TL,DR

- 2025年10月,美国进入货币宽松周期,美联储降息并暂停缩表,但经济复苏仍疲弱,高通胀、就业市场疲软、消费信心低迷以及政府和外部风险交织影响增长。通胀虽有所回落但仍高于目标,就业疲弱和财政限制削弱了宽松政策对消费和投资的短期拉动作用。总体来看,美国处于宽松周期初期,政策环境改善,但通胀、就业和外部风险的不确定性仍对经济复苏构成压力。

- 10月加密市场经历剧烈波动,“10·11”暴跌期间交易量飙升至4282亿美元创月内峰值,此后交投趋于平淡,资金面偏弱、风险偏好下降。总体市值较上月微跌0.57%,在剧烈回撤后维持震荡,市场情绪谨慎、增量资金不足。新上线代币以基础设施、DeFi与AI项目为主,中文meme短期走热但持续性有限。

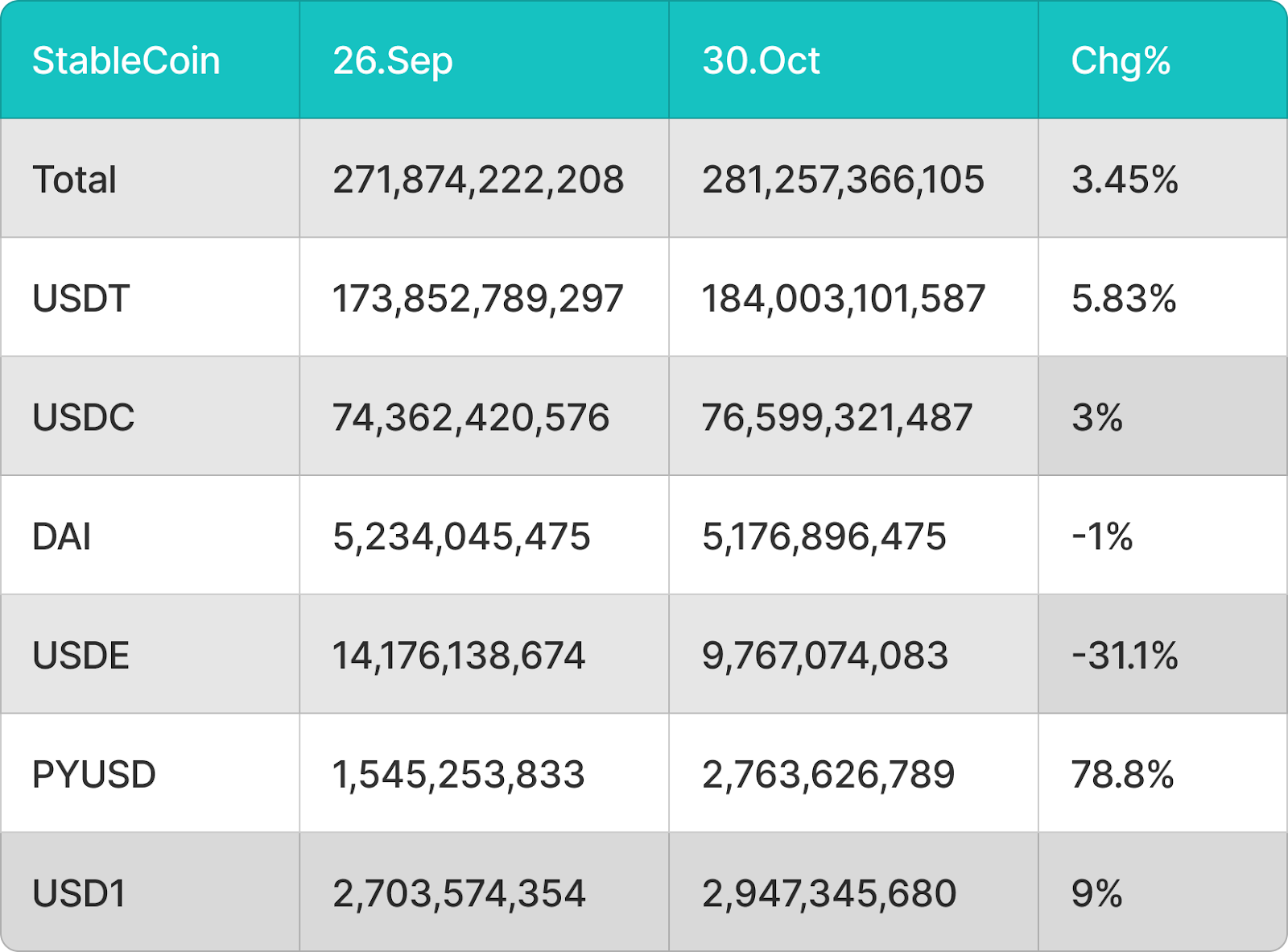

- 10月比特币与以太坊现货ETF分别净流入55.5亿美元和10.1亿美元,市场信心在黑天鹅事件后有所修复,但整体仍偏谨慎。稳定币总流通量增加93.8亿美元,USDT与USDC成为主要增量来源,而USDE因脱锚事件流通量大幅下滑31.1%。

- 比特币短期动能减弱,价格未能稳站50日SMA,目前在20日EMA附近震荡,若跌破$107,000支撑可能加速下探至$100,000,而上方$118,000是关键阻力。以太坊整体偏弱,价格回落至50日SMA下方,若跌破下降三角支撑可能进一步下探至$3,350;若重回50日SMA上方,多头有望推动反弹,但上方阻力仍强。索拉纳多空拉锯明显,未能稳站20日EMA,若突破并收稳上方有望上行至通道阻力线,跌破$190则空头占优,可能回落至$177甚至测试通道下沿。

- 10月加密市场经历史上最大清算,比特币、以太坊及山寨币因特朗普关税和USDe脱锚事件大幅下跌,全网爆仓金额创191亿美元新高,显示系统性杠杆风险暴露。中文meme币在币安及Solana、Base生态快速走红,“币安人生”等项目短期内市值暴涨并吸引大量新交易者,成为现象级热点。x402协议推出后引发市场关注,相关项目价格短期飙升,但随后回落,显示创新概念热度集中且波动剧烈。

