十月的巴塞罗那,阳光仍带着地中海的柔光。

两年前,在同一座城市,同一场会议上,监管曾是一种呼声。 那是 2023 年的欧洲区块链大会(European Blockchain Convention, 以下简称 EBC)——一个充满不安与自我怀疑的时刻。FTX 破产的阴影尚未散去,Luna、Celsius 等暴雷的余温仍在,巴塞罗那的舞台上,银行家与加密原教旨主义者第一次坐到一起, 彼此谨慎,却在同一句话上达成共识:“我们需要规则。”

那一年,监管是“话题”;两年后,它成了“前提”。

当我再次走进 2025 年的 EBC 会场时,场景几乎陌生。 会议人数从 2,500 人膨胀到 6,000 人; 参会人群也发生了微妙变化——不仅是穿着连帽衫的创业者,更多的是西装革履的资产经理和机构代表,理性与专业感弥漫在会场每一个角落。

今年的大会,更像一场“制度化的革命”。 它既不是旧秩序的覆灭,也不是新世界的狂欢,而是一场静悄悄的共识转移—— 从理想到治理,从口号到结构,从激情到理性。

在过去 48 小时的采访中,我见到了不同代表欧洲精神的面孔:

他们用各自的不同语言诠释同一个主题——

在一个崇拜速度的世界里,欧洲选择了新监管下的理性发展。

一、加密律师———鱼还是熊掌?

描述:Nikita Prokopenko 摄于欧洲区块链 2025 大会的活动现场

在 EBC 2025 的现场交谈区,我遇到了已经提前预约好的第一位采访对象:Nikita Prokopenko,一位来自意大利的加密货币律师,一套浅灰色西装笔挺,语气温和,就像 Neflix 美剧里所有优秀律师一样,话语锋利。他的开场白简洁而深刻:

“监管不是手铐,而是一张新地图。”

那一瞬间,我就知道,这次对谈不会乏味。

在这张地图上,每个司法辖区都有自己的代价。 “在加密货币领域,你面临一个两难选择。” 他抬手比划着,“一方面,像迪拜这样的地方税收极低——零财产税、五个百分点的增值税, 但牌照申请是地狱般的折磨,耗时漫长且成本高昂; 另一方面,你也可以选择流程简单的司法区,三个月就能拿到许可,但税收会更高。”

这是一个鱼与熊掌的选择。

当我问起欧洲许可证申请的现状时,他给出了以下数字:"在欧洲获得许可证,通常需要 300 小时的工作量,由于这个过程涉及多个法律团队和不同公司的协作,通常需要 2 到 3 个月才能完成 ,而具体费用取决于项目的复杂程度——你需要多少种业务活动?想覆盖多少个国家?已有多少客户基础?"

谈到欧洲各国的差异,Nikita 显得颇有经验:"比如在捷克共和国申请许可证就比在荷兰直接得多。荷兰的监管机构更加复杂,所以流程也更困难。"

马耳他还是加密天堂吗?

我们的对话转向了马耳他——这个曾经的"加密天堂"。"马耳他已经发放了五种不同的加密货币许可证,多家知名机构都在那里拿到了牌照。程序确实简单直接。

但简单的代价,是局限性。 “问题在于,几乎没有客户愿意把业务真正迁过去。它只是个离意大利不远的小岛,在我看来,没有太多可以做的事情,也没有人想在那里开会。”

他顿了顿,像在总结:

“监管越简单,生态越孤岛。”

如果把加密世界分成“政策洼地”和“商业高地”,马耳他显然属于前者。

当我问起全球范围内最容易获得许可证的地方时,他的回答出人意料:"坦率地说,最容易的司法管辖区之一是加拿大。他们的 MSB(货币服务业务)许可证给你从事加密货币工作的权利。"但他随即补充:"不过那里的税收不是最好的。"

关于 Mica 的现实主义和真实价值

一提到欧洲的 MiCA( 加密资产市场法规)监管框架,Nikita 的语气明显变得严肃。 “坦率地讲,欧洲目前是最具有挑战的司法管辖区之一。”

他在采访纸上写下几条要求:三名董事,其中一人必须是欧盟居民; 必须有网络安全、运营、市场和投诉处理团队; "这些必须是真实的人,你必须与他们签订合同——可以是雇佣协议,也可以是 B2B 协议,但不能只是说'我们人员还没有到位'。"

听起来繁琐,但客户们并不抱怨。 “因为一旦你在西班牙拿到许可证,就能在整个欧盟 27 国通用。” 他耸耸肩,“那是规则的好处——一旦你合格,就不需要再解释。”

预测市场,还是灰色预测?

对于当下热门的预测市场,他坦承这是一个灰色地带:"像 Polymarket 这样的预测市场在加密货币监管中没有直接规定。它看起来像赌博,很棘手。MiCA 从未直接提及它。"

他的判断是:"看起来,只要平台不保管资产或兑换加密货币,就可以在没有许可证的情况下运营。如果只是让人们在 Web3 去中心化平台上投注,则不需要许可证。"

在我们的对话结束时,Nikita 总结了他对当前监管环境的看法:"现在的情况很不确定,我们需要等待市场监管机构的进一步评论。但有一点是清楚的——规则正在变得更加明确,这对整个行业来说是好事。"

二、交易所高管———新加密大陆与船长

来源:“MiCA 牌照在客户获取方面的竞争优势” 座谈会

描述:Erald Ghoos(右)与本文作者 Carine(左)于会场合影

接近中午,会场人流明显增多。人声、脚步声与咖啡机的低鸣混在一起,像构成加密行业现实的底噪。

VIP 区的圆桌旁,我在等待采访 Erald Ghoos——本次大会的特邀 Speaker,一位拥有二十年金融行业经验的老兵,现任某头部一线交易所欧洲区 CEO。

他要谈的,是欧洲市场的本地化与用户信任逻辑。

而在不远处,某新晋交易所的展位前,几位亚洲员工正忙于给索要纪念品的人群派发礼物。超大的黄色购物袋在人群中晃动,其展示的交易特点极端而大胆:

“无 KYC 注册要求,400 倍高杠杆、快速入场。”喧嚣而醒目,像一场视觉化的风险隐喻。

欧洲市场,为何是新加密大陆的航海时代?

