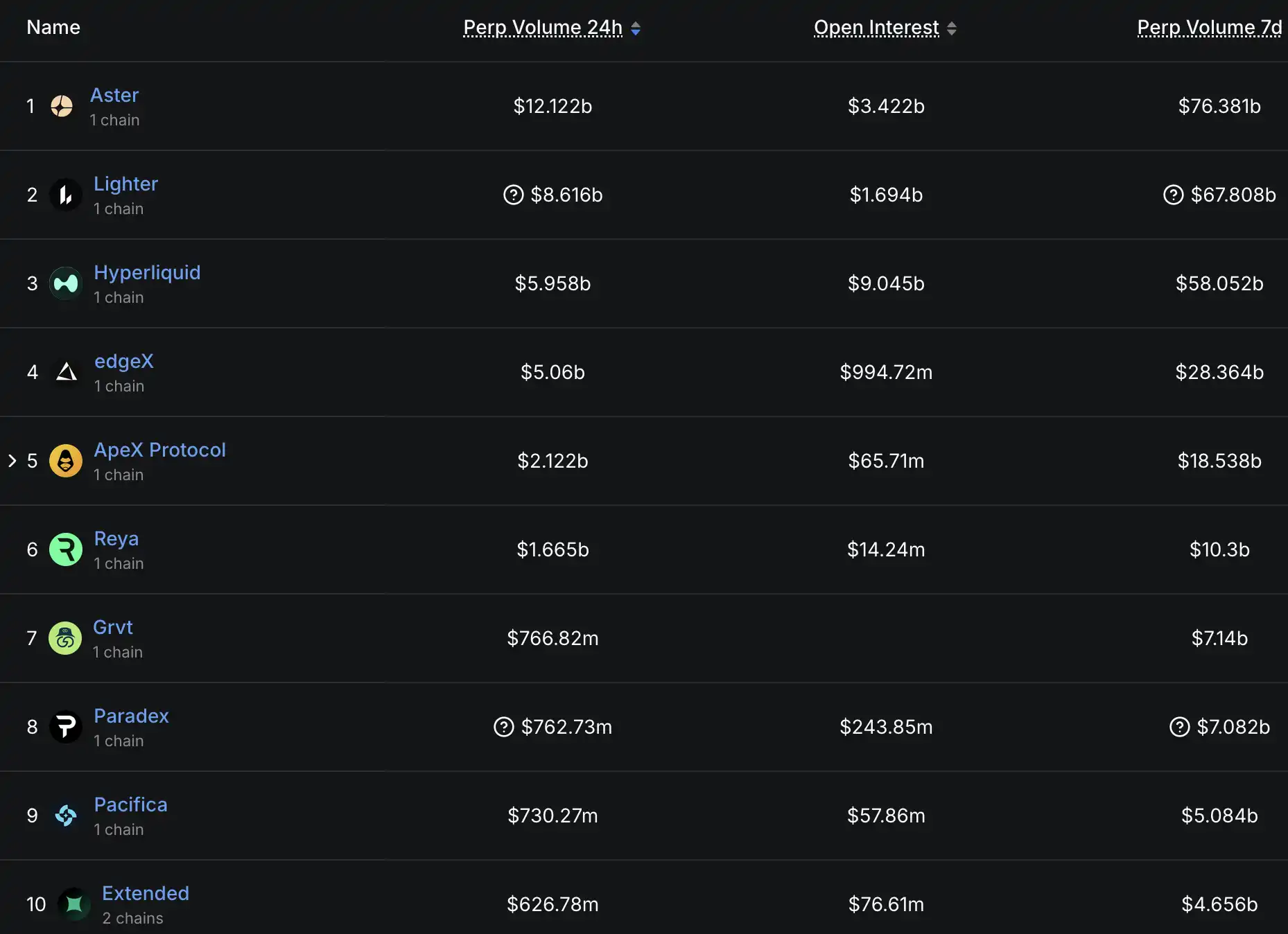

According to the latest on-chain data, the market landscape of decentralized perpetual contract exchanges (Perp DEX) has become relatively clear. In terms of 24-hour trading volume, Aster leads with $12.12 billion, followed by Lighter with $8.616 billion, Hyperliquid in third place with $5.958 billion, and edgeX and ApeX Protocol in fourth and fifth places with $5.06 billion and $2.122 billion, respectively.

The total trading volume of these five platforms exceeds $33.8 billion, dominating the entire Perp DEX sector.

For investors and traders looking to gain deeper insights into the Perp DEX sector, keeping an eye on the dynamics of these five major platforms can essentially grasp the direction of the entire sector. Therefore, this article by BlockBeats provides a detailed overview of the recent important developments, product updates, and community activities of these five platforms, helping readers comprehensively understand the latest trends in the decentralized derivatives trading market.

Lighter

- Suspected insider reveals Lighter's funding amount is $1.5B.

Recently, an insider who accurately predicted Coinbase's acquisition of Echo and Kalshi's $12 billion valuation hinted in a similar cryptic manner that Lighter's funding amount has reached $1.5 billion. This news has sparked widespread attention in the community, and although the official confirmation is still pending, the insider's previous accurate predictions have added to the credibility of this rumor.

