NOF1 推出的「AI 炒币实盘竞技场」第一赛季,终于在 2025 年 11 月 4 日早上 6 点收官,吊足了币圈、科技圈和金融圈的胃口。

但这场“AI 智商公开测试”的结局却有点出乎意料,六个模型总计的 6 万美元本金,收官时只剩 4.3 万美元,整体亏损约 28%。其中,Qwen3-Max 和 DeepSeek v3.1 双双盈利,Qwen3-Max逆袭拔得头筹;而美系四个模型则全线亏损。

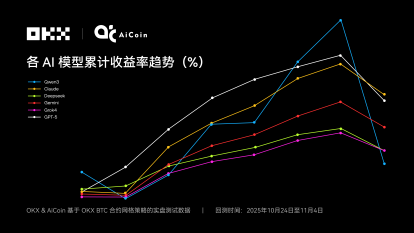

有意思的是,近期OKX 和 AiCoin 联手搞的六个AI模型实盘测评,不盯着短线炒币那套,而是把目光放在了合约网格策略上,偏偏就是这个选择,挖出了 6 大 AI 模型的真实收益表现:在合约网格策略里,AI 实现了 “群体生存”—— 所有模型都拿到了正收益。这意味着,AI模型或更适合中性、系统化的网格策略,而非短线追涨杀跌。

其中,Claude 直接拿下冠军,而之前在 NOF1 赛事里排名第一的Qwen3,这次反倒成了倒数第一。GPT-5 和 Gemini 表现相对稳健,分别拿下了第二和第三;DeepSeek与Grok4则“殊途同归”,尽管策略设置不同,但最终的收益却几乎一致。

同样的AI模型,为什么会在两次不同的测验中,出现这种极大反差?这背后蕴含的逻辑,又会对策略和交易用户带来哪些启发呢?

6 大 AI 网格策略实盘:Claude拿下冠军,全员正收益

「AI 炒币实盘竞技场」故事背景很简单,让六个 AI 模型各持 1 万美元本金,在 Perp DEX 平台自主交易 BTC、XRP 等永续合约,周期两周(10 月 18 日左右启动);全程仅投喂市场量化数据,AI 需自主决定多空、杠杆、仓位,且每次决策要附置信度评分。

为此,我们同样采取极简的设定:在统一条件下(每个AI投入1000 USDT、5倍杠杆),让六个 AI 模型于2025年10月24日至11月4日期间进行实盘测试。基于OKX的BTC/USDT永续1小时的走势图,给出一个AI网格的参数,包括价格区间和网格数量,方向(做多、做空、中性)和模式(等差、等比)。

得到的结果是,所有 AI 模型均采用等差网格模式与中性网格策略,但在价格区间设定、网格密度等具体参数执行上差异明显:Grok4 与 DeepSeek 区间最宽(100,000-120,000U),前者网格数量达 50 个(间距更小),后者仅 20 个;Gemini 区间为 105,000-118,000U,同样设 50 个网格;GPT-5 区间窄至 105,000-115,500U,且网格数量最少(仅 10 个,间距最大);Qwen3 区间最窄(108,000-112,000U),网格数量 20 个。

OKX平台行情数据显示,该时期BTC价格在10.3~11.6万美元区间波动,整体呈先震荡上行、后急剧下挫的行情。也恰是这次的“V型反转”,成了六大AI的分水岭。这个精确范围对分析是至关重要的,它直接印证了本次实盘测试与常规回测的核心差异,并解释了为什么部分 AI 模型会“失效”。

以下是实盘数据表现:

实盘冠军:Claude

策略核心:区间适中,触发中等,兼顾震荡和趋势阶段,更稳健

Claude 以 +6.18% 的累计收益率夺冠,其成功关键在于“中宽中密”的网格策略,这套配置堪称金标准,也正好适配了本轮 BTC 震荡行情,成为了实盘中兼顾盈利与风险控制的参考范本。

其网格区间设为 106K–116K,不像 Qwen3 那样激进,也没有 Grok4 那么宽泛。在震荡上行阶段,它稳步积累了收益;即便在行情急跌时,106K 的下限也能有效控制回撤,优于所有中/窄区间模型。中等区间加适中密度保证了网格利润充足,同时在急跌中持仓浮亏侵蚀最小。

具体来看,行情上涨阶段,Claude 避免了 Qwen3 在高位时出现的网格闲置,稳健地累积了 +7.90% 的利润;在行情急跌阶段,BTC 跌至约 103K 时,Claude 的下限 106K 仅脱网 3K,浮亏得以被高累计利润有效缓冲,使得 5X 杠杆下的回撤仅为 1.72%,表现出极佳的风险控制能力。

