Written by: Glendon, Techub News

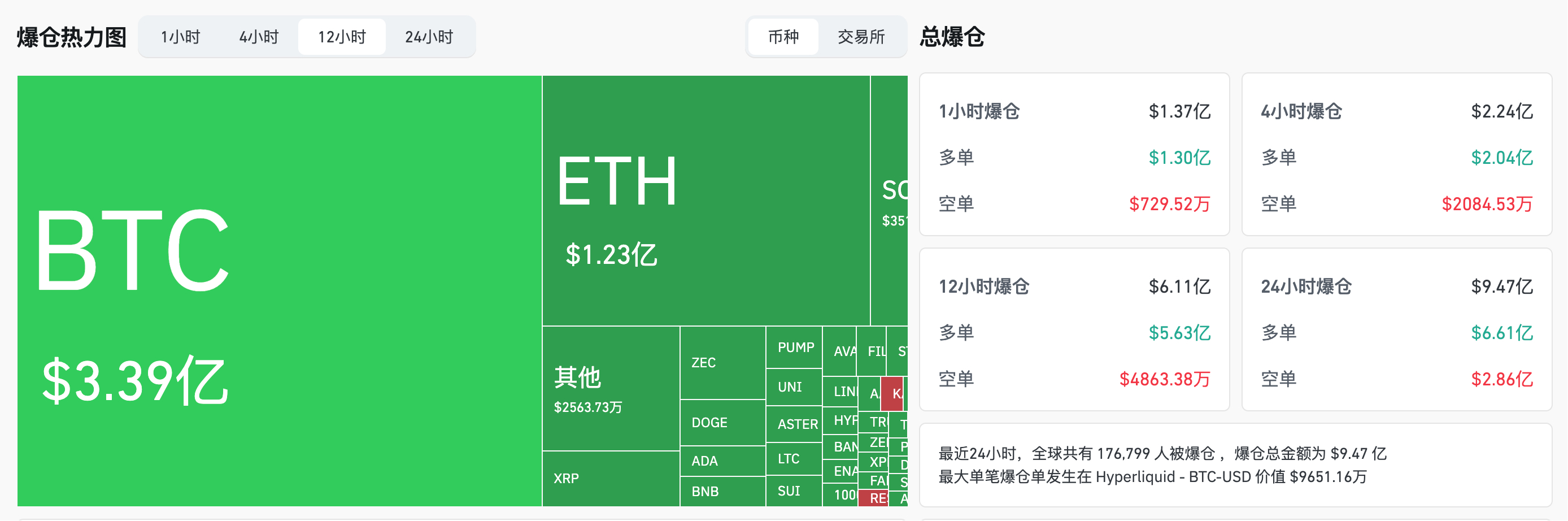

The cryptocurrency market is currently experiencing a downturn, having fallen for three consecutive days. At noon, Bitcoin dropped below the $90,000 mark, reaching a new low since April of this year, completely erasing its gains for the year. According to Coinglass data, as of the time of writing, the total liquidation amount across the network in the past hour has reached $137 million, with the liquidation amount in the past 12 hours exceeding $600 million, of which Bitcoin long positions accounted for $328 million.