- 下月预测市场有望继续加速扩张,Polymarket、Kalshi及Truth Predict等项目带动行业流动性和关注度上升,资本和公链生态布局同步加快。加密市场在10月11日黑天鹅事件后虽结构性受损,但贸易缓和预期和政策利好为短期风险资产回归提供支撑。后续需重点关注预测市场新项目表现、中美贸易进展、美元与流动性环境变化以及加密市场杠杆风险。

1、宏观视角

2025年10月,美国经济进入宽松周期,但复苏动能仍弱。美联储连续降息并将会暂停缩表,政策重点从压制通胀转向稳增长与保就业,反映出对经济放缓的担忧。通胀仍偏高,就业市场持续疲软、消费信心下滑、政府停摆和外部风险交织,使经济呈现出“政策已宽松、增长未起势”的状态。整体来看,美国正处于周期拐点早期,政策环境改善但宏观修复仍需时间。

政策转向

10月,美联储再次降息25个基点,将联邦基金利率下调至3.75%–4.00%区间,并宣布将会暂停缩表,以释放流动性并强化宽松效果。这标志着货币政策全面转向增长导向。当前决策逻辑强调稳增长优先,美联储认为通胀风险已相对可控,而就业恶化与财政不确定性是更紧迫挑战。市场预计年内有可能再降一次息,但政策传导仍需时间,短期内难以迅速刺激消费和企业投资。

通胀仍高于目标

9月CPI同比上涨3.0%,核心CPI同为3.0%,虽低于预期但仍高于美联储2%目标。食品、住房和服务价格涨幅依然坚挺,说明内生性通胀尚未完全消散。鲍威尔在声明中强调,通胀虽趋于温和,但政策不能过早放松警惕。若通胀回落放缓,美联储或将延缓进一步宽松。通胀阶段性可控,但目标区间仍未达成。

就业市场进一步疲弱

劳动力市场的快速降温成为本轮宽松的核心诱因。由于美国政府停摆,劳工统计局暂停发布9月非农就业数据,令市场缺乏关键参考。最新可得的8月数据显示,就业增长显著放缓,仅新增2.2万个岗位。同时,6月数据被下修至负增长。疲弱的劳动力市场正削弱消费与服务业的支撑力量,并加剧家庭收入预期的恶化。市场普遍担忧,若就业持续恶化,经济将陷入更深层次的增长衰减,迫使美联储不得不采取更为激进的宽松措施。

