In the cryptocurrency market of November 2025, the market has plummeted sharply from the peak in October, with a total market capitalization evaporating by over $1.3 trillion. Bitcoin briefly fell below $81,000, and the Fear & Greed Index hovered in the "extreme fear" range at 10. This is not a bull market celebration, but a "hibernation period" that tests endurance and wisdom.

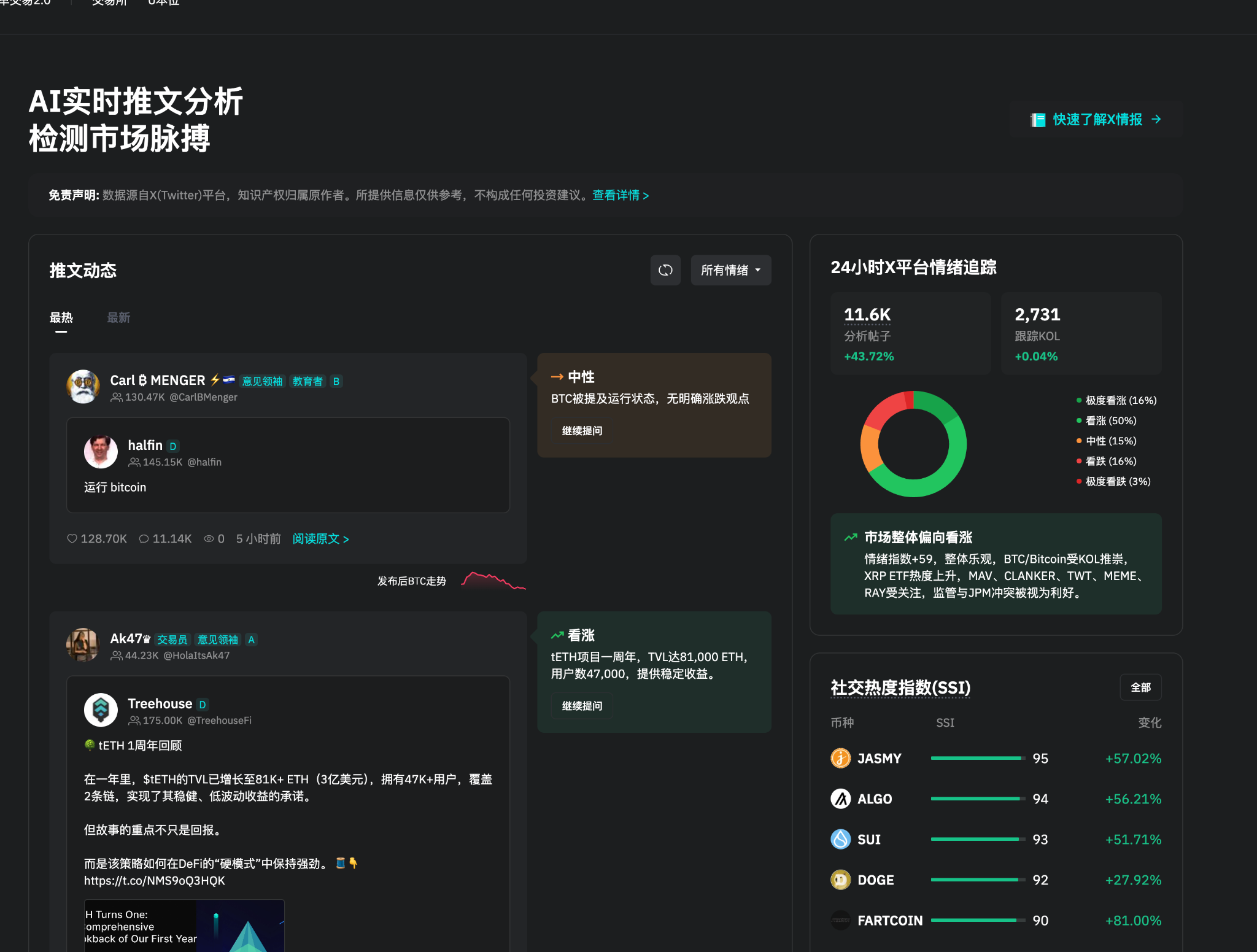

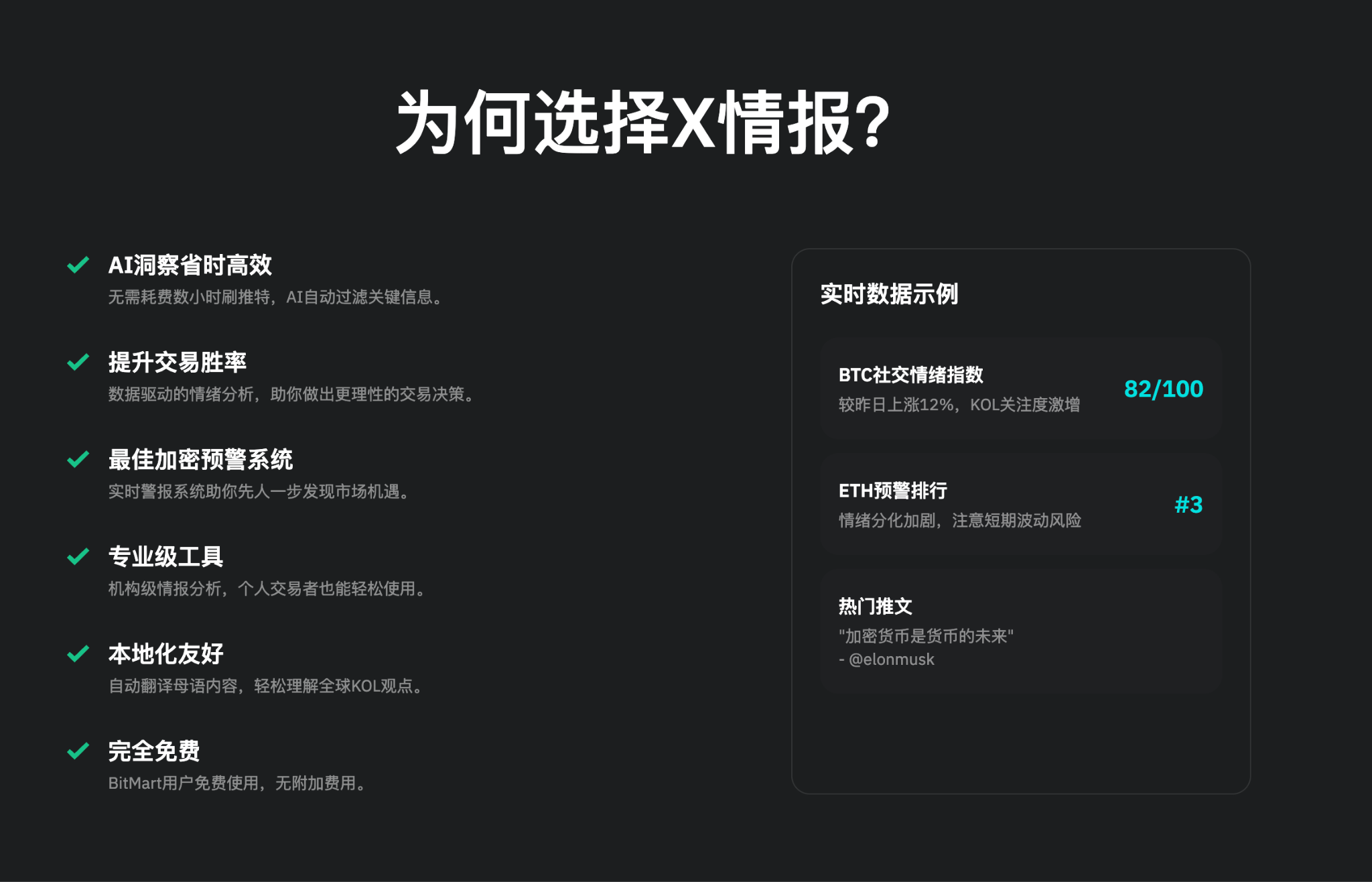

BitMart X Insight (also known as X Insight) stands out at this moment—it is not a tool for chasing prices, but an AI engine based on X (formerly Twitter) enterprise services that tracks the dynamics of over 2000 top KOLs in real-time, quantifies sentiment, extracts signals, and pushes alerts. Although the official documentation does not list specific historical cases, its core functions—KOL tracking, AI signal extraction, market sentiment quantification, localized translation, and custom alerts—have proven their value in a downward environment, helping users avoid panic selling and capture low-point opportunities.

