Written by: Panterafi

Translated by: Block unicorn

There has been much discussion about the stability of stablecoins, but very little about the risks, which I believe is the key issue that needs to be discussed. This is also something I have been thinking about for months, and I am glad to finally share it with everyone.

Summary

The future and past discussions of stablecoins

Main categories of stablecoins

Comparative analysis of risk indicators

Current state of Solana ecosystem

The Future and Past Discussions of Stablecoins

Here, I have compiled the insightful views of various leaders on the development of stablecoins. They mainly discuss several paths through which DeFi can achieve global mass adoption via stablecoins.

"Global adoption requires on-chain FX" -- haonan

This is expected to improve global trade settlement. On-chain foreign exchange trading can handle cross-border payments, remittances, and exchanges with local stablecoins or fiat currencies, free from regulatory barriers. It can replace the slow traditional systems with instant, low-cost exchange methods.

To achieve widespread adoption, on-chain FX needs deep AMM liquidity pools capable of handling transaction volumes of up to $11 billion within 30 days. Slippage management will soon become a challenge, along with the need for scalable infrastructure and payment systems built on top of it. The stablecoin ecosystem for foreign exchange must also prioritize robust security.

To achieve widespread application, on-chain FX trading needs to handle deep AMM liquidity pools capable of managing transaction volumes of up to $11 billion within 30 days. Slippage management will soon become a challenge, along with the need to build scalable infrastructure and payment systems. The stablecoin ecosystem for foreign exchange must also prioritize strong security.

"Proxy payments can significantly enhance the user experience for small online transactions" -- hazeflow_xyz

x402 is an open-source, internet-native payment protocol developed by Coinbase. It utilizes the HTTP 402 "Payment Required" status code to enable instant small payments using stablecoins like USDC.

x402 has several advantages:

Autonomous operation: AI agents can independently pay for services, data, computation, or tools in real-time, enabling machine-to-machine economies without human intervention.

Instant settlement: Transactions can be confirmed within seconds, with finality, no chargebacks, and zero protocol fees, making it ideal for high-frequency small payments.

Frictionless integration: Agents can add stablecoin payments to any web request with minimal setup, addressing traditional payment barriers like API keys or intermediaries.

Compliance and security: Built-in verification and settlement mechanisms ensure regulatory compliance while maintaining price stability using stablecoins in a volatile cryptocurrency environment.

Scalability of the AI ecosystem: It supports a marketplace for agents to autonomously trade resources, promoting the growth of stablecoin-based infrastructure supported by facilitators like Coinbase or PayAI.

"Blockchain and public trading networks can enhance trust and transparency, thereby reducing illegal transactions."

Traditional banks like Deutsche Bank and auditing firms like Deloitte and EY have faced serious allegations due to audit failures or money laundering. Many politicians have also been convicted of embezzling public funds.

I believe one major advantage of using blockchain-based stablecoins is the ability to reduce corruption, illegal transactions, and money laundering activities. Financial authorities will be able to trace any flow of funds, and auditors will have a clearer understanding of business operations. This could also give rise to new roles in wallet tracking/data analysis (e.g., Dune). A deeper understanding of fund flows and precise data analysis is expected to foster new concepts and economic models.

For me, blockchain is not just a practical revolution (from a business perspective); it has also regained public trust in government and its elite by empowering the public with control and oversight transparency.

"The infrastructure for stablecoins will eventually become invisible" -- SuhailKakar

He emphasizes that blockchain stablecoins will not be known to the public. Retail users do not care about the underlying technology as long as they have a fully functional payment system. He cites the example of Telegram, which initially developed as an instant messaging app and later integrated the TON network, allowing users to unknowingly gain wallet and payment services without realizing it was cryptocurrency or blockchain. Companies like Circle, Tether, Coinbase, and Stripe are building payment infrastructures that allow merchants to accept cryptocurrency payments without needing to understand any cryptocurrency knowledge. Merchants receive dollars, the infrastructure handles all blockchain-related work, and customers enjoy a smooth checkout experience.

The greatest success of cryptocurrency will come when people stop talking about cryptocurrency and instead become an invisible infrastructure that supports the experiences people truly want.

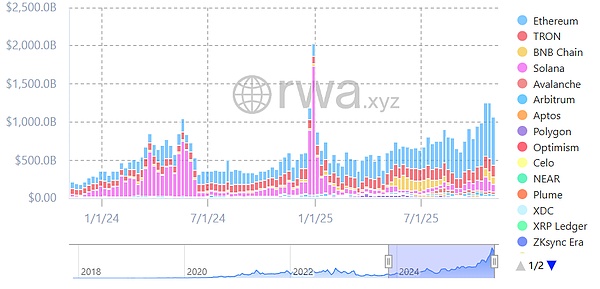

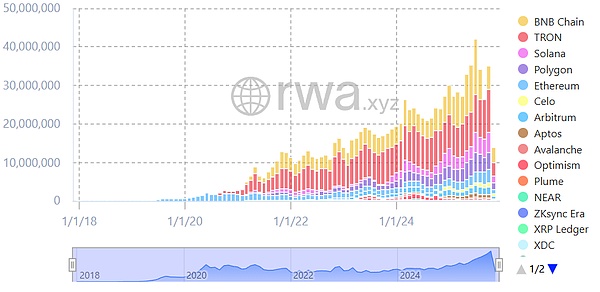

"Yield-bearing stablecoin protocols see skyrocketing market value" -- Jacek_Czarnecki

Their total market value has increased 13 times, from $666 million in August 2023 to $8.98 billion in May 2025, peaking at $10.8 billion in February.

