As the market price plummets, the mysterious whale "7 Siblings" is frantically bottom-fishing, acquiring nearly 38,000 ETH in just two days, with over $130 million quietly injected into the market. Despite the continuous decline in Ethereum prices, the mysterious whale "7 Siblings" once again showcases its role as a "bottom-fishing pioneer."

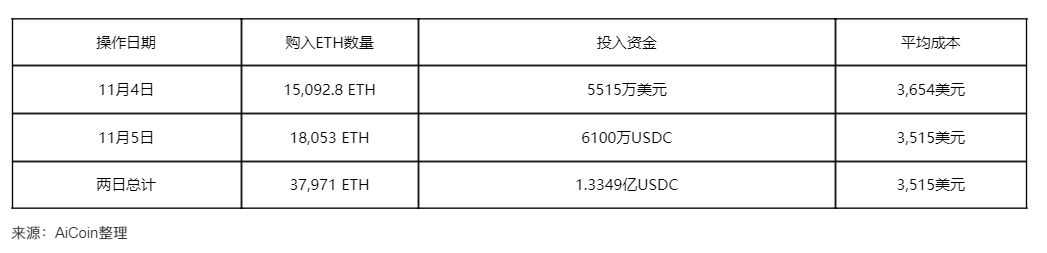

According to on-chain data, in the past two days, this well-known whale spent 133.49 million USDC to purchase 37,971 ETH, with an average price of only $3,515.

1. Counter-Trend Bottom-Fishing: Whale's Frenzied Buying in Two Days

In a time of widespread market panic, "7 Siblings" demonstrated its operational style of "being greedy when others are fearful."

● According to Ai Aunt's monitoring, on November 5, this bottom-fishing pioneer borrowed 61 million USDC to purchase 18,053 ETH. Combined with the previous day's recorded purchase of 15,092.8 ETH, "7 Siblings" has acquired a total of 37,971 ETH in two days.

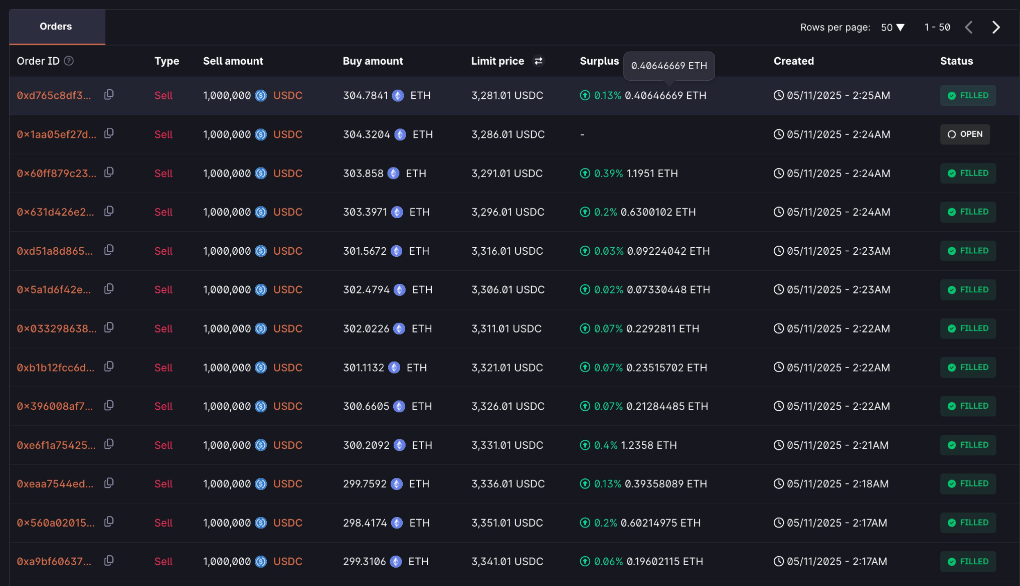

● More notably, these transactions were executed through the address 0x741aa7cfb2c7bf2a1e7d4da2e3df6a56ca4131f3, and this entity used multiple associated addresses for operations.

● Its buying strategy is not a one-size-fits-all approach but rather a phased accumulation strategy. These transactions were conducted through multiple addresses, including 0x741aa7cfb2c7bf2a1e7d4da2e3df6a56ca4131f3 and 0x28a55c4b4f9615fde3cdaddf6cc01fcf2e38a6b0.

The table below shows the detailed operation records of "7 Siblings" in the past two days:

2. Leverage Techniques: The Whale's Unique Operational Strategy

"7 Siblings" employs a distinctive operational method among whales, centered around a leveraged accumulation strategy.

