现实世界资产(Real World Assets, RWA)的代币化浪潮正在重塑全球金融版图,将不动产、债券、艺术品乃至供应链债权等传统资产锥入区块链轨道,实现 24/7 跨境流动与碎片化投资。然而,与纯加密原生资产不同,RWA 本质上是“链上证券化”,其底层现金流与现实世界法律权利紧密绑定,因而必须在合规框架内发行,方能规避非法集资、证券违规及跨境资本管制风险。

非合规平台发行虽技术门槛低,却易触发监管红线——如美国 SEC 将多数代币化房地产视为未注册证券、内地视无牌 RWA 为非法公开发行——导致项目夭折或资产冻结。相反,合规平台通过 KYC/AML 穿透、托管清算分离、定期审计与信息披露机制,确保底层资产真实性与投资者保护,进而吸引银行、资管等机构资金入场,真正激活万亿级流动性蓝海。

当前,全球已形成以香港( SFC虚拟资产沙盒+稳定币条例)、欧盟 MiCA、美国(SEC Reg A+/D 豁免 + Wyoming SPDI 特许)为首的三大合规体系;另有新加坡( MAS 支付服务牌照 + 基金级 RWA 豁免)、阿联酋( ADGM 数字资产框架)等次级赛道竞相布局。本文和之后的另一篇文章,将逐一剖析上述辖区监管逻辑、代表项目与可复制路径,为内地企业出海与全球机构入场提供实战坐标。

推荐阅读:《RWA的意义、优势与价值——传统金融看RWA系列文章一》

全球 RWA 市场监管情况

2025 年已成为全球 RWA(真实世界资产)监管的关键转折点,美国 GENIUS 稳定币法案和中国香港《稳定币条例》的相继落地,标志着监管从碎片化向统一框架转型。美国推动 GENIUS 法案的核心在于现代化支付体系并强化美元霸权,预计为美债创造数万亿美元需求;香港则以“价值锚定监管”原则创新,覆盖所有港元锚定稳定币,实现跨境管辖延伸。

美国:机构主导 + 监管沙盒驱动的合规创新

美国现实世界资产(RWA)市场以“机构主导 + 监管沙盒驱动的合规创新”为最大特征,区别于全球其他地区的零售驱动或政策试验模式。贝莱德(BlackRock)BUIDL,富达(Fidelity)、富兰克林邓普顿(Franklin Templeton)等传统资管巨头将 RWA 视为“链上版ETF ”,86% 的市场配置来自机构资金,彰显华尔街对链上金融的系统性重构。

美国 RWA 监管仍以 SEC 为主导,CFTC 辅助商品类资产,尚未出台专属联邦法案,但 2025 年立法密集落地标志监管从“执法优先”转向“规则导向”。SEC 持续以 Howey Test 判定代币化资产的证券属性,强调 KYC/AML 穿透与投资者保护;豁免框架(如 Reg A + 免州法)降低发行门槛,推动流动性(TVL 增长 800%),桥接 TradFi 和 DeFi;同时, Crypto Task Force 沙盒机制于 2025 年 5 月启动试点,支持端到端 RWA 发行与托管测试。州级层面,怀俄明州 SPDI 特许与 Reg A+ 豁免有效绕过蓝天法审查,降低中小发行人合规壁垒。然而,联邦与州级监管碎片化仍构成跨境与创新障碍,机构参与虽高企,但合规成本居高不下。

2025 年三项法案集中通过,构成 RWA 监管从“灰色执法”到“规则明朗”的历史性转折,直接解锁万亿级链上资产合规路径:

- GENIUS Act( 7 月):规范稳定币抵押,支持 RWA 作为后盾资产,强化美元链上锚定;RWA 成为稳定币“官方后盾”,允许代币化国债、私募信贷、REITs等作为 USDC/USDT 储备。

- CLARITY Act:明确数字资产证券/商品分类,降低Howey Test不确定性;房地产/债券代币化明确为“商品类 RWA ”时,仅需 CFTC 备案而非 SEC 注册,合规成本下降 60%,中小发行人入场。

- Anti-CBDC Surveillance State Act:限制央行数字货币监控,私人 RWA 生态“去监控化”:BlackRock BUIDL 等基金可绕开 CBDC 实时追踪,机构隐私保护,吸引高净值与主权资金,美元链上霸权反向巩固。

美国 RWA 合规框架的优势在于投资者保护强劲、创新空间可控、美元流动性全球辐射。严苛披露与托管分离机制显著降低欺诈风险,吸引机构资金持续入场;豁免路径与沙盒并行,兼顾效率与合规,推动 tokenized Treasuries 成为 DeFi “无风险利率”基准。GENIUS Act 背书的美元稳定币 + RWA 组合,进一步巩固美国在全球链上金融中的定价权与标准制定权。尽管联邦统一立法尚待突破,美国模式已为 RWA 从试点向主流转型提供可复制模板,预计将撬动 30 万亿美元级传统资产上链潜力。

欧洲:MiCA框架下的统一创新

欧盟现实世界资产(RWA)监管以“ Markets in Crypto-Assets Regulation (MiCA) ”为核心,标志着从碎片化国家规则向统一跨境框架的转型。截至 2025 年 11 月,MiCA 已全面生效,为 RWA 代币化提供清晰边界,推动市场从试点向规模化跃升。RWA 市场 TVL 欧盟占全球比例约 25%,预计 2025 年底达 500 亿欧元,主要受益于 MiCA 的“护照”机制,允许单一授权覆盖 27 国。 与美国 SEC 主导的证券导向不同,MiCA 强调技术中立与消费者保护,分类 RWA 为资产参考代币( ARTs,如房地产/商品支持)或电子货币代币( EMTs,如欧元锚定稳定币)。

MiCA 于 2023 年 4 月通过,2025 年进入全速执行阶段,核心要求包括:白皮书披露、储备审计、 KYC/AML 穿透等。 代表项目包括 Centrifuge 的 RWA 信贷池(德国,MiCA + ELTIF 2.0 合规,TVL 超 10 亿欧元),Tiamonds 的宝石代币化(卢森堡,2025 年获 MiCA 发行许可),Societe Generale 的欧元稳定币项目(法国,ARTs 框架下发行)等。

欧盟框架以统一性、风险导向与创新沙盒为特点: MiCA 的“单一规则集”消除国别壁垒,DLT 试点允许豁免传统清算要求,支持端到端测试;DORA 嵌入 ICT 风险管理,确保 RWA 托管分离。 优势在于:

(1)跨境效率高,护照权降低多国合规成本(对比美国州级碎片化,节省30%-50%);

(2)投资者保护强劲,强制披露与储备透明吸引TradFi资金,2025年机构配置占比升至65%;