政治、财政与外部风险仍在

美国政府因预算未通过已停摆,部分部门停薪停运,削弱财政支出与数据透明度。地缘摩擦持续,包括中东紧张与美中科技冲突,均增加风险溢价。财政与外部不确定性削弱了货币宽松的边际效力,使市场复苏节奏更显迟滞。宽松虽提供短期支撑,但政策传导通道受阻,企业信心与长期投资回升仍有限。

展望

美国正处于宽松周期早期,政策环境改善但经济复苏尚未稳固。未来重点在于通胀能否继续回落、就业是否企稳、宽松政策是否有效传导至消费与投资。财政僵局、地缘风险及市场信心仍是主要不确定因素。

2、加密市场概览

币种数据分析

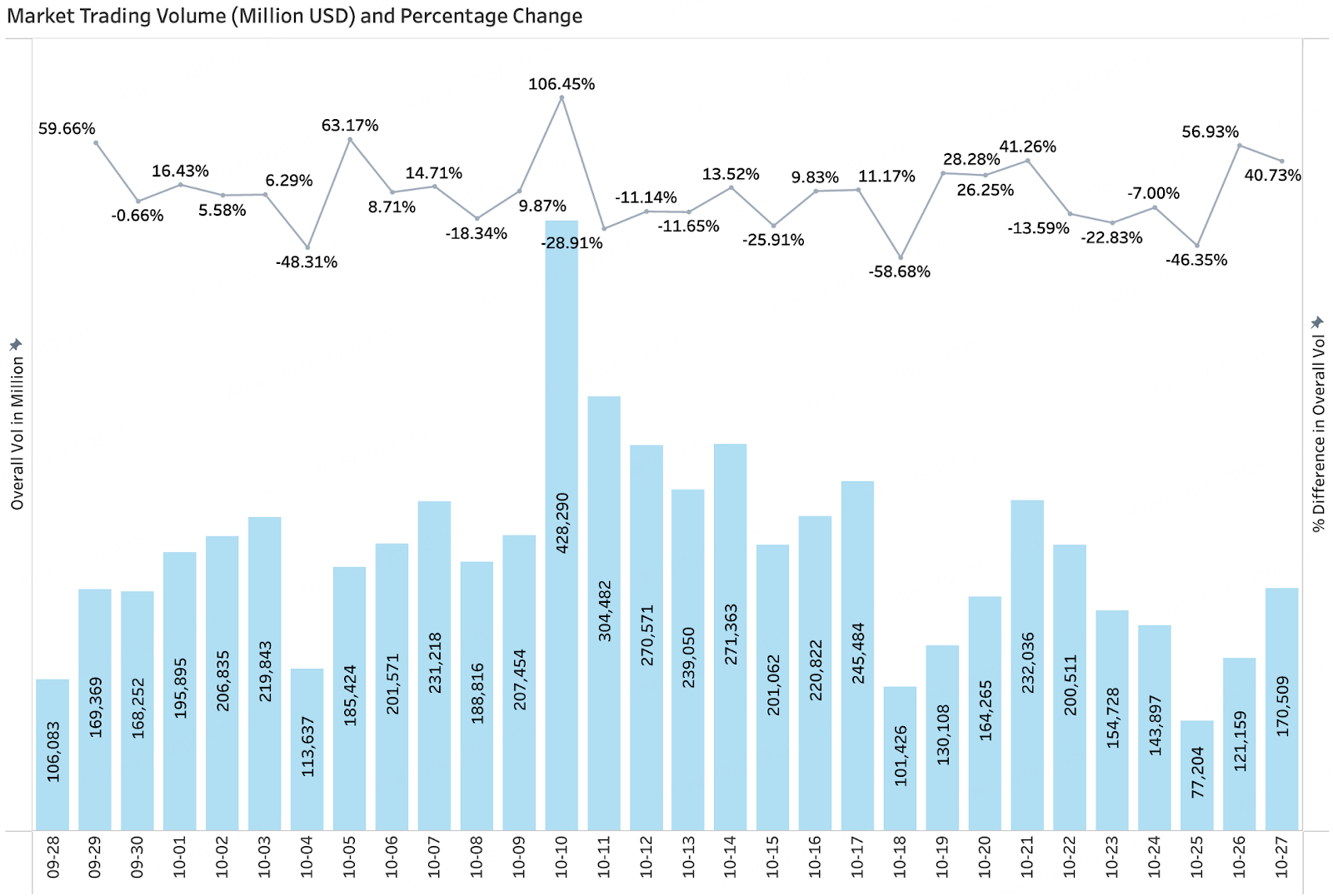

交易量&日增长率

据CoinGecko数据,截至10月27日,加密市场整体交易量波动显著,其中“10·11”暴跌期间,市场情绪急剧升温,交易量飙升至4282亿美元,环比上涨106%,创下月内峰值,资金在恐慌与博弈中短期集中释放。除该阶段外,市场整体交投趋于平淡,多数时间交易量维持在1500亿至2000亿美元区间,表明投资者风险偏好下降,情绪趋于谨慎。资金面略显疲弱,市场缺乏持续增量资金入场,短期仍需宏观及政策利好因素推动,方能恢复更强的上行动能。