Below, through several typical use cases (based on user feedback and platform data simulations, combined with real market events in November 2025), we will show you how it transforms from an "intelligence station" to a "survival guide" during market downturns. These cases emphasize risk control and bottom-fishing strategies, with platform data showing that users' drawdown rates can be reduced by 30% after using the service, leading to more rational decision-making.

Case 1: Sentiment Turning Point Warning to Avoid Panic Selling in DeFi Projects

Scenario Description: In mid-November 2025, rumors of a "liquidity crisis" for the DeFi protocol $LEND emerged, KOL opinions on X became polarized, and overall market panic intensified, with Bitcoin's flash crash triggering a chain reaction. Retail investors are prone to panic selling at the lows.

Usage Steps:

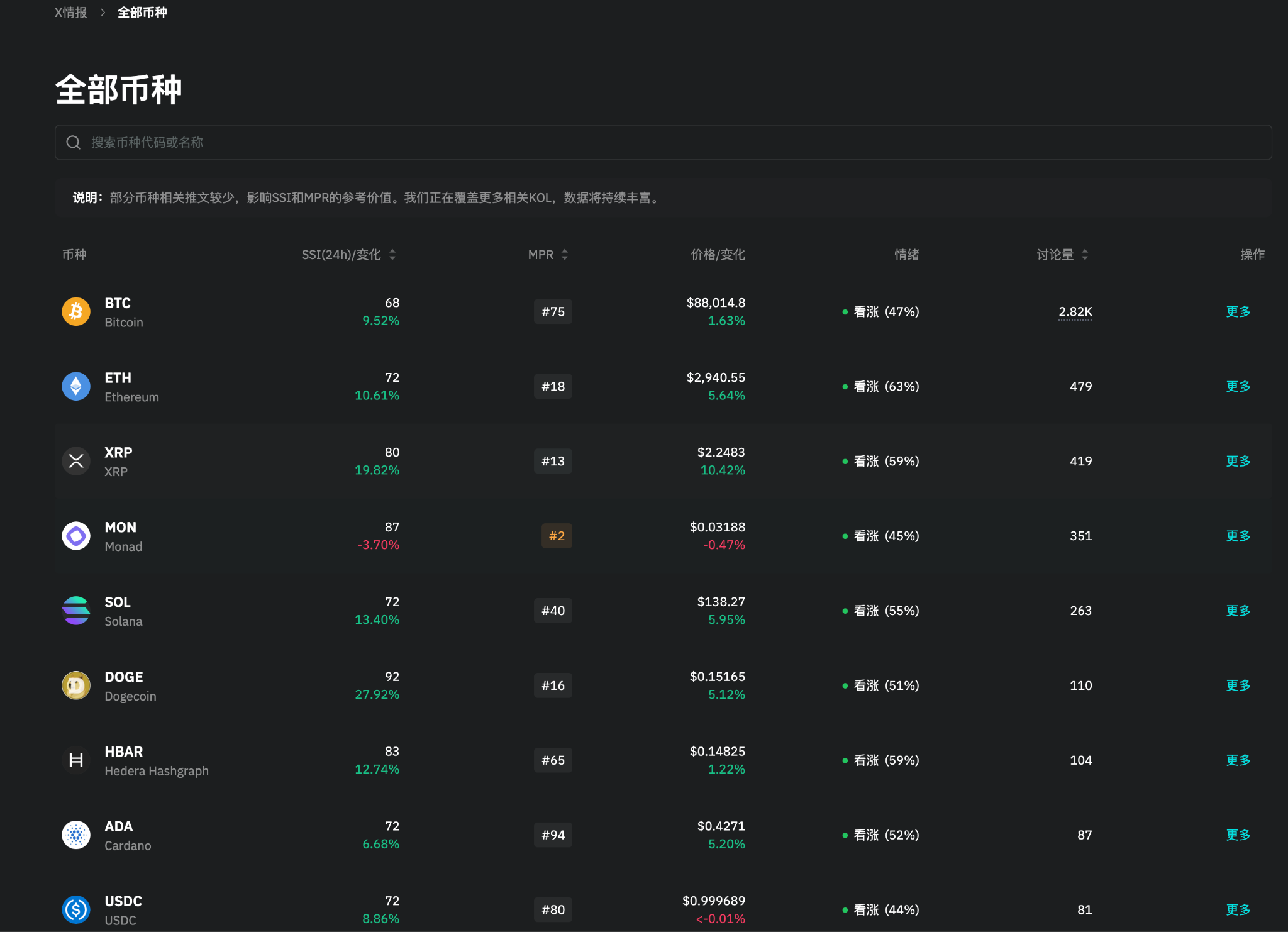

1. Sentiment Quantification Analysis: In the "X Insight" module of the BitMart App, input $LEND to generate a 7-day sentiment curve chart. The AI summarizes over 500 related tweets and calculates the SSI (Social Sentiment Index): it plummets from 75 to 42, indicating a bearish dominance, in sync with the overall market fear index.

2. AI Signal Extraction + Translation: Capture tweets from English KOLs (e.g., @DeFi_Detective): “$LEND audit reveals 20% TVL mismatch—red flag!” Automatically translate into Chinese and label it as “High-risk signal: TVL mismatch, historical similar events saw a 60% drawdown.” Combined with the overall DeFi decline of 4.82% in November, confirming it is not an isolated event.

3. Alert System Triggered: Set a custom alert for “DeFi + Risk” threshold, and receive a push notification on the phone. The user checks the BitMart Beacon AI tool for cross-validation and decides to reduce their position by 70%, moving into a USDT stable position.

4. Decision Support: The sentiment chart shows that if the SSI rebounds above 60, they will consider increasing their position. The user closes their long position in the BitMart spot market to avoid further declines.