(3)创新友好,技术中立设计兼容ERC-3643等标准,推动RWA从房地产(占比40%)向私募信贷扩展。

中东:VARA框架下的创新高地

中东现实世界资产( RWA )监管以“多管区沙盒 + 石油财富驱动的全球辐射”为核心,聚焦阿联酋(UAE)作为区域先锋,辅以沙特阿拉伯(KSA)和巴林的试验路径。截至2025年11月,中东RWA市场TVL达约 250 亿美元,UAE 占比超 70%(170 亿美元),主要受益于 VARA 的全面立法与 DIFC/ADGM 的英美法系沙盒,推动房地产(占比 45%)、黄金和基金代币化。 与欧盟 MiCA 的统一护照不同,中东强调“竞争性自由区”,UAE 的 72 个自由区(如 DIFC、ADGM )通过税收豁免与快速授权吸引全球机构,Vision 2030 框架下沙特 SAMA 沙盒则聚焦伊斯兰金融 RWA。

中东 RWA 监管碎片化但高效,UAE 主导 2025 年立法密集:VARA(迪拜虚拟资产监管局)5 月更新《虚拟资产发行规则手册》,将 RWA 分类为资产参考虚拟资产(ARVA),要求发行人资本金 150 万迪拉姆(约 40.8 万美元)或储备资产 2%,并强制月度独立审计与 KYC/AML 穿透。 DFSA(迪拜金融服务局)3 月 17 日发布《代币化监管沙盒指南》,首度明确纳入 RWA 测试,允许创新测试许可(ITL)下端到端试点(排除加密/法币代币)。 ADGM(阿布扎比全球市场)推出首个代币化美国国债基金(Realize T-BILLS Fund),SCA(证券商品管理局)管辖证券类 RWA 如债券/股票。 沙特 SAMA 沙盒支持受控实验,CMA(资本市场管理局)将资产支持代币纳入资本市场法;巴林 CBB 提供清晰沙盒,聚焦数字银行 RWA。 代表项目包括 Tiamonds 宝石代币化( VARA 许可),Centrifuge 信贷池扩展至沙特 SAMA 沙盒,高盛 UAE 三项 RWA 试点(房地产/苏库克)等。

中东框架以多辖区灵活、沙盒优先、创新辐射为特点:VARA/DFSA/ADGM 提供“一站式”授权路径,ERC-3643 标准嵌入转移限制与托管分离;SAMA 沙盒强调伊斯兰合规(如苏库克代币化)。 整体优势包括

(1)门槛低、速度快,沙盒豁免部分披露,吸引初创(对比美国Reg A+州级审查,节省40%时间);

(2)石油资金杠杆,主权财富基金配置占比60%,推动流动性(UAE TVL年增300%);

(3)全球桥接,英美法系兼容 TradFi,兼容 ERC 标准利于跨境 DeFi。

新加坡:灵活沙盒下的亚洲试验田

新加坡现实世界资产(RWA)监管以“沙盒驱动 + 跨境协作的渐进式商业化”为核心,由新加坡金融管理局(Monetary Authority of Singapore, MAS)主导,定位为亚太 RWA 创新高地。新加坡 RWA 市场聚焦基金代币化(占比 40%)、债券与房地产,支持多币种试验。 与中东 VARA 的自由区竞争不同,新加坡强调“监管 + 技术中立”,通过 Project Guardian(2022 启动)整合 TradFi 与 DeFi,实现端到端测试。 MAS 将 RWA 分类为资本市场的产品(Capital Markets Products, CMPs)或资产支持代币(Asset-Backed Tokens, ABTs),排除纯商品类(受Commodity Trading Act 管辖)。

MAS RWA 监管依托既有证券框架,2025 年加速商业化:DTSP(Digital Token Service Providers)框架于 6 月 30 日生效,扩展领土管辖至海外服务,强调 AML/CFT 与用户保护,但仅限“极有限”许可(年费 1 万新元,无过渡期)。 Project Guardian 扩展至 15+ 试验,覆盖六币种资产;Global Layer 1(GL1)倡议(11月推出)与 BNY Mellon、JP Morgan、DBS 及MUFG合作,标准化区块链平台。 MAS Sandbox Plus(8 月更新)豁免部分披露,支持基金级 RWA;IRAS 税收规则视代币为证券征税。代表项目有:InvestaX 平台(MAS CMS/RMO 许可,代币化 VCC 基金,AUM 超 10 亿美元);Franklin OnChain U.S. Government Money Fund ( Guardian 试点); Deutsche Bank 与 Memento 的 ZK 链 RWA 基础设施等。

新加坡框架以特性导向、沙盒优先、基础设施标准化为特点:SFA(Securities and Futures Act)下 RWA 视为证券,要求 CMS(Capital Markets Services)与 RMO(Recognized Market Operator)许可;ERC-3643 标准嵌入 KYC/AML 转移限制与托管分离;GL1 工具包解决互操作性。 优势包括

(1)创新友好,沙盒豁免降低门槛(对比美国 Reg A+ 碎片化,测试周期缩短 50%);

(2)机构吸引,Guardian 协作覆盖全球银行,机构配置占比 70%;

(3)跨境辐射,多币种支持与MoU提升流动性(TVL年增 300%)。

香港:SFC双轨沙盒下的亚太合规桥头堡

香港凭借其独特的金融枢纽地位和开放监管环境,成为连接中国大陆与全球 RWA (真实世界资产)市场的桥梁,定位为“亚洲华尔街”,以活跃的交易市场和创新驱动为核心。香港现实世界资产(RWA)监管以“SFC双轨沙盒 + 稳定币立法的亚太出海桥头堡”为核心,由香港证券及期货事务监察委员会(SFC)与金管局(HKMA)联合主导,定位为连接内地与全球的 RWA 合规枢纽。与新加坡 MAS 的特性导向不同,香港强调证券化路径,将 RWA 统一纳入《证券及期货条例》(SFO)框架,分类为“结构性产品”或“集体投资计划”(CIS),并通过双沙盒实现端到端测试。

2025 年 6 月 26 日香港特区政府发布的《香港数字资产发展政策宣言 2.0》推出“ LEAP ”框架,聚焦优化法律监管、扩展代币化资产类型(如政府债券、房地产、贵金属)、推进跨界合作及人才培养。2025 年 8 月 1 日生效的《稳定币条例》采用“价值锚定监管”原则,区别于欧盟 MiCA 的功能监管和新加坡的分级牌照模式,对港元锚定稳定币实施全面监管,无论发行主体所在地,延伸跨境司法管辖权。条例要求严格的储备管理、赎回机制和风险控制,首批许可预计2026年初发放。这些政策为 RWA 代币化提供清晰合规路径,增强全球竞争力。

香港于 2025 年 8 月 7 日推出全球首个 RWA 注册平台,由香港 Web3.0 标准化协会管理,为房地产、债务等资产的数字化和代币化提供统一框架,提升透明度和流动性。汇丰银行推动区块链结算服务,中国资产管理(香港)发行亚太首只零售代币化货币市场基金,中资机构如招商国际在 Solana、以太坊公链上代币化基金,展现技术创新。房地产 RWA 领先,绿色金融(如碳信用代币化)试点契合 ESG 趋势,贵金属和可再生能源代币化也在探索中。

