港股上市公司大洋集团(01991.HK)于2025年11月3日宣布,与RWA服务平台CoinVEX签署战略投资谅解备忘录。这是香港资本市场首次出现上市公司入股RWA+AI平台,标志传统金融资本首次进入RWA与AI交叉领域。这一合作发生在香港加速建设国际数字资产中心的关键时期,释放出传统金融资本加速布局Web3实体资产与智能交易赛道的积极信号。

传统金融拥抱数字资产:大洋集团的战略转型

大洋集团此次投资CoinVEX并非突发行动,而是其长期战略布局的关键一步。作为1991年成立、2007年在港交所上市的老牌企业,大洋集团已经构建了从传统制造业向数字经济转型的完整路径。

2025年8月,大洋集团举办Web 4.0战略发布会,明确提出以AI数字人为引擎、现实世界资产代币化(RWA)为价值通道的转型蓝图。集团董事长施琦在多个场合强调,"Web4.0时代是AI与RWA深度融合的时代,数字人借助AI赋能成为有经济产出能力的动态实体"。这一战略定位为此次投资CoinVEX提供了清晰的逻辑支撑。

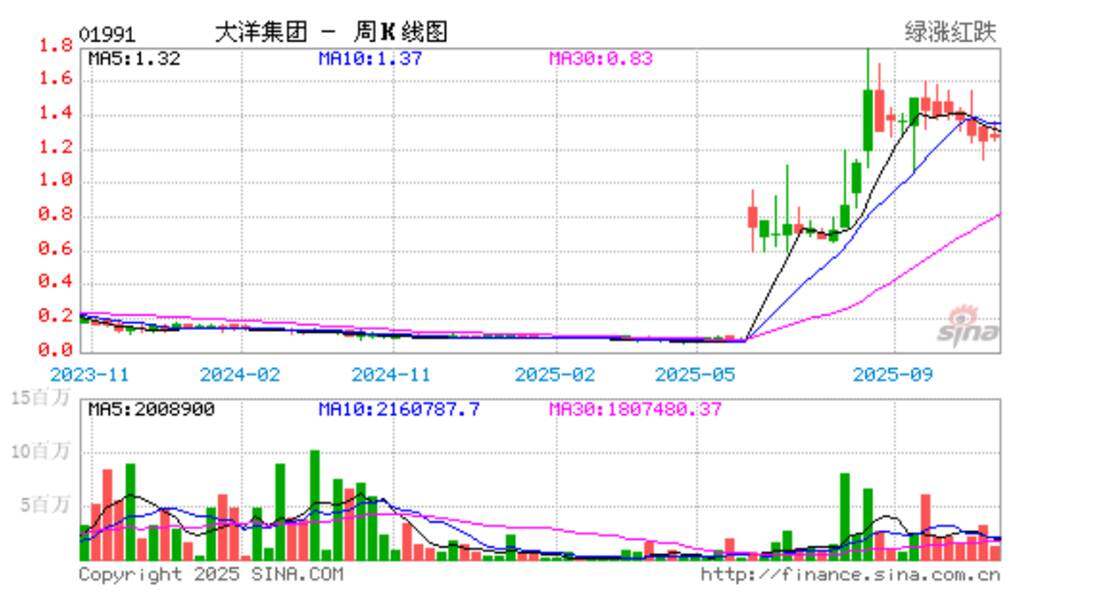

财务表现印证转型成效: 根据大洋集团2025年8月29日发布的中期业绩公告,2025年上半年,大洋集团录得净利润241万港元,成功扭亏为盈。这与2024年上半年净亏损3166万港元、全年净亏损8500万港元形成鲜明对比。集团毛利率大幅提升至21.3%,特别是数字营销分部的盈利能力显著增强,为进一步投资数字资产领域奠定了财务基础。