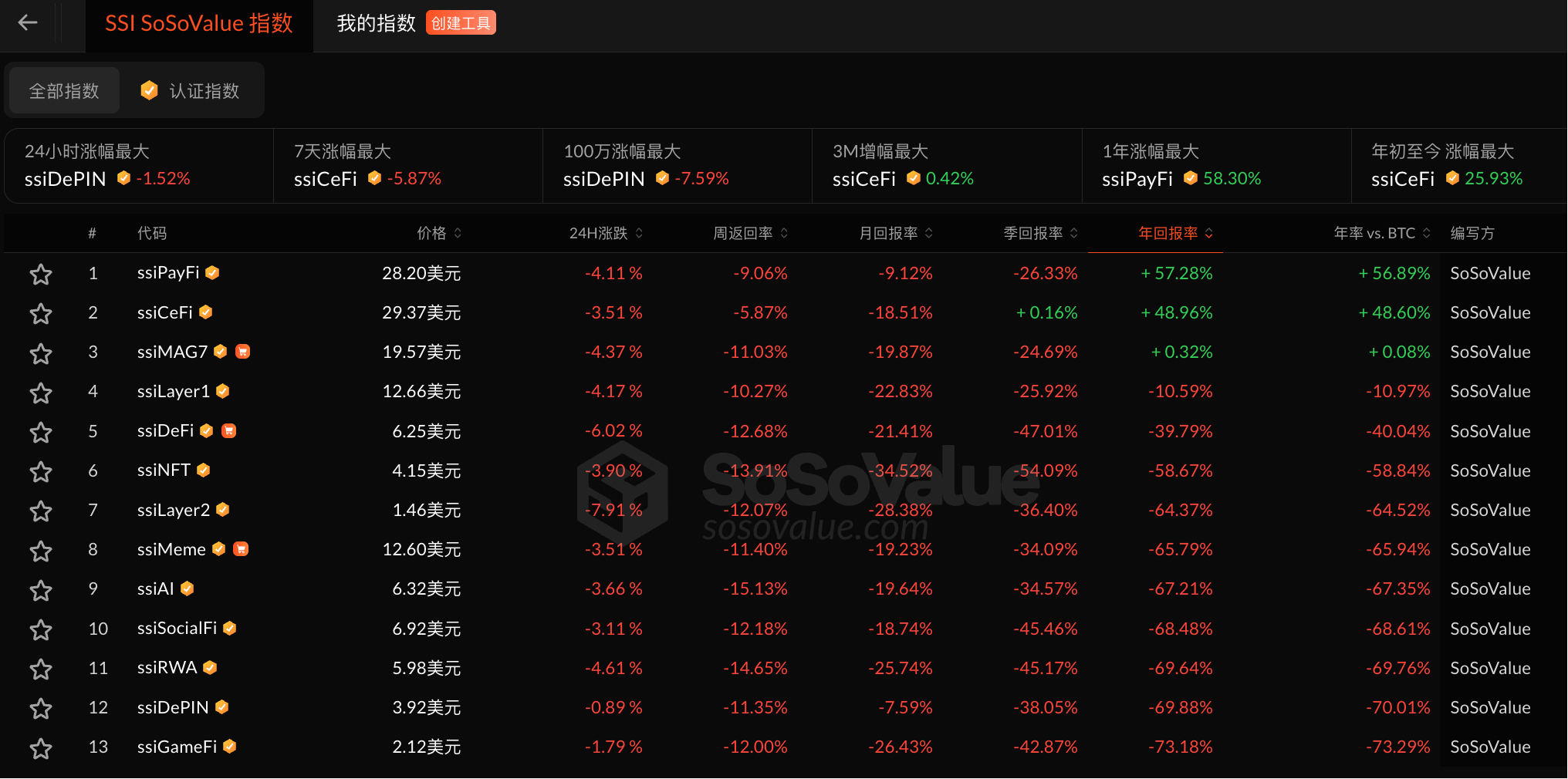

SoSoValue data shows that all major sectors in the cryptocurrency market are affected, collectively declining, with a general drop of over 3% in 24 hours. Among them, the Layer2 and DeFi sectors have been hit the hardest, with declines of 7.9% and 6%, respectively. In other sectors, the PayFi sector saw a decline of 4.11%, the CeFi sector dropped by 3.51%, the Layer1 sector fell by 4.17%, the NFT sector decreased by 3.90%, the Meme sector dropped by 3.51%, and AI fell by 3.66%. This indicates that the downward trend in the cryptocurrency market is much more rapid and severe than expected.

Additionally, Glassnode data shows that short-term holders of Bitcoin (holding for less than 155 days) currently hold a total of 2.8 million Bitcoins, almost all of which are in a state of loss, with the scale of this loss reaching the highest level since the FTX collapse in November 2022. Meanwhile, long-term holders continue to reduce their holdings. As of November 16, the number of Bitcoins held by this group has decreased from approximately 14.755 million in July to 14.303 million, a reduction of over 452,500. The outflow of a large number of Bitcoins has further worsened the imbalance between supply and demand in the market, creating strong downward pressure on prices.

It is well known that this round of decline in the cryptocurrency market is the result of multiple factors, including macroeconomic conditions and internal market factors.

