Original Author: SendAI Founder Yash Agarwal

Translation|Odaily Planet Daily (@OdailyChina); Translator|Azuma (@azumaeth)_

The x402 protocol is currently a hot topic, with a16z even calling it a new market that could potentially reach $30 trillion.

As someone who has been following this protocol since its inception, I began to ponder a more pragmatic question: if it truly has such immense potential, who will be the biggest value captor?

I will not delve into the technical details of x402, but rather explore its value capture mechanism and potential adoption pathways from a more practical perspective.

The core function of x402 is quite simple: it allows any API call to become a payment. In other words, any button click could potentially be a "micro-transaction."

x402 is not something new. All its functionalities can be achieved through blockchain transactions, and all the limitations of blockchain (such as gas fees and wallet interactions) also apply to x402 transactions.

However, as a standard protocol, it is indeed very powerful — because it can be compatible with HTTPS, making the payment experience across the internet more "user-friendly."

Like other payment systems, x402 has four main participants:

- API Sellers (Supply Side);

- API Buyers (Demand Side);

- Facilitators;

- Infrastructure (Chains and Tokens);

API Sellers (Supply Side)

API sellers can generally be divided into two categories:

(1) First/Second Party Sellers (e.g., Switchboard selling its own pricing data);

(2) Third Party Sellers (e.g., selling Helius's RPC services through agents or packaged APIs);

In the first case, once market demand is sufficiently large, they will have a direct incentive to make their APIs compatible with x402 — because this will allow them to tap into a whole new market. For example, a website like The New York Times could easily modify its web deployment to be x402 compatible, requiring crawlers or AI agents to pay when accessing, which would create a new revenue stream for them; similarly, a commercial platform like Airbnb could also choose to be x402 compatible, allowing AI agents like Perplexity to make payments via USDC, while the agents themselves could automatically earn commissions in the same transaction.

In the second case, they are more likely to evolve into an "API marketplace" — packaging various APIs and providing users with convenient payment methods. Their business model would involve arbitraging the difference between costs and charges (e.g., a monthly cost of $20, charging $0.0001 per call).

In the short term, facilitators also have an incentive to develop towards an API marketplace to attract users and solve cold start problems (like @corbits_dev).

The direct market opportunity for sellers is to transform their APIs or websites into x402 compatible ones, leveraging network effects to gain additional revenue and traffic.

API Buyers (Demand Side)

API buyers are the users or consumers of APIs — typically AI agents.

As long as a user or agent has a wallet, they can pay for any API via x402. However, this is also the most challenging link to initiate in the entire supply chain. It can be said that there is currently almost no real demand (most transactions are junk test transactions).

There are two ways to stimulate demand:

- Sellers only sell data via x402 (e.g., a news website only allows crawlers to pay via x402 for access);

- There are enough APIs available for agents or applications to easily access via x402;

