, they can reap the benefits of the price drop.

But this clearly violates the "no-arbitrage principle." To address this issue, trade.xyz has "internalized" dividends into the funding rate. We can use reverse induction to deduce this process:

Assume the oracle price is $100, and at a future time T, it jumps to $98 due to a $2 dividend payout. In every hour before T, the marked price must present a smooth discount curve.

At time T-1, to prevent arbitrage, the funding fee paid by the short must precisely equal the profit gained from the price dropping from the marked price to $98. According to the funding rate formula:

Funding Rate = (Marked Price - Oracle Price) / Oracle Price + Truncation Function (…)

By solving the no-arbitrage condition, we can deduce that the reasonable marked price at time T-1 should be approximately $98.975. Continuing this process to T-2, T-3, we find that the marked price will form a discount curve in advance.

Image source: https://oldcoinbad.com/p/non-arbitrage-conditions-for-perpetual

In simple terms, while short sellers seem to profit from the price drop, they actually pay it all through the funding fee; meanwhile, long holders, although they endure a nominal price drop, receive a "dividend" equivalent to holding the spot through funding fee income.

Design Challenge 3: Who Pays for "Volatility Arbitrage"?

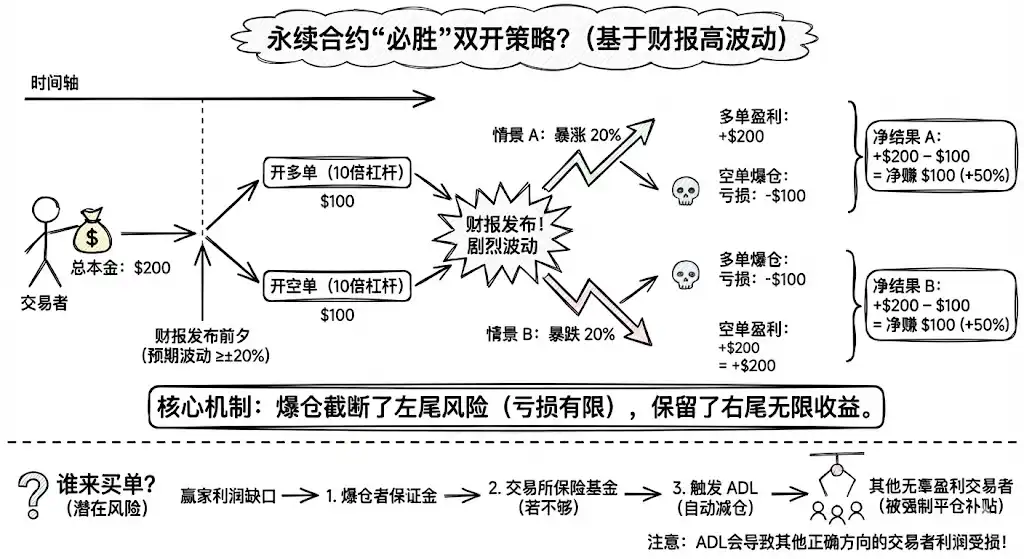

Perpetual contracts endow linear assets with a non-linear option attribute: the liquidation mechanism truncates left-tail risk (maximum loss of principal), while retaining the right-tail's unlimited profit.

Earnings reports are a typical "known unknown" event: the time is known, the direction is unknown, but the volatility is often huge (e.g., ±20%).

This gives rise to a guaranteed "double-opening strategy" in perpetual contracts with 10x leverage.

Let's look at a specific example: suppose a trader has $200 in capital, and the implied volatility on earnings report day is 20%. Before the report is released, he opens a long position with $100 margin at 10x leverage and a short position with $100 margin at 10x leverage.

Scenario A (20% surge): The short position is liquidated, losing $100; the long position gains $200. Net profit: $100.

Scenario B (20% drop): The long position is liquidated, losing $100; the short position gains $200. Net profit: $100.

Regardless of whether the price rises or falls, the trader seems to achieve a 50% return. This is because the liquidation mechanism truncates losses in the wrong direction, while profits in the correct direction remain unaffected.

So who pays for this?

In the case of major short liquidations, part of the long's profit is covered by the short's margin, and the remaining profit gap is first filled by the trading platform's insurance fund. When the insurance fund is exhausted, the platform will initiate an automatic deleveraging mechanism (ADL), forcibly liquidating profitable traders to subsidize the double-opening arbitrageurs with their paper profits. This will cause non-volatility arbitrage traders who correctly bet on the direction to lose part of their profits.

You cannot allow users to freely choose high leverage while also ensuring the fairness and stability of the system.

Current solutions, such as dynamic leverage reduction before earnings reports or increasing margin requirements, seem far from perfect.

Design Challenge 4: Market Manipulation

"The water is too shallow for the whale; a turn brings forth turbulent waves."