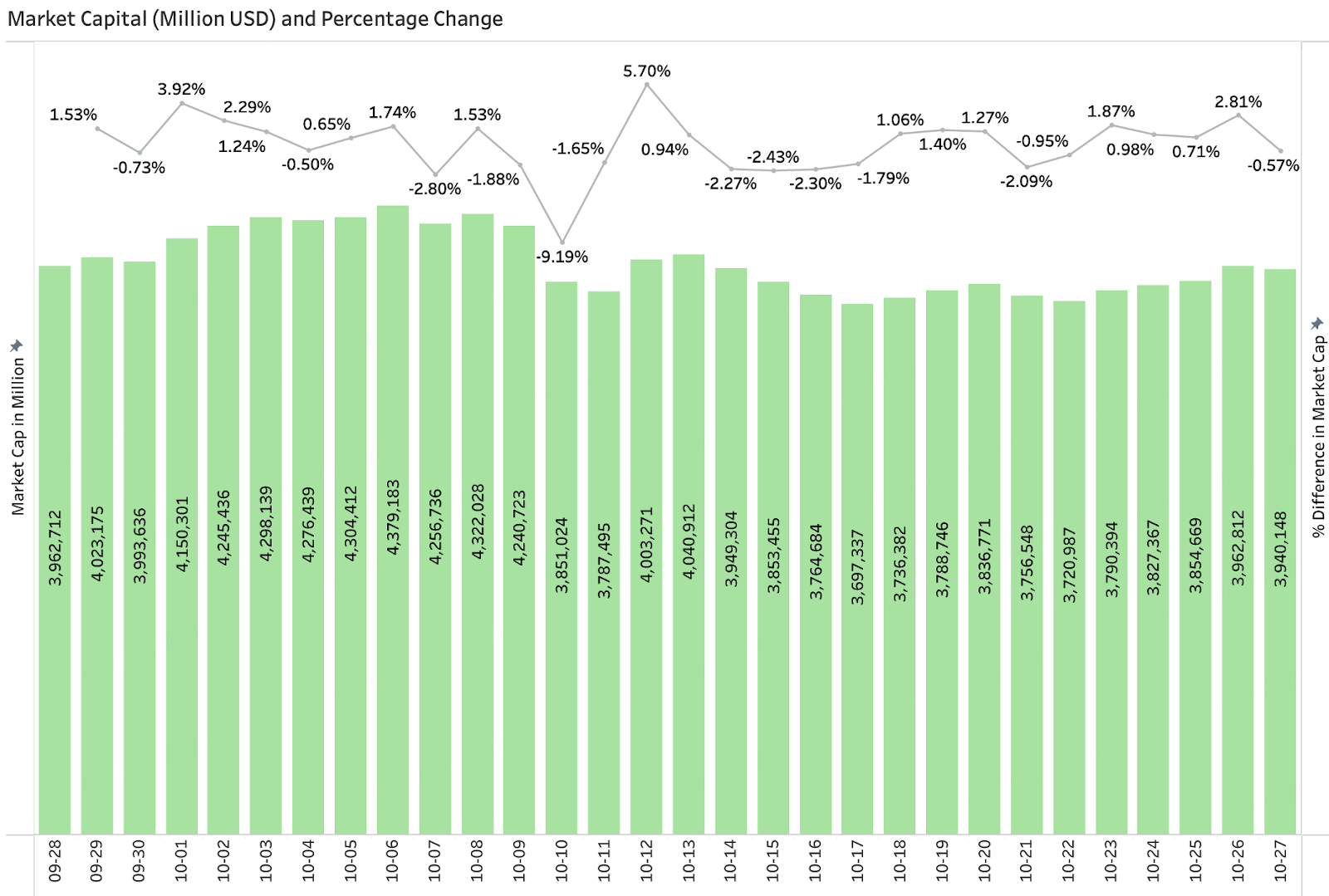

全市场市值&日增长量

据 CoinGecko 数据,截至10月27日,加密货币总市值为3.94万亿美元,较上月下滑0.57%,月初至10月9日期间加密总市值持续小幅上升,从3.96万亿美元增至4.32万亿美元,反映出资金在阶段性利好下逐步回流。但10月10日至11日市场突发下行,市值日降幅超9%,为全月最大回撤,显示在“10·11”行情中资金出现恐慌性出逃。此后市场虽短暂反弹,最高回升约5.7%,但整体反弹力度有限,市值维持在3.7万亿至3.9万亿美元区间震荡。