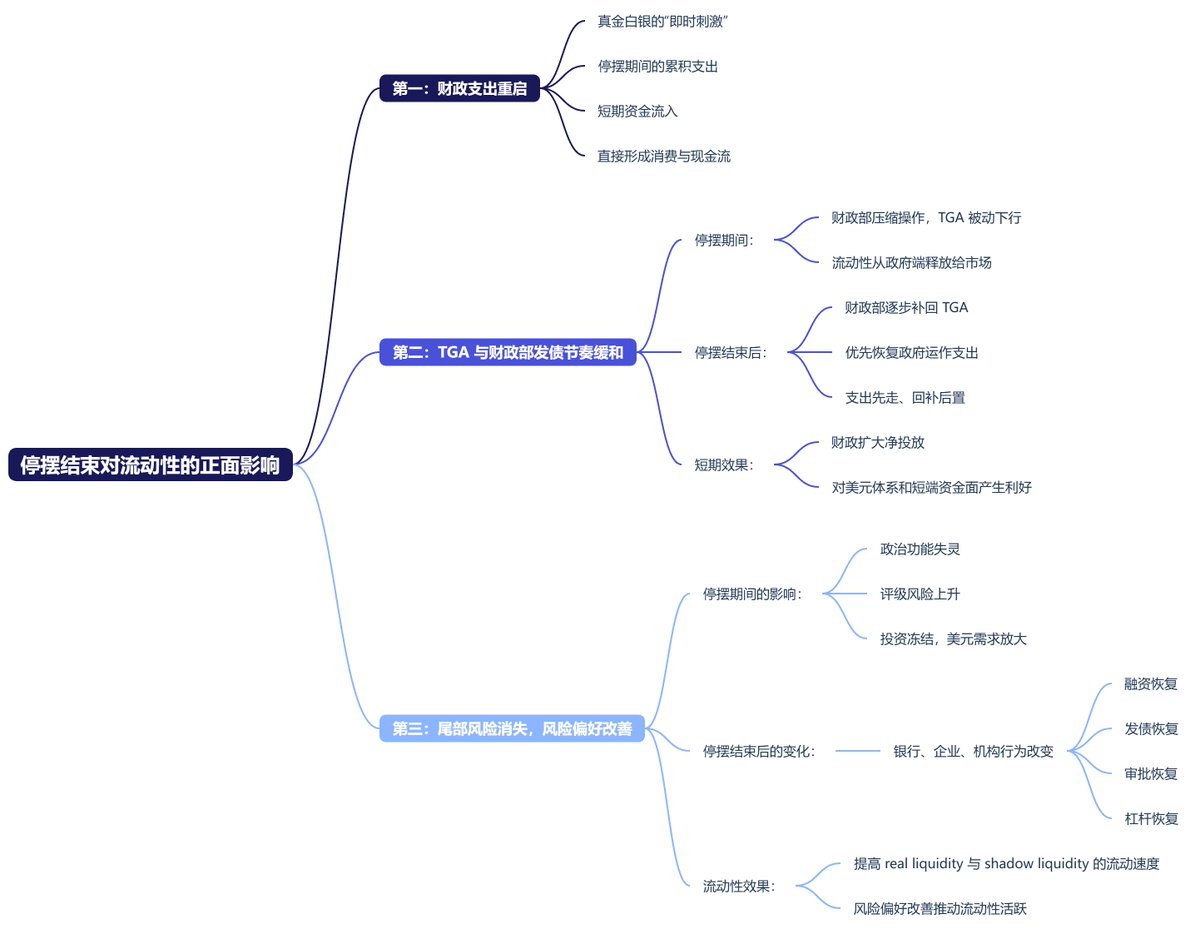

Recently, I have seen many investors questioning whether the expectations of a government shutdown have already been priced in, and whether the market has started to overreact to the positive expectations, turning them into negative ones. This is especially true after the drop in $BTC on Tuesday, which led some investors to believe that this is another "Sell The News" phase. However, I have a slightly different perspective. After the shutdown ends, it will have a tangible positive impact on liquidity, which includes:

First, the moment fiscal spending restarts, it will be a real "immediate stimulus" of cash.

During the shutdown, the U.S. federal government paused or delayed tens of billions in wages, contract payments, research budgets, and welfare expenditures. These are not "cancellations," but rather "accumulations." Once operations resume, this money will flood into the real economy in the short term, from the back pay for federal employees to payments to contractors, and the restart of welfare programs. All of this will immediately create a flow of consumption and cash flow; this is not just an expectation, but real liquidity that will be received.