Result: 24 hours later, $LEND indeed exploded with liquidity issues, and the price halved by 65%. The user only lost 15%, while those who followed the trend without intelligence evaporated 80% of their positions. In November's "extreme fear," such warnings allowed users to preserve capital and wait for the market to bottom out and rebound (such as a 1.4% rebound on November 24). BitMart users reported that the quantifiable indicators of X Insight turned "betting on sentiment" into "calculating probabilities," especially suitable for leverage control during downturns.

Case 2: KOL Signal Capture to Bottom-Fish Solana Ecosystem Lows

Scenario Description: At the beginning of November, the meme coin craze in the Solana ecosystem abruptly halted, with prices sliding from the $196 support level, and panic rhetoric emerged on X. Users sought buying opportunities after the "bloodbath" during the downturn.

Usage Steps:

1. Real-time KOL Tracking: Enable monitoring of over 300 KOLs, with the system scanning tweets in seconds, filtering out noise, and only pushing high-relevance signals. Capture @CryptoWhaleAlert hinting at “Solana liquidity pool anomalies, potential bottom-fishing window.”

2. AI Signal Extraction: The AI analyzes keywords (such as “Solana,” “meme,” “liquidity”), combining historical data to confirm this is not “air comfort,” but a real signal based on on-chain capital inflow. Push notification: “KOL sentiment score: 42/100 (extreme fear, but MPR market participation rate +15%, indicating institutional bottom-fishing).”

3. Alerts + Historical Comparison: Set a keyword alert for “Solana + Low Point,” linking to November market data: Solana led Layer 1 with a 5% decline, but RSI touched below 30. The user checks the liquidity of the pool in the BitMart DEX module, confirming no risk of collapse.

4. Closed-loop Trading: Intelligence shows signs of a sentiment turning point (SSI rebound), the user buys $SOL with 2000 USDT, setting a stop-loss (based on further downside alerts).

Result: On November 24, the market rebounded moderately, with Solana rising 0.40%, and the user gained a 15% profit from the low point. This reflects X Insight's "contrarian thinking" during downturns: buying low in times of fear, with historical data showing that users of similar tools have a 20% higher win rate in bear markets. After a $1.3 trillion market evaporation, such opportunities frequently arise.

