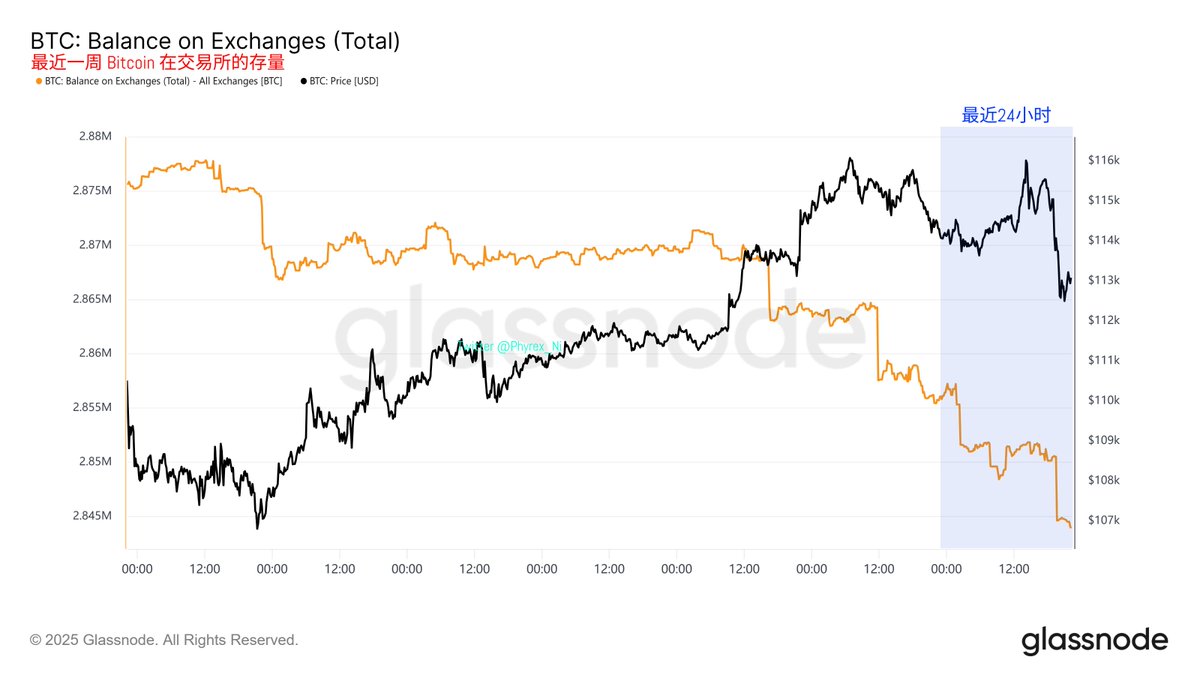

交易所的存量数据从周数据来看仍然非常的乐观,虽然周内 BTC 的价格并不稳定,但是交易所的存量还是再持续下降,不论是价格上升还是下跌的时候投资者买入 BTC 的情绪并没有因为价格的波动而停止,交易所存量的下跌基本就代表了投资者仍然长期看多 Bitcoin 的趋势。