CoinVEX独特价值:RWA+AI双引擎模式

CoinVEX作为获得大洋集团战略投资的平台,其核心竞争力在于创新性地将RWA服务与AI量化投资相结合,形成差异化的业务模式。

RWA服务能力: CoinVEX提供专业的真实世界资产代币化服务,帮助传统资产实现链上流通。这解决了传统RWA项目普遍面临的流动性管理难题。行业分析师指出,"传统RWA项目往往忽视代币化后的价值管理,CoinVEX将AI量化交易引入RWA生态,有效解决了资产上链后的流动性痛点"。

AI量化投资优势: 平台引入AI量化模型为数字资产交易提供智能化解决方案。AI量化模型实现自动化监控与风险优化,使资产管理更高效可扩展,大幅降低运营成本并提升投资决策效率。

从行业层面看,当前RWA市场的资产构成显示出明确的趋势。剔除稳定币后,私人信贷占据主导地位达138.1亿美元,其次为美国国债达73.7亿美元。CoinVEX通过AI技术优化这些资产的定价、风险控制和流动性管理,为投资者提供了更高效的资产配置方案。

三大信号:传统金融加速布局数字资产

大洋集团投资CoinVEX释放出三个重要的行业信号,对整个数字资产市场具有深远影响。

信号一:上市资本入场RWA赛道

这是港股上市公司首次战略投资专注于RWA+AI的数字资产平台。这一突破性合作表明,传统上市企业正将RWA视为核心战略方向而非边缘业务试验,大洋集团的示范效应可能引发更多传统金融机构跟进布局。

值得注意的是,2025年8月27日,"香港数字资产上市公司联合会"在香港成立,大洋集团董事长施琦出任联合会副会长。这一组织的建立为上市公司群体参与数字资产业务提供了协作平台,预示着更多传统企业将以合规方式进入这一领域。

信号二:AI重塑资产管理逻辑

AI与区块链的深度融合正推动RWA从"资产数字化"迈向"决策智能化",实现资产状态实时监控和动态定价。CoinVEX将AI量化技术应用于RWA资产管理,代表了行业发展的前沿方向。

AI在RWA生态中的应用场景包括:自动化资产评估、实时风险监控、智能合约优化、跨链互操作性增强、合规审计自动化等。摩根士丹利预测,AI驱动的资产管理将在2030年RWA市场16万亿美元规模中占据关键地位,AI驱动的资产评估、风险管理、合规审计将成为行业标配。

信号三:香港监管形成竞争壁垒

香港财库局发布《香港数字资产发展政策宣言2.0》,将稳定币和RWA等应用场景作为政策重点。2024年香港金融管理局推出"Ensemble"沙盒计划,允许银行等机构试验代币化资产交易,为创新金融业务提供了试验田。

香港监管框架的核心优势在于"相同业务、相同风险、相同规则"的穿透式监管原则。2025年5月21日,香港立法会通过《稳定币条例草案》,要求1:1全额储备、定期第三方审计、稳健赎回机制,为RWA生态的关键基础设施提供了法律确定性。

大洋集团选择在香港布局RWA业务,充分利用了这一监管优势。香港不仅提供了清晰的合规路径,还通过税收优惠等政策激励RWA项目发展。根据行业报告,香港对绿色能源类RWA项目提供前3年税收减免50%的优惠政策。

香港生态探索:传统金融拥抱RWA的先行实践

香港传统金融与RWA融合已有先行者在探索突破。2025年9月20日,由Ju.com联合xBrokers"在香港主办的港股流动性全球数字峰会,吸引来自监管机构、上市公司、券商及Web3生态的百余位嘉宾。

xBrokers创新模式:真实股票上链交易

xBrokers的突破在于实现了"1:1实股托管+链上校验"机制。与市场上大多数代币化项目不同,xBrokers让用户能够在熟悉的加密交易界面直接买卖真实港股,所有股票由持牌券商1:1托管,交易记录留存链上。更关键的是,用户购买的港股可在12月1日后直接提取至任何支持港股的券商账户,分红等股东权益完整保留。

这种模式解决了RWA领域长期存在的痛点。过去一年,RWA项目大多停留在代币化阶段,用户本质上买到的只是收益权凭证。xBrokers将资产交易本身搬进加密世界,而非仅做资产代币化,这是真正意义上的传统金融与Web3的深度融合。