On the macro front, the uncertainty of monetary policy has become a key factor affecting the direction of the cryptocurrency market. Recent weak economic data from the United States has raised concerns about an economic recession, leading to a rapid decline in investors' risk appetite, causing funds to flee from risk assets such as cryptocurrencies. At the same time, due to the increased correlation between the cryptocurrency market and traditional risk assets like U.S. stocks and bonds, cryptocurrencies are no longer seen as independent hedging tools. The failure of the Federal Reserve's interest rate cut expectations for December has been one of the "triggers" for market adjustments. According to CME's "FedWatch," the probability of a 25 basis point rate cut by the Federal Reserve in December has dropped to 42.9%.

From the perspective of internal market capital flow, institutional inflows have slowed, and the willingness to allocate has significantly decreased in recent months, which has become a key reason for the weakness in ETF and spot demand, causing the market to lose structural buying support. According to CoinShares' latest weekly report, the total outflow of digital asset investment products last week reached $2 billion, the largest scale since February of this year. This marks the third consecutive week of outflows, with a cumulative total outflow of $3.2 billion. Additionally, last week, the U.S. Bitcoin spot ETF saw a cumulative net outflow of approximately $1.11 billion, marking three consecutive weeks of net outflows, while the Ethereum spot ETF also saw a cumulative net outflow of $728 million last week. Coupled with the continuous reduction of holdings by whales this month, the market's selling pressure has intensified.

At this stage, retail investors are increasingly cautious, and the market's fear index has been trapped in the "extreme fear" range of 10-14 for several consecutive days, with panic spreading like wildfire. Especially after Bitcoin fell below the critical support level of $100,000, short-term technical factors triggered a large number of stop-loss sell orders, creating a negative feedback loop that makes the downward trend in the market increasingly difficult to curb.

CryptoQuant founder and CEO Ki Young Ju previously analyzed that Bitcoin investors who entered the market in the past 6 to 12 months have an average cost of around $94,000. He pointed out that only when the price falls below this cost range can the bear market cycle be confirmed. Currently, all data indicates that the market has entered a "bear market."

So, to what extent will the cryptocurrency market decline?

In addition to the many negative factors mentioned earlier, the current "Qian Zhimin case" is particularly noteworthy. Although the UK and China are still engaged in a tug-of-war over Bitcoin distribution rights, a significant portion of the 61,000 Bitcoins is likely to enter the market, bringing long-term selling pressure.

Currently, the UK Treasury has made it clear that it will not include these Bitcoins in the country's national reserves but plans to sell them for cash. The impact of this massive amount of Bitcoin on the market will undoubtedly be significant; however, the specific share that the UK government can "legally seize" and the timing of its market entry are both filled with uncertainty.

On the other hand, the market is not entirely shrouded in negative sentiment. As the market declines rapidly, while many whales are selling off, some institutions and whales have begun to "buy the dip."

