Crypto News

November 8 Highlights:

1. Trump Media's third-quarter losses widen to $55 million, with digital asset holdings reaching $1.5 billion.

2. According to Coinglass data, $771 million was liquidated across the network in the past 24 hours, with both long and short positions affected.

3. Franklin Templeton's XRP ETF has been added to the DTCC website.

4. "On-chain detective" ZachXBT: Beware of fake Hyperliquid apps on the Google Play Store.

5. Zcash's shielded pool now holds over 5 million ZEC.

Trading Insights

Here are some practical insights to help you trade more efficiently!

- Focus on the "leader": Bitcoin is usually the barometer for market trends; while Ethereum and other quality coins can occasionally move independently, altcoins are generally influenced by Bitcoin.

- Watch for USDT reverse signals: When USDT rises, be cautious of Bitcoin's potential decline; when Bitcoin peaks, it’s a good time to buy USDT.

- Late-night "easy profit" tips: Between 0-1 AM, price spikes can occur; domestic users can set low buy orders for desired coins and high sell orders for holdings before sleeping, which might lead to unexpected transactions.

- Pay attention around 5 PM: Due to time zone differences, this is when U.S. investors become active, potentially causing price fluctuations; historically, many price movements occur at this time.

- Don't panic on "Black Friday": While there’s a saying about significant drops on Fridays, large increases or sideways movements are also common; stay calm and focus on news.

- Have strategies for quality coin declines: If a coin with trading volume drops, don’t panic; holding for 3 days to a month usually leads to breakeven. If you have extra funds, consider averaging down; if not, just wait.

- In spot trading, "watch more, act less": For the same coin, holding long-term and reducing trades yields better returns than frequent trading; patience is key.

LIFE IS LIKE

A JOURNEY ▲

Below are the real trades from the Big White Community this week. Congratulations to those who followed along; if your trades aren't going well, you might want to give it a try.

Data is real, with screenshots of each trade at the time.