整体来看,市场在经历剧烈调整后趋于平稳,资金观望情绪增强,增量资金入场意愿不足,仍处于震荡阶段。

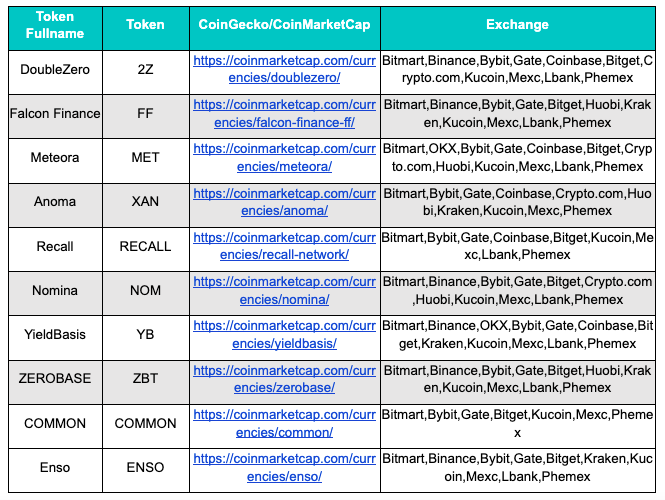

10月新上热门代币

10月新上线的热门代币主要集中于基础设施、DeFi 和 AI 赛道,整体仍以VC背景项目为主。其中Enso、 Recall、 Falcon Finance、 YieldBasis、 ZEROBASE等项目表现突出,上线后交易量较为活跃。此外,中文meme板块在“币安人生”效应及CZ喊单带动下短期升温,币安合约上线进一步推动其情绪发酵。