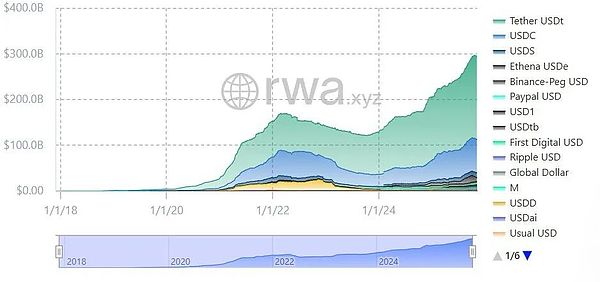

They currently account for 3.7% of the entire stablecoin market (totaling $300 billion).

There are now over 100 types of yield-bearing stablecoins on the market; among them, mainstream stablecoins like Ethena's sUSDe and Sky's sUSDS/sDAI account for 57% of the market share ($5.13 billion). Since mid-2023, they have distributed nearly $600 million in yields.

The recent surge of new yield-bearing stablecoins is driven mainly by two factors:

The first comes from their core concepts: delta-neutral hedging (Ethena USDe) and soft liquidation mechanisms (Curve crvUSD), allowing stablecoins to recover from the Luna crash and grow to a market value of $300 billion.

The second comes from the government level, where they have begun to recognize certain types of crypto assets as financial instruments, paving the way for innovation. Regulatory advancements, such as the U.S. "GENIUS Act" (signed in July 2025, requiring 1:1 reserves, anti-money laundering/know your customer processes, and banning uncollateralized algorithmic stablecoins), the EU's MiCA, and relevant frameworks in the UK and Asia, have all facilitated institutional adoption and trust.

"New yield models and white-label distribution" -- hazeflow

In a low-interest-rate environment, such as during government intervention, new reward models can be established. Governments can incentivize users to use stablecoins by issuing them. In a high-interest-rate environment, stablecoins, especially decentralized ones, can provide yields or incentives through their reserve assets, gaining an advantage. Users can earn annual yields sufficient to offset inflation just by holding stablecoins. These yields can be converted into cash back or practical benefits through close cooperation with partners.

Stable infrastructure and companies like Apple or Microsoft can benefit mutually. Companies can gain new revenue streams, while stablecoins can acquire a large user base, promoting global development.

The U.S. is the most fertile ground for stablecoin growth, with regulation on track and the largest market size. In terms of the practicality of stablecoins, poorer countries are more willing to use stablecoins due to the weakness of their local currencies.

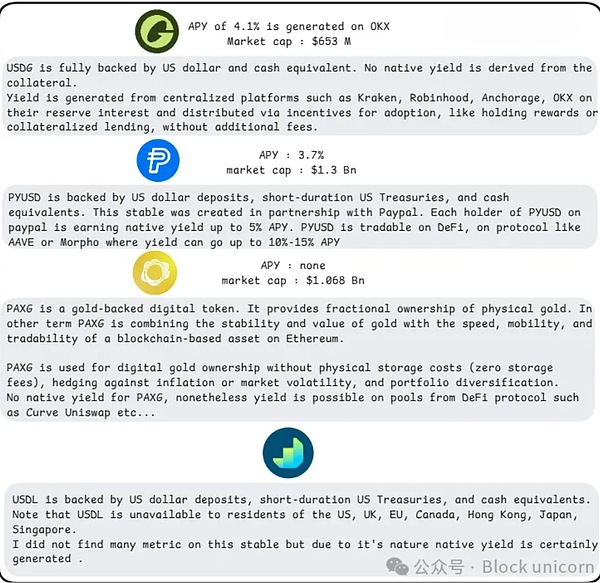

Now, let us delve into the specific characteristics of each type of stablecoin to understand their risk indicators and yield mechanisms. I have created these charts to help you gain a comprehensive understanding of various mechanisms, allowing you to find more robust, higher-yield, or lower-yield mechanisms.

Stablecoins are the pillars of DeFi, and putting all idle funds into one protocol is not the best choice; diversity is key. However, to achieve stable yields, diversity is limited, and trade-offs must be made between different stablecoins.

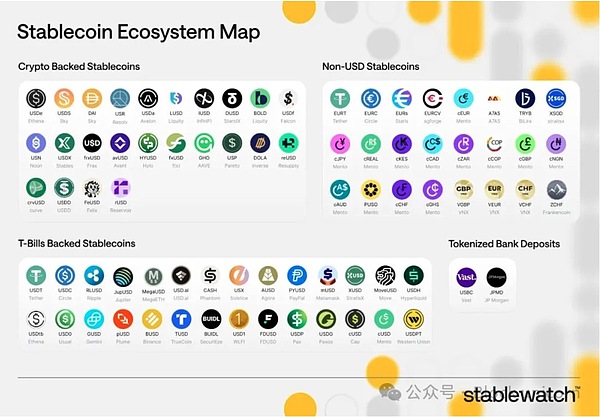

Categories of Stablecoins

Collateralized stablecoins (over-collateralized using cryptocurrencies or RWA):

Yield mechanism: Users borrow against collateral (ETH, BTC) valued higher than the issued stablecoin and earn yields through borrowing fees, RWA interest (U.S. Treasury bonds), or protocol profits. Over-collateralization serves as a buffer.

Examples: USDS (Sky, yields from RWA and borrowing), GHO (Aave, yields from borrowing fees), USR (Resolv, yields from tokenized assets), USDe (Ethena, yields from staked ETH and futures), USD0 (Avalon, yields from RWA interest), cUSD (Celo, yields from natural resource backing).