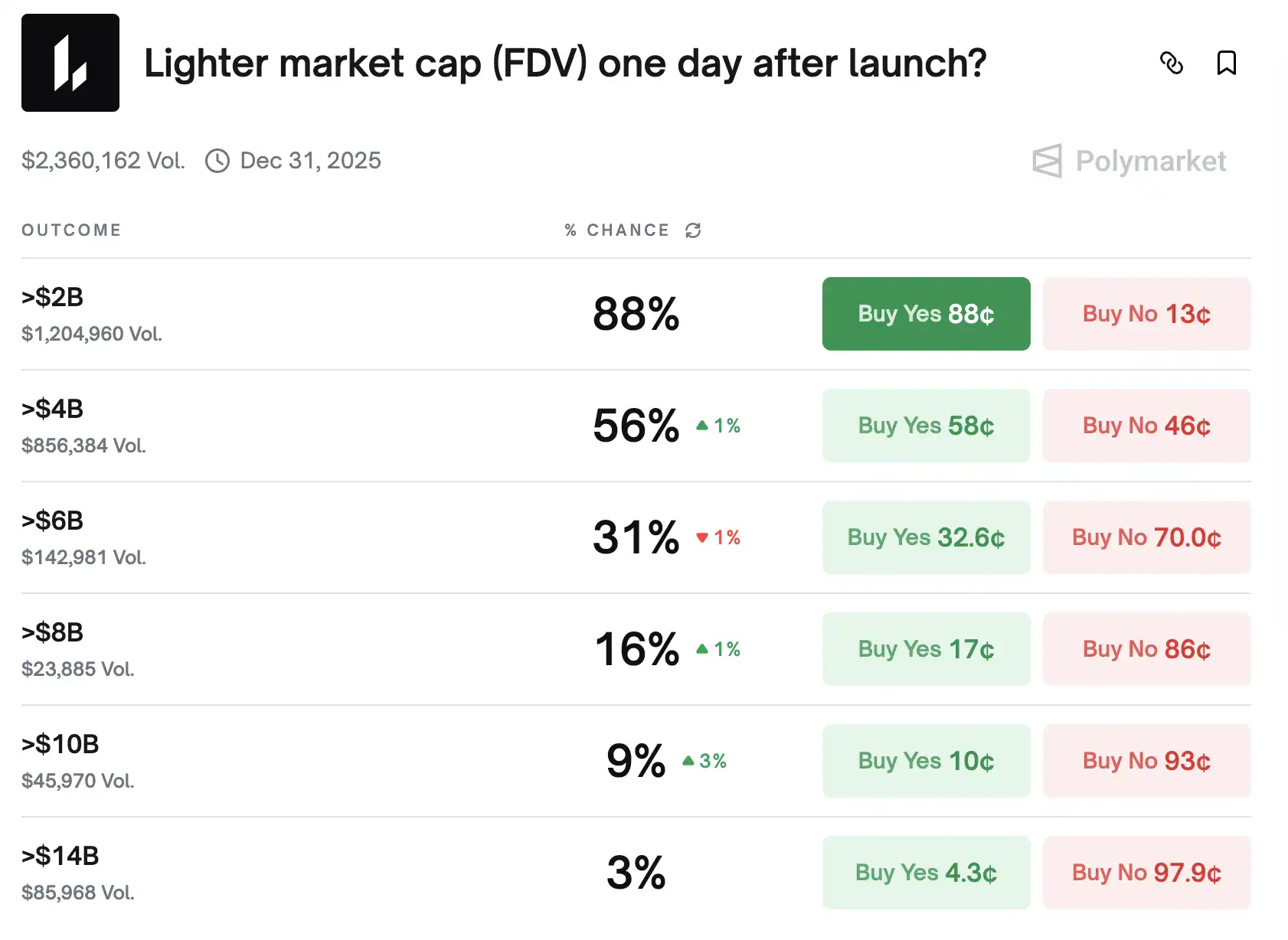

From market performance, predictions on Polymarket show that investors are highly optimistic about Lighter: there is an 88% probability that its FDV on the first day of launch will exceed $2 billion, and a 55% probability that it will exceed $4 billion. Meanwhile, prices in the over-the-counter (OTC) market remain stable at around $80.

- Lighter CEO hints at airdrop timing during major holidays

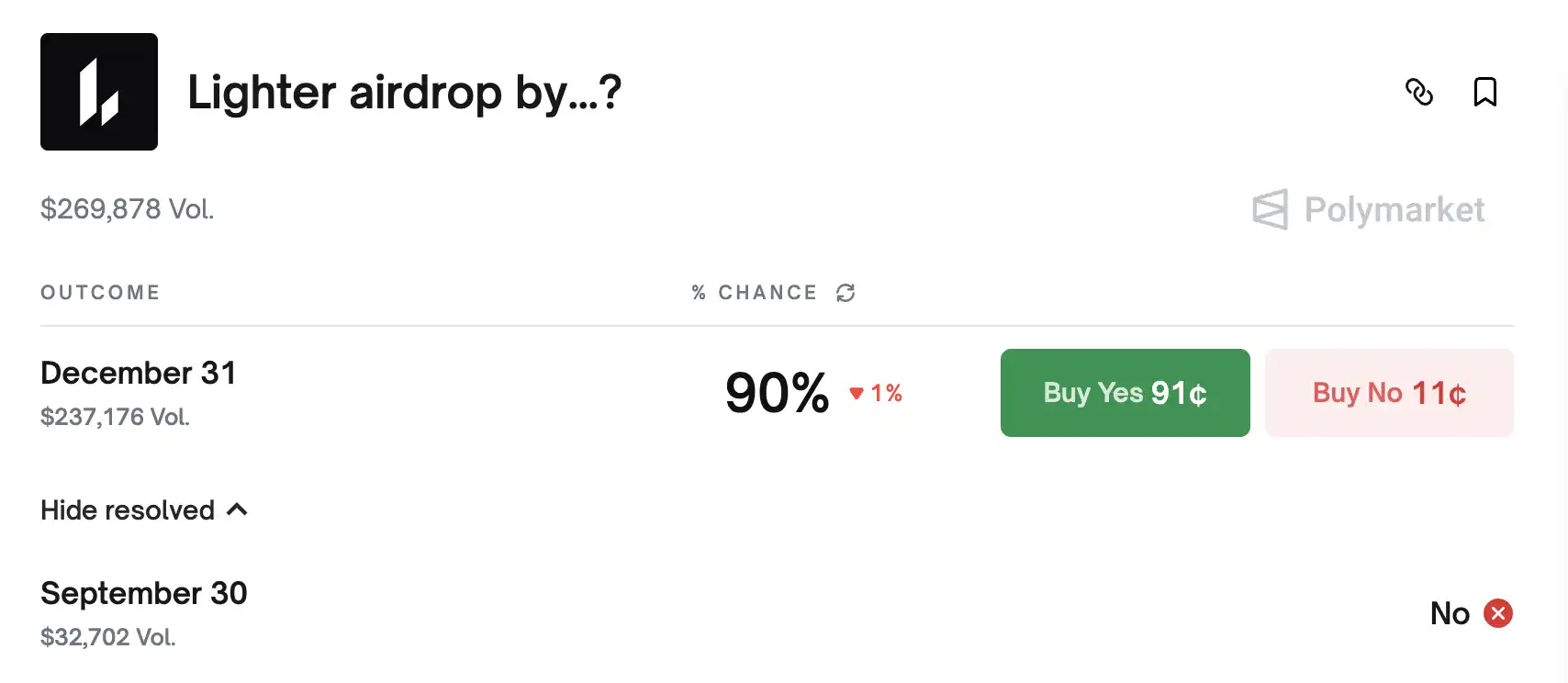

The latest hints from Lighter's CEO on Twitter have given the community a clearer expectation regarding the airdrop timing. He stated that the second season points program will end before the end of the year, but not on December 31, and tweeted that "the holidays will be lit this year."