3、链上数据分析

BTC、ETH ETF流入流出情况分析

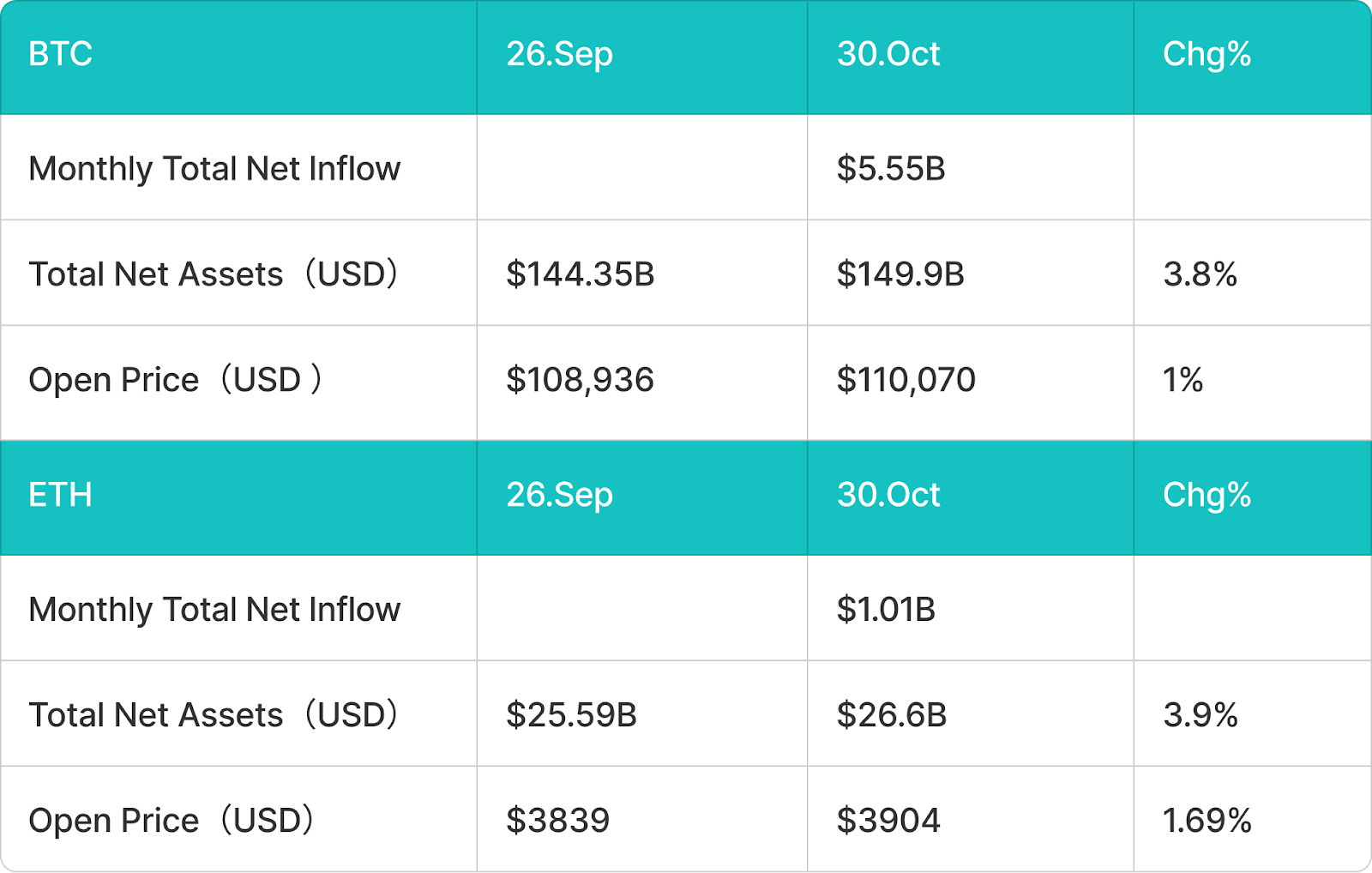

10月BTC现货ETF净流入55.5亿美元

10月比特币现货ETF延续资金流入趋势,月度净流入规模达到55.5亿美元,总资产增至1499亿美元,环比增长3.8%。比特币价格自9月底的108,936美元小幅上涨至110,070美元,涨幅1%。加密市场经历10月11日黑天鹅后目前市场信心有所改善,但整体变化不大依然处于低迷环境。

10月ETH现货ETF净流入10.1亿美元

以太坊现货ETF在10月录得约10.1亿美元的净流入,总资产规模增长至266亿美元,环比提升3.9%。ETH价格从3839美元上涨至3904美元,涨幅1.69%。

稳定币流入流出情况分析

10月稳定币总流通量激增93.8亿美元

虽然10月稳定币整体市场依然处于流入状态并保持增长,但是受到10月11日黑天鹅的影响市场信心严重受挫。其中尤其是USDE,因为在黑天鹅中价格脱锚导致市场怀疑其算法稳定币机制因此导致流通量减少近31.1%。其他方面,稳定币总流通量增加93.8亿美元,达到2812.5亿美元。USDT单月增加101.5亿美元,继续稳居首位。USDC(+22.3亿美元)亦成为主要增量来源。

