数字黄金失去光泽,加密货币市场在恐慌的泥沼中艰难前行。“比特币跌破9万美元!”这条消息如一颗炸弹落入市场,投资者们目瞪口呆地看着屏幕上一根根阴线。

2025年11月18日,比特币一度跌至89253美元,创下七个月新低,较去年10月的历史高点下跌超过27%。

加密货币恐惧与贪婪指数已骤降至16,进入“极度恐惧”区域,甚至有数据显示该指数进一步降到了13。市场情绪低迷至冰点,投资者们正为比特币可能进一步跌向8.5万甚至8万美元做准备。

一、市场现状:自由落体式下跌

比特币正经历一场自由落体式的下跌。截至11月18日,比特币价格已跌破9万美元大关,最低触及89253美元。这一价格标志着比特币抹去了2025年全部涨幅,较去年10月创下的历史高点下跌超过27%。

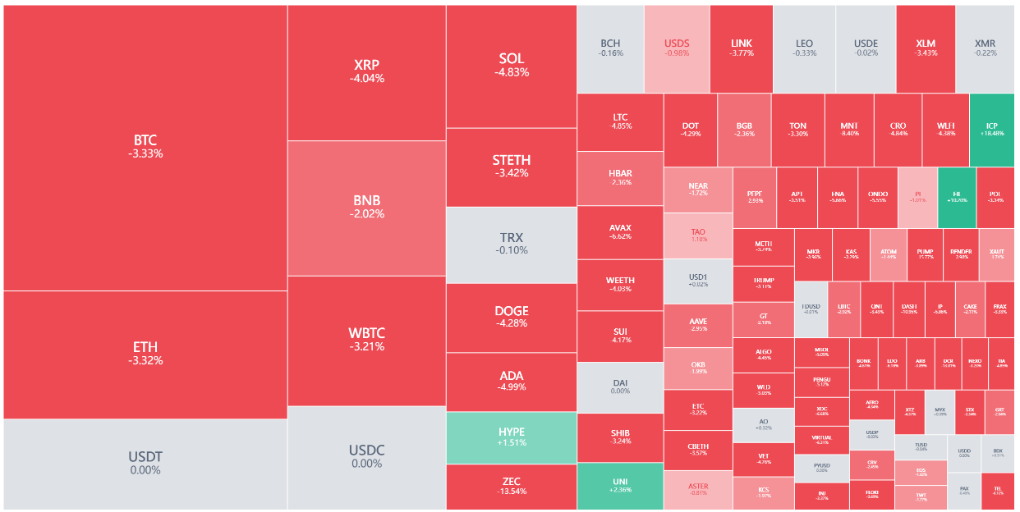

● 比特币的疲软表现迅速传染至整个加密货币市场。以太坊作为第二大加密货币,同样不堪重负,跌至2950美元,单日下跌2.6%。从10月初以来,以太坊已下跌约24%,表现更为疲弱。

● 亚洲交易时段,加密货币的卖压尤为明显。香港时间11月18日上午,比特币下跌超过3%,市场恐慌情绪持续蔓延。

● 整个加密货币生态圈都感受到了寒意。加密货币股票囤积者、矿企以及交易所Coinbase等公司的股价均随着市场情绪恶化而下滑。

二、期权市场:交易员为更大跌势做准备

面对市场的持续下跌,期权交易员正在为比特币进一步下跌做准备。

● 投资者对下行保护的需求急剧上升,看跌合约的购买量明显超过了看涨期权。

● AiCoin数据显示,交易员对比特币跌至9万、8.5万和8万美元的保护性需求大幅飙升。更有报告指出,11月底到期的看跌合约规模已超过7.4亿美元。

● 看跌/看涨比率这一关键期权市场指标提供了更多证据。尽管有数据显示比特币期权看跌/看涨比曾降至0.5,表明市场乐观情绪,但当前市场环境已发生显著变化。

● Astronaut Capital首席投资官Matthew Dibb表示:“下一个支撑位是7.5万美元,如果市场波动性仍然很高,可能会达到这个水平”。

三、衍生品信号:未平仓合约大幅下降

衍生品市场传递出更加明确的看跌信号。全网比特币期货合约未平仓头寸较10月7日峰值下跌约30%。

● 未平仓合约的下降意味着市场参与者的整体兴趣、资金流动性和投机强度正在减弱,这通常会导致市场波动性减小。这一数据与2025年加密衍生品市场未平仓合约总额首次突破500亿美元大关的早期趋势形成鲜明对比。

● 衍生品市场的降温预示着市场动能正在减弱。ChainCatcher消息确认,全网比特币期货合约未平仓头寸目前为73.754万枚BTC(约合665.4亿美元),远低于10月7日峰值的941.2亿美元。

