昨天我们对行情的定义是反弹,所以建议大家高空为主,在今天冲高到107500附近后就开始了下跌,符合我们的预期。同时昨天我们说压力在107500,今天也是打到了107500附近,寻找的压力位也是很准确的,我们的空单也盈利了。

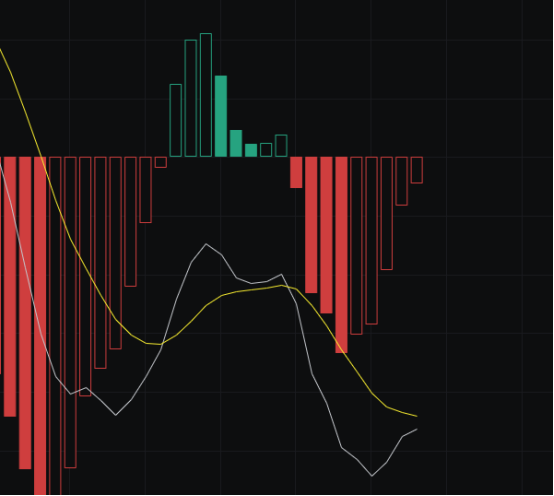

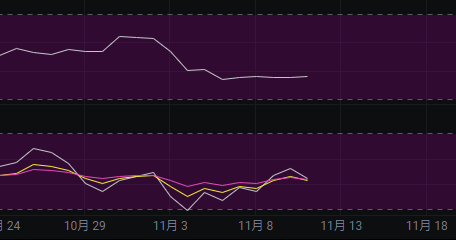

Macd上看,能量柱在收回,快线和慢线方向不一致,如果继续这样发展的话过两天就会形成金叉,从形态上看是利于多军的,但是形成金叉的时候也是很容易发生变盘的,所以这里不能认为金叉就一定会上涨,也有可能到达金叉后后续没有跟进而发生下跌。

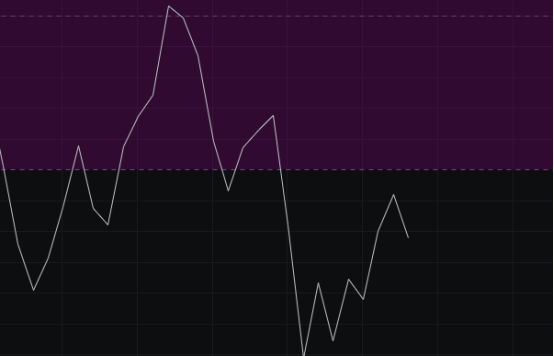

Cci上看,昨天cci快要触及-100了,我们也说了如果庄家是要让行情下跌,那么这里就最好不要去碰-100,今天看行情下跌,cci拐头向下没有去触碰,说明我们的判断还是正确的。

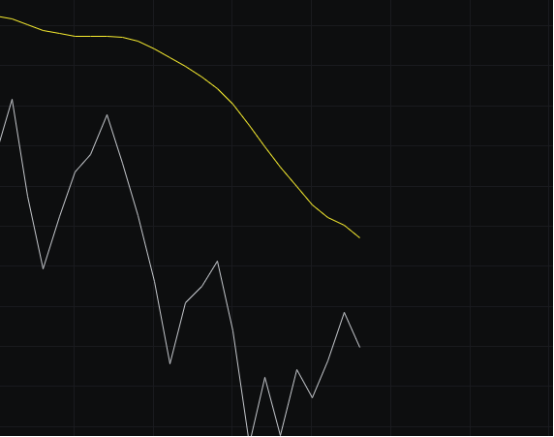

Obv上看,前几天的上涨使得obv有了回升,不过昨天我们也强调了虽然有回升,但是量能不大,所以多军还是比较弱的,今天看obv就继续下跌了,也是符合我们的判断。

Kdj上看,kdj方向还是向上,不过幅度走缓了,如果行情继续下跌,那过两天就能看到kdj拐头了,这里主要看kdj能不能过50.

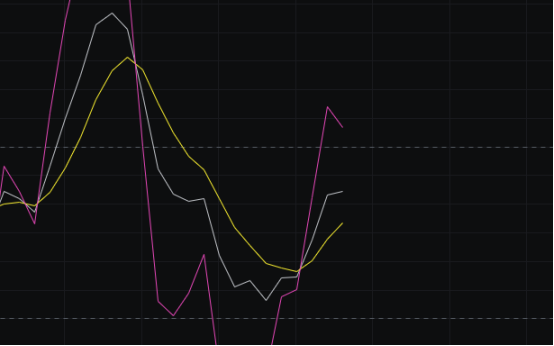

Mfi和rsi上看,mfi在中性偏下的位置,rsi在中性区间,这里只需要继续下跌一两天,mfi和rsi的方向就能一致向下了。

均线上看,昨天行情收在了bbi上方,但是今天又跌到了bbi下方,我们认为行情没能站稳bbi,所以就继续维持空头思维,同时均线也在继续下压,所以这里没有看多的理由。

Boll上看,昨天我们就说了,担心继续上涨会使boll过渡到宽幅,那样对于空军而言非常不利,要想打破这种可能就需要今天下跌收出阴线,现在看行情如我们昨天的判断一样,下跌了两个点左右,这使得行情走宽幅的可能小了一点,这样空军的胜利又多了一分。

综上:昨天我们对行情的判断完全正确,今天的走势都在昨天我们的预期之中,既然我们的预期都实现了,那就继续按照我们预测的方向做。今天压力看105000-106500,支撑看103000-101500.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。