How yields are generated: Interest generated from collateral (staking rewards or RWA returns) is distributed to holders or stakers through modules like savings rates.

Algorithmic or hybrid stablecoins:

Yield mechanism: Adjust supply based on demand (minting/burning) through algorithms to maintain stability, with yields coming from minting taxes (minting fees) or incentives (governance tokens).

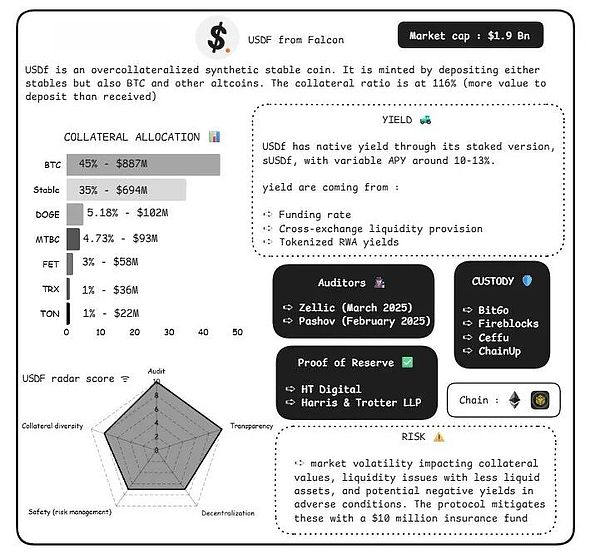

Examples: USDF (Falcon, yields from perpetual futures hybrid products), USDO (Avalon, combining algorithmic elements with RWA).

How yields are generated: Dynamic adjustments create arbitrage or reward opportunities, often amplified through DeFi integrations like staking or providing liquidity.

How yields are produced: Dynamic adjustments create arbitrage or reward opportunities, and DeFi integrations (like staking or liquidity provision) typically amplify these opportunities.

Fiat-backed or centralized stablecoins (for comparison only):

Yield Mechanism: Backed 1:1 by fiat currency or equivalents, yields come from reserves (government bonds). Base yields are typically not distributed to users but retained for company use.

For example: USDC (Circle), USDT (Tether)

How Yields are Generated: Low-risk interest is earned from reserves, but the level of decentralization is the lowest.

Risk Indicators

Depeg Risk

Depeg occurs when a stablecoin fails to maintain its intended peg of $1, usually due to extreme market pressure, supply-demand imbalances, or significant declines in the value of underlying collateral. This risk is inherent in stablecoin models, as they rely on economic incentives, algorithmic mechanisms, or reserves, which may fail during cryptocurrency market crashes or broader financial turmoil. Collateralized stablecoins may depeg when reserves are insufficient or liquidity is poor, while algorithmic stablecoins depend on fragile arbitrage mechanisms that may collapse under panic selling.

Other important supplements:

Types of Depeg Mechanisms: It is crucial to distinguish between temporary depegging (due to short-term liquidity crunches) and permanent depegging (death spirals in under-collateralized systems). Indicators to monitor include the anchoring deviation rate (the frequency of price tracking deviating ±0.5% within 24 hours), reserve ratio transparency achieved through on-chain audits, and redemption speed during stress tests.

Market Contagion: The depeg of one stablecoin can trigger a chain reaction throughout the DeFi ecosystem (similar to a "bank run"), as stablecoins are often used as collateral in lending protocols, amplifying losses.

Mitigation Strategies: Regular audits of reserves, maintaining an over-collateralization rate above 100%, and hybrid models combining fiat support and algorithmic adjustments can reduce risks. However, even stablecoins with sufficient reserves are not completely immune. For example, during severe market fluctuations, arbitrageurs may delay transactions due to high gas fees or network congestion.

Recent Developments: As of 2025, with increasing adoption rates, predictive models have begun to focus on monitoring depeg risks, incorporating factors such as collateral volatility, issuance volume, and macroeconomic indicators (affecting interest rate changes on government bond-backed reserves).

Typical Event: In May 2022, TerraUSD (UST) depegged, plummeting from $1 to nearly $0, leading to algorithm failure and market panic, triggering a collapse of over $40 billion in the ecosystem.

Smart Contract Vulnerabilities

Code vulnerabilities or exploits within protocols can lead to hacking incidents or data loss. The longer a stable protocol has been operational, the stronger its ability to withstand these vulnerabilities. Newer protocols face higher risks associated with smart contracts (unproven in real-world scenarios).

Smart contracts are the backbone of stablecoin protocols, but they may contain code vulnerabilities, logical flaws, or exploitable weaknesses that can lead to unauthorized access, fund loss, or protocol failure. Mature protocols that have been tested in real-world scenarios typically perform better due to multiple audits and practical application experience, while new protocols face higher risks due to unverified code.

Other important supplements:

Audit and Testing Practices: Emphasizing the identification of issues through multiple independent audits (using tools like Quantstamp or Trail of Bits), formal verification tools, and ongoing bug bounty programs before and after product release. Metrics include the number of audits, time since the last major update, and historical attack incidents.

Oracle Dependency: Relying on external data sources (oracles) for collateral pricing can lead to manipulation. For example, flash loan attacks may temporarily distort prices, triggering unnecessary liquidations (leading to temporary depegging).

Ecosystem-Wide Impact: Vulnerabilities are not isolated. A hack of one protocol can affect all stablecoins integrated with it, potentially triggering a chain liquidation of the entire stablecoin protocol (as they support each other/use similar collateral), leading to a collapse of trust and a decline in adoption. The SVB collapse led to a brief depeg of USDC, which affected the entire DeFi ecosystem, exemplifying this situation.