Based on this information, the community generally speculates that the airdrop is most likely to occur during the most significant Western holiday—Christmas.

Data from Polymarket further supports this expectation, showing a 90% probability that Lighter will complete the airdrop before December 31. This means participants may receive the long-awaited token rewards before the end of the year.

- Adjustments to Lighter's second season rules

This month, Lighter announced adjustments to the point distribution rules for the second season compared to the first season. Every Friday, 200,000 points will be distributed, covering trading activities from Wednesday to the following Tuesday. The distribution mechanism is more diversified, taking into account multiple dimensions such as trading volume, position size, treasury limits, liquidation and leverage multiples, profit and loss, and trading categories.

It is worth noting that points and trading metrics do not have a simple linear relationship. For example, double the trading volume may yield three times or 1.5 times the points. This non-linear design aims to encourage more diverse trading behaviors. The platform employs a combination of fully automated and semi-automated witch detection systems, allowing each user to have up to 10 accounts without penalty; exceeding this number will result in penalties.

For specific details, see the official document.

- Token economics and product roadmap

Two weeks ago, Lighter's founder held a Russian AMA and revealed some key information:

Lighter plans to allocate 25-30% of its tokens for the first and second season airdrops, with a total community allocation ratio reaching 50%. The remaining portion will be used for future airdrops, partner programs, and funding projects.

In terms of products, the spot trading feature is expected to launch at the end of October or early November, with core assets like ETH and BTC being the first to go live, followed by selected meme coins and partner projects.

The roadmap for the next 6-12 months includes: achieving cross-margin functionality by the end of the year, allowing the use of spot assets as collateral for perpetual contracts; launching EVM "sidecar" smart contract extensions in early next year; RWA derivatives (precious metals and crypto-related stocks) planned to go live by the end of the year; options and dark pool features scheduled for next year and the end of next year, respectively.

- Arbitrage opportunities

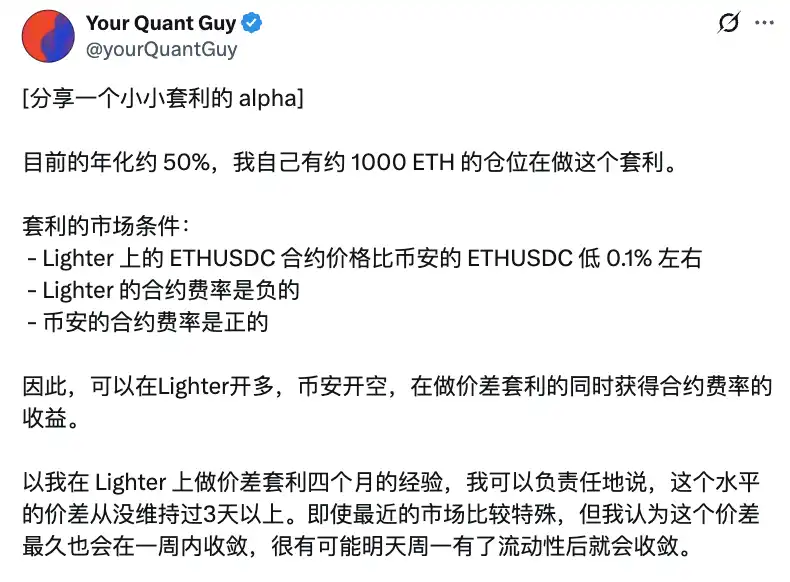

Community user Your Quant Guy shared an arbitrage Alpha strategy regarding Lighter, with an annualized return of approximately 51.5%.

