美联储内部分歧依然严重,昨日美联储副主席杰斐逊表示美经济中风险平衡已向就业下行倾斜,利率接近中性水平,进一步降息需要“缓慢进行”。而美联储理事沃勒重申其观点美联储应再次下调利率,力挺12月再降息...美联储共识不复存在的情况下,12月降息25bp预期下降至42%...

市场负面情绪下主力资金持续流出,比特币和以太坊ETF资金净流出状态延续,恐慌加剧抛压,比特币价格凌晨再度下跌最低低至91200,以太坊低至2960……虽然早间有回升,但力度不大。这次下跌在意料之中,上周恐慌情绪延续到这周,情绪主导市场,空头依然掌握节奏。

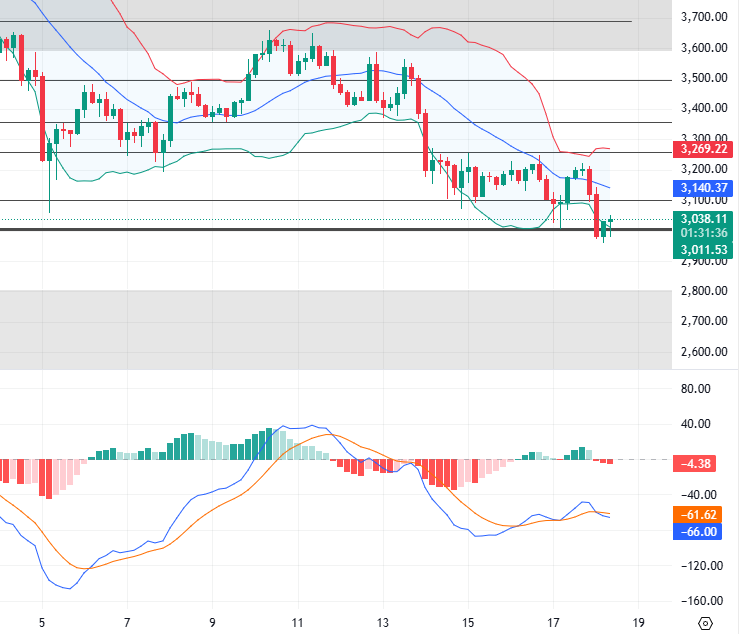

技术方面,大周期月线级别死叉成型,日图和周图MACD指标依然空头放量,空头明显。现在比特币90000支撑区测试,以太也是3000关口挑战,但本周非农美联储都不利多头,破位继续下跌概率依然很大,不过月线即将允许中轨88000附近,料想会测试有反弹。近期节奏震荡下行,超跌后有修正,亚欧先看反弹情况,上方短期阻力94500,96500,下方支撑91000,90000。

比特币短线操作建议参考:

1.回落91000-90000区域附近多单,目标92000-93000

2.反弹94000-94500区域附近空单,目标93000-92500

以太坊和比特币一样走跌,主力资金出逃破记录,买盘弱势,可见护盘谨慎。这种情况跟随市场情绪影响多头很难形成有效反扑。技术面价格下跌首破3000,接下来就是2800了,前期的买盘密集区会存在较强支撑。日内走势也是亚欧盘先看反弹,上方短期阻力3200,3260,下方支撑2950,2800位置。

以太坊短线操作建议参考:

1.回落2950-3000区域附近多单,目标3050-3100

2.反弹3200-3260区域附近空单,目标3150-3100

【温馨提示:行情瞬息万变,建议仅供参考,更多实时咨询可在线与本人实时沟通】

——作者原创,欢迎关注,点赞

本文由(公众号:杰恩Crypto)独家发布,仅供参考。交易本身不难,难在人心和不自律。希望我们都能不断的通过学习来提升自己,打磨自己,自强才能更长久。

行情实时波动有时效限制,欢迎扫码关注公众号,获取每日行情资讯,并实时交流

温馨提示:本文只有专栏公众号(上图)是杰恩Crypto所有,文章末尾及评论区其他广.告均与作者本人无关!!请大家谨慎辨别真假,感谢阅读。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。