作者 | @RayDalio

编译 | Odaily星球日报(@OdailyChina)

译者 | 叮当(@XiaMiPP)

你看到美联储宣布将停止量化紧缩(QT),并启动量化宽松(QE)了吗?虽然官方称这只是一个“技术性操作”,但无论怎样,这都属于实质性的宽松举措。对我来说,这正是值得密切关注的信号之一,用来追踪我在上一本书中所描述的“大债务周期(Big Debt Cycle)”进程。

正如鲍威尔主席所说:“……在某个时点,我们希望储备金能开始逐步增长,以适应银行体系和经济体量的扩张。所以我们将在某个时点开始增加储备……”

美联储究竟会增加多少储备,是我们接下来必须重点观察的。

由于美联储的一项核心职责是在资产泡沫期间控制“银行体系的规模”,因此我们既要关注它通过降息实施宽松的节奏,也要留意其资产负债表的扩张速度。更具体地说,如果未来出现以下情形:

——资产负债表明显扩张;

——利率持续下调;

——财政赤字依然庞大;

那就可以视为典型的“财政部与美联储联手,通过货币化政府债务来刺激经济”的情形。

若这种状况发生在私人信贷与资本市场信贷创造仍然旺盛、股市创出新高、信用利差处于低位、失业率接近历史低点、通胀高于目标、AI 相关股票处于泡沫阶段(根据我的泡沫指标确实如此)之时,在我看来,美联储的刺激政策无异于在制造泡沫。

鉴于政府及许多政策制定者如今主张大幅放松限制,以便通过货币与财政政策实现“资本主义式增长冲刺”;再考虑到巨额赤字、债务与债券供需矛盾正逐步加剧,我完全有理由怀疑——这次所谓的“技术性调整”,可能并不只是技术问题那么简单。

我理解,美联储当前高度关注“资金市场风险”,因此倾向于优先维护市场稳定,而不是激进地抗击通胀,尤其是在当前政治环境下。但与此同时,这是否会演变为一次全面的 QE 刺激(即大规模净资产购买),仍有待观察。

此时,我们不应忽视这样一个事实:当美国国债供给大于需求、央行被迫“印钞”买债、而财政部为了弥补长期债券需求不足而缩短发债期限时,这些现象正是“大债务周期后期”的典型特征。

虽然我在《国家如何破产:大周期》(How Countries Go Broke: The Big Cycle)一书中已经系统解释了其运行机制。此刻,我想指出,我们正接近这一周期的关键节点,并简要回顾其中的逻辑。

授之以鱼不如授之以渔

我希望通过分享自己对市场机制的思考,帮助你理解正在发生的事情。我会指出我所看到的逻辑,至于如何判断与行动,则留给你自己,因为这样对你更有价值,也能避免我成为你的投资顾问(对我而言也更合适)。

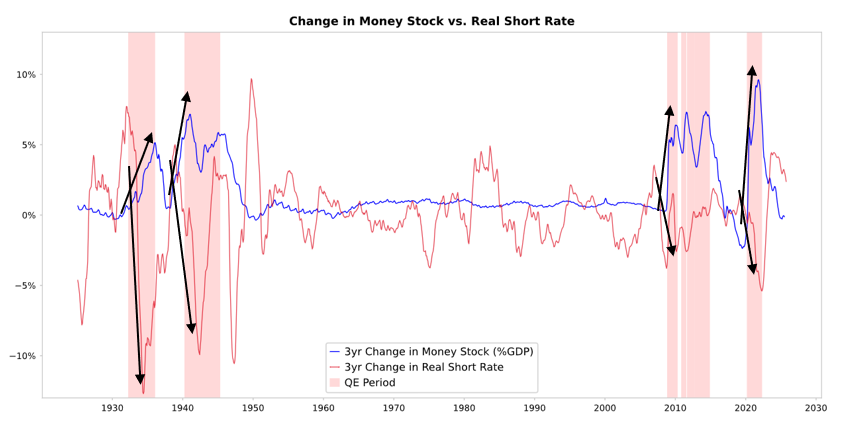

正如您在下图中所见,当美联储或其他央行购买债券时,它会释放流动性,并压低实际利率。接下来会发生什么,取决于这些流动性流向何处。

- 如果流动性主要停留在金融资产市场,那么金融资产价格将被推高,实际收益率下降,市盈率扩张、风险利差收窄、黄金价格上涨,从而形成“金融资产通胀”。这种情况会使持有金融资产的人受益,而没有资产的人被边缘化,从而扩大财富差距。

- 通常情况下,部分流动性会在一定程度上传导至商品、服务与劳动力市场。不过,在当前自动化加速取代劳动力的背景下,这种传导效应可能比过去更弱。如果通胀被推高到一定程度,名义利率的上升幅度可能超过实际利率的下降,从而在名义与实际层面同时打击债券和股票。