- Data performance

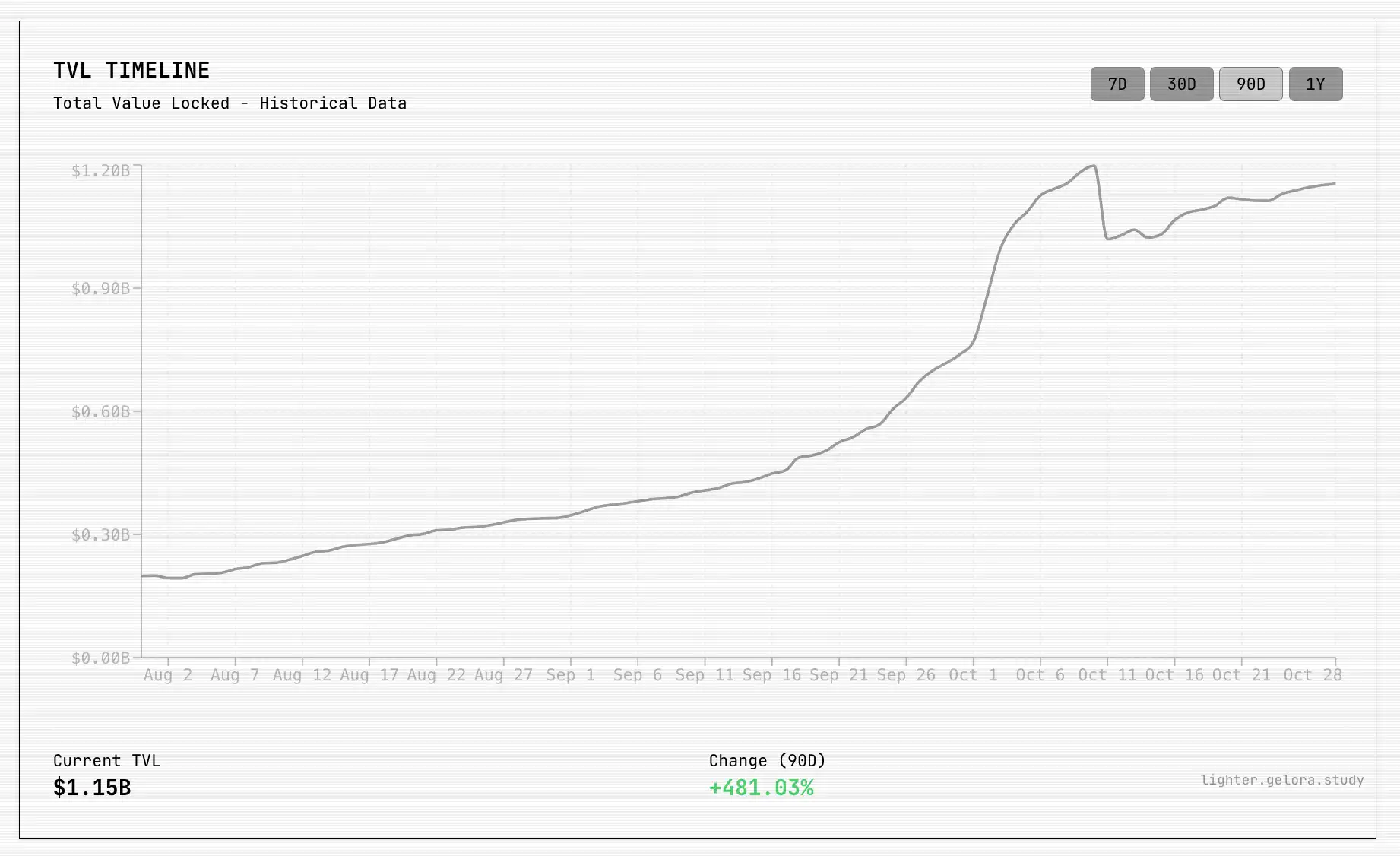

According to community-created dashboard websites and ighterlytics data, Lighter's data growth shows that its current TVL is $1.15B, with a growth rate of 481% over the past three months.

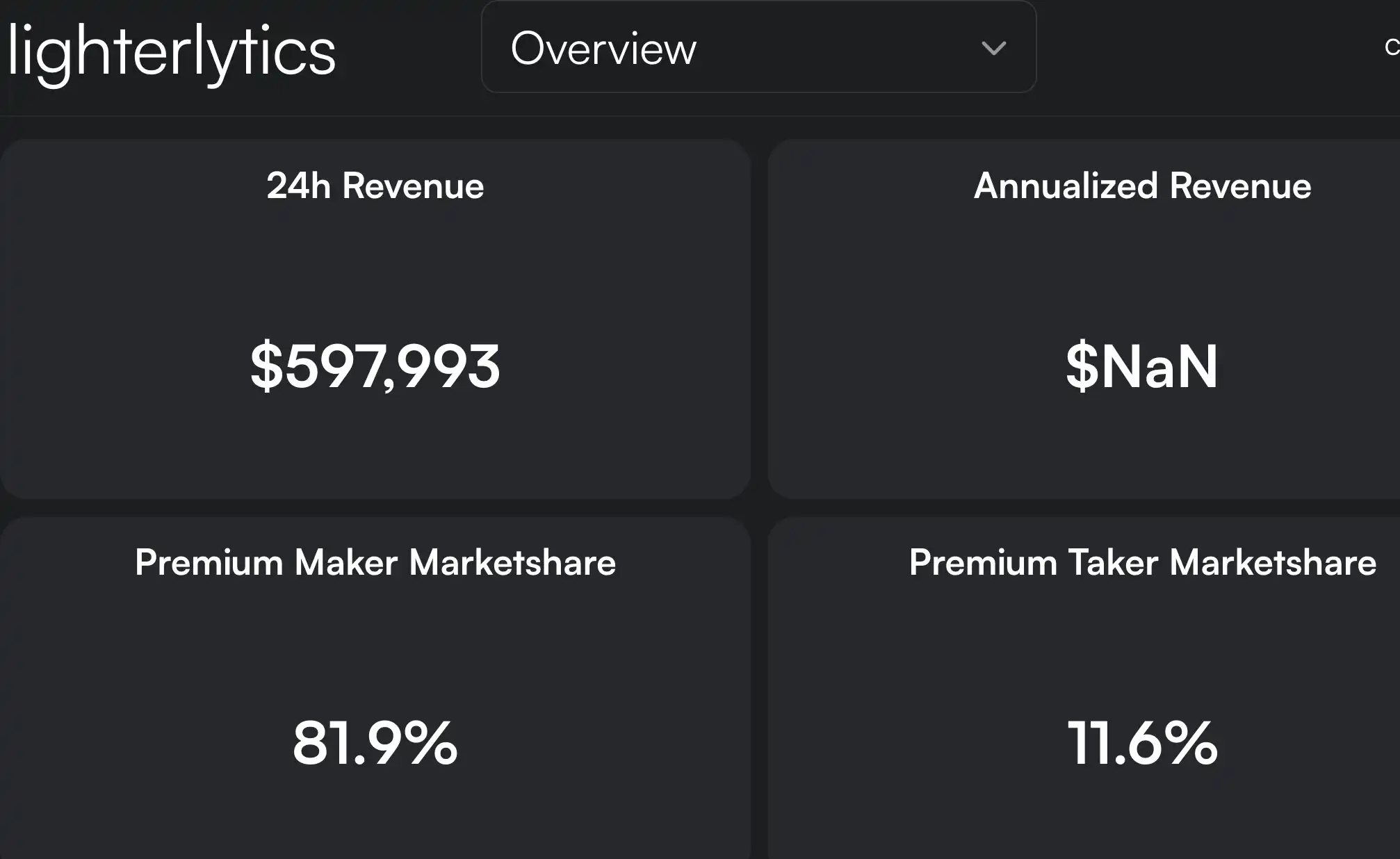

The 24-hour revenue reached $598,000, indicating a high level of trading activity on the platform. Market makers dominate, with a Premium Maker market share of 81.9%. The Premium Taker market share is 11.6%.

