加密市场从不缺机会,但第一波涨幅永远只属于少数人。在加密货币交易中,“盘前”阶段已经成为新一代交易者竞争的关键窗口。在某种程度上,市场在正式开盘前就已启动趋势和行情。对于个人交易者而言,盘前策略往往决定两件大事:其一,能否提前嗅到市场叙事的起点;其二,能否在主流情绪大规模涌入前完成布局。忽略盘前,你就错过了从种子估值到暴涨的黄金窗口。

真正能在盘前赚钱的人,只看三件事:

- 你进场时,项目刚出生多久? 越接近种子轮,估值越原始,肉越厚。

- 开盘那一刻,能不能顺利出货? 没深度的盘前 = 假突破,滑点吃掉利润。

- 亏了有人兜底吗? 没有缓冲的试错 = 高风险赌博。

本文基于链上资金流 + 交易所公开数据 + 实盘验证,拆解 Binance、OKX、Bitget、Gate.io 与 LBank 五大平台的盘前逻辑,告诉你谁在印钞,谁在放烟雾弹。

Binance & OKX:稳,但肉早被 VC 吃光

行业主流大型交易所(如 Binance、OKX,以及逐渐崛起的 Bitget 等)在盘前策略上整体表现为稳健保守,偏向“慢热”。它们通常以优质大项目上币为主,筛选严格,确保所上线的币种拥有成熟的技术和广泛的认可。这种策略的优点在于权威性和稳定性:用户相信在这些平台上线的币大多经过深度尽职调查,不太会出现“归零”或者流动性枯竭的极端情况。上币前,通常已完成多轮融资,机构与 VC 早有布局。然而,这种稳健也意味着缺乏令人兴奋的增量叙事,节奏相对缓慢。

对于寻求盘前机会的交易者来说,这类平台往往难以获得超额收益。因为当币安或 OKX 这样的平台在盘前宣布上架某个新币时,往往该项目早已在行业内声名在外,甚至可能已经经过多轮融资和估值提升。主流机构和 VC 可能早就布局其中,使得散户在真正开盘时接盘的价格已非常接近项目的公允价值或阶段性高点。事实上,有数据显示,在 2025 年 LBank 上线的新币中有 61% 随后登陆了币安,但其中 73% 的币种在币安上架时,LBank 的用户已经处于盈利状态 。这意味着对于许多热门项目而言,等到币安等大所上币时,“第一波行情”的利润往往已经被更快的市场参与者收割完毕。

这种“稳健而滞后”的节奏,其实与当前市场的整体气质如出一辙。如今,价格才是真正的终极裁决。在行情起伏不定、信心反复的环境下,没有任何叙事能够长期维系强势,即便是此前表现突出的隐私板块,也开始显露疲态。以 Canton 为例,纵然拥有 1 亿美元融资、5 亿 DAT 背景资源,以及 Yzi Labs、Circle、DTCC、高盛等头部机构的加持,甚至一度跌去一半。事实证明,市场早已进入“叙事免疫期”,投资者对概念和背景的溢价反应正迅速降温。

当然,大交易所的盘前稳健策略也有其合理性:它保护了绝大多数普通用户免于参与过早期、过高风险的博弈。对于喜欢提前埋伏、押注故事起点的交易者而言,在这些平台上难以体验到盘前布局所带来的丰厚回报。

Gate.io:快速彩票机,机会与噪音并存

与主流大所的谨慎形成鲜明对比的是 Gate.io 平台的激进盘前策略。Gate.io 的逻辑可以总结为“以量取胜”:通过高频率地上新币,给用户提供源源不断的盘前机会。

然而,筛选宽松导致两个问题:一是项目质量差异大。Gate上币门槛低,混杂优质与劣质项目;二是高波动、低深度。盘前流动性不足,常出现价格失真,开盘后易崩盘。数据显示,Gate新币上币后56%项目短期跌幅超20%。