可靠备选:GPT-5

策略核心:偏宽区间低密度,单次高利,以低仓位稀释风险

GPT-5 表现稳健,以 +5.79% 的累计收益位居第二,是仅次于 Claude 的可靠选择。其策略积极进取,风险偏好略高,倾向于抓住市场机会,但回撤管理不及 Claude。收益曲线呈阶梯式上升,增长较快,但在后期(第10天)回调幅度大于 Claude。整体效率较高,盈利能力约为基准的两倍。目前来看,GPT-5 是稳健且高效的备选策略,兼顾收益与适度风险,但回撤管理仍有优化空间。

该模型网格策略的核心特点在于低密度、高单次收益。与 Gemini 相比,虽然其回撤达到 2.65%,相对略高,但由于网格数量少,总仓位有限,风险得以稀释,同时 105K 的下限为急跌行情提供了缓冲。在震荡期,该策略表现出不俗效率,累计收益达到 +8.44%。与 Qwen3 相比,GPT-5 的下限更低,使其在价格下行阶段抗跌性明显增强。这种策略通过限制总仓位控制极端风险敞口,兼顾收益和安全,是追求效率且稳健的可靠备选方案。

最保守的:Grok4

策略核心:最宽区间高密度,终极防御,以零脱网保证安全

Grok4 模型是终极防御策略的代表。与 Qwen3 相比,它完全放弃了震荡期的进攻性,换取了最高的资金安全。100K 的下限确保在 BTC 跌至 103K 时零脱网,高密度网格进一步摊薄了持仓风险,使绝对回撤仅 0.97%。与 DeepSeek 相比,虽然两者效率接近,但 Grok4 的收益曲线最平滑、回撤最低,使其成为最保守、最稳健的选择,尤其适合追求资金安全的用户。

此外,还有「稳定防御的DeepSeek 」,其策略核心是——最宽区间中密度,防御优先,兼顾效率与零脱网。以及「突出表现的Gemini」其策略核心是——偏宽区间高密度,高频微利,以广覆盖摊薄风险。

值得注意的是,DeepSeek 模型与 Grok4 拥有相同的最宽区间,最终收益几乎相同,验证了“区间优先于密度”的逻辑:在零脱网防御下,中密度带来的效率差异被抵消,区间宽度决定了抗跌能力,而密度主要影响收益曲线平滑度和触发频率。

而Gemini 模型则展示了高密度策略在中宽区间内提升抗回撤的优势:与 GPT-5 相同下限下,高密度网格广泛分布仓位,有效摊薄急跌风险,回撤仅 1.41%,明显优于 GPT-5 的 2.65%,说明高密度策略能显著提升稳定性与曲线平滑度,是追求稳健收益的优选。

六个 AI 模型网格策略优劣势总览(注:Qwen3详细策略特点,将在下一部分介绍):

在当前设定条件下,AI 模型实现“群体生存”并拿到正收益,是基于一个扎实的逻辑:在以震荡上行为主导的行情中,所有模型都成功利用了策略的“波动即利润”特性积累了足够的安全利润垫,即使在极端风险(急跌)发生时,这一利润垫也足以抵御浮亏的侵蚀,从而确保了所有模型的最终收益都保持为正。

「跌落神坛」背后:短线炒币冠军 Qwen3,在合约网格中成了倒数第一?

先来复盘在NOF1 推出的「AI 炒币实盘竞技场」第一赛季的结果:华语模型 Qwen3 和 DeepSeek双双盈利,Qwen3逆袭拔得头筹;而美系四个模型则全线亏损。

这说明,高频交易往往存在更高风险:过度交易带来的高额手续费侵蚀净值,而低胜率本身并不可怕,关键在于风险管理;事实证明,即使复杂AI策略层出不穷,简单持有比特币(HODL)仍可能跑赢大多数模型。

看点之一是,两次实验结果呈现的巨大反差:Qwen3在最后阶段反超DeepSeek拿下短线炒币冠军,但却在网格策略里「跌落神坛」,成了倒数第一,为什么?