香港与大陆形成 RWA 发展“双轨战略”。大陆坚持“许可链优先”和“禁止公开代币销售”,严格遵循中国证监会(CSRC)监管及 KYC、AML、个人信息保护法要求,试点房地产、大宗商品、绿色金融和知识产权代币化。香港则以开放监管环境为中资银行附属实体提供公链发行 RWA 的舞台。然而,2025 年 9 月 CSRC 暂停部分香港 RWA 业务,反映大陆对金融稳定的谨慎态度。此双轨模式降低大陆系统性风险,同时通过香港吸引外资、扩大全球影响力,形成“中国大陆资产—香港发行—全球投资者”的可行路径。

香港的资金自由港地位、“前店后厂”历史基因及离岸人民币业务枢纽角色,使其有望成为“人民币与美元的数字桥梁”。相较新加坡“亚洲瑞士”追求稳定,香港以活跃市场吸引全球投资者,奠定亚太 RWA 领先地位。

香港-新加坡-迪拜:亚洲合规三角的全球协同

香港、新加坡、迪拜构成亚洲 RWA 合规“铁三角”,三地监管逻辑不尽相同却高度互补,共同撬动亚太万亿级链上资产流动。香港 SFC 以证券化桥接为核(SFO结构性产品 + 双沙盒),严守专业投资者门槛,优势在于内地出海通道与 mBridge 跨境结算,代币化绿色债券领跑。新加坡 MAS 走特性协作路线( Project Guardian + GL1 标准化),沙盒豁免灵活,聚焦多币种基金与亚太 MoU。迪拜 VARA 则推竞争沙盒模式(ARVA 简化框架+石油资金),房地产与苏库克代币化爆发,Tokinvest 赛马碎片化项目引爆流动性。

三地差异化定位形成协同闭环:香港提供人民币/港元锚定入口,新加坡输出技术标准与互操作,迪拜注入高净值与伊斯兰金融。2025 年三地联动加速——HashKey-UBS-Realize跨链债券试点打通三地监管核心框架(SFC-VATP、MAS-GL1、VARA-ARVA);mBridge + Guardian + ADGM 共建 RWA 清算层,单笔代币化国债结算时效从 T+2 降至分钟级;此“亚洲三角”以监管沙盒为锚、美元/港元/迪拉姆多锚并存,预计 2030 年贡献全球 RWA 流动性 30%,成为 TradFi 上链的东方加速器。

监管难点

RWA(真实世界资产)代币化在全球迅速兴起,但其监管面临多重难题,需平衡创新与风险,以下是主要难点总结,涵盖跨境合规、链下托管、非标资产定价及更广泛的法律、技术挑战。

跨境合规的复杂困境

RWA 的全球化特性引发“巴比伦之困”。例如,美国投资者购买德国商业地产代币需同时满足 SEC 的 Howey 测试、德国 BaFin 银行牌照要求及欧盟 GDPR 数据保护法规。2023 年一亚洲地产集团在新加坡发行 STO 融资欧洲酒店收购,因未获卢森堡 CSSF 牌照,代币被强制赎回,投资者损失 2700 万美元。IOSCO 报告显示,仅 27% 司法管辖区明确 RWA 法律属性,监管套利与冲突成为隐患。

链下托管的潜在风险

链下资产与链上代币的绑定存在“黑箱”隐患。波多黎各“Casa del Blockchain”项目因开发商挪用资金烂尾,代币价值归零,暴露托管漏洞。主流方案如高盛采用道富银行 SPV 托管国债,但艺术品、私人飞机等非标资产缺乏成熟机制。ISDA 警告,托管方破产可能导致“数字-实物解锚”,引发系统性危机。

非标资产的估值难题

非标准化资产定价如雾中探路。2023 年班克斯画作《垃圾桶中的爱》代币化为 1 万枚 NFT,估值 1600 万美元,但二级市场交易量仅占 3%,换手率仅 0.03% ,这些实物如何估值,如何增加流动性,在标准化的链上世界中成为了一个难题。再加上传统做市商-交易所体系尚未在 RWA 建立成熟,文物、IP 等复杂资产估值模型仍待完善。

更广泛的监管与技术挑战

- 法律与合规风险:链上代币与链下资产映射法律认可度低,智能合约替代传统合同效力存疑;复杂SPV结构难穿透监管,易藏风险;RWA证券属性需遵守多辖区规则,跨境冲突加剧投资者维权难度。

- 资产质量与透明度:底层资产真实性难保,虚构资产或重复抵押风险高;预言机中心化易被操控(由少数机构或节点控制),信息披露复杂性令投资者困惑。

- 技术安全隐患:智能合约漏洞、私钥丢失、区块链性能不稳可能导致资产损失。

- 流动性与投机风险:二级市场深度不足,估值易操纵,赎回机制或引发挤兑;“新概念”炒作与高收益诱惑助长投机,误解去中心化安全性加剧骗局风险。

如何破局?

要解决以上的监管难题,需要监管、技术和市场的协同进步。例如监管沙盒(如香港 Ensemble )通过链上审计动态调整规则;Chainlink CCIP 预言机实时验证链下数据;Maecenas 混合托管(链上交易 + 链下拍卖)提升流动性等。通过全球协作,强化法律、技术与市场机制,才能进一步化解 RWA 监管困局。

国际主流RWA平台

由于各地区 RWA 监管框架的区别,以及市场的不同,几个主要 RWA 市场均涌现出了一批 RWA 标杆项目。由于篇幅有限,这里我们将挑选一些相对比较成熟的,有一定规模,有商业闭环,且有落地案例的平台来作为主要案例进行分析,这些标的主要分布在美国(含加拿大)、欧盟和香港(下一篇文章中阐述)。

Ondo Finance(美国):美国RWA代币化的机构级标杆

在全球 RWA 生态中,Ondo Finance 无疑是美国市场的领军者之一。自 2021 年成立以来,这家总部位于纽约的平台以“将华尔街资产搬上链”为使命,通过严格合规的路径,将美国国债、股票、ETF 等传统金融产品转化为可交易、可抵押的区块链代币,成功搭建起传统金融(TradFi)与去中心化金融(DeFi)之间的桥梁。截至 2025 年 11 月,Ondo 管理的链上资产总值(TVL)已突破 17.4 亿美元,代币 ONDO 市值约 25 亿美元,累计获得 Pantera Capital、Coinbase Ventures 等顶级机构超 4600 万美元融资,显示出强大的市场认可与增长势头。

Ondo 的核心优势在于其高度机构化的设计理念。平台严格遵循美国 SEC 的 Reg D 与 Reg A+ 豁免机制,并深度对接 2025 年通过的 GENIUS Act 等新规,确保每份代币背后都有 1:1 的真实资产储备,并接受每日第三方审计。这一合规底盘不仅打消了机构投资者的顾虑——目前其资金来源中 86% 来自传统金融机构——还使其产品天然具备 DeFi 可组合性:用户可在 Aave、Compound 等协议中直接抵押 Ondo 代币获取流动性,真正实现“链上国债即现金”的愿景。