Typical Event: In March 2022, the Ronin Network hack saw attackers exploit vulnerabilities to steal $620 million worth of ETH and USDC from the Axie Infinity bridge.

Regulatory Risk

Stablecoins face increasingly stringent government scrutiny regarding anti-money laundering (AML), know your customer (KYC) requirements, securities classification, and transparency of fiat backing. This can lead to operational restrictions, asset freezes, or even complete bans, especially for stablecoins that integrate real-world assets (RWA) or engage in international business. In jurisdictions with rapidly changing cryptocurrency policies, these risks are amplified, affecting their global availability.

Other important supplements:

Global Regulatory Differences: In the EU, the Markets in Crypto-Assets (MiCA) regulation requires stablecoin issuers to hold reserves in licensed banks and maintain liquidity buffers, while the U.S. focuses on classifying some stablecoins as securities, subject to regulation by the SEC. Emerging markets may implement capital controls, restricting cross-border capital flows. Protocols must comply with relevant regulations to interact with citizens, increasing the complexity of their development. Additionally, protocols must choose a jurisdiction for legal development, and the EU is not the preferred choice…

Compliance Metrics: Tracking issuer licensing status, frequency of reserve reporting, and associations with sanctioned entities. Non-compliance may lead to exchanges delisting them, resulting in a loss of trust and user base.

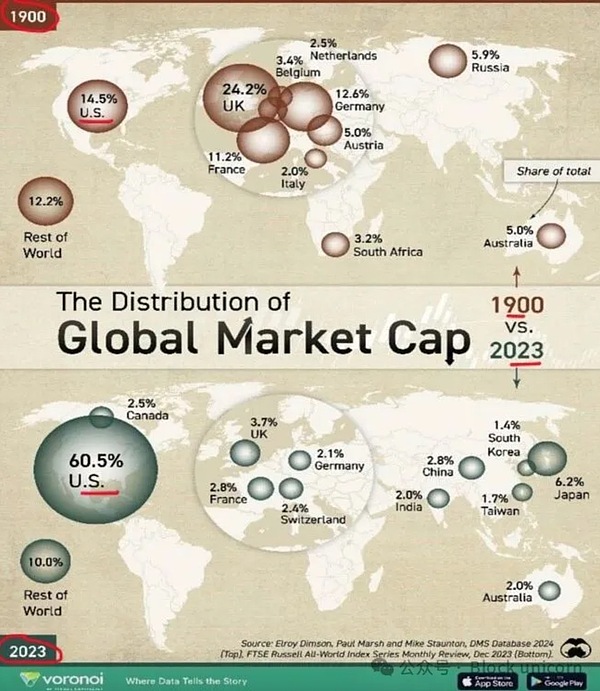

Geopolitical Factors: Stablecoins pegged to the dollar face risks from changes in U.S. policy, such as export controls on technology products or expanded sanctions on cryptocurrency entities. Most stablecoins are pegged to the dollar, but what would happen if the U.S. collapses or loses its financial influence over Asia or the EU? I think the Swiss franc is a relatively strong currency! Developing a stablecoin backed by one of the most stable countries could achieve diversified investment, enhance trust, and facilitate currency swaps.

Positive Side: Regulation can enhance legitimacy, but excessive regulation may stifle innovation, forcing users to turn to unregulated alternatives.

Typical Event: In August 2022, the U.S. Treasury's Office of Foreign Assets Control (OFAC) sanctioned Tornado Cash, blacklisting its addresses and prohibiting U.S. citizens from interacting with it, freezing $437 million in assets.

Liquidity Risk

Liquidity risk arises when users cannot buy or sell stablecoins without incurring significant price slippage, which is exacerbated in low-volume markets, during panic periods, or on exchanges with low trading volumes. Mature stablecoins with high total value locked (TVL) and deep liquidity pools tend to perform better, as long-term existence can establish network effects and reduce slippage.

Other important supplements:

Measurement Metrics: Using on-chain data, such as TVL (DefiLlama), the ratio of 24-hour trading volume to market cap, and slippage rates on major decentralized exchanges (DEX) during volatility peaks. A healthy ratio is when daily trading volume exceeds 5-10% of circulating supply.

Market Depth Issues: In bear markets, redemptions may exceed new liquidity reserves, depleting liquidity reserves.

Chain Liquidation: Similar to a bank run (I’ll say it again), large-scale withdrawals can create a self-fulfilling prophecy, turning perceived liquidity shortages into reality.

Improvements: Integration with automated market makers (AMM) and liquidity incentives (liquidity mining rewards, Merkl, Turtle) can enhance resilience, but over-reliance on incentives may lead to artificial liquidity disappearing during crises.

Typical Event: In November 2022, the FTX collapse caused an $8 billion liquidity shortfall, halting withdrawals and leading to bankruptcy amid massive capital outflows.

Counterparty Risk

Stablecoins often rely on third parties, such as custodians responsible for RWAs, oracles responsible for price data, or cross-chain bridges responsible for cross-chain functionality, which can lead to issues such as bankruptcy, fraud, or operational errors, creating points of failure.

Other important supplements:

Custodian and Oracle Failures: Custodians may default, while oracles (like Chainlink) may provide inaccurate data during network issues, leading to incorrect collateral pricing.

Assessment Metrics: Evaluating the diversification of custodians, insurance coverage, and the decentralization of oracles. High centralization of APIs may increase risk. For example, CURVE's crvUSD is based on multiple stable data sources to maintain the accuracy of its oracle prices.

Interdependence: In tokenized assets, counterparty chains may amplify issues; for example, a hack in a linked protocol could freeze stablecoin redemptions.