Ju.com生态布局:交易所系的前瞻视野

Ju.com作为交易所系生态平台,致力于让复杂技术隐于简单交互,把撮合、风控、合规、运营与社群能力抽象为可组合的接口,成为传统金融与Web3之间的关键桥梁。这一定位与大洋集团投资CoinVEX的战略思考不谋而合,都在寻求通过技术创新和生态整合,为传统资产进入数字世界提供合规、高效的通道。

行业观察人士认为,Ju.com和xBrokers的探索为香港RWA生态提供了可参考的实践样本。香港区块链协会共同主席方宏进曾在峰会上指出,"去中心化与多中心化机制的结合,正成为提升港股跨境流动性的关键工具"。这种观点与大洋集团董事长施琦强调的"Web4.0时代是AI与RWA深度融合"形成呼应,显示出香港市场参与者对数字资产基础设施建设的共识。

从政策信号到企业实践,从基础设施到生态协同,香港正在形成传统金融拥抱Web3的完整链条。不论是Ju.com和xBrokers前瞻的布局,还是大洋集团投资CoinVEX,都是这一浪潮中的重要一环。

RWA市场规模:万亿级赛道的投资机遇

当前RWA市场正处于从概念验证向规模化应用转型的关键节点。多项数据印证了这一赛道的巨大潜力。

市场规模快速扩张

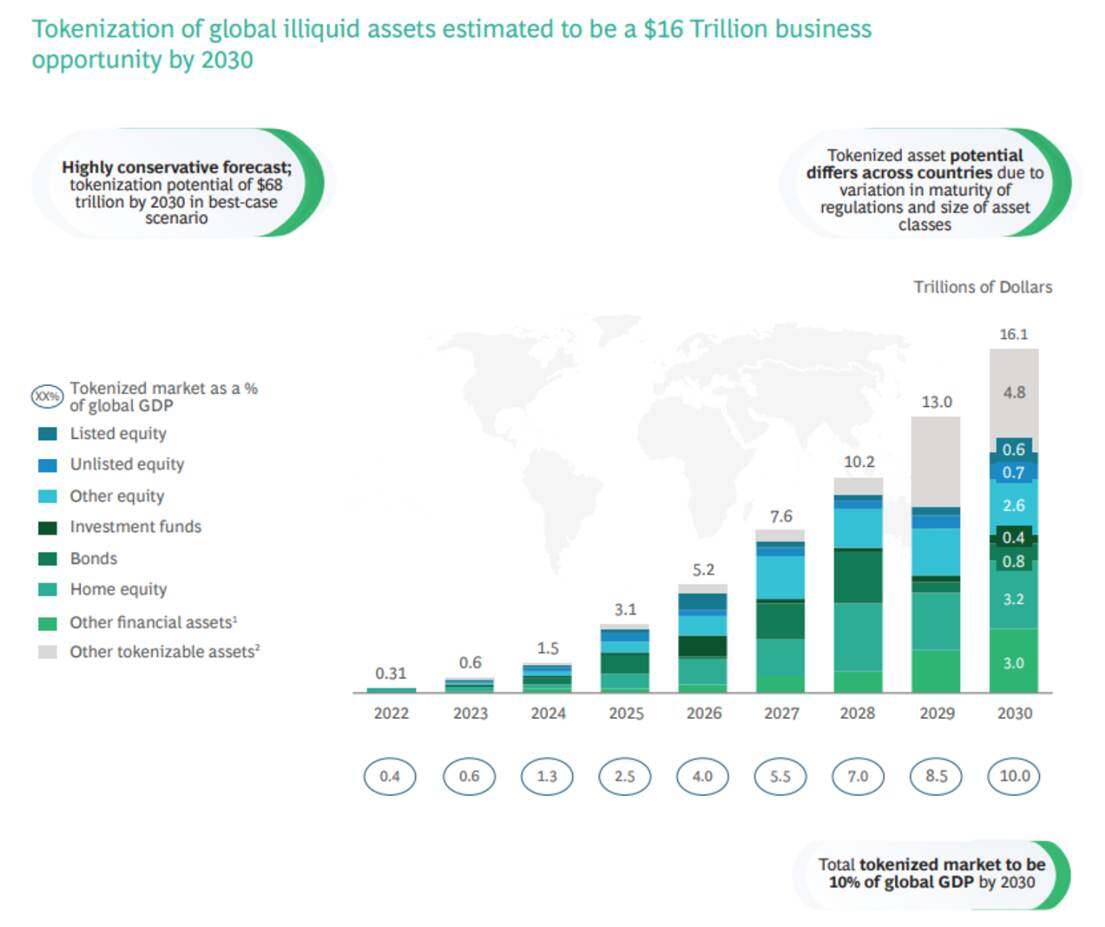

波士顿咨询集团(BCG)预测,到2030年,RWA赛道的市场规模将达到16万亿美元,远超当前整个加密市场总市值。如果实现10万亿美元的中值预测,RWA行业价值将比目前增长54倍以上。

更具想象力的是,全球房地产市场价值约300万亿美元,如果其中仅1%实现代币化,就能创造一个3万亿美元的RWA市场;全球债券市场规模超过120万亿美元,1%进入区块链将形成1.2万亿美元的新兴市场。这些数据揭示了RWA赛道真正的万亿级财富蓝海潜力。

资产类型多元化

RWA的应用范围正从传统的房地产、基础设施快速扩展至新兴领域。截至2025年6月,私人信贷占RWA市场主导地位约58%,代币化美国国债占比约34%。此外,绿色能源、碳信用、知识产权、供应链金融等新型资产也在加速代币化。

传统金融机构入场

