Written by: Frank, MSX Research Institute

Miners are being forced to choose: continue mining, sell electricity to AI, or transform into data centers? Where does capital stand?

On November 18, as the global financial markets were gloomy, Crypto once again faced a "Black Tuesday," with BTC dropping below the $90,000 mark during the day, a cumulative decline of about 30% from the historical high point of $126,000 over a month ago, entering a technical bear market.

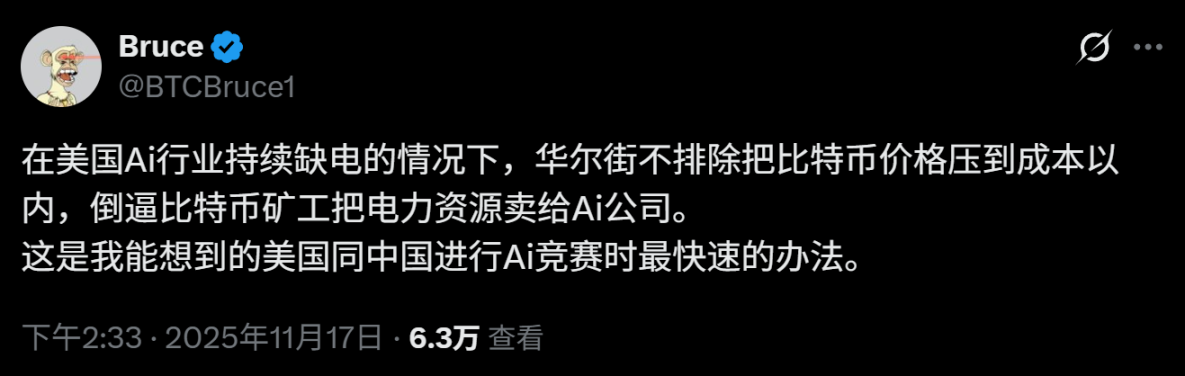

At the same time, discussions about BTC shutdown prices, mining company liquidations, and cyclical reshuffling have begun to emerge. However, unlike previous discussions, the core assumption of this round of discussions is no longer the internal supply and demand of Crypto, but rather a new macro fact: AI and Crypto are now competing for electricity from the same energy pool.

It can be said that over the past year, from policy subsidies to energy/land tilt, and then to marginal return differences, almost all variables are forcing mining companies to complete a significant role shift from "electricity consumers" to "electricity providers"—and when "using electricity to train models" is more certain and profitable than "using electricity to mine BTC," capital is also rapidly completing a new alignment.

This means that in the coming years, mining companies must make real choices under new structural pressures: continue mining? Rent electricity and facilities to AI? Or completely transform into general computing power infrastructure?

This may be a question far more valuable than predicting the trends of the Crypto market.

1. AI Accelerates the "Squeeze" on Crypto

What is the end of AI?

Electricity.

As early as 2024, Musk pointed out that the bottleneck in AI development is not computing power or algorithms, but energy supply, especially high-quality, sustainable electricity capable of supporting ultra-large load data centers. Entering 2025, the continuous power and transformer capacity warnings across the United States have further reinforced this judgment.

Thus, a real "energy run" around electricity, land, and facilities is happening.

Upon closer examination, it is easy to find that AI data centers and Crypto mining farms have a high degree of genetic similarity in engineering implementation, as both rely on dense arrays of computing units (NVIDIA GPUs/ASIC miners), require large scalable park land/infrastructure facilities, need high-density stable and long-term locked electricity supply, and require large cooling/heat dissipation/redundancy systems.

In other words, "first comes electricity and facilities, then comes computing units and customers," this statement applies equally to mining farms and AI data centers, with the only difference being that one uses electricity to train models to produce AI capabilities, while the other uses electricity to compute hashes to produce BTC.

