Daily market key data review and trend analysis, produced by PANews.

1. Market Observation

With the end of the 43-day U.S. government shutdown, the SEC and CFTC are set to resume operations. Some crypto companies have preemptively submitted IPO and ETF applications, and Grayscale has officially submitted an IPO application to the SEC, managing approximately $35 billion in assets. However, the market did not receive a breather, as hawkish comments from Federal Reserve officials raised investor doubts about the prospects of interest rate cuts in December, leading to the largest drop in the three major U.S. stock indices in a month. Disney, which reported disappointing quarterly earnings, led the decline in the Dow, while chip stocks and AI concept stocks also suffered significant losses. Michael Burry, the real-life inspiration for the movie "The Big Short," refuted media reports claiming he shorted Nvidia and Palantir with an actual investment of only $9.2 million, far from the reported $912 million. However, his warnings about the AI bubble and the liquidation of his fund, Scion Asset Management, intensified market anxiety.

The aftereffects of the shutdown are also beginning to show, as White House officials confirmed that some key economic data, including the October unemployment rate, may be permanently lost, presenting an unprecedented challenge for the Federal Reserve in assessing economic conditions and determining interest rate paths. Against this backdrop, several officials, including Minneapolis Fed President Neel Kashkari, expressed uncertainty or opposition regarding the necessity of a rate cut in December, with market expectations for a rate cut probability dropping to 47%. The current macro environment exhibits high uncertainty: AI investment returns are under pressure, stock market valuation disputes persist, the aftereffects of the government shutdown and data vacuum loom, FOMC divergences are widening, and the future direction of Federal Reserve policy remains unclear. In this context, the market holds a more cautious outlook for the coming months, particularly anticipating further clarity on inflation, labor, and growth trends after data normalization.

Amid the complex macro environment, Bitcoin prices have fallen below the $100,000 mark, with the fear and greed index dropping to 15, indicating extreme fear. Wintermute analyst Jasper De Maere pointed out that while Bitcoin maintains a high correlation of about 0.8 with the Nasdaq index, it exhibits an unusual negative skew: Bitcoin tends to decline more sharply when the stock market falls, while its response is relatively muted when the stock market rises. Analysts believe this is related to investors shifting their attention to high-growth tech stocks and the weakening liquidity in the crypto market. Most analysts expect short-term adjustments to continue, generally focusing on the key support levels in the $92,000 to $94,000 range, which KillaXBT, pschmitt, Kyle Reidhead, and Crypto Auris view as potential adjustment endpoints or ideal entry points. Notable trader Eugene noted that Bitcoin's drop below $100,000 symbolizes the first break of the high time frame bullish structure since 2022, with $100,000 shifting from support to resistance. He is focusing on the $90,000 area and does not consider bottom-fishing in the short term. Analyst Ayl pointed out that 65% of Bitcoin's cost basis is above $95,000, so a drop below this level could lead to stronger selling pressure. Analyst Ali stated that if Bitcoin falls below $95,930, the next key support levels would be at $82,045 and $66,900.

However, the market is not without long-term optimists. Haseeb Qureshi, managing partner at Dragonfly, believes that the current fundamentals remain solid compared to the industry's chain collapse in 2022, calling it "the easiest bear market." McKenna, CEO of Arete Capital, predicts that although new highs this year are unlikely, institutional adoption trends remain unchanged, with Bitcoin prices expected to break $150,000 in the second half of 2026 and reach $200,000 before the end of Trump's term.

Ethereum has also not been spared, with prices once dropping over 10%, making the road back to $4,000 increasingly difficult. Analyst Marcel Pechman pointed out that Ethereum is facing four major challenges: first, on-chain activity remains weak, with trading volume and active addresses down 23% and 3% respectively over the past 30 days; second, network fees have plummeted by 88%, weakening staking yields; third, pressure from competing public chains like Solana and BNB Chain, as well as emerging altcoin ETFs, is increasing; and finally, the pace of institutional capital inflows is slowing. These factors collectively suppress its price performance. Despite short-term pressure, many investors view this pullback as a good opportunity to position themselves. Analyst Donald Dean believes that prices may continue to dip to the strong support area of $2,800 to $3,000, but the risk-reward ratio is gradually improving, currently seen as an "accumulation" phase, with long-term target prices of $4,955 and $5,766. LD Capital founder Yi Lihua also stated that the $3,000 to $3,300 range is the best bottom-fishing opportunity and revealed that his team is consistently increasing their spot positions, patiently waiting for the market to recover.

The altcoin market has generally declined alongside the broader market, with many projects' positive news failing to counteract the overall market downturn. For example, dYdX announced that it would use 75% of its protocol fees for buybacks, and the NFT market Magic Eden also announced it would use 30% of its secondary market revenue for token and NFT buybacks, but the prices of ME and DYDX still fell. Solana, despite experiencing inflows for 13 consecutive days since the launch of its spot ETF, still saw its price drop below $140, with the probability of reaching a historical high before 2026 plummeting from 56% a month ago to 6%. Notable DeFi analyst Ignas has sold SOL to buy ZEC, influenced by Helius CEO Mert, who, while stating he still holds SOL, has become another major industry opinion leader supporting Zcash, alongside BitMEX co-founder Arthur Hayes. Amid the market's gloom, there are still bright spots, such as the Canary XRP ETF listing on Nasdaq, which achieved a trading volume of $59 million on its first day, slightly surpassing BSOL's $58 million, setting a record for the highest trading volume of new ETFs this year.