对交易者而言,盘前看似多,实则噪音大、筛选成本高。Gate像开放实验场:人人能上,但难有确定性。优势是机会多,适合猎手型交易者;局限是不稳,易陷“假象”。

有些币种虽然上线即暴涨,但可能存在交易深度不足、波动剧烈的问题,短时的爆拉涨幅未必人人都吃得到,稍有不慎也可能高位接盘。而另一些新币则可能无人问津。换句话说,Gate.io 犹如一个开放的实验场,任何项目都有机会登台亮相,但要从中筛选出下一个“十倍币”并不容易,确定性较低。

Gate.io 的盘前策略更像一场“速度与判断力”的测试。它为激进型交易者提供了无数尝新的机会,也考验着筛选与止损的执行力。适合的人,是那些能快速辨别噪音、仓位控制得当的玩家。铁律只有一条:单笔投入不超过总资金的 2%,Gate.io的所有盘前都应被视为高风险博弈。

LBank:将盘前等待期变成盈利期

LBank 交易所在 2025 年提出了三个交易关键词:上币最快、深度第一,以及交易包赔。

这一战略瞄准新兴项目和社区驱动的 Meme 币市场,旨在通过极致的上币速度和完善的风险控制,让用户在热点叙事启动之初就能参与其中并降低风险。上图为 LBank 官方宣传其 2025 年关键业务方向的示意图,其中强调了 “Pre-Market Guarantee”(盘前交易保障)等创新举措。

LBank 在过去一年中也展现了惊人的上币速度和成绩。2025 年全年,该板块累计上线 20+ 优质资产,总交易量突破 5,000 万美元,项目最高回报达 99 倍,平均收益率 5,072%。充分印证了“速度即收益”的逻辑 。可见在捕捉市场热点方面,LBank 的反应速度并不逊色于任何竞争对手。

然而,仅有速度还不够。LBank 更大的特色在于对盘前交易环境的结构性优化,以提升盘前交易的质量和持续性。首先,LBank 专门为 Meme 及其他新兴项目建立了深度流动性池,并引入做市商机制以确保初始交易阶段的市场深度。

他们宣称平台上 Meme 币的交易深度在行业中名列第一 。甚至推出“深度挑战”奖励,鼓励用户监督任何 LBank 平台上深度不达标的 Meme 币,一经核实将给予 200 USDT 奖励 。充沛的初始流动性意味着当热门新币开盘时,买卖盘厚实,价格发现过程更平稳。交易者能够顺畅地进出市场,不至于因为流动性匮乏而遭遇滑点过大或无法成交的情况。

其次,LBank 的“盘前包赔”机制堪称一项业界首创的创新举措(即官方所称 Pre-Market Guarantee)。当用户参与平台新项目的盘前交易时,如果该项目在正式开盘后价格大幅低于盘前买入价,平台将为用户提供差价补偿 ,用于弥补开盘价下跌造成的账面亏损 。这一机制等于由平台与用户共同承担部分早期交易风险:它降低了用户盘前试错的成本,极大提升了大家参与新项目的意愿,并由此形成“风险共担 → 信任加深 → 用户复购”的良性循环。

事实上,LBank 此前上线的 MON、MEGA、STABLE 等项目在盘前阶段均取得亮眼表现(最高涨幅分别约 21 倍、13 倍、6 倍),而用户之所以敢于踊跃参与,正是因为有平台提供的这一道保障 。可以说,LBank 将交易前的等待期真正转化为了交易者的盈利期。

平台盘前策略对比:谁能抢占先机?