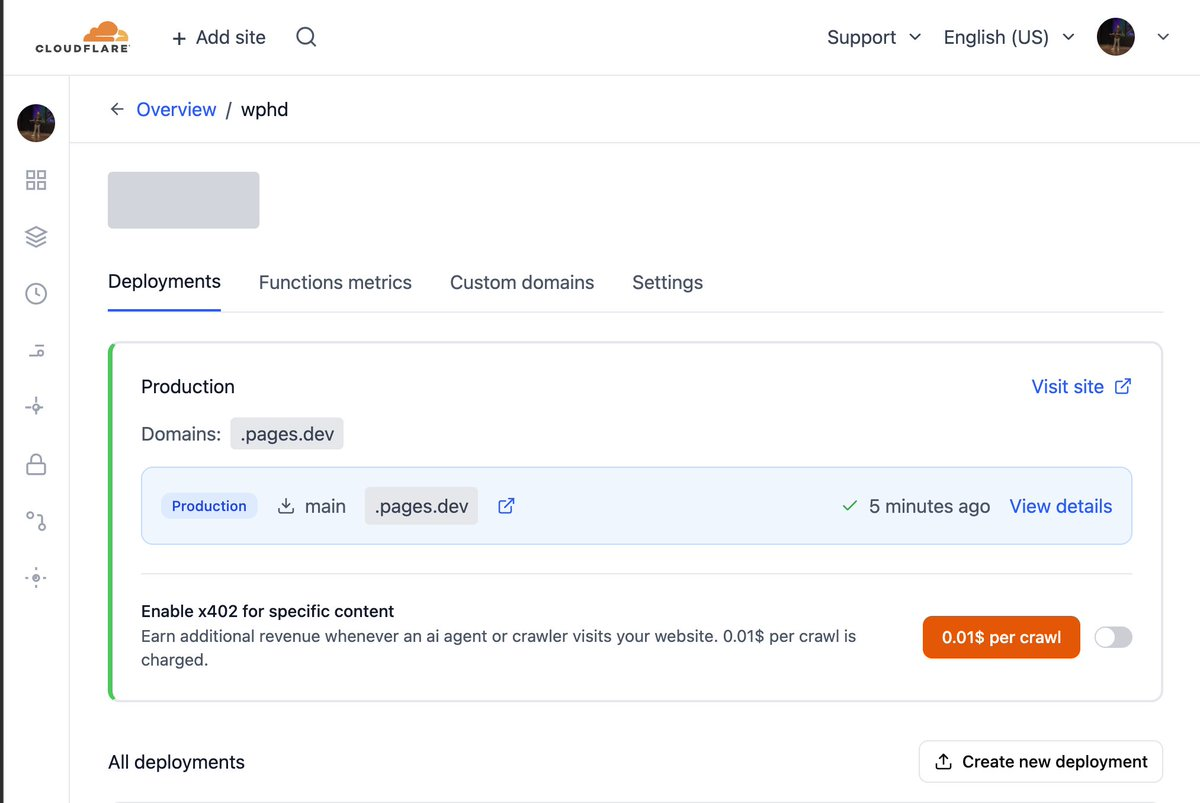

In my view, one of the biggest potential drivers is Cloudflare — it is a partner of the x402 foundation and is very interested in the "pay-per-crawl" model. Cloudflare is the largest content delivery network provider globally, deeply involved in the distribution of internet traffic (covering APIs, content, and services). They only need to provide a switch to enable x402 for specific content, allowing developers to earn additional revenue through traffic.

I speculate that Cloudflare may initially collaborate exclusively with Coinbase or Base, with the payment method being their own stablecoin, NET Dollar.

Agentic Commerce (like ChatGPT, Shopify) could also potentially become one of the largest demand drivers for x402.

It is important to note that many people believe x402 can achieve "wallet-less payments," but this is actually a misunderstanding. x402 is not magic — it still requires wallets and blockchain transactions with gas fees; it's just that these processes are abstracted away or can be settled off-chain in bulk as "API credits."