技术层面,Ondo 展现出极强的跨链与互操作能力。平台已支持 Ethereum、BNB Chain、Stellar、Sei 等多条主流公链,并集成 Chainlink 预言机保障价格实时性。2025 年 8 月,Ondo 推出自主 PoS Layer 1 链—— Ondo Chain,专为机构级 RWA 发行优化,支持高频结算与隐私计算,进一步降低跨境交易成本。此外,其借贷子协议 Flux Finance(基于 Compound V2 的合规版)与投资基金 Ondo Catalyst(规模 2.5 亿美元)共同构成了完整的生态闭环,从资产代币化到资金配置一站式覆盖。

在资产类别分布上,Ondo 已累计代币化超 17.4 亿美元资产,其中美国国债类产品占比 58%(约 10 亿美元),是其绝对核心;股票与 ETF 类占比 24%(约 4 亿美元),通过 Ondo Global Markets 实现美股碎片化投资;收益型稳定币 USDY 等货币市场工具占比 15%;其余为信贷与房地产类小额试点。这种结构清晰反映了美国 RWA 市场的典型特征:以低风险、高流动性的政府债券为锚定,逐步向高收益资产扩展。

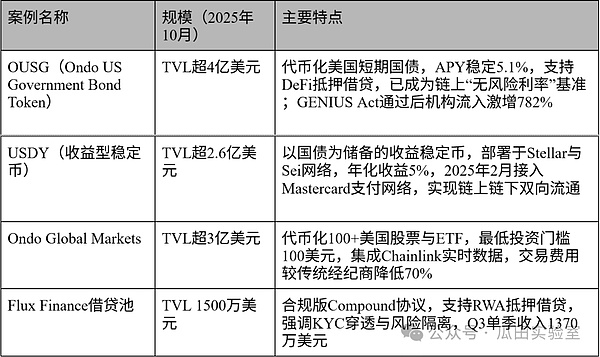

以下为 Ondo Finance 的主要项目案例,集中展示其在不同资产领域的落地成果:

通过以上案例不难看出,Ondo Finance 并非简单的资产上链工具,而是以合规为护城河、以美元资产为锚定、以 DeFi 为放大器的系统性金融基础设施。其成功不仅验证了美国监管框架下 RWA 的可行性,也为全球其他地区提供了可复制的“机构入场模板”。未来,随着 Ondo Chain 生态成熟与更多传统资管巨头入局,Ondo 有望推动 RWA 市场从百亿级迈向万亿级规模,成为链上金融新时代的基石性玩家。

Securitize(美国):RWA 代币化的合规发行与市场基础设施标杆

在快速演进的 RWA 代币化领域,Securitize脱颖而出作为美国市场的核心基础设施提供商。这家成立于 2017 年的公司,总部位于纽约,已成长为全球领先的数字证券发行平台,专注于将房地产、私募股权、债券和基金等传统资产转化为合规的区块链代币,帮助机构投资者实现 24/7 全球访问与碎片化所有权。截至 2025 年 11 月,Securitize 管理的链上资产总值已超过 28 亿美元,其中包括超 40 亿美元的已发行代币化资产,平台累计处理超 100 亿美元的交易量,吸引了 BlackRock、Morgan Stanley 等巨头合作,融资总额达 4700 万美元,凸显其在桥接 TradFi 与 DeFi 方面的战略地位。

Securitize 的独特价值在于其嵌入式合规架构,这让它成为 RWA 项目的“合规守护者”。平台深度集成美国SEC 的 Reg D、Reg A+ 和 Reg S 豁免机制,并顺应2025 年 GENIUS Act 对稳定币与 RWA 抵押的规范,确保每枚代币都经过 KYC/AML 穿透验证、1:1 资产储备审计以及转移限制(通过 ERC-3643 标准实现)。这种设计不仅降低了发行门槛——中小企业可快速上线代币化基金,而无需繁琐的传统证券注册——还为投资者提供了铁一般的保护:每日第三方报告和智能合约自动化执行,避免了“链下黑箱”风险。目前,机构投资者占比高达 85%,Securitize 的二级市场平台允许合格用户即时交易代币,进一步提升了资产流动性,年化收益率(APY)在债券类产品中稳定于 4%-6%。

Securitize 强调多链兼容与无缝互操作,支持Ethereum、Polygon、Avalanche 和 Solana 等主流网络,集成 Chainlink 预言机实时同步链下数据(如资产估值),并通过其专有转移代理(Transfer Agent)服务管理合规转移。2025 年,Securitize 推出升级版市场基础设施,支持跨链桥接与 API 集成,这让传统资管公司能轻松将产品“上链”,交易费用较传统经纪商降低 60% 以上。其生态还包括一站式工具链,从资产验证到分销,再到持续披露,形成闭环服务,推动 RWA 从试点向规模化转型。

Securitize 高度多元化,已代币化超 28 亿美元资产,其中私募股权与基金占比 45%(约 12.6 亿美元),聚焦高增长初创企业份额;债券与货币市场基金占比 30%(约 8.4 亿美元),以短期国债为主;房地产与信贷占比 20%(约 5.6 亿美元),支持碎片化物业投资;其余为艺术品与商品等非标资产。这种分布体现了美国 RWA 的机构偏好:以股权和债券为支柱,强调稳定收益与全球辐射,而非高波动投机。

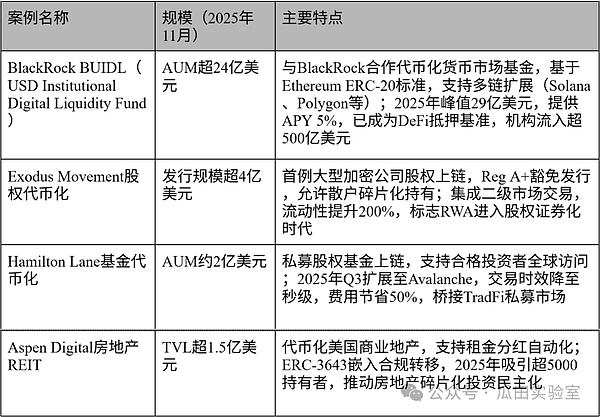

以下为 Securitize 的主要项目案例:

Securitize 在监管复杂环境下的执行力十分出色,还为行业树立了“合规即竞争力”的范式。其成功源于对法律与技术的深度融合,预计到2030年,随着更多巨头入局,Securitize 将助力 RWA 市场扩张至 16 万亿美元规模,成为数字证券时代的基石基础设施。