Legal Protection: Holders may be treated as unsecured creditors in bankruptcy proceedings, making it nearly impossible to recover any assets; this highlights the necessity of diversified reserves. In my chart, you will notice that some stablecoins rely on certain collateral, yet they do not even actually hold these collaterals (collaterals are often short-term government bonds, thus the default risk is nearly zero). Other protocols may overly rely on ETH-LST, BTC-LST, or SOL-LST, which is particularly concerning regarding yield volatility issues.

Typical Event: In June 2022, Celsius Network filed for bankruptcy, freezing $4.7 billion of user funds due to poor investments and counterparty defaults.

Yield Volatility

The yields of stablecoins typically come from lending protocols or government bond investments, fluctuating with market conditions, lending demand, and interest rate changes, reducing predictability for users seeking stable passive income.

Other important supplements:

Influencing Factors: In low-volatility environments, yields decline due to reduced lending; during bull markets, yields increase. Another yield factor related to RWA is external interest rates (e.g., federal funds rate).

Risk Indicators: Monitoring historical yield ranges, correlation with the cryptocurrency volatility index (CVIX), and protocol utilization rates is key to predicting potential yield volatility and preemptively closing positions (a borrowing ratio above 80% indicates high yields but also risk).

Sustainability Considerations: High yields may signal potential risks such as excessive leverage. Sustainable development models prioritize delta-neutral strategies to minimize directional risk exposure, such as Ethena, which also explains part of its success.

User Impact: Volatility may lead to opportunity costs, as users may miss out on higher yields elsewhere, or if yields fall below fiat savings rates, they may suffer from inflation erosion.

Typical Event: In 2022, during the crypto winter, Aave/Compound yields dropped from over 10% to below 2% due to exhausted lending demand.

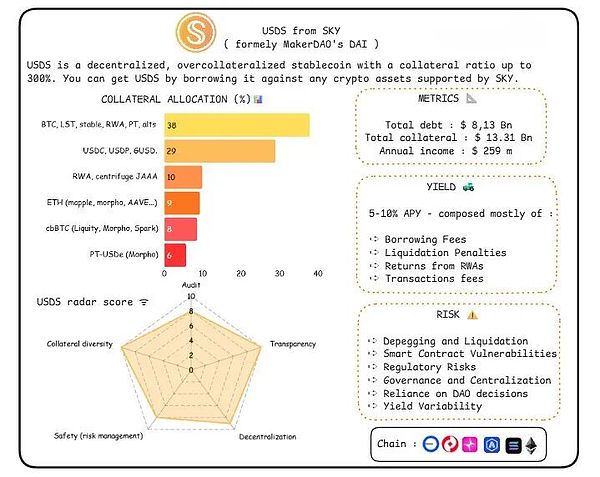

Sky Dashboard Metrics

Unique Risks: Smart contract vulnerabilities (due to complex lending modules), regulatory risks (RWA exposure to U.S. government-backed securities will be scrutinized), yield volatility (dynamic savings rates may decline).

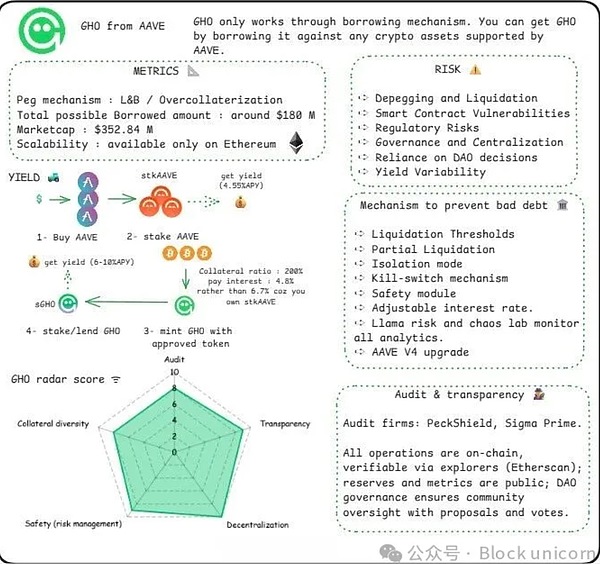

GHO Dashboard Metrics

Unique Risks: Vulnerability of the lending mechanism (over-collateralization may lead to chain liquidations), yield generation failure (if lending demand decreases, yields will drop to zero).

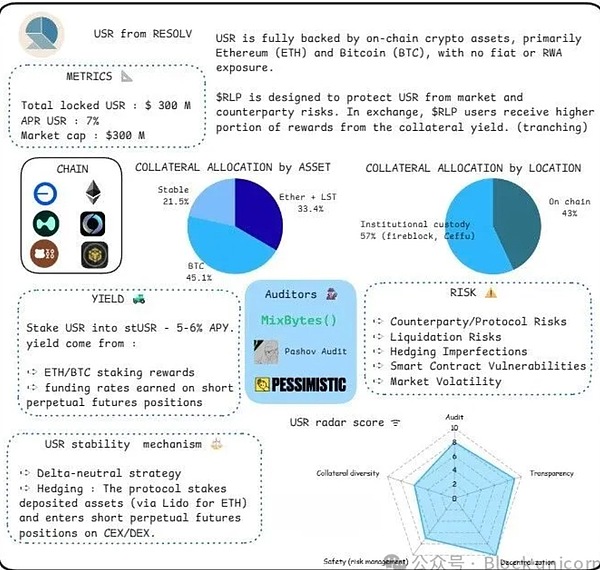

USR Dashboard Metrics

Unique Risks: Under-collateralization risk (if RWA depreciates), liquidation thresholds (high volatility of underlying ETH/BTC), security module failures (insurance-like buffers may be insufficient).

