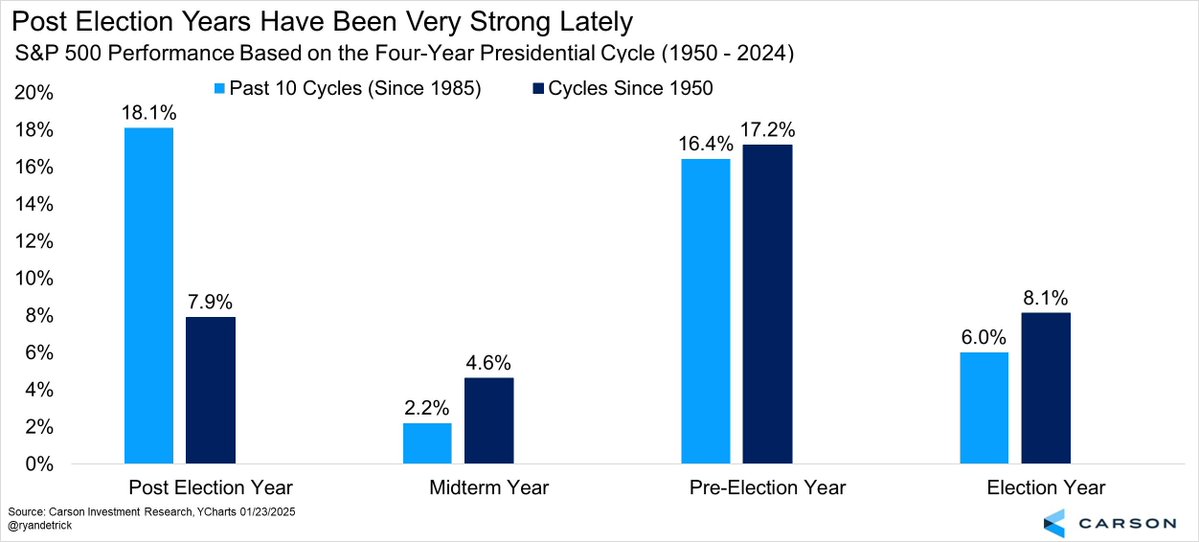

不知道还有多少小伙伴还记得我以前说过的大选和中期大选对于风险市场的影响,从1950年到2024年的统计来看,大选和中期大选仍然是利于风险市场的,虽然有小伙伴说2018年和2022年市场很差,中期选举未必是利好市场的,但站在宏观角度,2018年和2022年都是美联储的加息周期。

而如果剔除了加息的影响,比如2006年,2010年和2014年收益都是不错的,而到了2026年的中期大选,很大概率是美联储的降息周期,除非是通胀大幅走高,否则26年中期大选的环境应该还是不错的。

而至于现在的下跌,我个人认为更大的可能性还是因为政府停摆带来的流动性短缺,这个问题我会在明天的周报上有更详细的阐述,而且在停摆结束以后仍然往往是对于风险市场有利好刺激作用的,这部分的文章框架已经写完了,明天能发出来了。

本文由 @Bitget 赞助|省最多手续费,领最多豪礼,做VIP 就上Bitget

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。