Facilitators

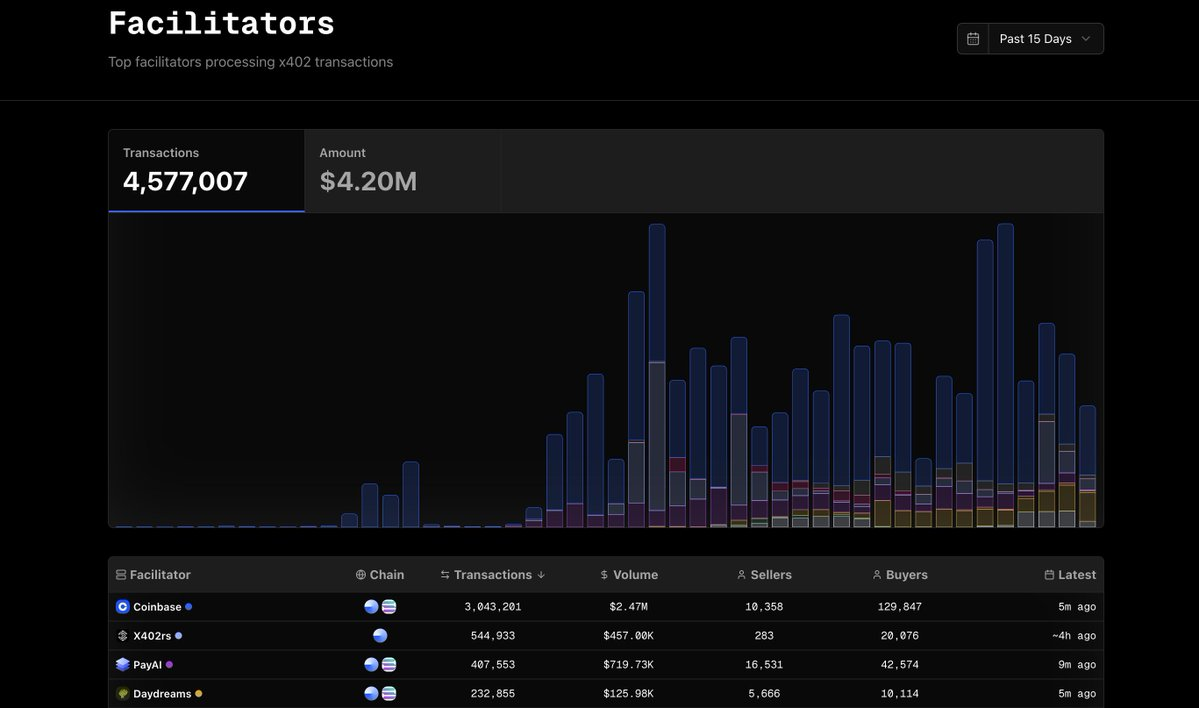

Like Visa or MasterCard, facilitators need to route payments between API buyers and sellers. They typically charge fees ranging from 0 to 25 basis points (most even charge a 0 rate) — but ultimately this will evolve into a "price war," because establishing a new facilitator has almost no barriers to entry.

Visa and MasterCard have strong network moats, but x402 facilitators have almost no moat — because the underlying blockchain itself is the true owner of the network effects. Large players like Cloudflare or Google can launch their own facilitators on any blockchain (like Solana or Base) in just a day, as they already control the interface layer.

Larger entities, such as Coinbase, are more inclined to make facilitators completely free and open-source to drive ecosystem adoption, thereby compressing all profit margins in the short term.

Infrastructure (Chains and Tokens)

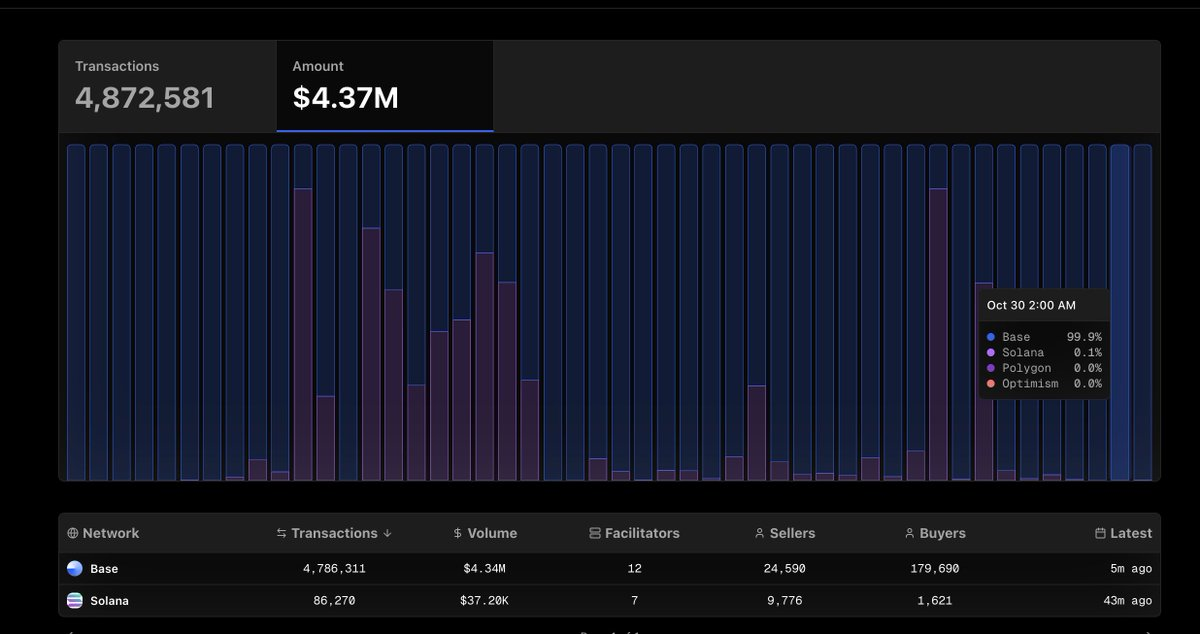

Since x402 is Coinbase's "favorite child," Base and USDC will always be the top chain and top stablecoin.

However, every chain is actively promoting the adoption of x402, including Solana, which is hosting x402 hackathons. Every stablecoin project and public chain will fiercely compete for dominance in x402, as this will directly enhance the "on-chain GDP" of that chain — including the total locked value (TVL) of stablecoins and transaction volumes, as more and more micro-payments occur on that chain.

