The market is chaotic, yet it always operates along the path of least resistance. There’s no need to guess, just follow, and time will provide you with the answers.

Hello everyone, I am trader Gege. Bitcoin has completely broken down, so according to the previous bull-bear thinking, it seems that the bear market has fully arrived. Today's article has two main points: first, to estimate the recent trends and the prices to watch, and second, to predict the bear market bottom. Long-term and spot traders can refer to this, of course, on the condition that your account is still alive, as this round of decline has already liquidated many bulls. Especially from November 11, when it fell from the high point of around 107,000 to the final spike at around 80,600, the gradual decline is more terrifying than a violent plunge, as it not only torments your account but also your mindset.

Some say this bull market is different because of ETFs, and the participation of large institutions will break historical cycles. Others say that even if we enter a bear market this time, it will be different because of the existence of ETFs; institutions and long-term believers will support the market and prevent deep declines. However, the simplest purpose of institutions entering the market is the same as yours and mine: to make a profit. So perhaps the buying pressure will become the selling pressure, and the biggest bulls may also be the biggest bears. Therefore, do not overly trust these factors; just guard your own piece of land.

Back to the main topic, let’s first estimate the recent trends. The monthly candlestick is a large bearish candle, and there are still 6 days until the close, so it is impossible to turn it into a bullish candle. The key nodes to watch will be after next month's close; if there is a downward test, it will be a good opportunity to build positions in batches. Specific prices will be updated later, but for now, keep this thought in mind and plant a seed, waiting for the right time to act.

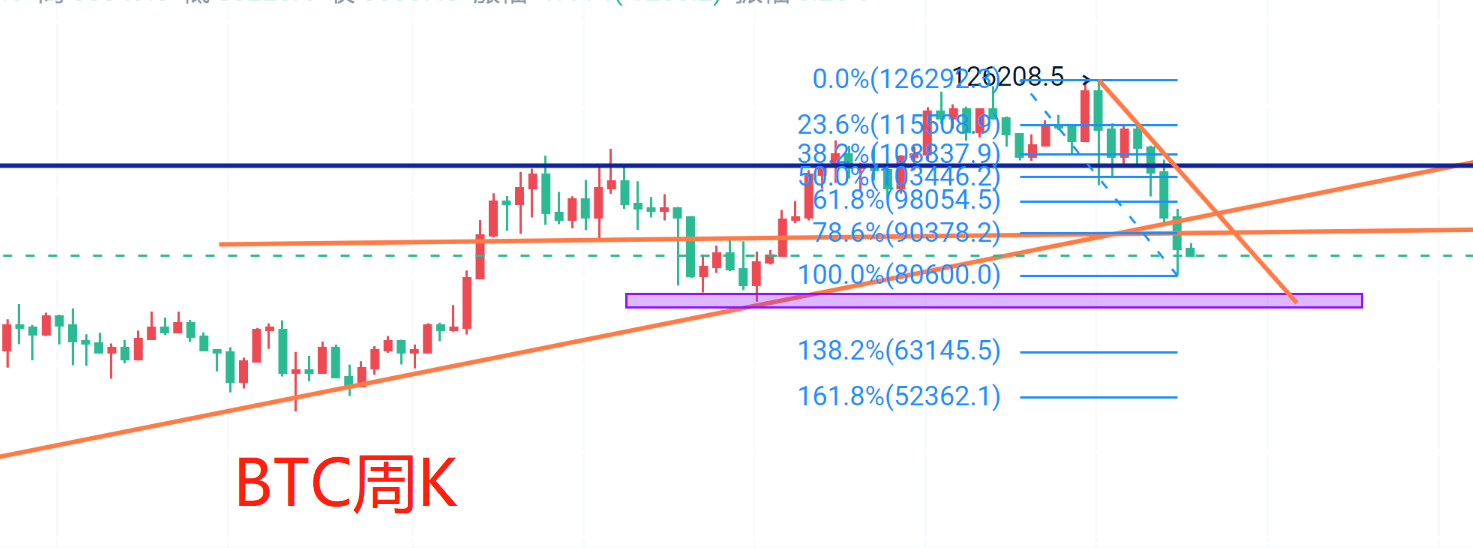

On the weekly level, there have been four consecutive bearish candles breaking below the MA60 and the upward trend line. The MACD's double line death cross has not yet shown signs of turning upward. There is a high probability that the previous low is not the bottom. Even if there is a short-term rebound, there are two key boundaries above: the 90,000-91,000 range, and then the 98,000-99,000 range. Gege estimates that it will be very difficult to break through the second key boundary in the next 8 weeks. Below, we can refer to the previous low and the low point from April, focusing on not breaking or slightly breaking these levels. First, consider buying around 80,000 with a 1,000 USD margin. If it breaks, then look to buy around 74,000. If it does not break, buy in the 77,000-76,000 range, and if it breaks, buy in the 73,800-72,800 range. The above is the current short-term analysis based on the market structure; specific operations can be flexibly adjusted according to subsequent changes.

Regarding the bear market bottom, it is still too early to predict. I will simply provide two price references based on Fibonacci extension lines, which are actually quite similar to historical cycle prices: 63,145 and 52,362. If needed, you can take a screenshot to save these prices and wait for future market conditions to verify. When we truly reach the time node of the bear market bottom, Gege will also provide my views in updated articles. That’s all for today.

The suggestions are for reference only. Please manage your risk when entering the market, and control your profit and stop-loss spaces accordingly. Specific strategies should be based on real-time conditions, and you can consult for advice.

Alright, friends, we’ll see you next time. I wish everyone success and smooth sailing in the crypto world! More real-time advice will be sent internally. Today's brief update ends here. For more real-time suggestions, find Gege.

Written by / I am trader Gege, a friend willing to accompany you in your resurgence.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。