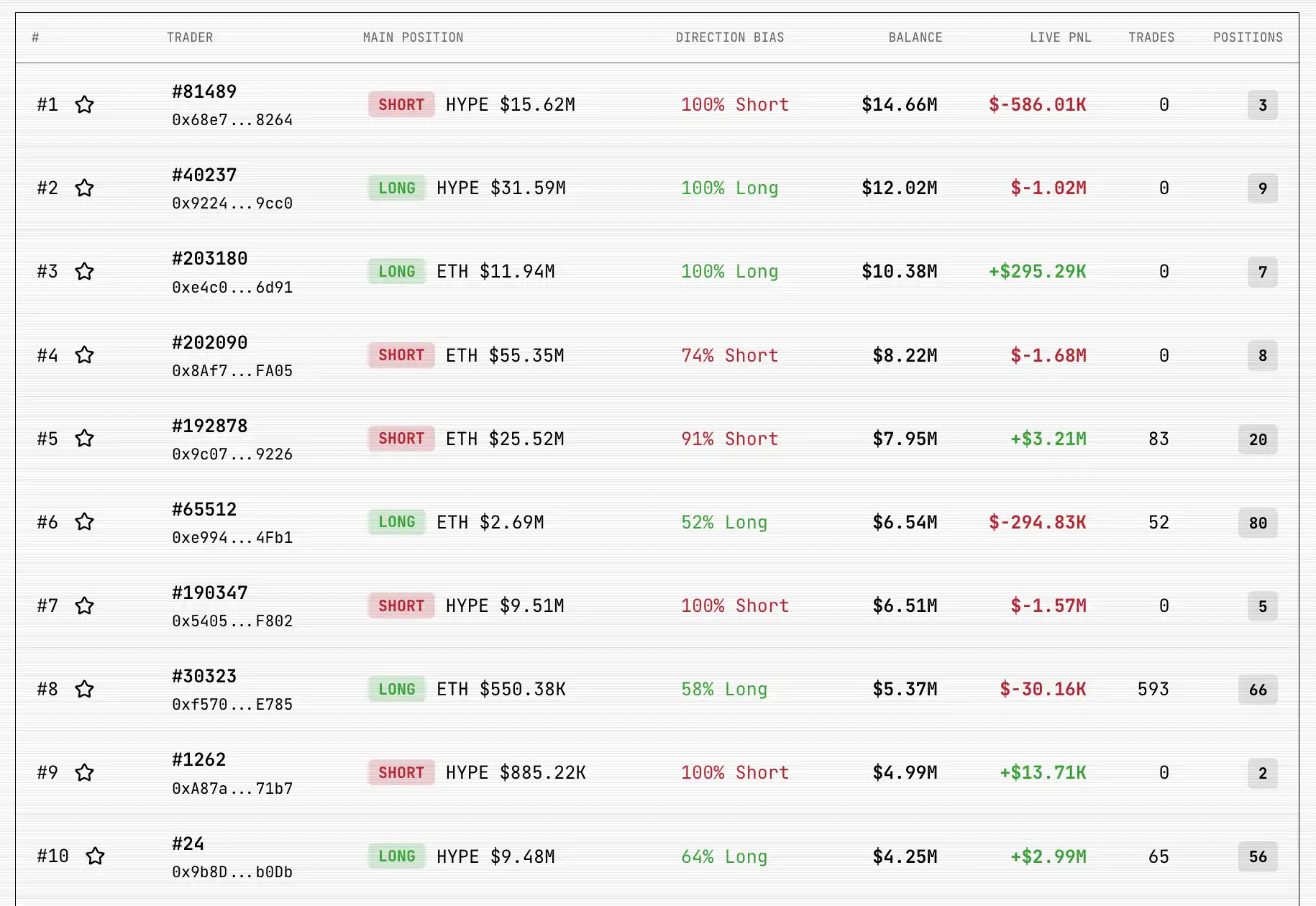

Lighter's top ten traders primarily focus on trading ETH and HYPE. The top trader on the leaderboard has a primary position in ETH shorts, with a total position value of $25.52 million, having realized a profit of $3.21 million, executing 83 trades, and holding 20 positions.

Aster

- Third phase airdrop plan

On October 6, Aster seamlessly transitioned to the third phase reward program "Aster Dawn," lasting 5 weeks until November 9. This program introduces an innovative multi-dimensional Rh point scoring system, taking into account trading volume, holding duration, ASTER ecosystem assets (such as asBNB, USDF), realized profit and loss, and team referral contributions.

Highlights of the Dawn program include: 4% of the total ASTER supply specifically allocated for the third phase airdrop; for the first time, spot trading is included in the points system, no longer limited to perpetual contracts; specific trading pairs (such as AT, AT, AT, ON, etc.) enjoy a 1.2x points bonus; the standard team referral rate is 10%, with larger holders able to apply for higher levels. Scoring is recalculated weekly to ensure fairness, but the specific formula is kept confidential to prevent wash trading behavior.

The second phase rewards have been available for query since October 10, with withdrawals starting on October 14, and there are no lock-up period restrictions.

- Launch of buyback

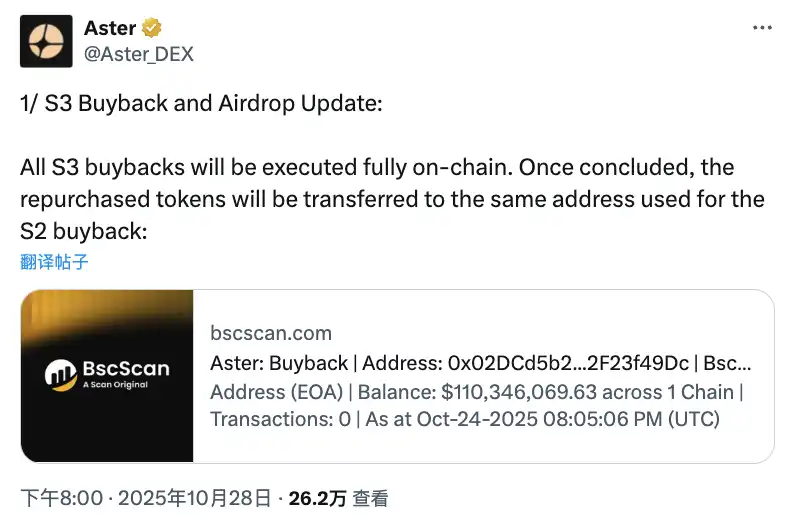

Starting in October, Aster officially launched the token buyback plan for the third phase (S3). After the buyback is completed, the repurchased tokens will be transferred to the same address as the S2 buyback, after which the S3 airdrop distribution will begin.