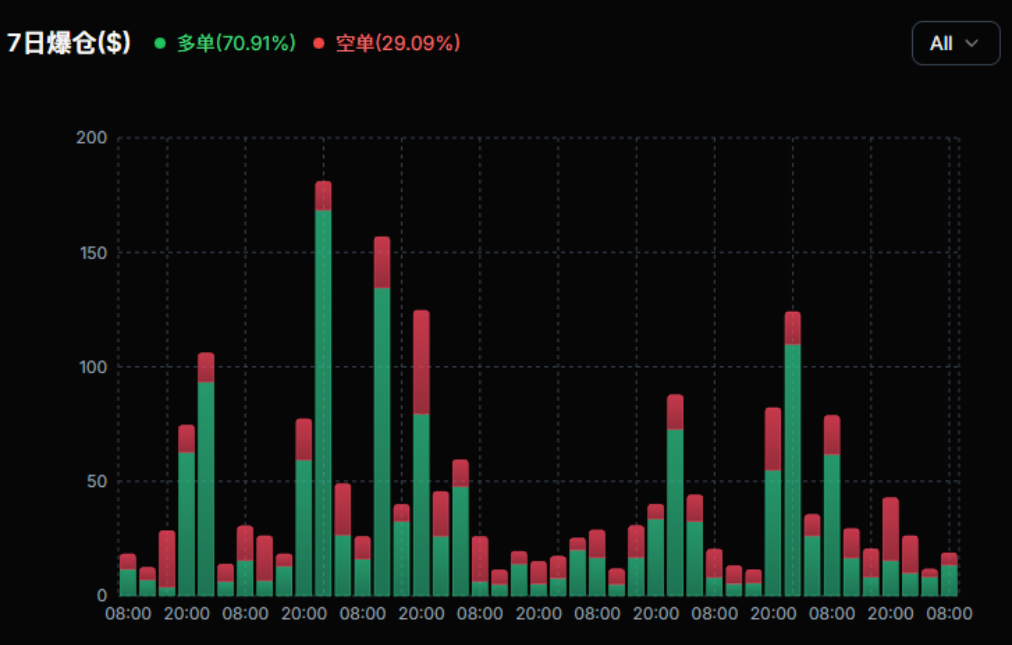

这种下降与加密货币市场更广泛的去杠杆化过程同时发生。

四、下跌元凶:多重因素压制市场

宏观压力与美联储政策

● 更广泛的市场力量正在压制加密货币市场情绪。市场参与者指出,对美国未来利率削减的怀疑以及更广泛市场的情绪正在拖累加密货币。

● “美联储和AI泡沫讨论是年底前风险资产面临的两大主要阻力,”Kaiko分析师Adam McCarthy表示。投资者对美联储12月降息的预期已经减弱。根据芝加哥商品交易所(CME)的数据,只有约44%的交易员预测12月会降息。

