Author: Bootly

Recently, a research paper from Columbia University has sparked controversy around the trending topic of "Prediction Markets."

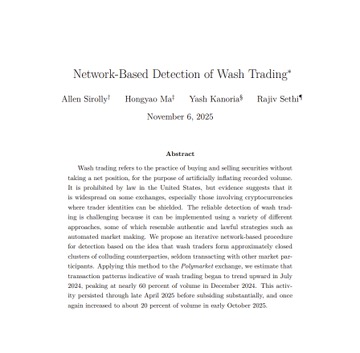

The authors of the paper analyzed two years of historical data from the blockchain platform Polymarket and found that about 25% of the trading volume may belong to wash trading—where the same entity trades back and forth between their own accounts to create a false sense of activity. During certain high-profile event weeks, such as the U.S. elections or sports finals, this percentage even soared to 60%.

Although the research has not undergone formal peer review, it is enough to peel back a layer of the hype surrounding prediction markets. Over the past six months, the excitement in this sector has been almost "visibly" apparent: regulatory easing, backing from major players, capital surges, and political involvement—prediction markets are becoming the most watched "new financial species" of 2025.

From "Marginal Gambling" to "New Financial Species"

The mechanics of prediction markets are not complex: you can bet on events like "Will Trump win the election?", "Will the Federal Reserve cut interest rates?", or "Which country will the next Nobel Prize winner come from?" The platform forms a "market probability" based on the prices set by both parties, which is seen as a manifestation of "collective wisdom."

In 2025, this "money voting" method is poised for a triple explosion:

Regulatory Easing

In May of this year, the U.S. Commodity Futures Trading Commission (CFTC) withdrew its lawsuit against Kalshi, officially recognizing that prediction contracts can be legally traded "within a specific framework."

In September, the CFTC issued a "No-Action Letter" to Polymarket, allowing it to reopen its U.S. market.

This means that prediction markets are moving from a "gray area" to "regulatory visibility," clearing the biggest obstacle for capital involvement.

Capital + Political Bets

Immediately following this, funds began to pour in:

In August, Polymarket received investment from 1789 Capital, which is partially owned by Donald Trump Jr.;