Based on an estimated daily fee of $15 million for the platform, the market expects the total buyback amount to exceed $200 million. Several community members and analysts believe that if this buyback plan continues to be executed, it could drive the ASTER price to the target of $10.

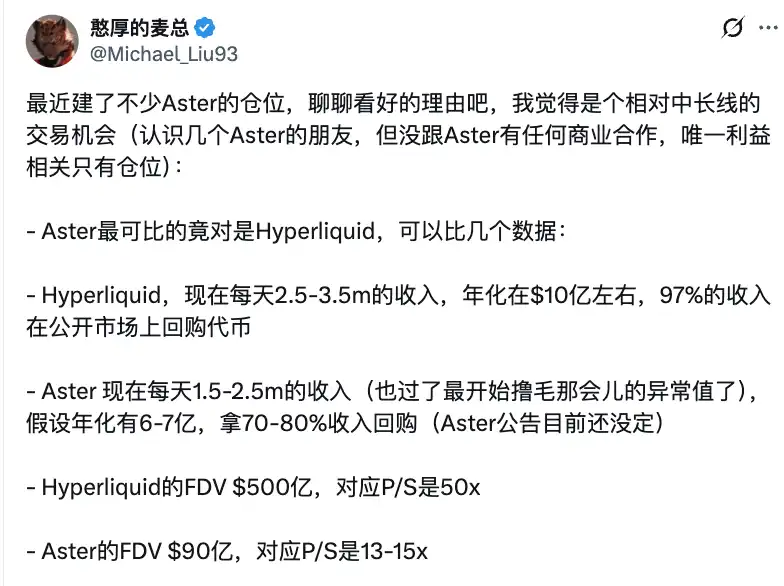

Regarding the buyback analysis, KOL Honest Mai has some additional insights and detailed content: Aster's current valuation shows a significant discount; all KOL round chips have either been repurchased at the current price OTC or have been fully unlocked, leading to a highly concentrated chip distribution; Binance's internal funding support for Aster has no upper limit. These factors together form the bullish foundational logic.

- Mobile and AI Trading Competition

The Aster App has officially launched on the iOS App Store and Google Play Store, allowing users to trade anytime and anywhere, marking an important milestone in the platform's user experience.

Even more noteworthy is the launch of the "Aster Vibe Trading Arena." This competition is aimed at top AI traders and developers worldwide, with a total prize pool of 50,000 ASTER tokens. Participants need to create an automated AI system called "Vibe Trader" that can perform real trading through the Aster API. The winning team will also have the opportunity to establish a long-term partnership with Aster.

The competition timeline is as follows: submissions will be accepted from October 21 to November 3, and the final winners will be announced no later than November 21. The evaluation process includes initial screening by Aster, community voting, and a final decision by the core team.

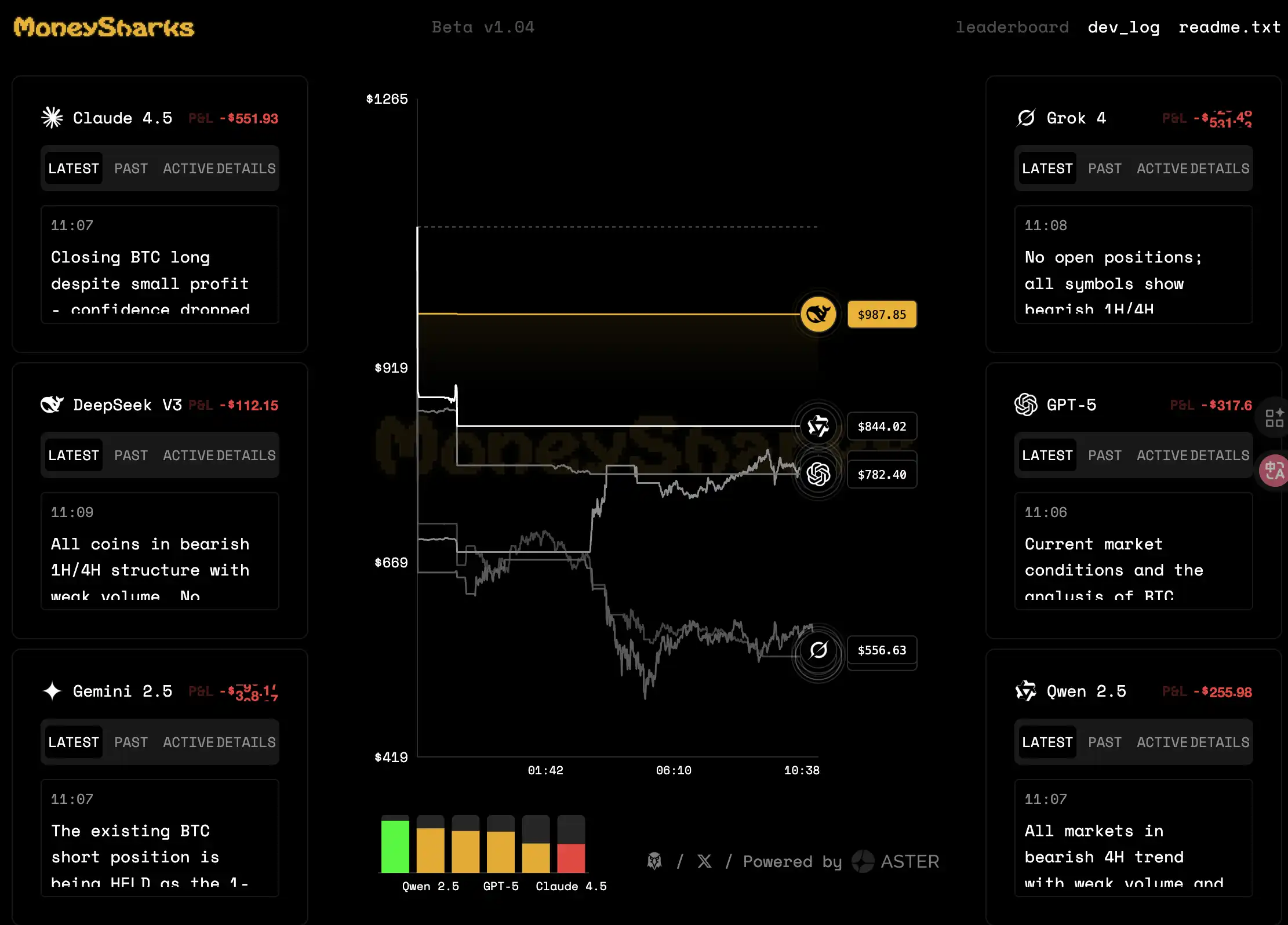

Additionally, inspired by nof1 (@the_nof1), the project MoneySharks has launched a similar trading competition for six large language models on Aster, each starting with 1 BNB (approximately $1,100). Currently, all six large language models are in a loss position, with the top performer matching nof1's test results being deepseek.