贝莱德的数字美元债(BUIDL)以26亿美元市值占据美国国债代币化基金榜首,市场份额达37%。摩根大通、高盛等传统金融巨头的积极探索,为整个RWA行业注入更多流动性和机构信任背书。

值得关注的是,目前全球债务市场规模已超过300万亿美元,而加密市场总市值仅2-3万亿美元。如果传统金融机构推动的债券代币化能够引入DeFi生态,将极大改变市场格局。链上债券提供的7×24小时交易、无国界准入、秒级结算等优势,使其成为万亿级市场增长的关键驱动力。

投资者如何把握RWA+AI机遇

面对RWA市场的快速发展,投资者需要理性评估机遇与风险。

关注监管合规性:选择在香港等监管明确地区运营的RWA平台,确保项目符合当地法律要求。香港证监会要求机构对代币化产品进行技术风险评估,并强制披露区块链安全威胁等风险。

评估底层资产质量:并非所有资产都适合代币化。成功实现规模化落地的资产需满足价值稳定性、法律确权清晰性及链下数据可验证性三大门槛。优质的RWA项目应具备稳定现金流、明确产权和较高市场认可度。

重视技术平台能力:AI技术在RWA生态中的应用决定资产管理效率和安全性。投资者应选择具备成熟AI量化模型和自动化风控系统的平台,确保资产数字化、流动性提升和投资决策智能化。

把握政策红利窗口:香港将在2025年8月正式实施稳定币发牌制度,代币化ETF与数字资产基金若立法通过将享有与传统ETF同等的印花税和利得税豁免。这些政策红利为早期投资者提供了显著优势。

关键启示

大洋集团战略投资CoinVEX代表了传统金融与数字资产融合的重要里程碑。在RWA市场未来五年将达16万亿美元规模的预期下,上市公司资本的进入为行业注入了更多信任和流动性。CoinVEX独特的RWA+AI双引擎模式,结合香港友好的监管环境,为传统企业数字化转型提供了可行路径。

这一合作释放出的三大信号将深刻影响整个数字资产行业格局。对于投资者而言,在关注政策红利和技术创新的同时,必须理性评估项目的合规性、底层资产质量和技术平台能力,才能在这一万亿级赛道中把握真正的投资机遇。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。