RealT(美国):RWA 房地产碎片化的零售级先锋

在 RWA(现实世界资产)代币化浪潮中,RealT以“让普通人也能买得起美国房产”为使命,成为美国房地产碎片化投资的零售级标杆。这家成立于 2019 年的平台,总部位于密歇根州,专注于将底特律、芝加哥、迈阿密等城市的单户住宅和小型公寓楼转化为区块链代币,每份代币代表房产的真实份额,并自动分配租金收益。截至 2025 年 11 月,RealT 已代币化超 450 套物业,总资产管理规模(AUM)突破 5.2 亿美元,累计分红超过 3200 万美元,平台用户超 12 万( 90%为零售投资者),融资总额约 2500 万美元,成功将传统高门槛的房地产市场转化为“链上 REIT ”体验。

RealT 的核心吸引力在于其极致的零售友好与合规透明。平台严格遵循美国 SEC 的 Reg D 与 Reg A+ 豁免机制,确保每套房产通过 SPV(特殊目的实体)持有,代币( ERC-20 标准)1:1 锚定底层资产,并由第三方托管机构(如 First Integrity Title)管理产权与保险。用户最低仅需 50 美元即可购买房产份额,租金收入每日通过 USDC 自动分红到钱包。这一设计彻底打破了传统房地产的流动性壁垒——过去需数十万美元首付,如今链上即可秒级交易——同时通过智能合约嵌入 KYC/AML 与转移限制( ERC-3643 兼容),让散户也能享受机构级透明度:每笔租金、维修、税费均上链可查,审计报告实时公开。

RealT 采用 Ethereum 主网 + Polygon Layer 2 双层架构,集成 Chainlink 预言机同步房产估值与租金数据,支持跨链桥接与 DeFi 抵押(如 Aave)。2025 年,平台推出 RealT RMM(租金货币市场),允许用户将代币化房产作为抵押品借贷 USDC,年化收益率稳定在 7%-9%(租金+增值)。其一站式 DApp 覆盖从选房、尽调到分红的全流程,交易费用较传统房产中介降低 95%,用户体验媲美“链上 Airbnb 投资版”。

在资产类别分布上,RealT 高度专注单户住宅与小型多户物业,其中底特律占比 55%(约 2.86 亿美元,租金收益率最高达 12%)、芝加哥占比 25%、迈阿密与亚特兰大合计 20%。这种“中低端城市+高租金回报”策略,精准捕捉了美国“租金飞涨”趋势,同时避开了高端市场的监管复杂性,完美契合零售投资者的风险偏好。

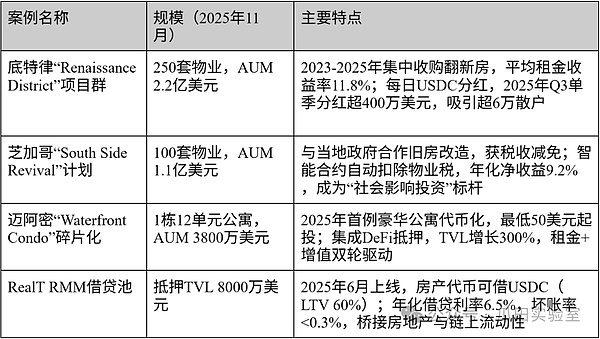

以下是 RealT 的主要项目案例:

RealT 不仅通过以上案例验证了 RWA 在房地产领域的可行性,更开创了“房产即收益型 NFT ”的范式。其成功源于对零售痛点的精准打击——低门槛、每日分红、链上透明——预计到 2030 年,随着更多中产城市加入,RealT 将推动全球房地产 RWA 市场突破 2 万亿美元,成为普通人财富上链的入口级基础设施。

Propy(美国):RWA 房地产交易与所有权的全球链上闭环平台

在 RWA(现实世界资产)代币化赛道中,Propy 以“让跨境买房像买 NFT 一样简单”为使命,已成为全球房地产交易上链的领先实践者。这家成立于 2017 年的美国公司(总部加州帕洛阿尔托),通过区块链 + NFT + 智能合约三层技术栈,实现了从房产搜索、尽调、支付到过户、代币化分红的全流程链上化。截至 2025 年 11 月,Propy 已促成超 45 亿美元的链上房地产交易,代币化物业总值突破 12 亿美元,覆盖美国 40 个州以及迪拜、葡萄牙、泰国等海外市场,用户数超 65 万,累计融资超 5000 万美元(2024 年完成 4600 万美元 A 轮),并成为首个获得美国 21 个州房地产经纪牌照的区块链公司。

Propy 的核心竞争力在于其端到端合规交易闭环。平台严格遵守美国各州房地产法与SEC Reg D/Reg A+框架,每笔交易都由持牌经纪人陪同,产权通过Propy专属的PRO token(ERC-20)+ NFT产权凭证双重形式交付:NFT记录完整产权文件、历史交易与税单,ERC-20代币则可用于租金分红或碎片化转让。2025年推出的Propy Title Agency(自有产权保险公司)进一步将过户时间从平均45天缩短至最快24小时,交易费用降低70%。这一模式不仅满足了高净值客户的跨境置业需求(尤其是亚洲与中东买家),还通过KYC/AML穿透与Chainlink预言机,确保每份NFT都对应真实、可司法追索的产权。

技术层面,Propy构建了多链+AI驱动的房地产操作系统:主网基于Ethereum与Polygon,支持Solana与Base扩展;集成AI尽调机器人(自动核查产权瑕疵、洪水风险、税历史);2025年上线的PropyKeys功能允许用户一键将普通房产铸造成地址绑定的NFT,实现“链上Homestead”。平台还与美国最大产权保险公司First American合作,提供最高200万美元的产权保险,让链上房产交易具备与传统市场完全等价的法律效力。

在资产类别分布上,Propy以美国单户住宅与海外豪华物业为主,其中美国本土占比72%(约8.6亿美元,佛罗里达与加州最活跃)、迪拜与欧洲豪华公寓占比18%、泰国与东南亚度假物业占比10%。这种“美国合规核心+全球高端物业”的组合,既享受美国法律保护,又捕捉了新兴市场的高净值需求。

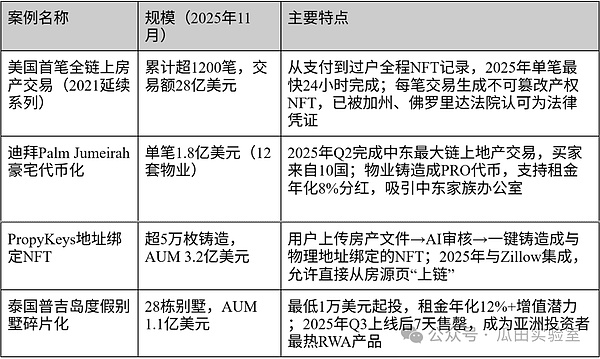

以下为Propy的主要项目案例,集中展示其从交易到代币化的完整闭环能力:

通过这些案例,Propy 不仅解决了房地产交易的“信任、速度、跨境”三大痛点,更开创了产权即NFT、交易即结算的新范式。其成功源于将美国最严格的房地产法规与区块链透明性完美结合,预计到2030年,Propy将推动全球10%以上的跨境房产交易上链,成为RWA时代真正的“链上Zillow+链上Notary”。