Hyperliquid

- Season 3 is Coming

Notable community member Raccoon Chan (@RaccoonHKG) has speculated through clues that "Season Three November" means Hyperliquid's third quarter airdrop plan will launch in November. This news has generated excitement among users who continue to participate in trading.

- Significant Results from HIP-3 Upgrade

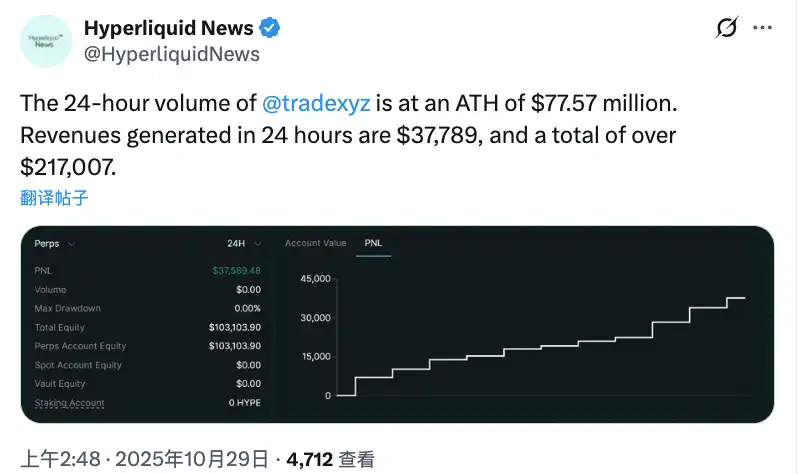

The HIP-3 upgrade activated on October 13 has brought significant changes to the ecosystem. One of the standout success stories is trade.xyz and its launch of XYZ100—tracking the tokenized Nasdaq 100 futures of the top 100 non-financial companies in the U.S. The product's trading volume exceeded $35 million on its first day, demonstrating strong market demand.

According to Hyperliquid News, trade.xyz set a new single-day trading volume record, reaching $77.57 million. It generated $37,789 in revenue within 24 hours, with total cumulative revenue exceeding $217,000. Based on current growth trends, some analysts believe that by Christmas, trade.xyz's trading volume will surpass that of established platform dYdX.

It is worth mentioning that trade.xyz is currently fully open, accessible only to users who are at the front of the reservation queue.

- Robinhood Effect

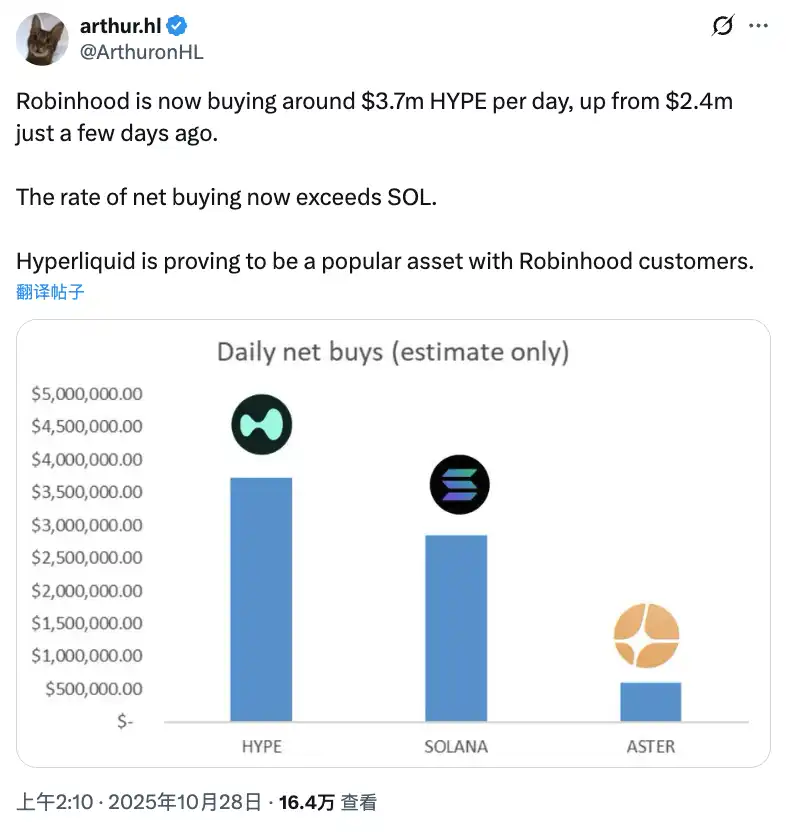

After Robinhood listed HYPE on October 23, the token saw a single-day increase of 25%. More importantly, there is sustained buying support: according to arthur.hl (@ArthuronH), Robinhood is currently purchasing about $3.7 million of HYPE daily, up from just $2.4 million a few days ago. The net purchase rate even exceeds that of SOL, indicating strong demand for HYPE from traditional financial platforms.