4、主流货币的价格分析

BTC价格变化分析

比特币未能稳站在50日简单移动平均线(SMA,$114,278)之上,引发了新的抛压,使价格跌回至20日指数移动平均线(EMA,$112,347)下方。这表明短线动能开始减弱,市场情绪趋于谨慎。如果BTC收盘价持续低于20日EMA,空头可能进一步发力,将BTC/USDT价格压向关键支撑位$107,000。多头预计会在此位置全力防守,因为一旦该支撑失守,将确认“双顶”形态,或引发价格加速下探至心理关口$100,000。

上行方面,$118,000仍是多头需要攻克的重要阻力。若价格能突破并稳定在该水平之上,将释放出强烈的上行动能,推动BTC向历史高点$126,199发起冲击。在此之前,市场可能会在均线附近维持震荡格局,并伴随短期波动加剧。

ETH价格变化分析

以太坊在触及50日SMA($4,220)后再度回落,显示空头仍在高位积极出手,整体趋势依然偏弱。当前价格正在逼近下降三角形的支撑线,这是决定短期方向的关键位置。一旦该支撑被有效跌破,ETH/USDT可能进一步下探至$3,350甚至更低。

若多头能够重新夺回50日SMA上方,则意味着短线动能正在恢复。届时,价格有望反弹至下降三角形的上边界,而该区域的卖压预计将非常强劲。只有当以太坊能够成功突破该阻力线,并稳固站上上方时,才可能开启新一轮上升趋势,并确认中期反转信号。

SOL价格变化分析

索拉纳一度突破20日EMA($196),但未能稳住涨势,显示高位买盘动力不足。当前20日EMA趋于走平,RSI指标也在中性区域附近波动,表明多空双方处于拉锯状态。如果买方能推动价格并稳稳收在20日EMA之上,SOL/USDT有望进一步上行至通道阻力线,若成功突破该区域,将显著增强市场的看涨预期。

反之,若价格跌破$190,将意味着空头重新占据主导地位。该情况下,SOL可能回落至$177,并进一步测试上升通道的下沿支撑。若能在此获得支撑并企稳,可能意味着资金开始在低位积累;但若支撑失守,调整幅度可能扩大。

5、本月热点事件

加密市场迎来史上最大清算,特朗普关税与USDe脱锚引发连锁暴跌

10月10日晚,美国总统特朗普突袭宣布自11月1日起对中国进口商品征收100%关税,同时取消原定在亚太经济合作峰会(APEC)期间的中美会晤,引发全球金融市场剧烈波动。美股盘中先涨后跌,道琼斯工业指数一度上升283点后暴跌887点,纳斯达克指数重挫逾3.5%。风险资产连锁反应,加密市场在数小时内经历猛烈下跌,比特币一度跌至10.2万美元,以太坊最低触及3,392美元,全网爆仓金额高达191亿美元,创历史新高。根据Coinglass数据,全球被爆仓人数超过162万人,其中多单爆仓167亿美元,空单爆仓近25亿美元。山寨币受冲击最为严重,跌幅多超过80%,部分小型代币甚至接近归零,稳定币USDe在币安平台一度脱锚至0.6美元,随后回升至0.99美元以上。

本轮市场暴跌不仅由宏观政策冲击引发,更揭示了做市商资金短缺的系统性风险。做市商在Jump倒台后承担了大量原本由Jump服务的项目,但资金有限,优先保障Tier0和Tier1大型项目,导致小型山寨币在市场抛售潮中几乎失去支撑。USDe的高息循环借贷活动在极端抛压下被集中清算,杠杆倍增,触发连锁爆仓,进一步加剧了市场恐慌。

中文meme

2025年10月初,币安联合创始人何一在社交媒体上的一句“祝你享币安人生”,意外点燃了中文加密社区的创作热情,催生出名为“币安人生”的meme币。这一概念在社群传播与KOL助推下迅速发酵,短短数日内市值飙升至5亿美元,涨幅高达6000倍,形成现象级热点。根据DeFiLlama统计,BNB链DEX日交易量飙升至60.5亿美元,吸引了超过10万名新交易者入场。