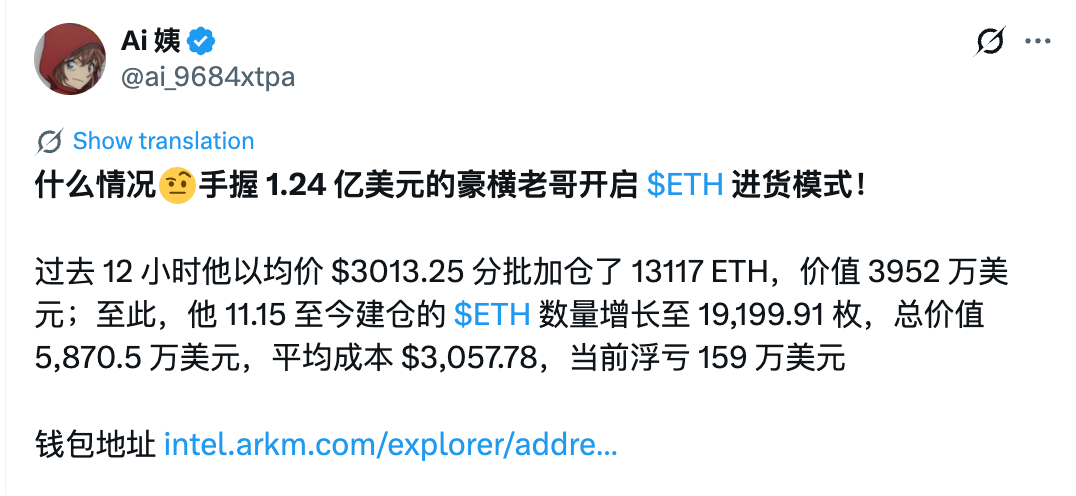

Taking Ethereum as an example, according to monitoring by X user Ai Yi, an address starting with "0x1fc7" has accumulated 13,117 Ethereum in batches at an average price of $3,013.25 over the past 12 hours, worth approximately $39.52 million. This address has accumulated a total of 19,199.91 Ethereum since November 15, with a total value of about $58.705 million. Moreover, in the past week, the Ethereum treasury company BitMine has increased its holdings by a total of 67,021 Ethereum through Galaxy Digital, FalconX, and Coinbase, worth approximately $234.47 million.

In the Bitcoin market, positive signals are also emerging. According to SoSoValue data, as of November 17, Eastern Time, the total net buying amount of Bitcoin by global listed companies last week reached $848 million, excluding mining companies. Among them, Strategy (formerly MicroStrategy), the "big brother" of the DAT market, increased its holdings by 8,178 Bitcoins at a price of $102,171, costing approximately $836 million.

It is worth mentioning that the management of Strategy has made it clear that they will not sell Bitcoin and pointed out that the company's leverage is conservative, with debts of only $8 billion secured by $61 billion in Bitcoin holdings, and dividends "fully covered by its cash reserves," with further funding available through market issuance plans.

Additionally, El Salvador has also significantly increased its Bitcoin holdings in the past 7 days, totaling 1,098.19 Bitcoins, raising its total holdings to 7,474.37 Bitcoins.