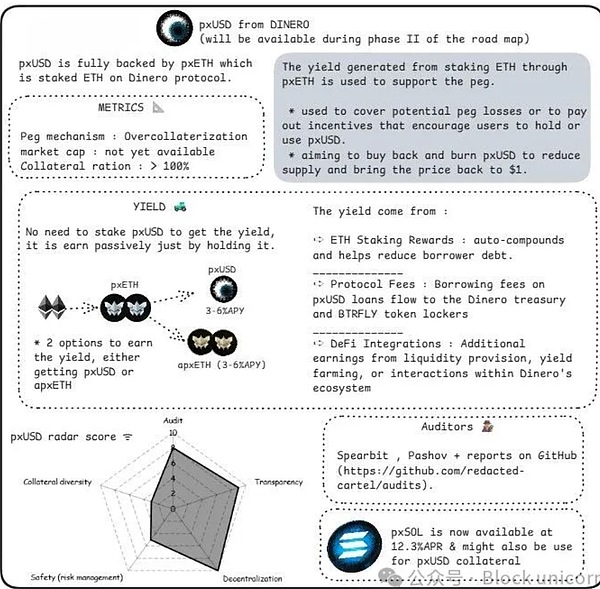

Dinero Dashboard Metrics

Unique Risks: Unlike fully over-collateralized tokens, the yield from auto-compounding staking rewards makes it susceptible to Ethereum penalty events or low-yield periods.

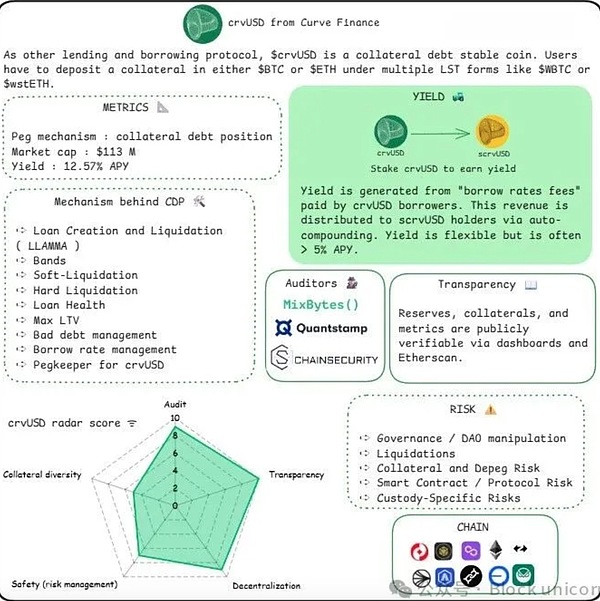

crvUSD Dashboard Metrics

Unique Risks: The CDP model of crvUSD (healthy ratio of 150-167%, backed by BTC/ETH LST) focuses on lending, making chain liquidation risk a primary concern during market volatility, while fee income, although flexible, typically exceeds an annualized yield (APY) of 3.5%.

Falcon Dashboard Metrics

Unique Risks: Market volatility of underlying assets (futures may lead to rapid losses), regulatory compliance issues (as a currency linked to PPI), counterparty risks from exchanges.

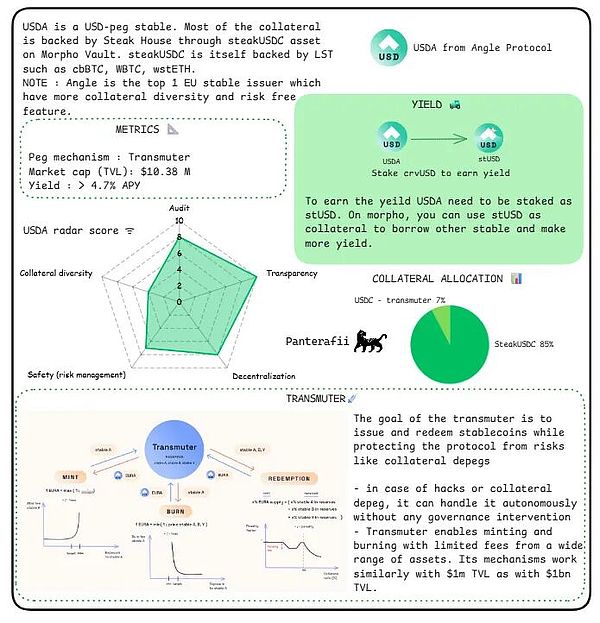

Angle Analysis

Unique Risks: The conversion target of USDA aims to prevent depegging by allowing minting/burning with limited fees (1 million TVL equates to $1 billion), but this introduces autonomy risks, such as governance allowing actions without intervention, making it vulnerable to hacks or collateral failures, with 85% of its steakUSDC backing.