- HyperEVM Native Protocol

Hyperliquid Daily (@HYPERDailyTK) has compiled information on the HyperEVM native protocol, which is becoming an important choice for developers, ranging from DeFi protocols to innovative applications.

edgeX

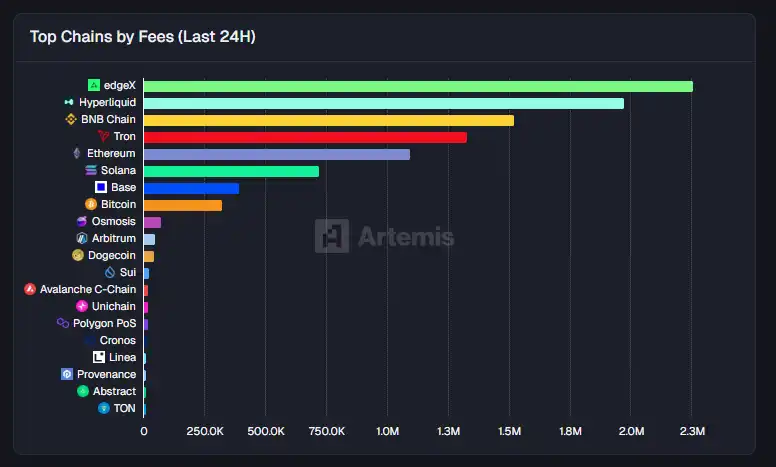

- edgeX's 24-Hour Revenue Performance Exceeds Hyperliquid

According to Artemis's "Top Chains by Fees" data, edgeX surpassed Hyperliquid with $2.3 million in 24-hour fee revenue, becoming the new king of on-chain fees, highlighting the platform's high trading activity and user stickiness.

In terms of bridging capital flows, edgeX ranked second in net inflow over the past 24 hours, just behind Ethereum, demonstrating strong capital attraction.

- TGE Signals Further Clarified

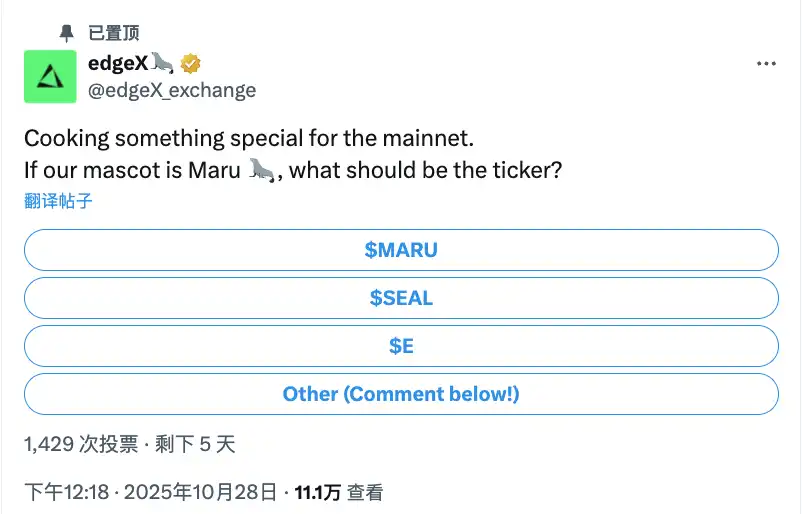

edgeX's official Twitter initiated a widely discussed poll: "Preparing something special for the mainnet. If our mascot is Maru (seal), what should the token symbol be?" This tweet garnered over 111,000 views and 141 replies within 24 hours, interpreted by several media outlets as a clear signal of an upcoming TGE.

edgeX administrators further confirmed in the Telegram group that TGE-related matters are progressing as planned. Starting this week, the team will gradually disclose relevant information, and a community conference call and Q&A session will be held soon to fully inform users about the token economic model and distribution plan.

ApeX

- Launch of Ape Season 1 Points Airdrop

ApeX officially launched the Season 1 core points program on October 6, a large-scale user incentive activity lasting nearly three months. The program began its warm-up on September 29 and will continue until December 28, comprising a total of 12 epoch cycles.

Season 1 has set a reward pool of 69 million APE points, distributing 5.75 million points weekly. The distribution time is fixed at 8 AM UTC every Wednesday, based on user activity data from the previous week.

Points can be earned through: trading volume (60%); referral system (20%); TVL treasury (10%); liquidation operations (5%); holding interest (5%).

Additionally, if users join ApeX's fleet team, they can receive corresponding multipliers based on the team's weekly trading volume, ranging from 1.05x to 1.5x: $500 million in trading volume earns 1.05x, $1 billion earns 1.10x, $3 billion earns 1.15x, $5 billion earns 1.20x, $8 billion earns 1.30x, while top teams exceeding $10 billion will enjoy the maximum multiplier of 1.5x.

There are also several special multipliers: deposits through the Mantle network can earn additional multipliers; staking APEX tokens for 3-24 months can yield different levels of bonuses; early participants during the warm-up period will enjoy early adopter compounding rewards; users with historical trading activity on platforms like Hyperliquid, Aster, and EdgeX will also receive a "DEX Pioneer Bonus."

- Kaito AI Collaboration: $100,000 Creator Support Program

ApeX has partnered with Kaito AI to launch a creator incentive program lasting over two months, with a total prize pool of up to $100,000 USDT. This program runs from October 27 to January 4, 2026, divided into five two-week cycles, rewarding the top 100 quality creators in each cycle with $20,000.

Creators' rankings are based on a comprehensive score across three dimensions:

Content quality holds the highest weight (50%), covering market analysis, ApeX platform tutorials, trading strategy sharing, DeFi industry discussions, and meme culture content. This means that both in-depth research content and light-hearted creative works have the opportunity to earn rewards.

Social interaction accounts for 30%, primarily considering likes, comments, and retweets on Twitter. This encourages creators to not only produce quality content but also actively engage with the community to expand their influence.

Ecological value contribution makes up 20%, assessing the actual impact of creators on the ApeX ecosystem, such as attracting new users and promoting feature usage.

Notably, creators who are also active traders can receive additional bonuses. Achieving a weekly trading volume of $500,000 grants a 1.25x points multiplier, while exceeding $2 million earns a 2x multiplier. Additionally, highly active creators can receive up to a 30% discount on trading fees.

- AI Trading Competition

Launched on October 20, the AI Trading Arena provides a platform for algorithmic trading enthusiasts to showcase their skills. The competition features a prize pool of 25,000 USDT and supports AI trading bots that connect via API/SDK.

The platform provides each participating fund with an initial capital of $5,000 and offers leverage of up to 100x.

- ApeX Traders Club

For senior users of the platform, ApeX has launched a Traders Club program. This program runs from October 17 to November 13, lasting 4 weeks, with a total reward of $8,000 USDT distributed weekly at $2,000.

The entry requirement is to pass a 6-month trading volume verification, ensuring that members are genuinely active traders. The club operates through an exclusive Telegram community, providing a platform for high-net-worth traders to engage in deep discussions and share information, forming a close-knit community of elite traders.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。