For instance, we can observe that some stablecoin public chains (like Tempo and Arc) are trying to deeply integrate x402 into enterprise-level development tools. In my view, public chains, tokens, and wallets will ultimately capture the most value within the entire x402 tech stack.

The reason Coinbase and Brian Armstrong are vigorously promoting x402 is that Coinbase effectively controls the entire x402 tech stack:

- Facilitator: Coinbase;

- Chain: Base;

- Stablecoin: USDC;

- Wallet: Base App and Coinbase embedded wallet;

Coinbase can directly market this entire system to enterprises (like Cloudflare or Vercel) — providing end-to-end business solutions on an open-source protocol.

Almost all large enterprises (like Stripe) wish to have their own x402-like protocol or run an x402 payment system on their own chains (like Tempo).

Moreover, large-scale micro-payments on blockchains like Solana or Base are still economically unfeasible at present. For example, on Solana, due to base and priority fees, any payment below $0.1 is not economically viable — because payment transactions need to compete for block space with speculative transactions (like meme coin exchanges).

I personally like Tempo's design, which sets up a dedicated payment lane for payment transactions. It is foreseeable that as the adoption of x402 increases, there will be dedicated payment sidechains, application chains, or Rollups designed specifically for x402 micro-payments.

Interfaces and Wallets: Value Capture

There is no secret here, whoever controls the distribution channels and interfaces can capture the most value — this includes various platforms, marketplaces, AI chat applications, AI browsers, and so on.

In the internet world, browsers capture the most attention, making them the most natural, potential candidates for deep integration with x402 and dominating the wallet layer.

Imagine if Chrome had a native wallet, then every click in the browser could potentially become an x402 payment. Any API could become a payment-triggering API call simply by passing secure whitelisting. They could even charge a 0.05% fee on each transaction, and users would willingly pay for the convenience.

However, the biggest competitor facing x402 is actually Stripe. For example, the largest consumer AI application, ChatGPT, has announced a partnership with Stripe to implement e-commerce functionality. Stripe has its own Agentic Commerce Protocol, which can complete transactions over existing credit card payment networks through shared payment tokens.

x402 and Dynamic Resource Pricing

While x402 excels in static pricing (e.g., "charging $0.001 per API call"), it has yet to demonstrate the most powerful potential of blockchain — creating a market for everything.

In my view, x402's unique advantage lies in its ability to empower "resource markets," which can include:

- Data or results (such as prices or news articles)

- Computing power or reasoning capabilities;

- Specific operations (such as booking flights);

- Complex tasks (such as customizing a chair);

- Priority services (like time slots or bandwidth reservations).

Historically, the essence of a market is its ability to solve information coordination problems — prices naturally reflect supply and demand.

Imagine a future where you can tell an AI agent, "Help me customize a chair to these specifications for $500." The agent would then automatically coordinate multiple individuals and systems to find wood, hire a carpenter, and arrange delivery — completing the entire process autonomously, effectively solving the "resource coordination problem" at the machine level.

Thanks to LLMs and AI agents, we now have machines capable of reasoning and negotiating across the entire supply chain. This will lead to extreme financialization — every resource and action can be dynamically priced, and agents can seamlessly trade and pay in the background. While x402 itself does not directly handle dynamic pricing, blockchains like Solana can achieve this — by creating permissionless markets.

In the future, Airbnb's pricing may no longer need to be set by hosts themselves, but could be automatically determined by market demand — this is the future we are moving towards.

The Future Path of x402

I love standard protocols, and I love x402 and the infinite possibilities it brings, but there is no doubt that x402 is currently being severely hyped.

If you are buying so-called "x402 tokens," I can say with certainty — 99% of it is air, and I am relatively pessimistic in the short term; but in the long term, I am extremely optimistic about the future of x402: it is likely to become the foundational protocol of the Agentic Web and one of the native functionalities of future crypto networks.

x402 reminds me of Solana Blinks — at that time, every click could trigger a Solana transaction request, but unfortunately, Blinks ultimately failed to achieve mass adoption, and this time, the giant Coinbase is leading the way. If all of this succeeds, we will completely reshape the internet payment system.

To summarize, in the x402 tech stack, the party that controls the interfaces, distribution channels (as well as assets and blockchains) will capture the most value. The reason Coinbase is vigorously promoting x402 is that it has a complete closed loop from top to bottom.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。