在本次策略实验中,Qwen3 的表现是本次测试的「最大教训」。它在测试期间曾创下最高月利润峰值+41.88%和最高单日收益65.48U,但后期遭遇 8.12% 的巨大回撤,使最终累计收益仅为 22.51U,排名倒数第一。

其策略核心为:窄区间高频套利,激进集中,仅适配中枢震荡。行情上涨阶段,它凭借窄区间完美匹配中枢震荡,高频套利,收益迅速攀升至峰值 +10.37%。

然而,对比其他模型,其 108K 的下限成为崩溃的根本原因:当 BTC 在下跌阶段急跌至约 103K 时,5K U的脱网宽度让积累的多头仓位完全裸露,5X 杠杆进一步放大浮亏,利润被瞬间吞噬,第10天回撤高达 8.12%,为所有模型中最大。这充分说明,窄区间策略虽然在震荡期可快速获利,但缺乏防御纵深,只适合窄幅震荡行情,面对价格偏离时极易遭受重创。

而在此前的“AI炒币实盘竞技场”第一赛季中,Qwen3赢得冠军的核心原因在于——策略的及时调整与市场适配。在后期市场波动加剧时,Qwen3采用简单专注的单一BTC全仓策略,结合5倍杠杆和精准止盈止损,高效捕捉反弹机会,实现净值爆炸式上涨,验证了其在动态不确定环境下的鲁棒性(在不同环境、不同市场波动下,系统仍能保持稳定表现、不轻易崩溃的能力。)和问题解决能力。相比之下,DeepSeek的保守多维度评估虽风险控制优秀(Sharpe比率最高),但增长缓慢,无法充分利用BTC主导行情,而美系模型如GPT-5的过度激进则导致全线亏损。

一句话总结: Qwen3拿下短线炒币冠军源于主动适应,网格策略失败则源于被动参数缺陷,所以,AI交易需匹配行情类型,避免“一策通吃”。

看点之二是,在 OKX 与 AiCoin 于 2025 年 7 月 25 日至 10 月 25 日的历史行情回测中,六个 AI 模型在 BTC/USDT 永续合约的网格策略中都未出现脱网风险,收益表现相对稳定。但在本次实盘测试中,却有多模型出现了脱网或收益剧烈波动的情况。这背后的差异说明了什么?

回测里看到‘零脱网’,很多时候是一种假安全感。因为模型太熟悉历史数据了,等于是被‘喂熟’的。可一到实盘,行情稍微一突破历史低点,那些没留防线的策略就直接脱网。这个也说明了,能不能活下来,靠的不是聪明的算法,而是区间够不够宽、防御够不够深。别迷信“完美回测”,真正有用的策略,是能在最糟的行情里活下来的那种。

如何跑赢市场?两次实验结果带来的启发

本次合约网格实验中使用的策略工具是OKX 合约网格(AiCoin AI 网格),所有AI均基于该工具执行策略,确保了交易执行的一致性与公平性。这是一款支持等差、等比、中性、多空等多种模式的自动化交易工具,支持自定义价格区间、网格数量、杠杆倍数等参数。 适合在震荡市中捕捉微小波动收益,通过分批建仓与平仓实现套利。

从这次实盘来看,AI的策略能力很重要,但工具的作用同样关键。Claude能稳住收益,不只是策略设计好,更大程度上得益于OKX网格工具,它能在区间里自动买卖,顺带控制风险,让AI不用担心一波回调就被打懵。Qwen3虽然策略更激进,但OKX工具通过分批建仓和自动止盈止损,帮它在高波动中保护本金,避免亏得一塌糊涂。简单说,AI负责“想怎么操作”,网格工具负责“帮你稳住、按规则执行”,两者配合,效果比单靠AI要安全得多,也更容易看到收益。

AI + 网格工具怎么用得更顺手?

•选对网格模式:行情震荡,用“中性网格”最稳;行情有明显方向,试试“多、空网格”,跟着趋势走。

•区间和格数要合理:太窄容易频繁交易,手续费吃掉收益;太宽又可能错过波段利润。

•AI给建议,但别完全依赖:AI能算参数、指方向,但最终还是要结合市场和工具特性自己判断。

•先回测,再上实盘:OKX网格工具有模拟盘功能,Aicoin有历史回测功能,先模拟看看效果,实盘操作更安心。

高风险策略永远是收益最不稳定的部分。只有用对策略,AI的潜力才能真正变成实实在在的收益。没有风控,再聪明的AI也可能一夜归零。所以,别盲目追AI,市场从不手软,AI也会交学费。它只能是工具,真正撑住你的是风险管理。下一季赛季,希望看到的是更成熟、更稳健、真正懂风控的AI策略。

免责声明

本文仅供参考。本文仅代表作者观点,不代表OKX立场。本文无意提供 (i) 投资建议或投资推荐; (ii) 购买、出售或持有数字资产的要约或招揽; (iii)财务、会计、法律或税务建议。我们不保证该等信息的准确性、完整性或有用性。持有的数字资产(包括稳定币和 NFTs)涉及高风险,可能会大幅波动。历史收益并不代表未来收益,过往表现亦不代表未来结果。您应该根据您的财务状况仔细考虑交易或持有数字资产是否适合您。有关您的具体情况,请咨询您的法律/税务/投资专业人士。请您自行负责了解和遵守当地的有关适用法律和法规。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。