● This entity does not solely use its own cash but uses its held ETH as collateral to borrow USDC and other stablecoins from lending protocols like Aave, then immediately uses these borrowed funds to purchase more ETH. For instance, in the operation on November 5, they borrowed 61 million USDC to buy 18,053 ETH. This operation is akin to leveraging, which can amplify returns but also carries risks.

● However, some analysts pointed out that the liquidation price of its borrowing position is controlled below $1,100, meaning that unless ETH prices experience a drastic drop, its position remains relatively safe.

● From the timeline perspective, "7 Siblings" has consistently adhered to its core strategy of "buying on dips" from the end of 2024 throughout 2025. Historical records show that this entity possesses keen timing abilities, with significant large purchases often occurring precisely at market phase bottom areas.

For example, during the market downturn in August 2024, it purchased 100,000 ETH at an average price of about $2,270, after which the ETH price began a long-term upward trend. Between February and April 2025, it again made multiple large purchases in the range of $1,700 to $2,480, successfully capturing the year's lows.

Even after buying at around $3,731 in October 2025, when the market declined again, it remained optimistic about the future and viewed the drop as a good opportunity to further accumulate, continuing to invest over $130 million during the market panic in early November. This series of operations clearly demonstrates its contrarian investment mindset and adeptness at accumulating chips amid market fluctuations.

3. High Selling and Low Buying: A Remarkable Historical Record

● "7 Siblings" does not merely hold; it also partially sells at high prices to lock in profits, showcasing precise timing abilities. In August 2025, when Ethereum prices exceeded $4,500, they sold 19,461 ETH at an average price of about $4,532, realizing a profit of approximately $88.2 million.

● Even after that significant reduction, "7 Siblings" still retains a large reserve of ETH, indicating their firm belief in Ethereum's long-term value.

● The entity's name may derive from the famous "Sudairi Seven" of Saudi Arabia, representing a powerful alliance composed of multiple key members or parts, collectively managing vast funds. By continuously accumulating chips at low prices and then taking profits in multiple batches near cycle peaks, its strategic layout and timing abilities are exceptional.

4. Market Impact: Signals from Collective Whale Actions

The large-scale bottom-fishing behavior of "7 Siblings" occurs against a specific market backdrop, releasing multiple signals.

● In this market adjustment, "7 Siblings" is not the only one bottom-fishing Ethereum. A suspected address linked to Bitmine also increased its holdings by 10,000 ETH, valued at approximately $32.72 million.

● Meanwhile, another whale that previously borrowed 66,000 ETH has fully repaid its loan, deposited USDC into Binance, and withdrawn 34,155 ETH (about $111.6 million), suspected of adding to its position at lower prices.

The collective actions of these whales seem to suggest that Ethereum has entered a valuation range recognized by institutions after experiencing a significant correction.

● The difference between whales and ordinary investors is highlighted at this time. While seismic market conditions cause ordinary investors to panic sell, whales like "7 Siblings" see an entry opportunity. From the market environment perspective, the current crypto market is undergoing severe turbulence. At the same time, Ethereum's price performance is particularly weak, having once fallen below the critical support level of $3,500.

5. Whales Are Not Always Victorious

Despite the impressive past operations of "7 Siblings," on-chain analysts also cautiously point out that following whale operations carries significant risks.

● A recent example is a trader once revered as a "100% win-rate insider whale," who suffered a floating loss of nearly $40 million during the recent week of market volatility, ultimately liquidating and incurring a loss of $39.37 million. This once high-performing whale opened long positions in BTC and ETH at the end of October, floating a profit of over $10 million within three days, but its positions quickly turned to losses as the market declined.

● By October 31, its long positions had a floating loss that increased to over $16 million, with floating losses of $4.31 million in ETH long positions, $3.27 million in BTC long positions, and $9.16 million in SOL long positions. Even more ironically, due to this "100% win-rate insider whale's" past impressive performance, there were many followers in the market.

● As the market continued to decline, these followers also received corresponding lessons. One follower lost about $217,000 in just four hours, while another lost about $1.061 million within 24 hours.

On-chain data shows that after "7 Siblings" implemented these purchases, the entity's total investment reached 133.49 million USDC, acquiring 37,971 ETH. The collective actions of these whales indicate that Ethereum has entered a valuation range recognized by institutions after experiencing a significant correction.

However, as evidenced by the $39.37 million loss of the "former 100% win-rate whale," there is no certainty in the market. Whales can also run aground, and after the storm, the truly successful investors are always those who can remain rational and adhere to their strategies.

Join our community to discuss and become stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。