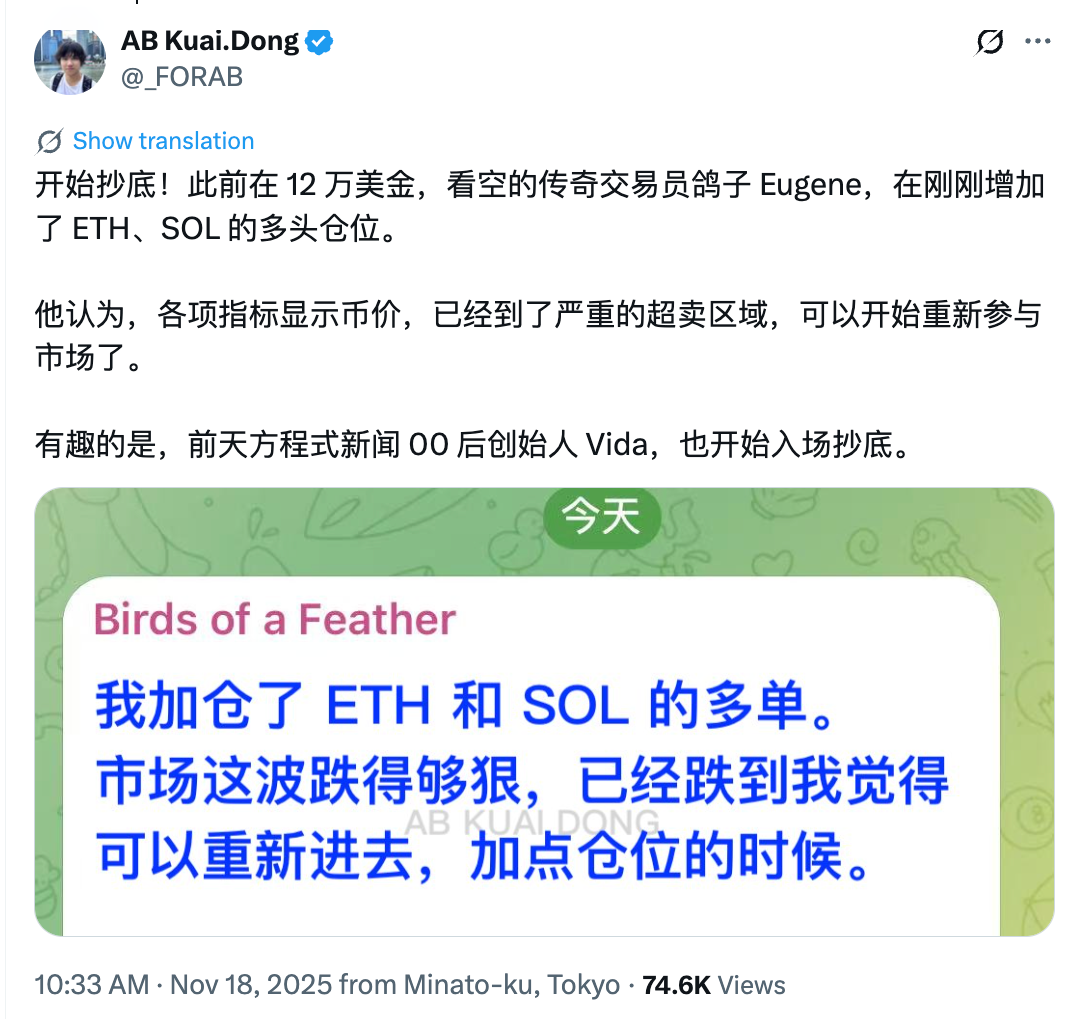

Trader Eugene Ng Ah Sio stated in a post on his personal channel today that he has "increased long positions in Ethereum and SOL. The swing indicators have clearly returned to the oversold range, and I believe it is time to start increasing risk exposure in this market again."

The above data indicates that when the prices of Bitcoin and Ethereum drop to a certain extent, the "buy the dip" behavior of whales will also help offset some of the selling pressure. Although it is difficult to quickly stop the downward trend in the cryptocurrency market entirely, the subsequent trend may not accelerate downward as pessimistic expectations suggest.

In contrast to the rapid decline of cryptocurrencies like Bitcoin, ETF assets have shown a higher level of stability. CoinDesk noted that in Bitcoin terms, the assets under management (AUM) of U.S. ETFs remain close to historical highs. According to checkonchain data, as of the time of writing, the AUM is 1.3377 million Bitcoins, while the peak on October 10 was 1.38 million Bitcoins. Compared to Bitcoin's nearly 29% drop from its price peak of $126,000, the Bitcoin ETF AUM has only decreased by 3.2%.

Currently, mainstream analysts generally believe that around $80,000 will be a key support level for Bitcoin, which is also a critical level for Bitcoin after Trump won the U.S. election.

BitMEX co-founder Arthur Hayes stated that Bitcoin has fallen from the $125,000 to $90,000 range, but U.S. stocks remain at historical highs, indicating that "a credit event is brewing." Hayes pointed out that his dollar liquidity index has significantly weakened since July, and if the market further deteriorates, the Federal Reserve, Treasury, or other institutions will be forced to accelerate "money printing" to stabilize the situation. During this period, Bitcoin may fall back to the $80,000 - $85,000 range. However, Arthur Hayes believes that once U.S. liquidity expands again and stimulus policies are intensified, Bitcoin will quickly reverse.

Analysts from Bernstein Research believe that the current situation in the cryptocurrency market does not mark the beginning of a significant downward trend. This decline more reflects investors' concerns about the historical four-year cycle pattern, but the current market fundamentals are stronger, with long-term holders' supply being largely absorbed, suggesting that it may only be a short-term pullback to a new local bottom. Additionally, the proportion of institutional holdings in Bitcoin ETFs has increased from 20% at the end of 2024 to the current 28%. Although ETF outflows have reached $3 billion in the past three weeks, the total assets under management still amount to $125 billion, reflecting a "higher quality and more stable holding structure," which reduces the likelihood of significant sell-offs.

In summary, it is clear that the cryptocurrency market will continue to decline for some time. Especially after experiencing the "10.11" flash crash and a month-long decline, the market is unlikely to quickly form sustained buying support. With the increase in holdings by some institutions and whales, whether $80,000 can become a solid support level for Bitcoin's price has become the focus of market attention.

However, the cryptocurrency market has always been full of uncertainty and variables, making it difficult to predict its future direction. Will it continue to struggle in the depths of decline, or will it experience an unexpected reversal and recovery? Only time will reveal the answer.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。