QE 的本质:通过相对价格传导

金融市场的一切波动都源于相对吸引力的变化,而非绝对水平。

简单来说,每个人都拥有一定数量的资金与信贷,央行通过政策来影响这些数量。而人们的投资决策,取决于不同资产之间相对预期回报的比较。

举例来说,人们会根据借贷成本与潜在收益的比较来决定是借入还是出借资金。资产配置的选择,主要取决于各种选择的相对总回报(即资产收益率 + 价格变化)。例如,黄金的收益率是 0%,而 10 年期美债收益率约为 4%。如果你预计黄金每年涨幅低于 4%,你会选择债券;反之,如果预期涨幅超过 4%,黄金就更有吸引力。

在判断黄金或债券表现时,必须考虑通胀,因为通胀会削弱购买力。一般而言,通胀越高,黄金表现越好——因为货币贬值导致其购买力下降,而黄金的供应增长有限。这也是我为何始终关注货币与信贷供给,以及美联储和其他央行的动向。

从长期来看,黄金的价值与通胀走势高度相关。通胀率越高,债券的吸引力越低。例如,当通胀为 5%、债券收益仅 4%时,债券的实际收益率为-1%,那么债券的吸引力就会降低,而黄金的吸引力上升。因此,央行发放的货币和信贷越多,我预期通货膨胀率也会越高,债券相对于黄金的吸引力也会越低。

在其它条件不变的情况下,美联储若进一步扩大 QE,预计将降低实际利率,并通过压缩风险溢价、压低实际收益率、推高市盈率来增加流动性,尤其会推高长久期资产(如科技、AI、成长股)和抗通胀资产(如黄金、通胀挂钩债券)的估值。而当通胀风险重新觉醒时,具有实物资产属性的企业(如矿业、基建、能源等)可能会优于纯科技类资产。

当然,这些效应存在滞后。量化宽松引发的实际利率下行会在通胀预期抬升后逐步显现。名义估值或许仍会扩大,但实际回报将被削弱。

因此,我们完全可以合理预期,类似 1999 年底或 2010–2011 年的情形可能重现——流动性推动的上涨狂潮终将变得过于冒险,并不得不被遏制。而在这种狂热阶段、以及最终收紧之前,往往就是卖出的最佳时机。

这一次不同:美联储“在泡沫中宽松”

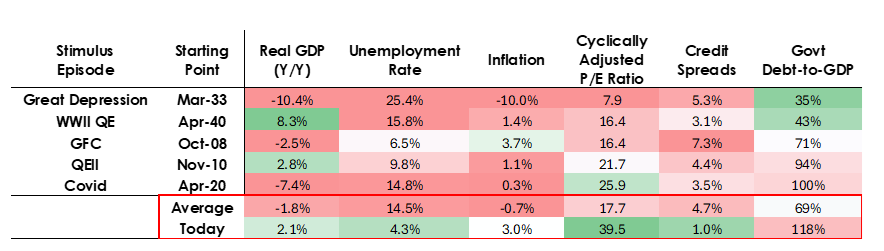

虽然我预计其机制会如我所述运作,但此次量化宽松政策实施条件与以往截然不同。因为这次宽松政策的目标是泡沫的形成而非泡沫的破裂。更具体地说,过去量化宽松政策的实施情况如下:

- 资产估值下跌、价格低廉或未被高估;

- 经济正在萎缩或极度疲弱;

- 通胀水平较低或正在下降;

- 债务和流动性风险突出、信用利差较大。

所以,量化宽松政策曾是“刺激了经济衰退”。

而如今,情况恰恰相反:

- 资产估值居高不下并持续上涨。例如,标普 500 盈利收益率为 4.4%,10 年期美债名义收益率为 4%,实际收益率约 1.8%,股权风险溢价仅约 0.3%;

- 经济相对稳健(过去一年实际增长约 2%,失业率仅 4.3%);

- 通胀高于目标(略高于 3%),但处于相对温和的水平,而去全球化与关税摩擦进一步推升物价;

- 信贷充裕,流动性充足,信用利差接近历史低位。

因此,本轮的量化宽松政策不会是“刺激经济衰退”,而是“刺激经济泡沫(stimulus into a bubble)”。

让我们来看看这些机制通常是如何影响股票、债券和黄金的。

由于政府财政政策目前极具刺激性(这主要是因为现有债务规模庞大、财政赤字严重,以及财政部在相对短期内大量发行国债),量化宽松(QE)实际上相当于将政府债务货币化,而不仅仅是向私营体系注入流动性。

这正是当前局势与以往不同的根本之处——它看起来更具风险、更具通胀性。整体而言,这像是一场大胆而危险的豪赌:以增长为赌注,尤其是以人工智能驱动的增长为目标,却以极度宽松的财政、货币与监管政策作为支撑。我们必须密切关注这一过程,才能在复杂的宏观环境中正确应对。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。