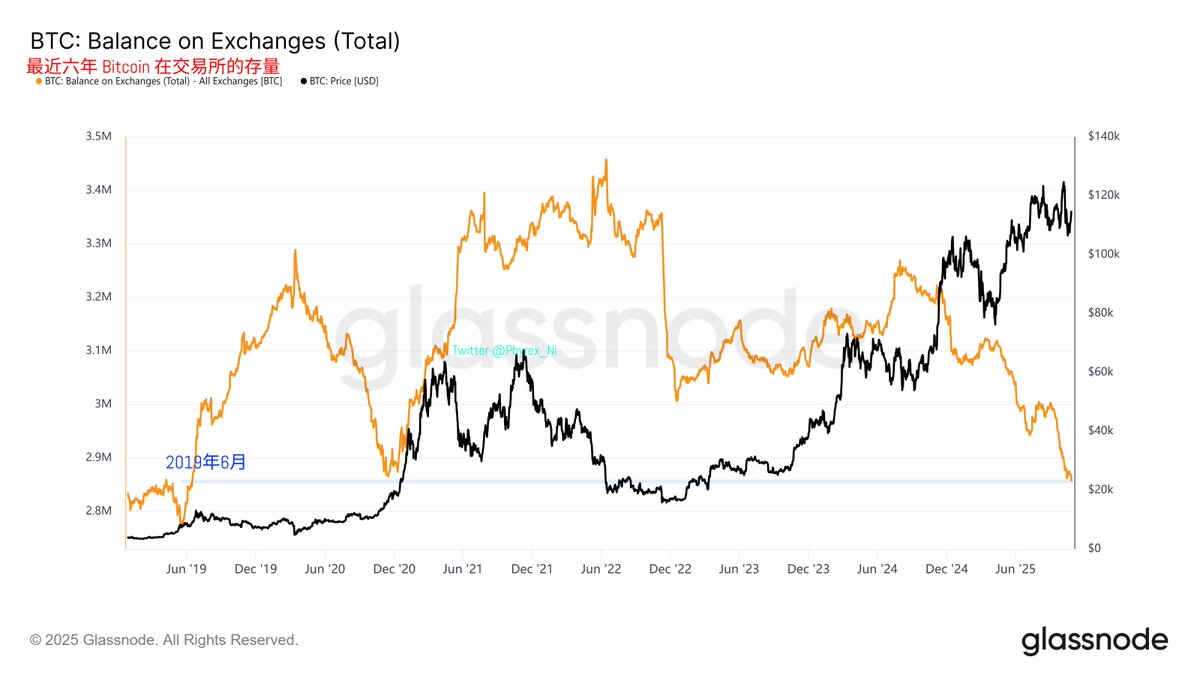

拉长时间线来看,目前交易所中 BTC 总的存量和2019年6月是一致的,这也是这个周期中最大的不同,以往都是随着 BTC 价格的上升会有越来越多的投资者将 BTC 转移到交易所中来寻求最好的抛售时间。

而这次能明显看到从川普参加完 Bitcoin 共识大会说出 BTC 战略储备以后,在将近一年的时间当中无论 BTC 的价格走势如何交易所的存量都是在降低的。

一方面降低了短期流动的 BTC,随着机构和 ETF 投资者的持续购买,这种周期性基于价格变化的抛售就得到了很大的缓解,另一方面更多的投资者在持续买入也说明了 BTC 已经成为了一个新的资产类目。

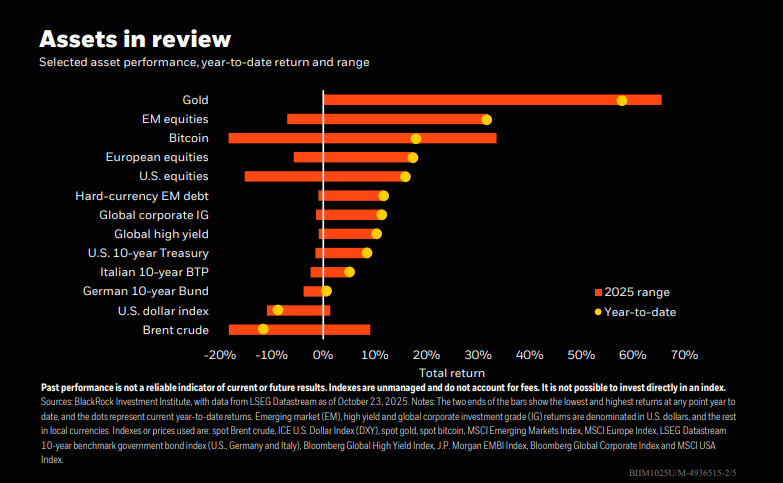

在贝莱德最新发布的投资回顾细节中,BTC 的收益率已经排在第三位,并且是一个完全独立的类目,代表了 BTC 已经成为了全球风险偏好的核心资产,从本质上改变了 BTC 以前的四年周期的属性。

本文由 #Bitget | @Bitget_zh 赞助

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。