In simpler terms, when the shutdown ends, the government will immediately start disbursing funds, whether to suppliers or individuals, ultimately compensating for the purchasing power lost over the past forty-three days. This money is likely to directly inject liquidity into the market in the short term because all delayed expenditures are necessary, not optional. Federal employees receiving back pay will not save it; they have already been behind on rent, loans, and daily expenses. Government contractors receiving payments will not sit idle; they have already covered cash flow and owe their supply chains. Welfare program recipients will immediately spend the funds.

In other words, this money will not slowly trickle into the economy but will rapidly return to the real economic system in a "concentrated release," creating a surge in purchasing power in the short term. For the market, this is equivalent to a small fiscal stimulus, with consumer recovery, corporate cash flow restoration, alleviation of bank pressures, and a decrease in short-term dollar demand. The overall speed of the capital chain will significantly increase. Therefore, the end of the shutdown is not just "good news," but represents a tangible influx of funds that has accumulated for 43 days, which will quickly flow back into the system in the coming short term. This is why the end of the shutdown essentially constitutes a real incremental injection of liquidity.

Second, the TGA and the Treasury's bond issuance pace will show marginal easing, resulting in a net release of short-term liquidity.

During the shutdown, the Treasury was forced to compress some operations, and the TGA passively declined, releasing liquidity from the government to the market. After the shutdown ends, although the Treasury will gradually replenish the TGA, it will typically adopt a more moderate pace and prioritize restoring expenditures necessary for government operations. Expenditures will come first, and replenishment will be postponed, effectively expanding net fiscal injections in the short term, which is particularly beneficial for the dollar system and short-term funding.

To clarify, during the shutdown, the Treasury had no money to spend and could only use cash from the treasury, which effectively pushed government account funds into the market. After the shutdown ends, although the Treasury will need to replenish this money, it will not drain the market all at once. Instead, it will first activate all government expenditures and then gradually replenish. This will result in a net injection into the market.

Third, the disappearance of tail risks and the improvement of risk appetite itself signifies an increase in "shadow liquidity."

A shutdown means a failure of political function, with rating risks, institutional concerns, and investment freezes amplifying dollar demand and pushing funds toward conservatism. After the shutdown ends, this tail risk is suppressed, and the behavior of banks, companies, and institutions will change immediately—financing will resume, bond issuance will restart, approvals will return, and leverage will be restored. All of these will increase the velocity of real liquidity and shadow liquidity. An improvement in risk appetite itself is a reactivation of liquidity.

In plain terms, as soon as the government shuts down, the entire market automatically enters a defensive mode. Banks will reduce lending, companies will hesitate to issue bonds, cross-border capital will slow down, and even the internal approvals of large institutions will freeze because no one wants to take on additional risks in a context where "the U.S. government is not functioning normally." In this environment, dollar demand will suddenly rise, as everyone scrambles for liquidity, dollars, and short-term safe assets, ultimately leading to a slowdown in the market's capital turnover speed. Even if the Federal Reserve does not raise interest rates, financial conditions will be passively tightened.

Once the shutdown ends, tail risks are immediately eliminated, and risk behavior will switch from "defensive" back to "normal." Banks will restore normal lending limits, corporate bond issuance will instantly unfreeze, funds will be able to reapprove investment projects, insurance capital will be reallocated, and cross-border capital will return to normal reporting rhythms. The market will no longer need to hoard dollars as a safety net. Overall, the end of the shutdown brings about a decrease in risk premiums, which in turn stimulates an improvement in the financing environment, leading to more fluid capital movement, thereby increasing the velocity of liquidity in both the real economy and financial markets.

Therefore, I do not believe the market has fully priced in this situation, nor do I think the end of the shutdown is merely a short-term "Sell The News."

On the contrary, I tend to believe this is a transition from "improved expectations" to "real liquidity entering the market." Short-term fluctuations do not affect long-term trends; the real stimulus comes from the capital inflow and the resumption of government activities after the shutdown ends, which will gradually reflect in the market over the coming weeks.

This is the true benefit for risk markets, as it does not rely on emotions or narratives but is constituted by substantial improvements from three real "liquidity sources": government spending, TGA operational pace, and institutional risk appetite. Thus, the end of the shutdown does not bring a one-time benefit but rather a sustained fiscal repair period lasting several weeks or even months. During this time, the funds that were previously suppressed will re-enter the economic cycle, frozen financing activities will return to normal, and tight short-term liquidity will significantly ease.

This structural improvement will make the underlying funding environment of the market healthier and provide more solid support for risk assets. Therefore, what the market is currently seeing is just the first step; the true capital effects have not yet fully manifested. As government spending fully activates, various debts return, bond issuance progresses steadily, and tail risks disappear, the performance of risk markets in the coming weeks is more likely to shift from being "emotion-driven" to "liquidity-driven." This is a trend worth paying attention to and represents the core value of the end of this shutdown for the entire market.

This article is sponsored by @Bitget | Save the most on fees, receive the most gifts, and become a VIP at Bitget

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。