This explains why mining companies have become one of the main players in this AI arms race: Crypto mining farms have long been prepared with ample electricity supply, land parks, and facility infrastructure, allowing tech giants to transform existing mining farms into usable AI infrastructure in just a few months, providing them with ready-made solutions that can immediately meet demand.

Of course, this is not the first time Crypto has deeply intersected with the "big computing power era." The last time was during the Ethereum mining boom from 2017 to 2018, which "exploded" NVIDIA's graphics card sales (Jensen Huang even got a tattoo on his left arm to commemorate NVIDIA's stock price first breaking $100).

However, this time the direction is reversed; it is no longer Crypto driving the computing power cycle, but AI squeezing the energy space that miners rely on for survival.

Source: Xueqiu

According to Morgan Stanley's estimates, if a mining company converts a 100 MW mining farm into a "powered shell" data center (providing space, electricity, and cooling, but excluding chips and servers), and then leases it long-term to customers, it could create an equity value of about $5.19-7.81 per watt, far exceeding the current trading levels of many Bitcoin mining stocks.

More critically, beyond market forces, the policy side is also continuously tilting: the U.S. has viewed AI energy as a key pivot in strategic competition, with subsidies, tax incentives, land quotas, and electricity planning around AI data centers clearly prioritized over Crypto mining.

Overall, the situation facing mining companies now is that they are caught in a deadly "sandwich" layer:

- Above is AI's dimensionality reduction strike: Tech giants hold trillions of dollars in cash and are willing to pay several times more than miners to seize electricity contracts and transformer capacity, with greater capital return desires strongly pushing mining companies to transform;

- Below is BTC's own deflationary mechanism: The halving cycle continues to compress coin-based income, network difficulty keeps rising, the output per unit of computing power continues to decline, and the selling pressure from price fluctuations further seals the survival space for small and medium-sized mining farms;

In this environment, squeezed by multiple pressures from AI, whether mining companies can find a new path to survival is evolving into a fundamental question of whether they can traverse the cycle, leading to three distinctly different development paths:

- Stubbornly mining: Continue to mine BTC, drastically lower electricity prices, improve mining machine efficiency, and compete for the remaining survival space after the halving and rising difficulty;

- Becoming a "sub-landlord": Rent out their own electricity, facilities, and cooling systems to AI companies or computing power service providers, transforming into "electricity intermediaries + data center service providers," earning stable rent and service fees;

- Complete role transformation: Evolve from a single mining company to a general computing power provider, offering long-term computing power and hosting services for AI, cloud computing, and high-performance computing (HPC) data centers, truly becoming a new type of "digital infrastructure company";

Moving forward, the valuation and fate of U.S. mining companies will largely depend on which path they choose.

2. The New Valuation Logic for Mining Companies: Not Looking at EH/s, Only Focusing on GW/MW

As mentioned above, mining companies seem to be forced to face a "three-choice" question: continue mining, sell electricity to AI, or fully transform?

However, in the face of the infrastructure wave triggered by AI, there is only one ultimate solution to survive: regardless of which path is chosen, they must complete the role switch from "electricity consumers" to "electricity suppliers" within the next few years, otherwise they will be forced out before the next cycle arrives.

The reason is very simple—over the next three years, the electricity gap is rigid. Morgan Stanley's model shows that between 2025 and 2028, the electricity demand for U.S. data centers is expected to be 65GW, while the current grid can only provide a near-term access capacity of 15GW. Adding the approximately 6GW of data centers under construction, there remains a huge electricity gap of about 45GW.

In the context of AI's rapidly rising energy consumption curve, the ability to control electricity directly determines survival.

MARA Holdings (MARA) CEO Fred Thiel bluntly stated: "By 2028, you will either be a power generator yourself, be acquired by a power generator, or be deeply tied to a power generator. Mining companies that solely rely on grid power have already entered a countdown to death."