**Search for the public account: *Big White Talks Coins*

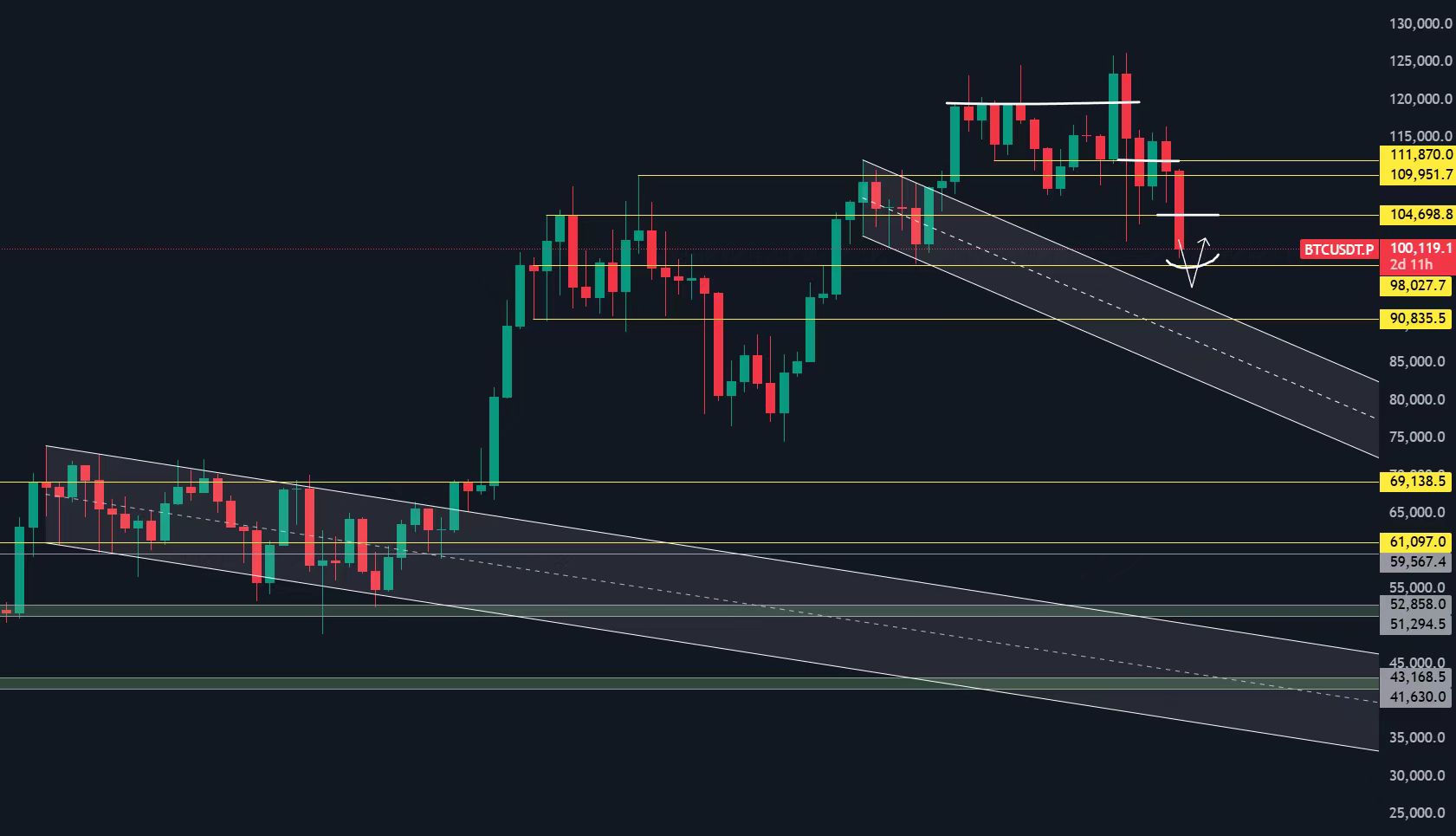

BTC

Analysis

Current market predictions indicate that the U.S. government may face a 47-day shutdown, suggesting that the market is not optimistic about a bipartisan agreement this week to resume work next week. It’s likely that discussions will continue, and work may resume a week later. However, negotiations are indeed taking place, and although the Republican Party rejected a proposal, the market still sees a chance for dialogue.

Before the market closed today, U.S. stocks quickly rebounded, driven by expectations of a compromise between the two parties, hoping for a swift resolution.

Bitcoin's short-term strength and weakness hinge on the key level of 105,000. If the weekly candle does not return above this level, the lower key level of 98,000 may be tested again. If it does test this level, a false breakdown followed by a rapid rebound could occur, so keep an eye out for any false breaks. Today's spot ETF saw net inflows with large on-chain whales making small purchases; all positions should be held firmly.