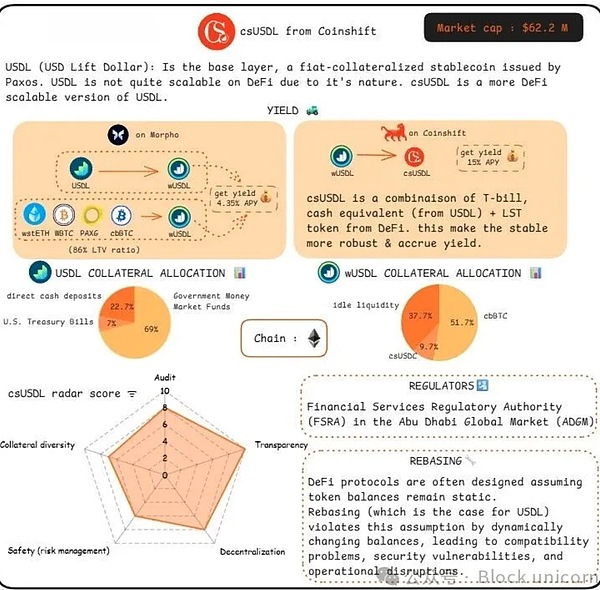

Coinshift Analysis

Unique Risks: The tri-party market of csUSD (holders, generators, re-stakers) uniquely re-bases through yield (from government bonds/LST), but also carries balance fluctuation risks, leading to compatibility issues with DeFi protocols.

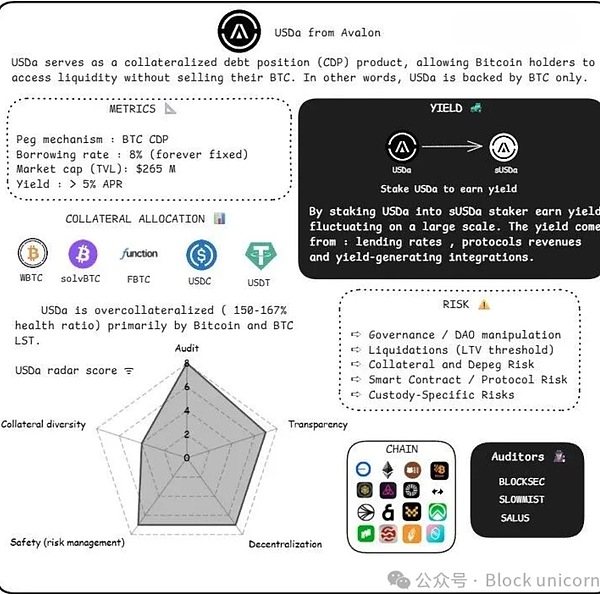

Avalon Analysis

Unique Risks: The USDA's fixed borrowing rate (8%) and CDP model collateralized solely by Bitcoin (annual income yield exceeding 5%) expose it to Bitcoin price volatility risks, differing from diversified collateral, and no mention of over-collateralization buffers.

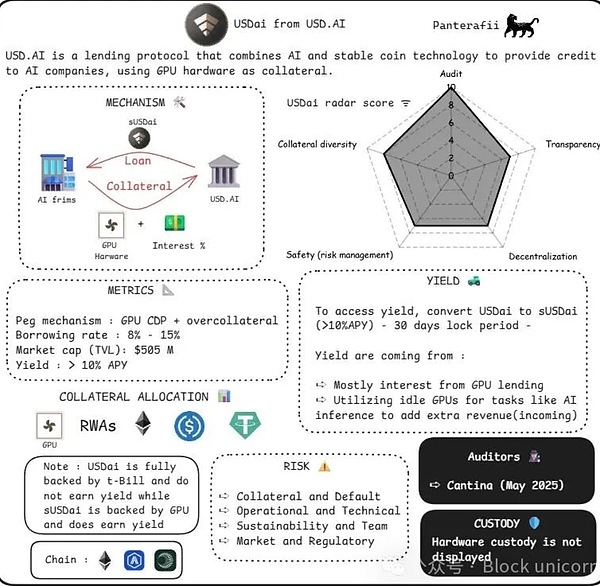

USDai Analysis

Unique Risks: GPU CDP collateral consists of illiquid assets.

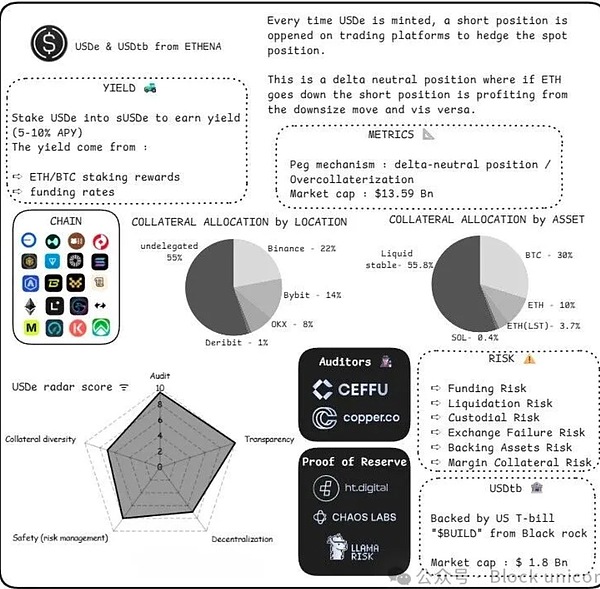

Ethena (USDe) Analysis

Unique Risks: Sharp increases in interest rates (futures positions may lose value), fluctuations in financing rates (negative rates can erode yields), perpetual futures risks (market crashes leading to liquidations).

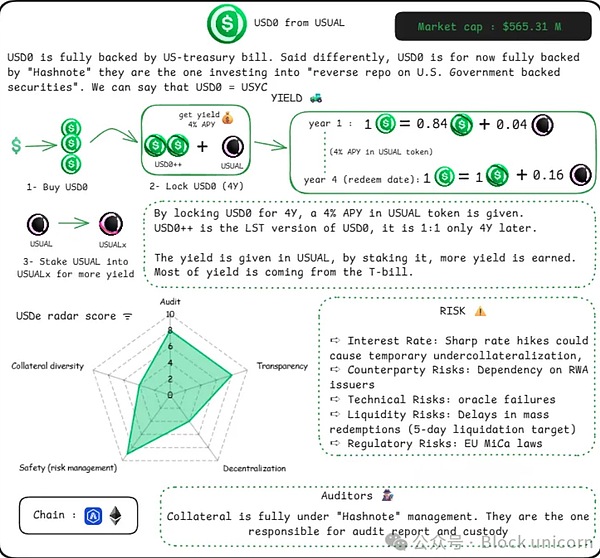

Usual Analysis

Unique Risks: Custodial-specific risks (RWA managed by Hashnote).