2. Key Data (as of November 14, 13:00 HKT)

(Data source: Coinglass, Upbit, Coingecko, SoSoValue, CoinMarketCap)

Bitcoin: $97,308 (YTD +3.92%), daily spot trading volume $107.48 billion

Ethereum: $3,178 (YTD -4.8%), daily spot trading volume $49.08 billion

Fear and Greed Index: 15 (Extreme Fear)

Average GAS: BTC: 1.02 sat/vB, ETH: 0.067 Gwei

Market share: BTC 59.2%, ETH 11.7%

Upbit 24-hour trading volume ranking: XRP, BTC, ETH, SOL, AVNT

24-hour BTC long/short ratio: 48.11%/51.89%

Sector performance: Ethereum ecosystem down 10.6%, NFT sector down 9.88%

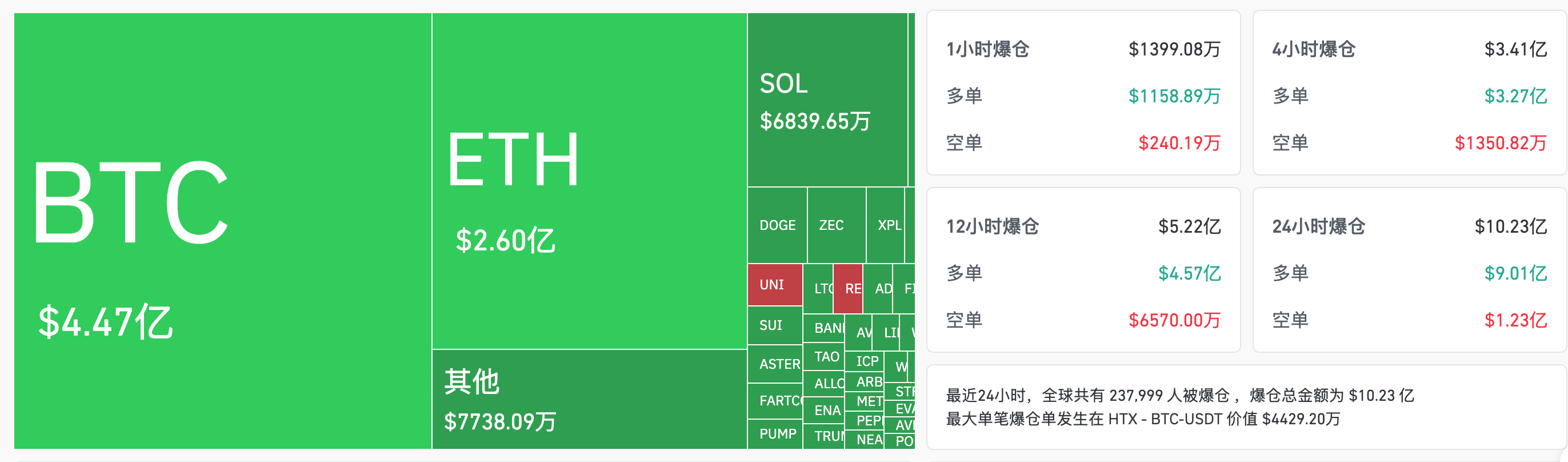

24-hour liquidation data: A total of 237,999 people were liquidated globally, with a total liquidation amount of $1.023 billion, including $447 million in BTC, $260 million in ETH, and $68.39 million in SOL.

3. ETF Flows (as of November 13)

Bitcoin ETF: -$870 million, the second-highest in history

Ethereum ETF: -$260 million, continuing three days of net outflows

Solana ETF: +$1.49 million, continuing 13 days of net inflows

Hedera ETF: +$5.37 million

Litecoin ETF: +$698,000

4. Today's Outlook

Binance will remove C/BNB, C/FDUSD, DOGE/TUSD, and NIL/BNB spot trading on November 14

Binance Alpha will launch the Play Solana (PLAYSOLANA) airdrop on November 14

Binance will delist MYROUSDT and 1000XUSDT perpetual contracts on November 14

Solomon will conduct a SOLO token ICO on MetaDAO on November 15

Starknet (STRK) will unlock approximately 127 million tokens at 8 AM on November 15, accounting for 5.34% of the current circulating supply, valued at approximately $17.7 million;

WalletConnect Token (WCT) will unlock approximately 124.9 million tokens at 8 AM on November 15, accounting for 65.21% of the current circulating supply, valued at approximately $15 million;

Sei (SEI) will unlock approximately 55.56 million tokens at 8 PM on November 15, accounting for 1.11% of the current circulating supply, valued at approximately $9.6 million;

Today's largest declines among the top 100 cryptocurrencies by market capitalization: Story down 19.9%, Aerodrome Finance down 16.7%, Jupiter down 14.6%, Pudgy Penguins down 12.8%, Aave down 12.3%.

5. Hot News

“Whale that once borrowed to short 66,000 ETH” buys back 16,937 ETH, worth $53.91 million

GAIB announces token economics: total supply cap of 1 billion, with 40% allocated to the community

Anchorage Digital has received 4,094 BTC in nearly 9 hours, worth $405 million

Magic Eden announces that 30% of secondary market revenue will be used for ME token and NFT buybacks

Liquid staking protocol Drop announces orderly shutdown and cancellation of TGE and airdrop

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。