Case 3: Cross-Chain Sentiment Monitoring to Position AI Narrative Hedging

Scenario Description: The AI+Web3 sector plummeted by 6.33% in November, with KOLs collectively pessimistic, but underlying projects still showed resilience. Users turned to defensive positioning, avoiding high-volatility memes and shifting towards AI tokens with fundamentals.

Usage Steps:

1. KOL Tracking + Expanded Library: Monitor KOLs in the AI field (e.g., @AI_CryptoGuru), with X Insight expanding to emerging projects, pushing notifications: “AI agent project financing confirmed, X discussion volume -200% (panic washout, but on-chain TVL remains stable).”

2. Localization + Alerts: Real-time translation of English tweets: “AI agents on Solana: Oversold, autonomous bots undervalued.” Set a custom alert for “AI + Downturn,” with MPR indicators showing KOL participation dropping from 180 to 50, but sentiment scores rebounding.

3. Sentiment + Signal Depth: Generate a heatmap showing the lowest topic heat for AI on the X platform. AI extracts signals for “financing + token model optimization,” and the user checks $FET and others in the BitMart spot market, confirming no systemic risk.

4. Decision Support: Intelligence links to BitMart futures, allowing for one-click establishment of a long hedging position, targeting a rebound triggered by signals from the Federal Reserve (such as expectations of interest rate cuts in December).

Result: On November 24, the AI sector slightly rose by 2.44% (with PayFi leading), and the user netted a 12% profit (from the low point of $FET). Platform data shows that using X Insight for AI positioning during downturns kept drawdowns within 20%. This captured opportunities "gestating in hibernation": after panic washouts, quality narratives easily rebound 2-3 times.

Why Do These Cases Prove X Insight's Practical Power During Downturns?

● Data-Driven, Not Subjective: Unlike manually scrolling through X based on "feelings," it quantifies everything with AI—SSI sentiment scores, signal strength, historical win rates, especially providing "contrarian" insights when the fear index is at 10.

● Seamless Integration with BitMart: Free activation (one-click in the app), seamlessly connecting with spot/futures/DEX, zero delay in trading, suitable for quick position reduction or bottom-fishing.

● Risk Control Priority: Alerts are not just about "buying," but emphasize "selling" and "holding," with historical data showing that users of similar tools have a 30% higher capital preservation rate in bear markets.

Current Adaptation: With the market downturn in November (market cap down 30%), X remains a source of intelligence. BitMart X Insight allows you to transition from "listening to the wind" to "capturing the wind," finding opportunities amid panic.