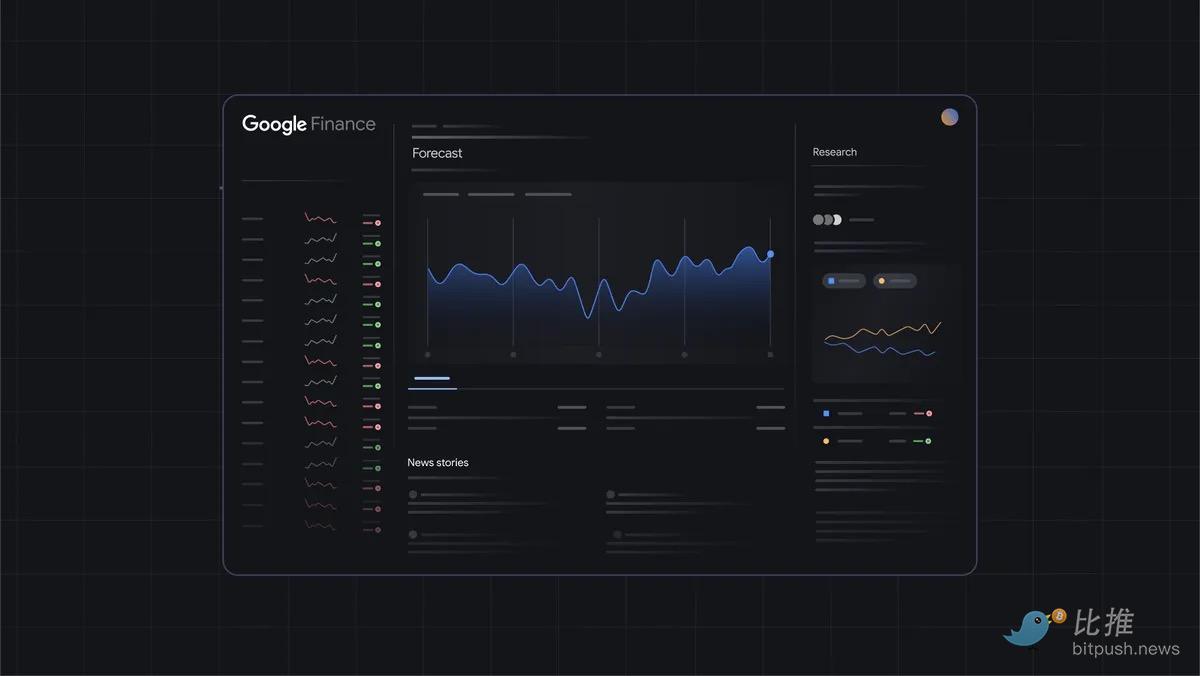

Then, in September, the parent company of the New York Stock Exchange, ICE, invested $2 billion, raising Polymarket's valuation to $8 billion, and in October, competitor Kalshi reached a valuation of $5 billion under the leadership of a16z and Sequoia Capital, with market enthusiasm continuing to surge.

According to the latest news from Bloomberg, Polymarket is seeking to raise a new round of financing at a higher valuation of $12 billion to $15 billion, while Kalshi's valuation is believed to have also surpassed the $10 billion mark.

Behind this capital frenzy, the deep involvement of political forces cannot be ignored.

The "market-friendly" regulatory atmosphere created by the Trump administration paved the way for the explosion of prediction markets. The CFTC's change in attitude and ICE's massive investment have both been interpreted by the market as clear policy signals.

Notably, the personal involvement of the Trump family is worth mentioning: Donald Trump Jr. not only invested in Polymarket through 1789 Capital but also serves as an advisor to Kalshi;

ICE CEO Jeff Sprecher—who is also the husband of former Small Business Administration head Kelly Loeffler—personally led the investment in Polymarket;

And Trump's social platform Truth Social has also announced plans to launch its own crypto prediction platform, "Truth Predict."

The combined forces of capital, policy, and family influence are driving prediction markets from marginal experiments to the mainstream financial stage.

Major Players Boosting Mainstream Adoption

In October, Google announced it would integrate real-time prediction data from Polymarket and Kalshi into Google Finance search results. For example, when users search for "Who will be the president in 2028?" or "What is the probability of a Federal Reserve rate cut?", real-time data charts from the prediction markets will appear below the results.

This means that prediction markets are being "embedded" into the world's largest information gateway for the first time, becoming part of the public information flow.

Google did not disclose the specific cooperation model with the two companies, but for the market, this move is a "milestone in mainstreaming": prediction markets have transformed from "betting tools for crypto players" into data products visible to ordinary users and quotable by the media.

The results are clear: in October, Polymarket's trading volume hit a historic high, with monthly trading exceeding $3 billion and the number of users growing by 93.7% compared to September.

How Serious is Columbia's Concern About "Fake Transactions"?

Returning to the research data from Columbia: Polymarket has about a quarter of its transactions between 2024 and 2025 exhibiting suspicious patterns: frequent back-and-forth trading between accounts, very short transaction time intervals, and almost no positions being settled. These characteristics are very similar to the "wash trading" seen in the past NFT market.

The report's authors speculate that the motivations for wash trading in prediction markets mainly include:

- Competing for future token airdrops or incentive points;

- Creating market heat to attract new users;

- Individual market makers stabilizing price ranges through "fake transactions."

