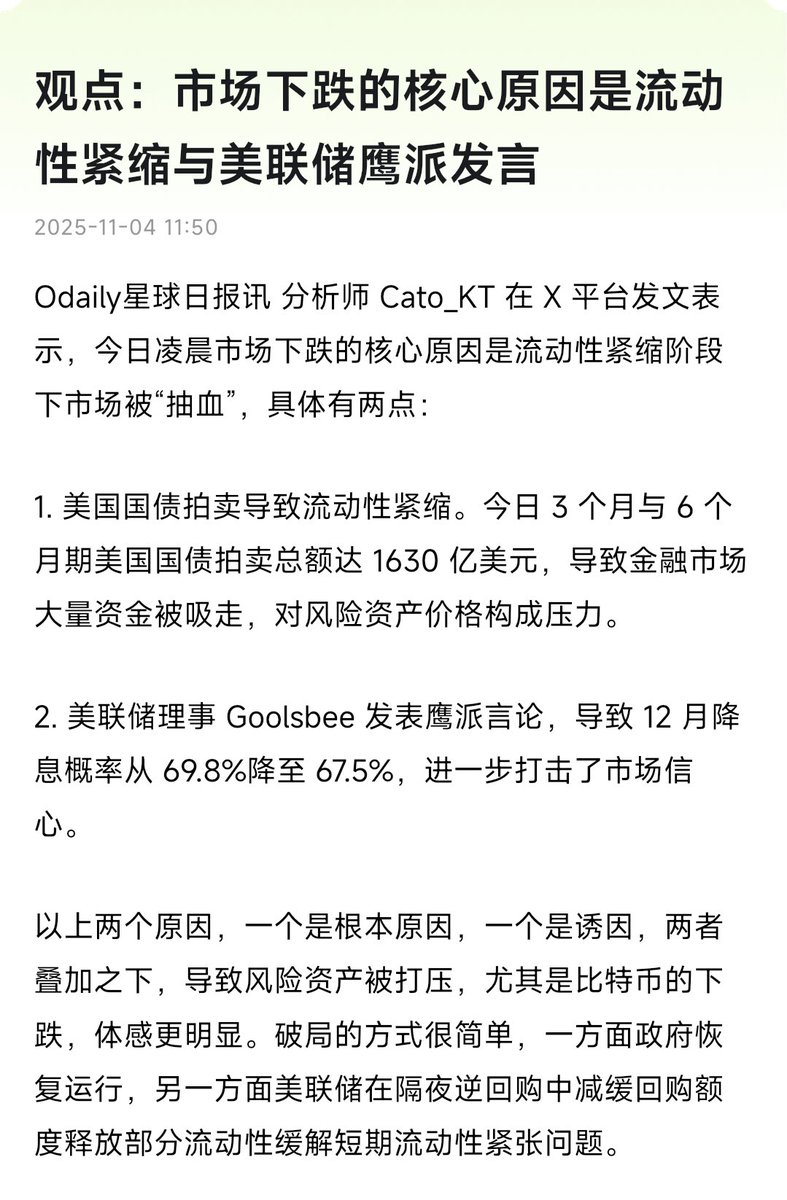

After the liquidity shortage in 1011, coupled with the draining effect of U.S. Treasury issuance and the Federal Reserve's hawkish statements further pulling market liquidity, Bitcoin and U.S. stocks are bound to decline in sync.

This reflects the Federal Reserve's continued policy inertia of maintaining high interest rates + controlling inflation.

However, from a cyclical perspective, I personally see this as a micro oscillation phase, not a trend reversal.

Once the Treasury stops issuing large amounts of debt, or the Federal Reserve initiates liquidity hedging, BTC will rebound first. However, this round of "liquidity draining" has a greater impact on altcoins because they have a high risk premium and are easily marginalized by funds, so altcoins really struggle to shine and need to first look at Bitcoin's performance.

Just like @Super4DeFi said: the overall liquidity is tight, it's a difficult mode, be cautious yet optimistic, and keep hope.

This is also what I want to say!

The following image is from: @OdailyChina

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。