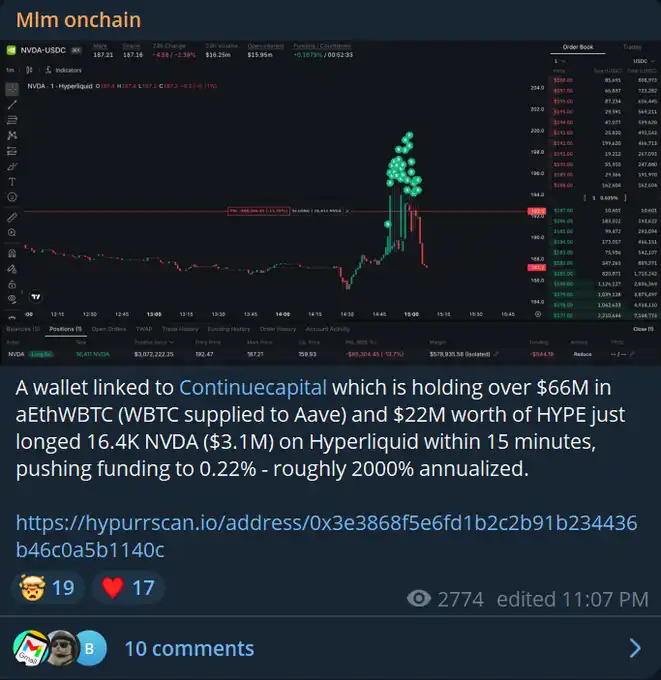

In addition to the challenges of mechanism design, the early market's fragile liquidity is also a significant risk.

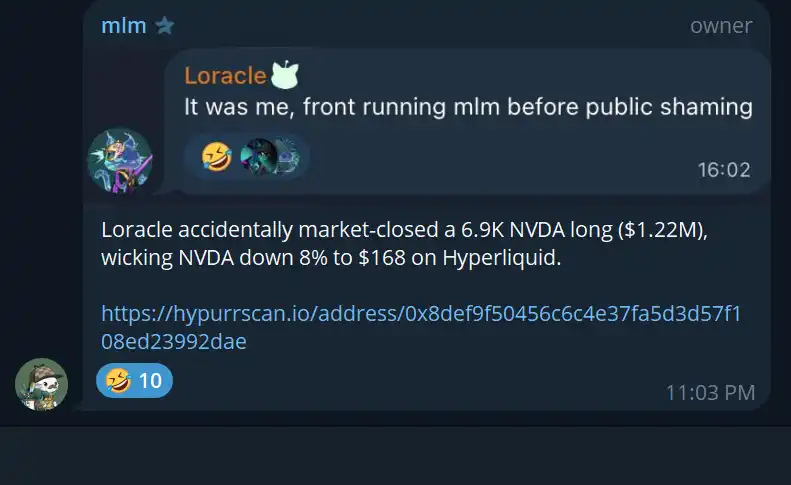

Recently, Continue Capital established a $3.1M long position in NVDA on trade.xyz, directly pushing the short-term annualized funding rate to an astonishing 2000%. KOL trader @CL207 complained, "This guy forced me to give up my position because at a yield rate of 0.2% per hour, I would have to pay $200,000 by Wednesday, which would bankrupt me."

Another whale, Loracle, unexpectedly market liquidated a $1.2M long position in NVDA, causing the price to drop 8% instantly. If trade.xyz offers options with more than 13x leverage in the future, such instantaneous liquidity depletion will lead to countless traders being liquidated.

Generally, the "market manipulation" behavior of whales would result in them incurring hefty funding fees as punishment, but during market closure periods, the oracle price loses its anchor to the spot price, and this "punishment" may be weakened.

To address this, trade.xyz employs an oracle price algorithm during market closure that maintains stickiness to the closing price and sets minimum and maximum price limits based on the last opening price to prevent extreme volatility during market closure.

However, ultimately, before solving the liquidity issue, any "stopgap" measures are merely "scratching the surface." You cannot completely prevent well-capitalized players from manipulating a fragile order book while keeping the market open.

Conclusion

Perpetual contracts are expected to be another crypto application with massive potential for large-scale use, following stablecoins.

The PMF of U.S. stock perpetual contracts has been preliminarily validated. Data shows that trade.xyz's cumulative trading volume has surpassed $2 billion, with a record single-day trading volume of $200 million during the NVDA earnings report.

The history of traditional financial markets tells us that the trading volume of derivatives often far exceeds that of the spot market. CME gold futures trade 27 million ounces daily, more than 30 times the SPDR Gold ETF's daily average of 800,000 ounces. The OTC nominal trading volume of interest rate derivatives reaches hundreds of trillions of dollars.

Compared to the spot market, the derivatives market does not involve physical delivery, offers higher capital efficiency, and has a more efficient price discovery mechanism driven by leverage.

Perpetual contracts push these advantages to the extreme. They provide continuous exposure, extremely low costs, and the highest efficiency.

As Bitcoin struggles in a bear market, U.S. stocks continue to thrive, further highlighting the potential of stock perpetual contracts.

Despite facing numerous technical and strategic challenges, perpetual contracts are beginning to "devour" the U.S. stock market in an irreversible manner.

References:

https://oldcoinbad.com/p/non-arbitrage-conditions-for-perpetual

https://docs.trade.xyz/xyz-perps-specification/equity-perpetuals/single-name-equities

https://docs.trade.xyz/xyz-perps-specification/equity-perpetuals/xyz100-and-index-perpetuals

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。