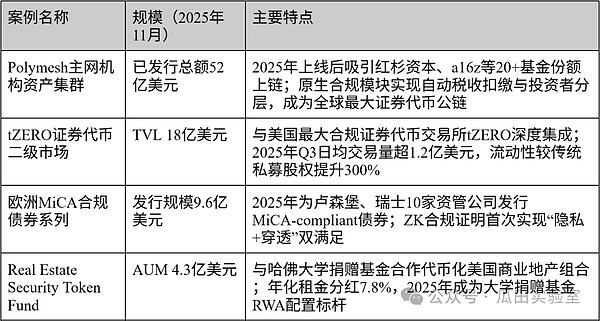

Polymath(加拿大):RWA证券代币化的合规基础设施先驱

在RWA(现实世界资产)代币化早期浪潮中,Polymath 是当之无愧的“证券代币教父”。这家成立于2017年的加拿大-美国项目(现总部迁至美国纽约),最早提出并实现了Security Token(证券型代币)完整标准与发行框架,被业界称为“ERC-20的合规版”。尽管2023-2024年经历团队重组与市场低谷,Polymath 在2025年强势回归,其旗舰产品Polymesh(专为受监管资产打造的Layer 1公链)已成为机构级RWA发行的底层首选。截至2025年11月,Polymesh链上已发行超85亿美元的代币化证券(包括私募股权、债券、基金份额),TVL稳居7.2亿美元,累计为420+ 项目提供合规基础设施,融资总额超1.1亿美元(2025年完成由Animoca Brands领投的6000万美元轮),重新确立了其在RWA“合规底座”领域的统治地位。

Polymath的核心价值在于它从第一天起就把合规写进了链的基因。不同于大多数公链“先上车后补票”,Polymath 自研的Polymesh 是全球首个专为受监管资产设计的Layer 1:节点必须完成KYC/KYB并获得许可才能参与共识,链上身份(Identity)与权限(Compliance)是原生模块,每一笔转账都强制执行白名单、黑名单、冻结、税收扣缴等规则,完全兼容美国SEC、欧盟MiCA、瑞士FINMA等多国证券法规。2025年推出的Polymesh 2.0 进一步集成零知识证明(ZK)合规,让机构能在保护隐私的同时满足穿透式监管要求,彻底解决了传统区块链“匿名性 vs 合规性”的死结。

技术层面,Polymath提供了一站式证券代币SaaS工具链:从Token Studio(无代码发行界面)到Polymesh Wallet(机构级多签+合规转移代理),再到Polymesh Private(许可子链用于私募资产)。平台支持ERC-3643标准的前身(ST-20),并在2025年全面升级为Polymesh Asset Protocol,实现与Ethereum、Polygon、Solana的跨链资产镜像。机构用户可在几小时内完成从资产尽调、投资者KYC到代币发行、上所交易的全流程,成本仅为传统证券发行的5%-10%。

在资产类别分布上,Polymath高度聚焦机构级受监管资产:私募股权与基金份额占比52%(约37亿美元)、债券与结构性产品占比28%、房地产与信贷占比15%、其他(艺术品、碳信用)占比5%。这种结构完美匹配全球资管机构对“合规、可审计、可司法追索”的核心诉求。

以下为Polymath的主要项目案例,集中展示其作为RWA合规基础设施的统治级应用:

Polymath 不仅奠定了证券代币的技术标准,更重新定义了“受监管资产的区块链原生形态”。其成功源于对全球证券法规的前瞻性拥抱与底层公链的重构,预计到2030年,Polymesh将成为90%以上机构级RWA的结算层与合规底座,真正实现“Wall Street on Chain”的终极愿景。

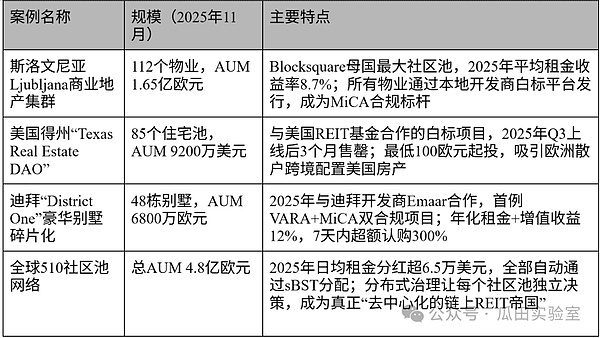

Blocksquare(欧盟):RWA房地产代币化的白标基础设施与全球最大分布式网络

在RWA(现实世界资产)代币化赛道中,Blocksquare 以“让任何人都能一键推出自己的房地产代币化平台”为使命,已成为全球最大的分布式房地产碎片化基础设施提供商。这家成立于2018年的斯洛文尼亚公司(欧盟成员国),通过开源协议+白标SaaS模式,帮助房地产开发商、基金和地方政府在几周内上线合规的链上REIT。截至2025年11月,Blocksquare网络已代币化超4.8亿欧元的物业(约5.3亿美元),覆盖28个国家、510个社区池,累计发行超12.8万枚房地产代币,用户数突破18万,平台代币BST市值约1.8亿美元,累计融资超1500万美元(2025年完成由Kraken Ventures领投的800万美元战略轮),被誉为“房地产界的Shopify”。

Blocksquare的核心竞争力在于其白标+分布式合规双引擎。平台提供完整的一站式工具链:Oceanpoint(无代码发行仪表盘)、Marketplace Protocol(去中心化交易协议)、Staking & Governance(BST质押分红机制),任何机构只需接入API即可推出自有品牌的代币化平台,而底层所有合规逻辑(KYC、AML、白名单、税收扣缴)均由Blocksquare统一处理。这使得它完美适配欧盟MiCA法规(2025年获卢森堡CSSF监管沙盒认可),同时兼容美国Reg D、瑞士DLT法、迪拜VARA等全球主流框架。2025年推出的Blocksquare 2.0进一步将发行成本降至传统REIT的1/10,平均上线周期仅21天。

技术上,Blocksquare采用Polygon为主网+Layer 2扩展架构,所有房地产资产以sBST(staked BST)+ NFT双代币形式存在:NFT记录产权份额与法律文件,sBST用于租金分红与治理。平台集成Chainlink预言机实时同步物业估值与租金数据,并通过分布式社区池(每个城市或项目一个独立池)实现真正去中心化的流动性聚合——截至2025年,全球已有510个活跃社区池,日均租金分红超6.5万美元,全部自动上链。

在资产类别分布上,Blocksquare高度聚焦商业地产与住宅混合:欧洲商业物业占比58%(约3.1亿美元,租金收益率6%-9%)、美国与加拿大住宅占比22%、亚太与中东酒店/度假物业占比15%、新兴市场(非洲、拉美)占比5%。这种“欧盟合规核心+全球物业覆盖”的策略,既享受MiCA护照红利,又捕捉高增长市场的租金溢价。

