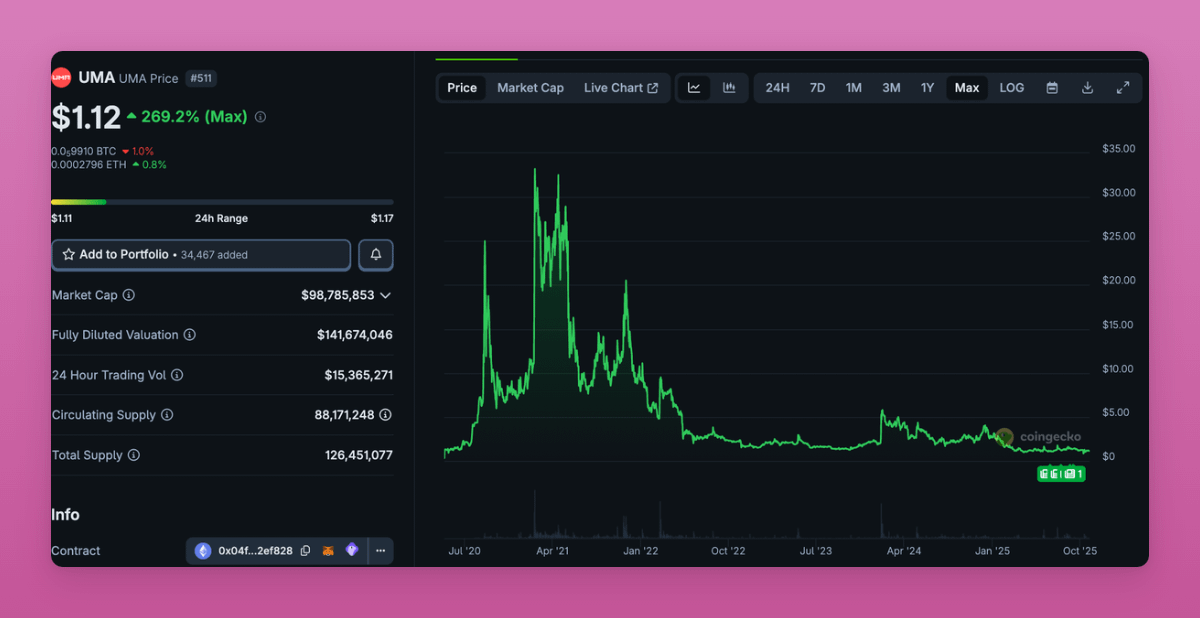

I was really tempted to buy $UMA as Polymarket success should've pumped it.

Yet $UMA trading below bear market lows.

Why?

Polymarket trades $1B USD monthly bets but less than 0.3% of outcomes go into disputes.

UMA only matters when a dispute happens.

So while Polymarket grows fast, UMA’s demand stays low. The success didn't translate into token value.

Ironically, the lower the $UMA MC the higher the governance risk.

With a $100M MC, it takes only a few % of token supply to effect a vote.

There were already (reported or purposely FUDed?) cases where whales influenced outcomes.

That hurts trust as UMA rewards consensus instead of truth.

The final nail in the coffin is recent switch to Chainlink for price markets and even bigger is their own POLY token launch.

I suppose POLY will be used for disputes and governance.

So, why bet on a proxy token that 1) has low value accrual 2) is being replaced by another oracle 3) and Polymarket token is launching.

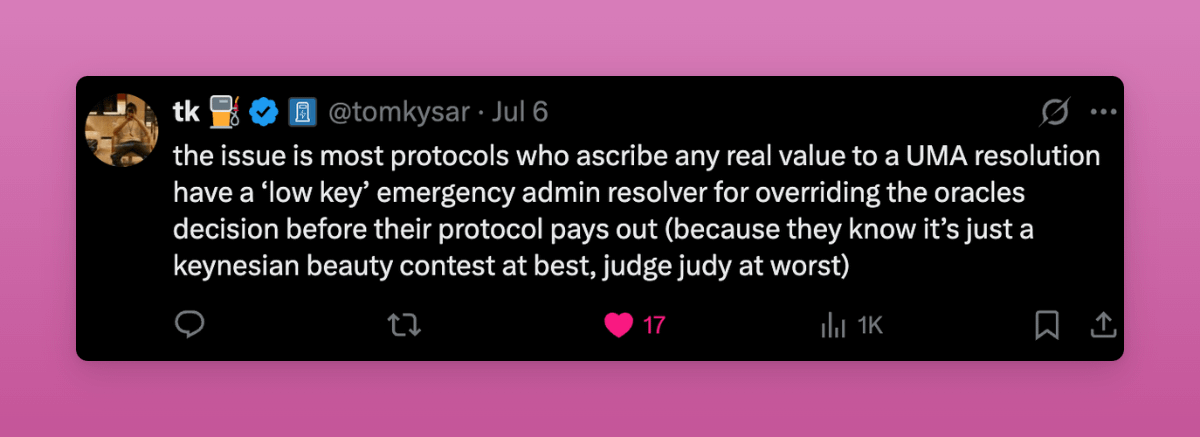

Perhaps @tomkysar explained it best:

What he means is that even protocols using UMA don't really trust it.

I still believe that $UMA could've pumped if it was 2020-21 bull cycle.

But crypto market has matured and pure narrative plays without real fundamentals won't work.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。