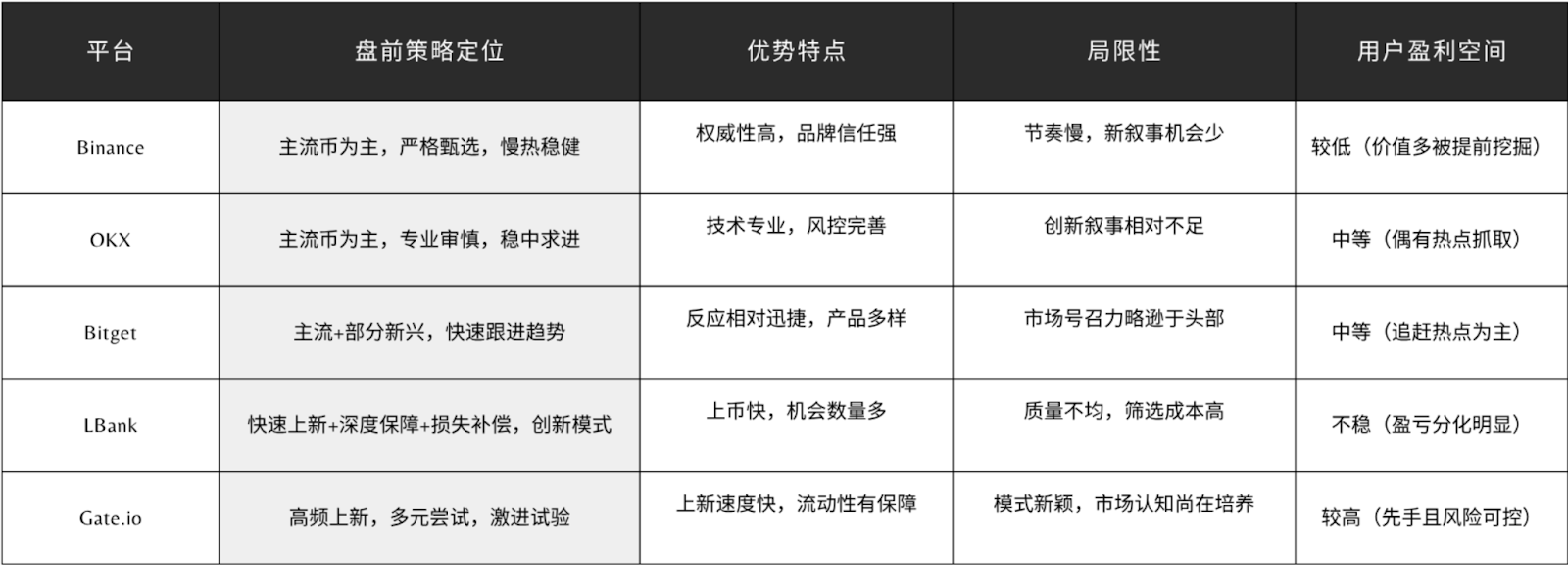

综合以上分析,我们可以将几家主要交易所的盘前定位和效果进行对比:

(注:上述“盈利空间”是相对比较不同平台盘前策略下,普通用户有望获取超额收益的可能性。)

从上表可以看出,Binance 更像是在“看市场”:它等待项目成熟后再入场,因此稳健但错过早期红利;OKX 则擅长“算市场”,注重专业研判,在风险控制下追求确定收益;Bitget 有点类似在“顺势而为”或“消耗市场”,快速复制市场热门但缺乏独有亮点;Gate.io 沉迷于“试市场”,用海量的新币尝试来博取高增长,但结果参差不齐;而 LBank 则是主动“做市场”,通过机制创新引导市场,在盘前阶段就创造交易机会和流动性。

赢在盘前,赚在速度

对于个人交易者而言,盘前布局的意义愈发明确:市场从不奖赏犹豫和等待,它眷顾的永远是快人一步的先行者。无论是币安的稳健、OKX 的精准、Bitget 的迅捷,还是 Gate.io 的多元尝新,每个平台都有自己的节奏与拥趸。然而可以预见的是,在下一个周期中,真正能把握盘前红利的交易者将占据更大优势。

当主流平台还在评估市场走势时,机会已经在边缘市场悄然酝酿;当大众情绪开始高涨时,先行者们或许已经收获颇丰。LBank 将“速度”与“稳定”合二为一的探索,正是顺应了这一趋势:让交易者能够在开盘前就锁定属于自己的第一波行情 。对于追求高收益又希望相对可控风险的玩家来说,这无疑提供了一个值得关注的全新赛道。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。