以下为Blocksquare的主要项目案例,集中展示其白标模式与分布式网络的全球落地能力:

Blocksquare不仅降低了房地产代币化的技术与合规门槛,更开创了“白标+分布式社区池”的全球扩张范式。其成功源于将欧盟最友好的监管环境与开源基础设施完美结合,预计到2030年,Blocksquare网络将代币化超5000亿欧元的物业,成为RWA时代房地产行业的“链上操作系统”。

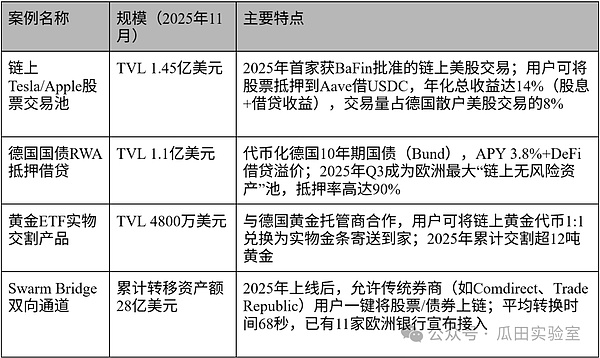

Swarm Markets(欧盟):DeFi与TradFi完全合规双向互通的德国RWA门户

在RWA(现实世界资产)代币化赛道中,Swarm Markets 以“让散户也能合法交易链上债券、股票与大宗商品”为使命,已成为欧洲最激进的合规DeFi-RWA混合平台。这家成立于2021年的德国公司(柏林总部),是全球首家获得德国BaFin(联邦金融监管局)完整证券经纪与托管双牌照的去中心化交易所,彻底打通了传统证券与DeFi协议的双向流动。截至2025年11月,Swarm Markets链上TVL突破4.1亿美元,累计交易量超68亿美元,支持股票、债券、黄金、加密ETF等20+类真实世界资产,注册用户超15万(其中德国与欧盟用户占比72%),平台代币SMT市值约2.3亿美元,累计融资超3000万美元(2025年完成由Circle Ventures与L1 Digital领投的1800万美元B轮),被MiCA法规视为“合规DeFi样本”。

Swarm Markets的最大突破在于其全球首个“受监管DeFi”架构。平台获得BaFin完整牌照(§32 KWG银行牌照+§15 WpIG证券机构许可),用户只需一次KYC即可在同一界面同时交易链上代币化股票(Apple、Tesla)、德国国债、黄金ETF,并直接将这些RWA抵押到Aave、Compound等协议获取流动性——这在传统金融中完全不可能。2025年推出的Swarm 2.0进一步实现“零滑点”实物交割:用户可将链上德国国债兑换为真实债券存入传统券商账户,反之亦然,真正做到TradFi与DeFi资产1:1互换。

技术上,Swarm采用Polygon+Layer 2结算+许可节点混合架构,所有RWA以ERC-3643合规代币形式存在,由德国持牌托管银行(Solaris SE)提供链下储备。平台前端像Uniswap一样丝滑,后端却完全受BaFin监管:每笔交易实时报告、投资者分级、自动税收扣缴一应俱全。2025年Q3上线的Swarm Bridge允许用户在1分钟内将传统券商账户里的股票/债券“上链”成RWA,反向赎回同样秒级完成,费用仅为传统经纪商的1/20。

在资产类别分布上,Swarm高度聚焦欧洲机构级资产:股票与ETF占比48%(约1.97亿美元,含Tesla、LVMH、DAX指数)、债券与固定收益占比32%(德国与欧元区国债为主)、大宗商品与黄金占比15%、加密ETF与结构化产品占比5%。这种“欧洲蓝筹+固定收益”组合,既满足欧盟投资者对安全资产的需求,又通过DeFi放大收益率。

以下为Swarm Markets的主要项目案例,集中展示其“受监管DeFi”的颠覆级应用:

Swarm Markets开创了“受监管资产的原生DeFi”新范式,其成功源于德国最严格监管环境下的极致执行,未来Swarm将成为欧洲散户与机构共享的RWA-DeFi主门户,真正实现“任何人、任何资产、任何时间”的链上交易自由。

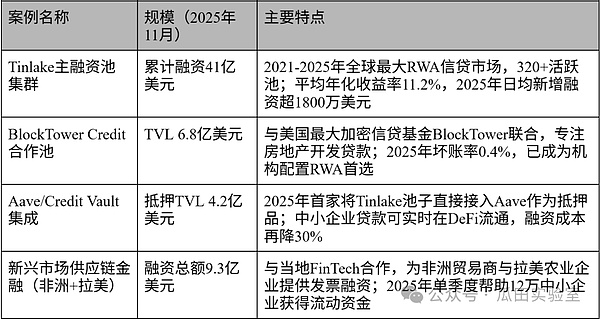

Centrifuge(欧盟):RWA私人信贷代币化的开源与机构级双料王者

在RWA(现实世界资产)代币化赛道中,Centrifuge 是当之无愧的“私人信贷之王”与“开源基础设施之王”。这家成立于2017年的德国-美国项目(柏林+旧金山双总部),最早将企业应收账款、发票、供应链金融等非标信贷资产上链,通过真实世界资产池(Real World Asset Pools)为中小企业提供链下-链上双向融资。截至2025年11月,Centrifuge已累计代币化并融资超58亿美元真实世界信贷资产(历史上链RWA融资量第一),链上TVL稳居9.8亿美元,活跃池子超320个,服务全球1200+家中小企业与机构,用户数突破42万,平台代币CFG市值约4.2亿美元,累计融资超1.1亿美元(2025年完成由ParaFi与Coinbase Ventures领投的4500万美元C轮),被BlackRock、Goldman Sachs等巨头视为“链上私募信贷标杆”。

Centrifuge的核心竞争力在于其双层架构:Centrifuge Chain(2023年独立为Substrate-based Layer 1,现已升级为Polkadot平行链)作为合规结算层,专为RWA设计原生NFT(代表信贷资产)+Tinlake协议(结构化融资池);上层则完全开源、无许可,任何人都可部署资产池。这让它同时满足机构严苛合规(KYC/AML穿透、SPV隔离、第三方审计)与DeFi原生可组合性(池子可直接接入Aave、MakerDAO、Curve)。2025年推出的Centrifuge V3进一步引入RWA Market(链上二级市场)与Credit Vaults(自动化信贷评估),将中小企业融资周期从90天缩短至最快3天,成本降至传统银行的1/5。

技术上,Centrifuge是RWA领域最彻底的开源玩家:核心协议Tinlake、Centrifuge Chain代码100%开源,社区治理占比超70%。平台支持多链资产镜像(Ethereum、Base、Arbitrum、Polkadot),集成Chainlink预言机+零知识证明实现隐私合规融资。2025年Q3上线的Centrifuge Prime为高净值与机构提供“一键投资全球RWA信贷组合”产品,年化收益率稳定在8%-14%,坏账率仅0.7%(远低于行业平均3.2%)。