● 美联储官员,包括主席杰罗姆·鲍威尔,已经表示不愿意进一步宽松政策,使投资者对央行的下一步行动感到不确定。

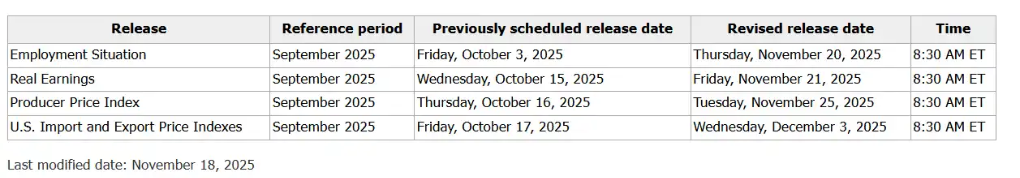

数据延迟与市场不确定性

● 数据空白加剧了市场不确定性。由于近期美国政府停运导致数周数据延迟,政策制定者仍缺乏足够的数据。这些延迟的数据预计将在本周开始发布,非农就业报告定于周四公布。

● 市场对这些数据的反应可能会决定加密货币的短期走势。

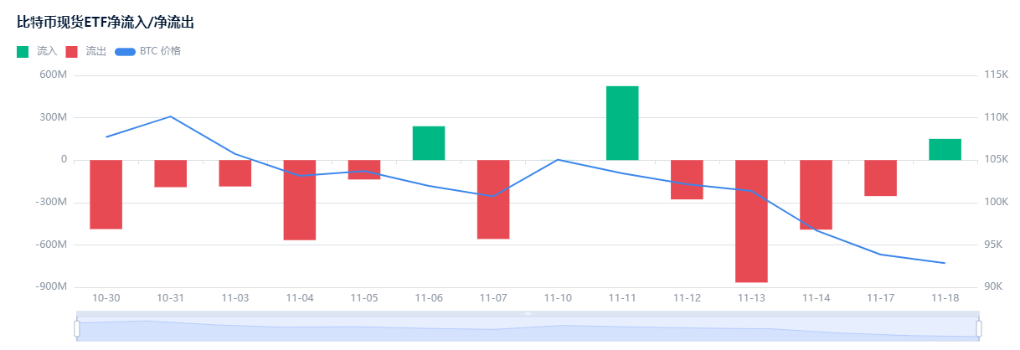

ETF资金流入减缓

● 比特币ETF资金流入减缓也是下跌原因之一。随着波动性上升,机构买家已退缩,现货比特币交易所交易基金的资金流入减弱。这些ETF在推动比特币价格上涨方面发挥了重要作用,但它们的影响力正在减弱。

清算潮与杠杆瓦解

● 市场自10月初经历剧烈清算浪潮以来一直处于动荡之中,当时约190亿美元的加密货币头寸被抹去。“所有在情绪都很低落,自10月的杠杆清洗以来一直如此,”Astronaut Capital首席投资官Matthew Dibb表示。

加密货币借贷公司、矿企和其他加密货币原生实体公司面临的财务压力加剧了这些担忧。

五、市场恐慌:连锁反应与机构困境

加密货币财库公司承压

● 数字资产“财库公司”正承受巨大痛苦。这些公司在今年早些时候囤积了大量加密货币,试图在股市中成为加密货币囤积概念股。

● 尽管Michael Saylor的MicroStrategy近期又购买了价值8.35亿美元的比特币,目前持有近65万枚比特币,其总平均成本约为每枚74,433美元。这一至关重要的成本线,为它在当前超过9万美元的市场价格中建立了强大的安全垫,使其在整个持仓周期内始终保持整体浮盈。

● Amberdata衍生品总监Greg Magadini表示这种抛售造成了恶性循环,他指出:“以太坊非常容易受到这种趋势的影响,因为目前最大的数字资产财库公司都处于亏损状态”。

市场恐慌情绪蔓延

● 市场恐慌不仅限于比特币。世界第二大加密货币以太坊跌至2975美元,自10月初以来跌幅达24%,表现尤为疲弱。

● 专注去中心化金融的Ergonia研究总监Chris Newhouse表示:“随着过去六个月累积头寸的买家发现自己已经严重套牢,基于信念的多头需求正变得越来越疲软”。

● 加密货币参与者陷入“极度恐慌”状态。市场上挤满了投资者,他们亏损太深,无法继续买入,但又不愿止损。

六、黑暗中透出的微光

悲观预期

市场分析师们对比特币短期走势预期悲观。许多分析师预测比特币将进一步下跌至86000美元水平。

● 技术分析显示,比特币未能守住94000美元附近的支撑位,并触发了短期移动平均线与长期移动平均线的“死亡交叉”信号。

● CoinBureau创始人Nuc Puckrin指出,尽管25%的跌幅是本轮周期中最低的调整级别跌幅,与之前超过30%的跌幅相比,投资者情绪仍然崩溃。

长期积极因素

● 尽管市场一片悲观,但仍有声音对加密货币长期前景保持信心。Bitwise首席执行官Hunter Horsley表示,尽管市场暴跌,加密货币长期基本面“从未如此强劲”。

● Horsley认为,四年市场周期已经消亡,取而代之的是更成熟的市场结构,以及因美国监管转向支持加密货币而改变的市场动态。

● Kraken策略主管Thomas Perfumo预计,到2025年加密货币ETF资金流入规模将翻倍至500亿美元。他认为,主权财富基金、捐赠基金和养老基金等终极配置机构将在明年陆续进场。

历史模式的启示

● 历史数据表明,当前的市场恐慌可能正为未来的反弹创造条件。根据Crypto Fear & Greed Index的历史模式,当该指数跌入“极度恐惧”区域(低于20)时,往往与重大市场底部相吻合。

● 这些低点包括2021年7月、2022年6月、2022年12月、2024年8月和2025年3月。当前市场情绪已接近这些历史低点水平,暗示可能正在形成短期底部。

技术图表上,比特币的下一个关键支撑位在75000美元水平,如果市场波动性仍然很高,可能会测试这一位置。但若在这一位置获得强力支撑,市场可能会走出新的上升行情。

市场总是在绝望中新生,在狂欢中结束。今日的恐慌,或许正为明日的回升埋下种子。

加入我们的社区,一起来讨论,一起变得更强吧!

官方电报(Telegram)社群:https://t.me/aicoincn

AiCoin中文推特:https://x.com/AiCoinzh

OKX 福利群:https://aicoin.com/link/chat?cid=l61eM4owQ

币安福利群:https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。