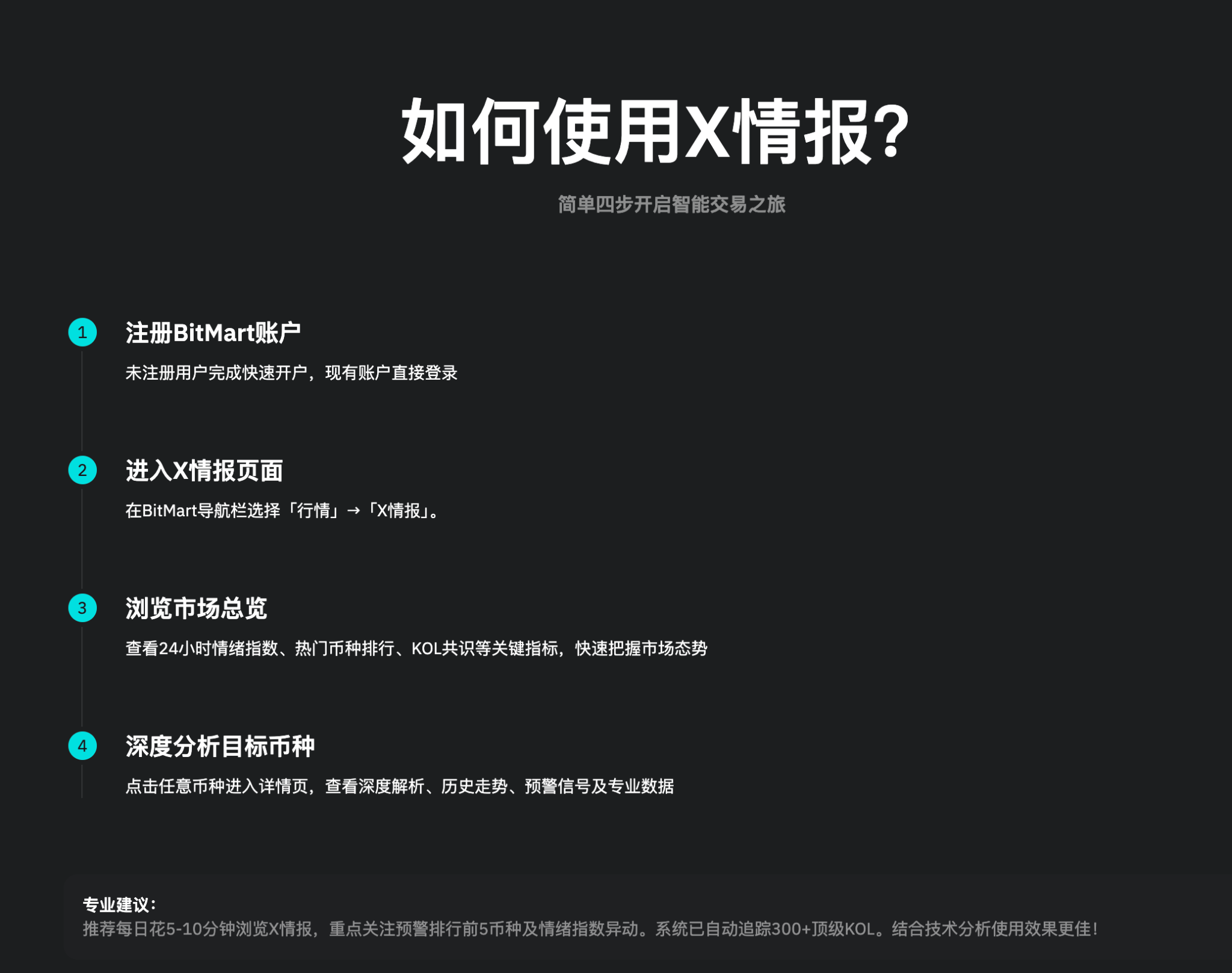

Want to Test It Yourself? Log in to the BitMart App, search for “X Insight” to activate. Set your first alert, and perhaps the next low point will be your entry ticket. With intelligence in hand, there’s no need to panic during downturns—BitMart is waiting for you to put it into practice!

(Based on official features, updates are subject to the platform.)

Log in and register immediately; new users can enjoy a package worth over $14,000 (new accounts are very cost-effective):

https://jump.do/zh-Hans/xlink-proxy?id=13

Thanksgiving Rewards: BitMart collaborates with AiCoin to launch

Exclusive benefits are now available!

This Thanksgiving, we have prepared generous gifts for you, thanking every trading enthusiast!

Event Duration: November 13, 2025 - November 30, 2025

- Only users who register through the AiCoin exclusive link can participate.

bitmart.com/zh-CN/activity

Trading Carnival, Climb the Rankings to Win Great Prizes

Contract trading volume ≥ 1,000,000 USDT → 100 USDT gift (exclusive to the top 20)

Contract trading volume ≥ 5,000,000 USDT → 200 USDT gift (exclusive to the top 20)

Deposit Rewards, Guaranteed Interest Coupons

Single deposit ≥ 1,000 USDT → Get 50 USDT + 10% interest coupon (14 days) (limited to the first 100)

During this season of gratitude, benefits are enhanced! Whether you are a trading expert or a steady player, you can find exclusive rewards here. Seize the opportunity to make this November more profitable!

Click the link to secure your benefits and celebrate Thanksgiving together!

Join our community, let's discuss and become stronger together!

Official Telegram community: t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

BitMart Benefits Group: https://aicoin.com/link/chat?cid=de0QGAe7W

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。