在资产类别分布上,Centrifuge高度专注私人信贷与应收账款:发票与贸易融资占比62%(约36亿美元)、房地产开发贷款占比18%、消费信贷与供应链金融占比15%、新能源与碳信用占比5%。这种“中小企业真实现金流”导向,使其成为RWA中最贴近实体经济的一环。

Centrifuge的主要案例:

通过以上案例,Centrifuge不仅解决了中小企业“融资难、融资贵”的世纪难题,更开创了“真实现金流即流动性”的RWA终极范式。其成功源于开源精神与机构执行力的完美结合,预计到2030年,Centrifuge将代币化并融资超5000亿美元的全球私人信贷资产,成为RWA时代中小企业与实体经济的链上“央行”。

小结 -RWA全球版图已成,万亿赛道正式起跑

本文主要探讨了全球范围内主要RWA市场的监管框架、特点及法律法规,并深入介绍了北美和欧洲市场的主流RWA平台与项目。从2017年Polymath首次提出“Security Token”概念,到2025年BlackRock BUIDL单品突破24亿美元,现实世界资产(RWA)代币化仅用八年时间,便完成从“实验玩具”到“机构主战场”的惊人跃迁。2025年11月,全球RWA链上TVL已稳稳突破2500亿美元,较2023年底增长超过15倍,正式跨入万亿级赛道的起跑线。

回顾全球版图,五极格局已清晰成型,各具特色、互为补充:

- 美国以美元、国债、私人信贷为锚,依靠SEC三法案(GENIUS/ CLARITY/ Anti-CBDC)与华尔街信用,构建了“机构主导+最高流动性”的美元RWA霸权,Ondo、BlackRock BUIDL、Securitize、Centrifuge、RealT、Propy成为最强代表。

- 欧盟凭借MiCA“单一护照”与DLT试点,打造了“最统一、最标准化、最跨境友好”的RWA大陆,Swarm Markets与Blocksquare的白标模式正将欧洲商业地产与中小企业信贷推向全球。

- 中东(迪拜-阿布扎比)用VARA沙盒+石油主权财富,创造了“最快速度+最低门槛”的新兴高地,房地产与伊斯兰金融RWA全球领先。

- 新加坡以Project Guardian与GL1工具包,扮演“技术标准输出者+亚太枢纽”角色,成为最擅长多币种、跨链落地的试验场。

- 香港则凭借SFC双沙盒+mBridge,成为“连接内地与全球的最重要出海桥头堡”,绿色债券与大湾区供应链金融独树一帜。

国际上几个标杆项目进一步勾勒出RWA的完整拼图:从合规基础设施(Securitize、Polymath)、白标分发(Blocksquare)、零售民主化(RealT、Propy)、私人信贷深耕(Centrifuge)、受监管DeFi(Swarm)、到美元机构飞轮(Ondo、BlackRock),每一块都已出现全球头部玩家。这些项目多数在2017-2018年的STO热潮前后就已成立,经历了多年的摸索与发展,跌宕起伏,总算在近期迎来了RWA市场的高光时刻。

未来五年(2026-2030)将是决定性决战期,三大趋势已不可逆转:

- 监管竞赛进入尾声,合规护照决定胜负:美国若推出联邦统一法案、欧盟MiCA全面落地、亚洲铁三角(香港-新加坡-迪拜)完成互认,全球将形成“三极+区域护照”的最终格局。

- 机构资金洪流全面开启:2025年机构配置占比已达70%,2030年预计90%以上,30-50万亿美元级传统资产将加速上链,国债、房地产、私募信贷、股票ETF将成为前四大主战场。

- RWA将成为DeFi新底层资产:代币化国债将彻底取代稳定币成为链上“无风险利率”,房地产与信贷池将成为主要抵押品,DeFi年化收益与传统金融收益率曲线将实现完全融合。

RWA 不再是加密圈的“小众叙事”,而是全球金融体系下一次基础设施级重构。

2025 年,我们站在潮水真正涨起的岸边;

2030 年,RWA 将不再是“链上金融”,而就是“金融”本身。

下一篇研究长文,我们将专注香港市场,深度解读香港政策、市场版图和实际案例,敬请期待。

Reference List

- DefiLlama (2025). Real World Assets (RWA) Dashboard. https://defillama.com/rwa

- RWA.xyz (2025). Real World Assets Analytics. https://rwa.xyz

- Dune Analytics (2025). RWA Dashboard by Messari & Dune. https://dune.com/messari/rwa

- Chainlink (2025). Real World Assets On-Chain Data. https://data.chain.link/real-world-assets

- IOSCO (2023). Crypto-Asset Roadmap 2023-2024. https://www.iosco.org/library/pubdocs/pdf/IOSCOPD747.pdf

- Ledger Insights (2023-2025). Various RWA reports and case studies. https://www.ledgerinsights.com

- BaFin (2025). Swarm Markets Regulatory Announcements. https://www.bafin.de

- VARA (2025). Virtual Asset Issuance Rulebook (May 2025 Update). https://rulebooks.vara.ae/rulebook/virtual-asset-issuance-rulebook

- MAS (2025). Project Guardian Updates & GL1 Toolkit. https://www.mas.gov.sg/schemes-and-initiatives/project-guardian

- SFC Hong Kong (2025). Guidelines on Tokenised Securities Activities (March 2025 Update). https://www.sfc.hk/en/News-and-announcements/Policy-statements-and-announcements/Circular-on-tokenised-securities-activities

- Securitize (2025). BlackRock BUIDL & Securitize Markets Reports. https://securitize.io/learn/press/blackrock-launches-first-tokenized-fund-buidl-on-the-ethereum-network

- Ondo Finance (2025). Monthly Transparency Reports & OUSG/USDY Updates. https://docs.ondo.finance/general-access-products/usdy/faq/trust-and-transparency

- Centrifuge (2025). Tinlake & Centrifuge V3 Monthly Reports. https://centrifuge.io/transparency

- BlackRock (2025). BUIDL Fund Quarterly Reports (via Securitize). https://securitize.io/blackrock/buidl

- Propy (2025). Propy Title Agency & PropyKeys Statistics. https://propy.com/browse/propytitle/

- Blocksquare (2025). Oceanpoint & Community Pools Dashboard. https://marketplace.oceanpoint.fi/

- Swarm Markets (2025). BaFin-Licensed Trading Volume Reports. https://swarm.com/transparency

- RealT (2025). Property Portfolio & RMM Updates. https://realt.co/investor-dashboard

- Polymath / Polymesh Foundation (2025). Polymesh 2.0 & Asset Issuance Reports. https://polymesh.network/reports

- Boston Consulting Group & BlackRock (2025). Tokenized Funds: The Third Revolution in Asset Management Decoded (2030 Outlook). https://web-assets.bcg.com/81/71/6ff0849641a58706581b5a77113f/tokenized-funds-the-third-revolution-in-asset-management-decoded.pdf

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。