值得注意的是,Solana、Base这两条meme主要集中地的公链近期也出现了热度较高的中文meme。Solana官方发推表示自己的中文名字叫做索拉拉,从而衍生出相关中文meme索拉拉。Base上的Base人生市值也突破了千万,并且Base上也出现了一些小市值的中文meme。目前看来,从币安人生到修仙、客服小何等项目的接连爆火,中文meme已经在加密市场占据了一定的地位。随着BSC生态的持续扩张与更多创作者的参与,预计还会有更多以中文话题、人物形象或互联网热梗为灵感的新Meme项目涌现。

x402协议

x402由Coinbase与Cloudflare联合推出AI支付协议,其灵感源自长期未被启用的HTTP状态码“402 Payment Required”。协议的核心创新在于将支付逻辑嵌入网页交互流程,使支付成为互联网通信的一部分,形成支付即网页交互(Payment as Interaction)的新模式。通过x402,AI Agent、API服务及Web应用可在标准HTTP请求中直接完成即时稳定币支付,由于天然支持稳定币、小额高频和低延迟,x402 适合AI Agent按调用为数据、工具、算力即买即用,也让Web2服务以很小的改动接入链上结算,不必再绕注册、邮箱或复杂签名的多重门槛。

尽管x402概念在推出后的短短两天内便成为市场热议焦点,带动多个相关项目价格大幅上涨,其中典型的项目如PING的价格在两天内上涨近20倍,市值一度达到8000万美元,Payai市值最高上涨至7000万美元。但其热度在一周后迅速回落。多个热门项目从高点出现近80%的深度回调。然而这一概念并未就此消退。随着Kite、Pieverse等新代币的陆续推出,市场对x402生态的关注有望再次被点燃。

6、下月展望

预测市场进入加速扩张阶段

2024–2025年,预测市场赛道迎来了爆发式增长阶段。以Polymarket与Kalshi为代表的“双龙头”项目持续领跑行业,其日均交易量多次突破1亿美元,累计交易量已达数百亿美元规模。在资本层面,Polymarket与Kalshi分别以约90亿美元与50亿美元估值完成新一轮融资,标志着预测市场正从边缘创新走向主流金融基础设施的关键拐点。

10月,特朗普旗下媒体TMTG宣布通过Truth Social平台正式进军预测市场,推出Truth Predict服务。这不仅将进一步扩大预测市场在美国政治与公众舆论领域的影响力,也可能成为传统社交媒体与加密预测市场融合的里程碑事件。与此同时,资本与公链生态布局也在同步加速。YZI Labs本月连续投资了两个预测市场项目——Opinion与Apro;Coinbase参投的预测市场协议Limitless于本月正式发行代币,目前市值约3.5亿美元。主流机构与头部生态的积极入场,意味着预测市场正从早期的“加密小众实验”转向以流动性、合规性与可组合性为核心的下一代金融市场基础设施。后续需要重点关注Limitless、Opinion(暂未发币)、Apro等项目代币的市场表现,在当前市场缺乏热门叙事的情况下可能会带来新的讨论热点。

10月11日黑天鹅后的市场行情恢复

自10月11日市场“黑天鹅”事件后,加密市场已显著呈现结构性受损,短期内仍可能维持高波动与高风险状态。10月30日,特朗普与习近平会晤,缓和了中美之间的紧张局势;次日,美国参议院以51票赞成、47票反对通过决议,意在终止特朗普在全球范围内实施的全面关税政策。这一政策层面的变化,对市场来说是一个积极信号,有望释放贸易缓和预期、改善风险偏好。但与此同时,结构性损伤并未立即修复:关税制度虽被议会“否决”,但实际执行层面与中美全面贸易协定尚不确定,政策落地仍具不确定性;此外美国政府因预算未通过已停摆,部分部门停薪停运,削弱财政支出与数据透明度。而加密市场高度依赖宏观流动性、美元强弱、地缘政治与监管预期,多重变量仍在发酵。

后续来看,若贸易关系真正转暖并带动实体经济恢复,则可能为加密资产提供“风险资产回归”的触发点;若政策兑现滞后或新的摩擦再起,则仍可能引发资金回撤与市场再度波动。在此背景下应重点关注:一是中美贸易谈判进展及具体关税解除/恢复时间表;二是美元走势、流动性环境变化、尤其是美国货币政策与外汇政策的传导效应;三是加密市场中杠杆使用情况与清算风险,因为结构性受损的环境下,杠杆被动平仓容易引发连锁反应。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。