In other words, some may repeatedly "place fake orders" in the market to boost activity, grab points, and obtain future token rewards. This is not unfamiliar in the crypto space: from NFTs to DeFi, almost every round of innovation has been accompanied by "data washing" behavior, but even so, the "inflation" in prediction markets is not the highest in the industry. In comparison:

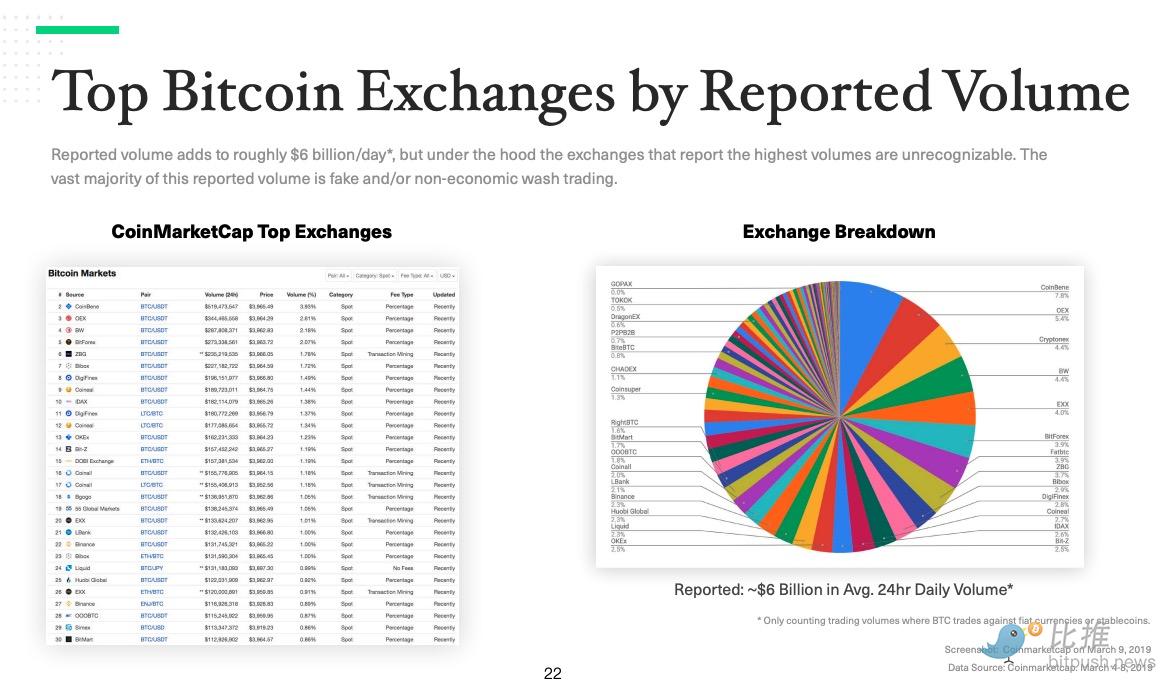

The early "fake volume" in unregulated Bitcoin exchanges once exceeded 70% (according to a Bitwise report from 2019).

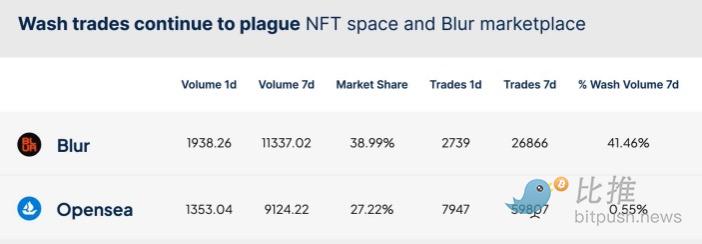

In the NFT market, the proportion of wash trading during peak market periods was also between 20% and 50%.

In contrast, Polymarket's average of 25% is considered "moderately high." Additionally, with Kalshi's stronger compliance and strict KYC, the overall "authenticity" of the industry has far exceeded that of the early crypto space. Therefore, from an industry perspective, the inflation in prediction markets is not a catastrophic issue.

Moreover, there are differing voices regarding the conclusions of the Columbia study.

Former AWS engineer yassinelanda.eth raised several counterarguments after reviewing the paper.

