总的来说目前仍然是偏向乐观为主,一方面是美国政府的停摆大概率在美国时间的周三就能停止,流动性会有恢复,其次是美国最高法院可能并不会支持川普的关税政策,如果川普被迫放弃或减少部分关税,对于市场来说也会降低消费和通胀的风险,美联储可以将更多的精力放在降息上。

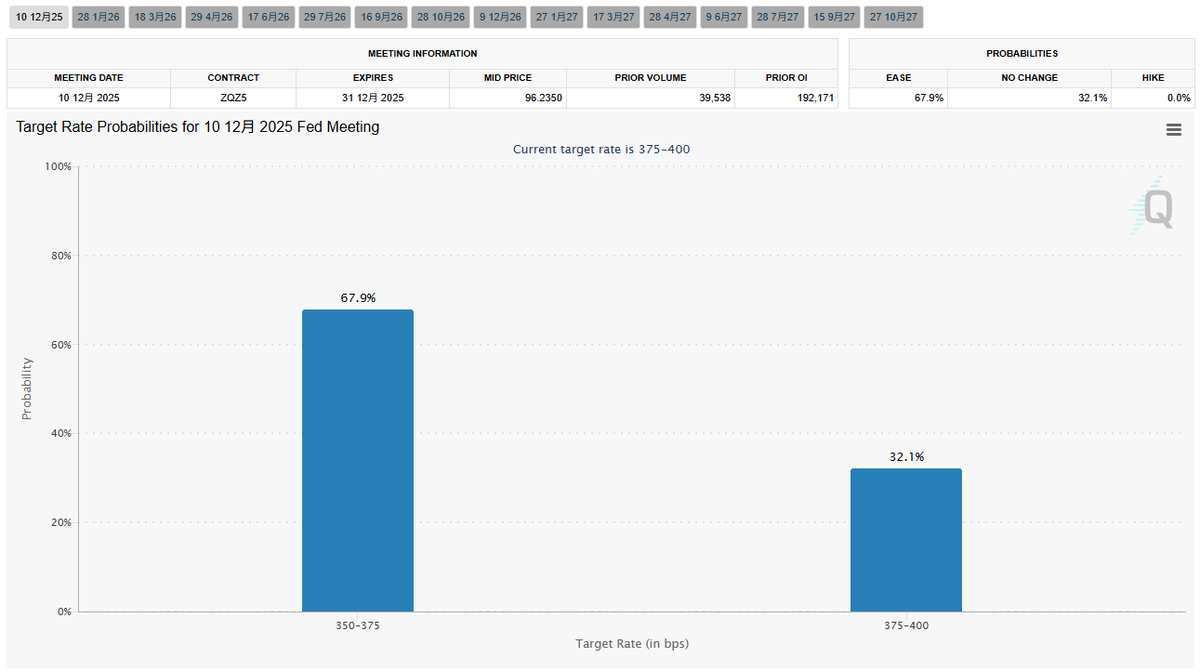

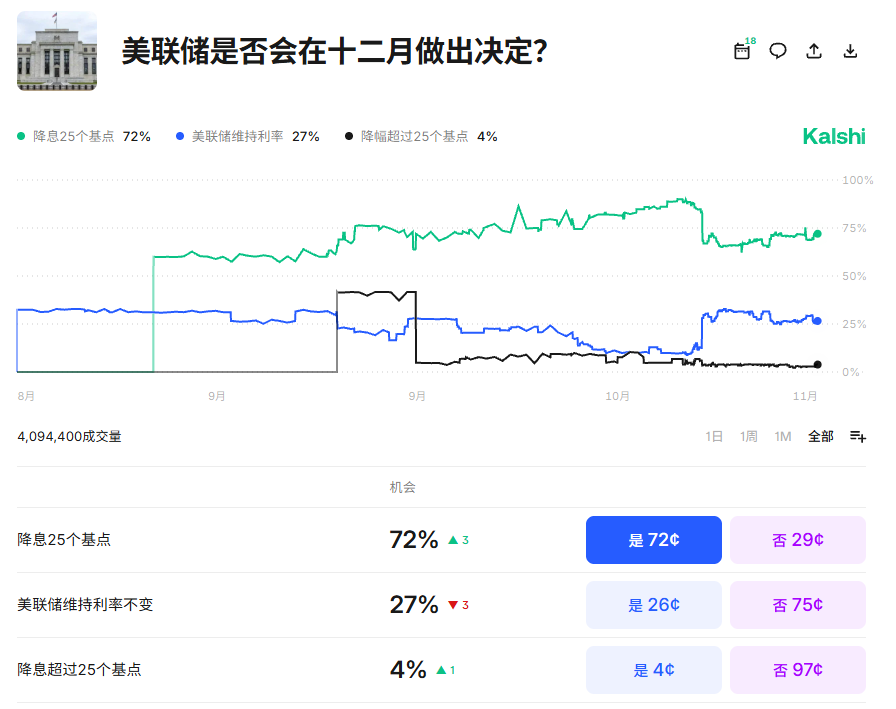

不过从 CME 的数据来看,最近一周对于美联储在12月降息的预期从上周的 74% 降低到了本周的 68% ,但从 Kalshi 的数据来看,最近一周对于12月降息的预测不但没有下降,反而还在上升。很有可能是最近频繁传出的裁员和劳动力衰退的数据让部分投资者认为就业数据会到达美联储的阈值,从而推动美联储的降息。

今天也有小伙伴问我,随着美国停摆的结束,更多的数据逐渐恢复出台,对于市场是利好还是利空,我个人的看法是,劳动力的数据很有可能是会更差了,这对于帮助美联储降息是好事,而且劳动力数据的下跌和停摆有挺大关系,未必就是长期的,这个数据应该是利好风险市场。

而停摆当中虽然没有完善的通胀数据,但我还是觉得通胀应该是略微下行的,随着最高法院对于川普关税的口头说明,很大可能投资者认为关税是不能直接这么执行的,对于进口商品的购买可能会延后。

本文由 @Bitget 赞助|省最多手续费,领最多豪礼,做VIP 就上Bitget

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。