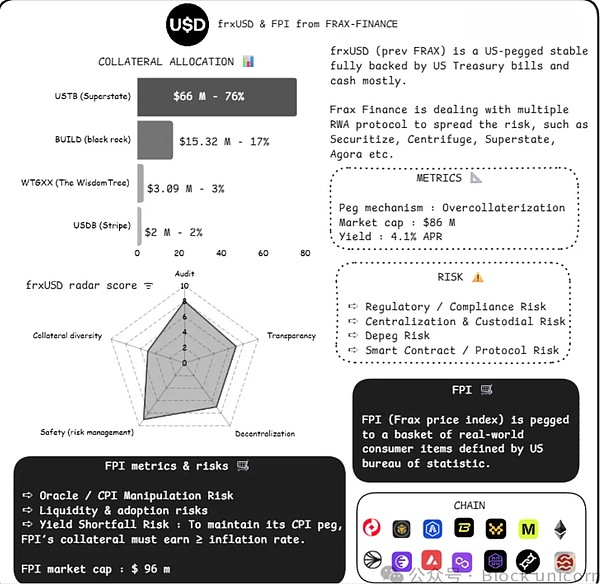

Frax Analysis

Unique Risks: The hybrid mechanism may exacerbate the failure of the pegging mechanism during economic transitions.

Paxos Transparency Report

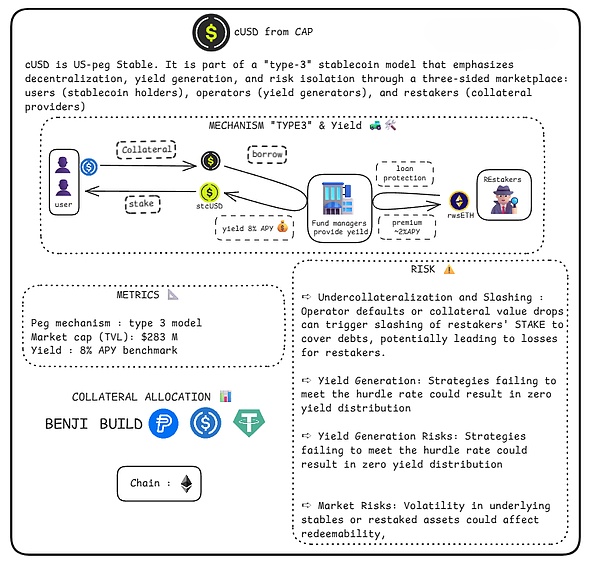

Cap (cUSD)

Unique Risks: cUSD emphasizes decentralization, yield generation, and risk isolation through tri-party markets (holders, generators, re-stakers), which introduces unique penalty risks for re-stakers, with yields (8% annualized yield benchmark) dependent on loan protection failures.

Current State of the Solana Ecosystem

With ongoing rumors about Solana issuing ETFs, the stable development momentum of Solana has begun to strengthen.

Solana ranks in the top five for on-chain transfer volume.

Solana in stablecoin active addresses

Some noteworthy native stablecoins are emerging (such as Jupiter's jupUSD, Solstice's USX, and Hylo's hyUSD). They all possess clever algorithmic mechanisms to maintain stable pegs. Worth paying attention to.

Conclusion

Sometimes, yields and collateral values do not match, as exemplified by Terra Luna, which maintained a stable annual yield of around 20% but had significantly low income. It is essential to closely monitor the correlation between yields and collateral values, as this is often where doubts arise.

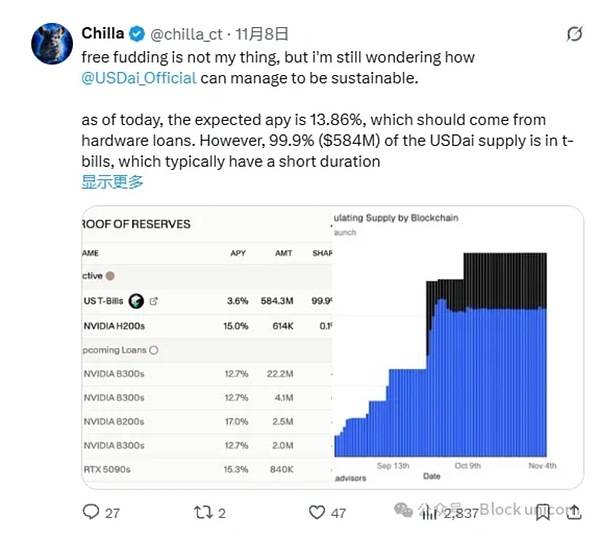

For instance, our friend here raised an interesting point about dollar stablecoins:

USDai has released an announcement regarding this matter, hinting that GPU loans will be delayed. Borrowers hope to obtain USDai, while lenders find it challenging to deliver collateral, creating a gap between the two. News reports: "NVIDIA B200 graphics cards are stuck at French customs after leaving Taiwan."

I hope you enjoy this content. I firmly believe that DeFi will one day become the core driving force of the entire financial system. I will continue to share strategies, concepts, and those truly innovative protocols.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。