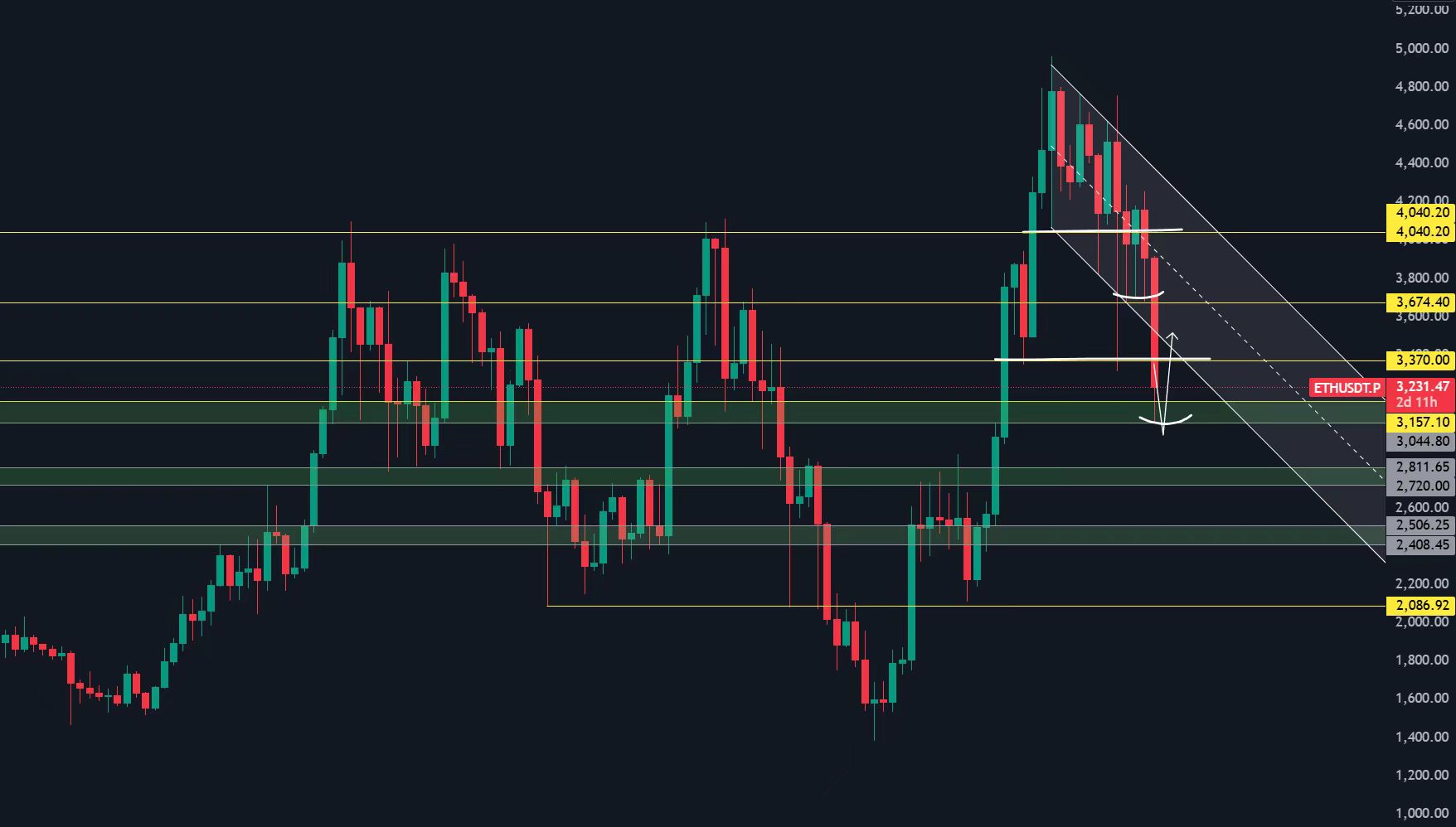

ETH

Analysis

Looking at the data, today’s turnover suddenly increased, likely due to Bitcoin's significant price fluctuations, dropping nearly below $99,000 before bouncing back above $103,500, which may have triggered panic among some investors. However, the outcome isn’t too concerning, which is why I often say not to be overly bullish when prices rise or overly bearish when they fall: emotions can reverse unexpectedly.

From the current chip structure, it remains very healthy. Although it temporarily broke below the support level, the gap isn’t large, and the support level hasn’t collapsed. The key moment to wait for may be the end of the shutdown.

Ethereum's performance will largely depend on Bitcoin's movements. If it tests 98,000 repeatedly, Ethereum may also test the key level of 3044, where there could be opportunities for a rebound.

Disclaimer: The above content represents personal opinions and is for reference only! It does not constitute specific trading advice and does not bear legal responsibility. Market conditions change rapidly, and the article may have some lag; if you have any questions, feel free to consult.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。