In short, the future value of mining companies will no longer depend more on computing power scale (EH/s) or mining machine/Bitcoin reserves, but will begin to anchor on the energy infrastructure they possess (GW/MW). Whoever can control electricity can control costs and thus control the future business direction—whether to continue mining or to supply power to AI.

The market has also long reacted to the shift in valuation logic for mining stocks transitioning to AI. For instance, the iconic example of a mining company transitioning to AI, Iris Energy (IREN), saw its stock price rise from around $6 to a peak of $76.87 within the year, an increase of over 1200%.

The key factor here is that it has benefited from the first-mover advantage in strategic transformation. For example, while traditional mining companies were still expanding ASIC computing power in 2023, IREN began to extract its own electricity from the mining business, gradually upgrading the entire park to an AI/HPC data center. In 2024, it became the first to obtain the title of NVIDIA's preferred partner, ensuring a more stable GPU allocation, locking in key customers earlier, and entering the upstream position of the AI energy market.

This month, IREN also signed a $9.7 billion five-year AI cloud computing power contract with Microsoft, once again pushing its transformation story to a climax. According to the agreement, Microsoft will prepay about 20% of the amount, meaning the contract's annual revenue could reach $1.94 billion, which is undoubtedly a significant increase for IREN's existing revenue.

Of course, although IREN's ideal transformation path is enviable, this path is not one that all mining companies can replicate, as not all mining companies, like IREN, choose to bet everything on AI—after all, not all mining companies are qualified to transform/surrender; the premise of transformation is not willingness, but (own) electricity, scalable land, and infrastructure elements.

Mining companies without these resources, even if they want to surrender to AI, will find it difficult to become valuable computing power infrastructure providers. In a sense, it seems that "mining companies are choosing AI," but in reality, it is closer to "AI is choosing mining companies."

This is also the most fundamental change in the entire mining company sector.

3. The "Arms Race" of Transformation: Ambition, Gambling, and Lying Flat

This article also briefly reviews the basic situation of eight U.S. listed mining companies: IREN, CIFR, RIOT, CORZ, MARA, HUT, CLSK, BTDR, and HIVE, hoping to showcase the diverse choices and challenges faced by different mining companies in the transformation to AI infrastructure.

From the transformation paths of these companies, the "arms race" of transformation among U.S. mining companies is accelerating. Whether it is IREN leading the shift from traditional mining to AI data centers, or CORZ, CIFR, and MARA making significant investments in their own electricity and land layout, these companies are striving to become digital infrastructure providers.

At the same time, mining companies like CIFR and BTDR are also gradually expanding their electricity and computing power resources, extending their business boundaries into the AI industry. However, not all companies are advancing in this competition at the same speed.

For example, companies like HUT and HIVE, due to insufficient power infrastructure, transformation determination, or resource accumulation, have relatively conservative transformation paths and still rely on traditional Bitcoin mining operations. Because of this, the fate of mining companies is showing clear stratification:

- Resource-based mining companies: Have the opportunity to evolve into "energy-like companies" or "AI data centers";

- Light asset mining companies: At most, act as "sub-landlords," renting out electricity or facilities to AI and earning service fees;

- Small mining farms highly dependent on the grid: With rising electricity prices and increasing difficulty, they are likely to be the first to be washed out in the next upward cycle;

This historic tide of AI is vast and sweeping, not only changing the direction and power structure of global internet development but also driving a new round of reshuffling in the global energy industry. The transformation struggle of mining companies is a microcosm of this macro trend.

It can be said that when AI giants begin to directly seize resources such as electricity and land, the valuation logic of mining companies has been permanently altered—mining farms are no longer mirror assets of BTC but are being repriced as part of AI energy infrastructure, and their market value elasticity is no longer directly linked to computing power scale and Bitcoin prices, but determined by the scale of GW/MW they control.

In the coming years, as electricity demand continues to rise and the competition for data center resources becomes increasingly fierce, mining companies must find their position in this battle for electricity and computing power.

This is the true competitiveness in the future cycle.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。