He believes that the study has methodological limitations—its conclusions are based on a single on-chain data model, while platforms like Polymarket actually have more complex signaling systems to identify real users and fairly distribute rewards. Additionally, the conclusions of the study are very sensitive to the parameters set during analysis, and the severity of the issues revealed may not be stable.

He further pointed out a key characteristic of prediction markets: in this field, valuable signals are far more important than raw trading volume. A simple "left hand to right hand" volume washing cycle cannot generate real profit (PNL). Nowadays, advanced on-chain monitoring and recommendation systems can effectively distinguish between informed real trading flows and market noise from market makers, bots, and self-trading, reducing the weight of the latter in recommendations and rewards.

In his view, the core criteria for evaluating a prediction market should not be the "total trading volume," which is easily inflated, but rather:

- Prediction accuracy: How accurate are the market outcomes?

- Calibration: Do the predicted probabilities match the actual occurrence frequencies?

- Bid-ask spreads and market depth: How good is market liquidity, and how high are transaction costs?

- Slippage during news events: Can prices respond quickly and smoothly to new information, rather than experiencing violent fluctuations?

These indicators regarding market quality and information efficiency are the true core of measuring the value of prediction markets.

The Resurgence of Gambling: When "Betting" Becomes the Mood of the Times

As observed by University of Chicago sociologist Lydia Grant: "Prediction markets, in a sense, extend the American belief system—they allow people to gain a sense of illusory control through the act of 'betting' amidst great uncertainty."

This statement accurately captures the current social pulse in America. Faced with high inflation, political division, and class stagnation, a "gambling mentality" is quietly becoming a common emotional outlet. From sports betting to cryptocurrencies, and now to prediction markets, more and more Americans are beginning to entrust their fate to probabilities, releasing their anxieties in the betting lines.

And as Wall Street giants also dive in, this trend has received dual validation from capital and institutions. The massive investments from organizations like ICE indicate that the mainstream financial sector is viewing prediction markets as the next generation of "event-driven" risk pricing infrastructure, rather than merely marginal gambling games.

As Rachel Lin, CEO of SynFutures, pointed out: "The true value of prediction markets lies in their ability to quantify things that traditional finance cannot price, such as policy decisions, technological breakthroughs, and geopolitical risks."

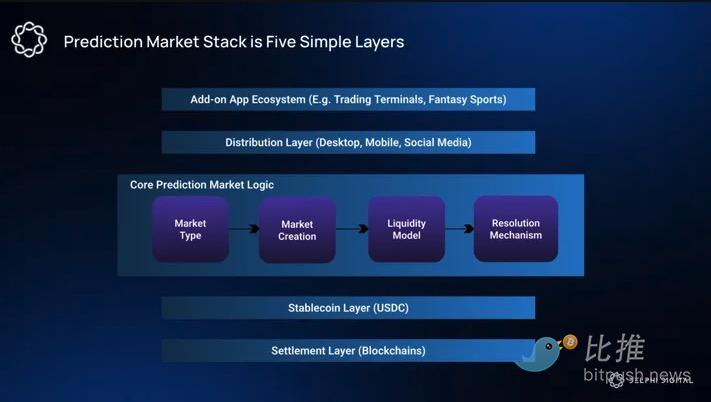

At the same time, Polymarket's launch of the POLY token and other initiatives has injected new fuel into ecological development. Research firm Delphi Digital believes that future prediction "terminals" that integrate multi-market data and AI analysis could open a new trading track similar to the meme coin craze.

Of course, challenges still exist. U.S. regulators are still debating whether to define these as "derivatives" or "gambling," and this lingering policy cloud remains the final hurdle for prediction markets to achieve full mainstream acceptance.

However, the convergence of capital, technology, and social sentiment is irreversible. People think they are predicting the future, but they do not realize that this nationwide betting craze has become the most authentic reflection of this era.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。