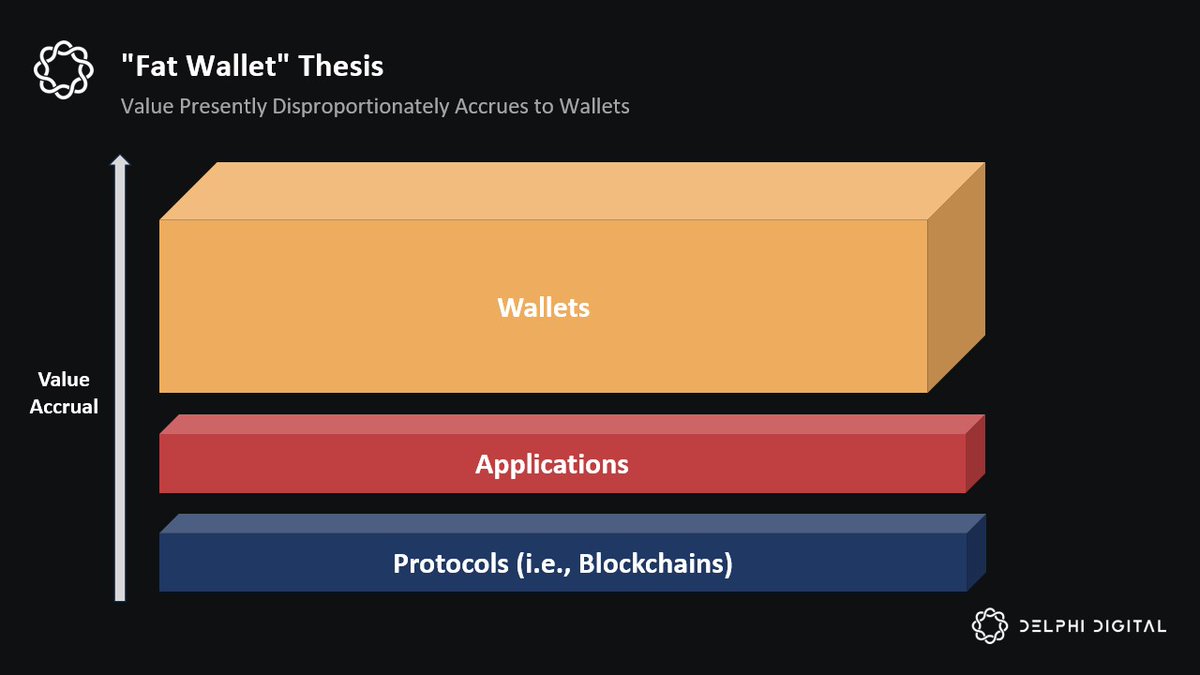

A year ago we released the Fat Wallet thesis. Today we're seeing this play out in real time.

Crypto frontends could become the blackhole of value capture.

While people debate protocols vs applications, wallets could be the layer that accrues the most value.

Protocols are thinning out. MEV redistribution is pushing value upward to whoever originates order flow. Applications face the same fate. Forkability, composability, and token incentives are accelerating competition.

As both layers thin out, value has to go somewhere. The answer is whoever originates the order flow.

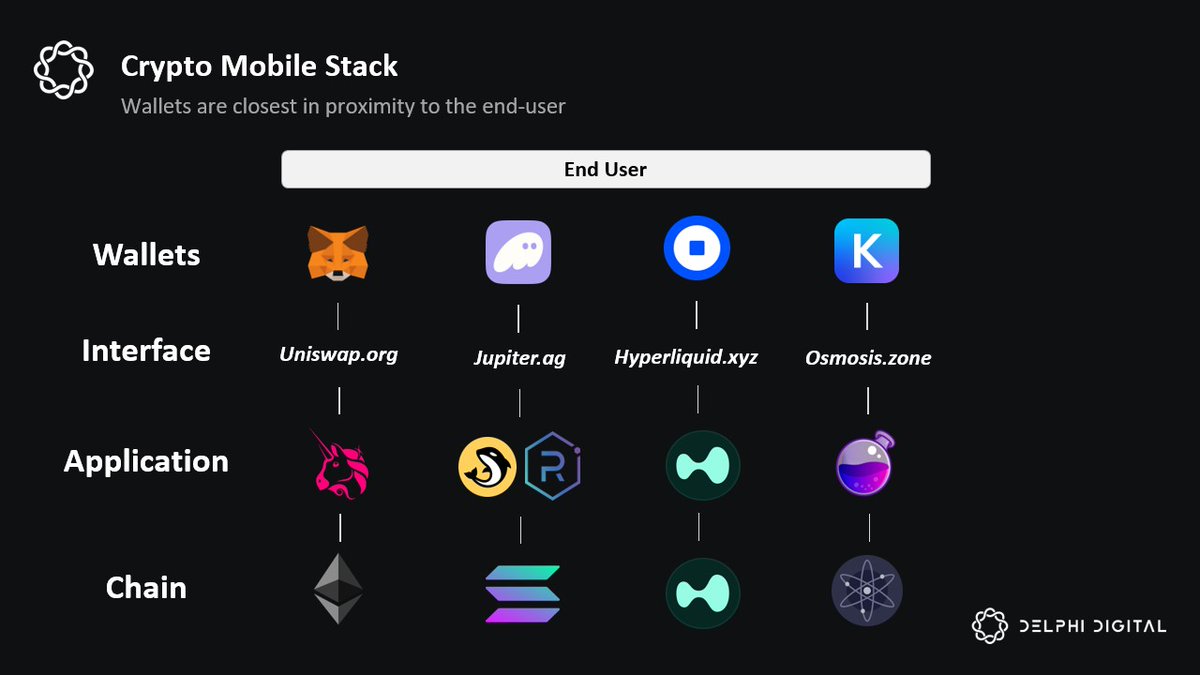

Wallets own the most valuable order flow. On mobile, users don't interact with Uniswap directly. They access it through their wallet which becomes the interface.

However, not all order flow is created equal.

Solver models serve fee sensitive whales trading large positions who won't accept even 10 bps in excess fees. These traders pay for execution quality. Fee sensitive traders are the least valuable customer segment.

Wallets and Telegram bots own fee insensitive retail traders. These users pay for convenience, not execution. They don't care about 50 bps slippage when expecting either 100x or zero. This generates far more revenue per dollar of volume swapped.

High switching costs protect this moat. Moving private keys create friction. Trust in wallet providers runs deep. This is pricing power that doesn't exist anywhere else in the stack.

As protocols and apps commoditize, value concentrates where it can't be competed away. Frontends that own order flow become the blackhole that absorbs value.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。