“速度是亚洲的超级语言,而信任,是欧洲市场的底层逻辑。”

Erald 本人气质沉稳,如一位经验丰富的绅士,不急不躁,言语间透出对市场的长期理解。

“MiCA 之前,欧洲市场更像未绘制的海域——冒险家凭直觉航行,靠经验寻找财富,也承担沉没的风险。”Erald 说。

“MiCA 出台后,航线被画在了地图上。我们开始知道哪些水域安全,哪些风暴可测。”

他称这场变革让“信任开始变得可定价”。

“监管让风险可量化、行为可预期,机构资金因此得以真正进入。”

“银行、保险公司、资产管理公司,他们关心的是规则是否明确、风险是否透明。MiCA 之后,不确定性降低,资本自然流入。”

在他眼中,欧洲不再是试验场,而是一片可预测、可投资的新加密大陆——

航线清晰,信任成为通货。

关于欧洲本土化和用户心智:如何打造信任?

Erald 滑动手机屏幕,展示自家 App 的多语言界面和本地支付选项,包括荷兰的 iDEAL、比利时的 Bancontact、波兰的 BLIK,以及覆盖全欧的 SEPA。

“我们与这些本土的支付机构合作,是为了让用户在熟悉的系统里完成交易,”他说,语气平稳,“当用户能用每天买咖啡的方式来买比特币,那一刻,信任就发生了。”

他提到,公司已连续多年公开储备证明(Proof of Reserves),并在欧盟范围内通过多项金融许可,计划扩展结构化与杠杆产品,以匹配机构投资者的需求。

信任,从抽象概念落到具体操作;在熟悉的路径里,摩擦越小,信任越稳固。

在他的语气里,产品设计与行为心理学被浓缩为一句商业箴言:

在金融领域,人们最信任的,是他们真正看懂和理解的系统。

欧洲市场总结:慢变量的竞争

谈到欧洲市场的节奏,Erald 特意放慢了语速。

“在加密行业,很多人以为护城河是流量或交易量。但在欧洲,护城河是信任。”Erald 说。

他把这种结构性优势称为“慢变量的竞争”:

监管的清晰、合规的习惯、信任的积累——这些看似缓慢,却最难被复制。

“你可以在三个月内上线一个交易所,却要三年才能在一个国家建立品牌信任。”

MiCA 带来的,不只是规则,更是一种持续可复用的信任机制。

在这个框架里,竞争者之间拼的已不再是速度,而是稳健执行与长期信用。

我顺势看向会场另一侧,某所的黄色袋子仍在空气中晃动。

喧嚣的流量与稳健的建设在同一空间里并存——

看来不同机构之间,除了体量和定位,更是战略与价值观的分野。

三、标准制定者——创新,必须推倒重来吗?

描述:Rowan Varrall 代表 DTI 基金会出席圆桌论坛

来源:“数字资产市场 ISO 标准的演变”圆桌论坛

“成功不是创造新的规则,而是让所有人能在同一个语言体系里创新。

下午时分,在主会场的侧厅,我见到了第三位受访者——Rowan Varrall,Digital Token Identifier Foundation(DTI 基金会)监管事务负责人。

他刚从一场关于“数字资产监管与标准化”的圆桌论坛下来,身着深灰西装,语速平稳、逻辑清晰——那种带着制度自信的语气,让人立刻明白,他属于那一类靠“逻辑”说服世界的人。

(*DTI 基金会是 ISO 24165《数字代币识别码》(Digital Token Identifier, DTI)标准的注册机构,该标准目前已获欧洲证券市场管理局(ESMA)认可。)

给项目方入场前的的建议

“最常见的错误,是项目方试图在他们并不需要竞争的地方竞争。”

Rowan 说,“真正的成功,是在共同的数据标准之上创新——那样,产品和服务才能在生态中自由流动。”

在他的叙述里,创新并不意味着颠覆,而意味着兼容。那些看似冷冰冰的通用数据元与消息格式,其实是创新的土壤——让不同系统、不同市场能够对话的语言。

“如果每个人都用相同的词汇、相同的数据结构,那么交易、产品、监管信息都能无障碍地在不同市场之间传递。”

他停顿片刻,语气平静:“真正的创新,不在于你造出新的形状,而在于你是否能让这个形状与系统对话。”

这听起来像是欧洲式理性的极致表达:在共识之上再建造,而非推倒重来。

欧洲监管是否会限制创新?

当我问起欧洲监管是否“限制创新”时,他几乎没有犹豫:“没有监管,你什么都做不了。”

他解释得很直白——

“任何一家机构,做决策前都会问自己:这合法吗?我能否在不被监管敲门的前提下运营?”

于是,监管的意义不再是约束,而是一种确定性的保障。

“如果有明确的框架能消除模糊性,那反而会带来投资。”

据他所述,欧洲的监管方式与我们直到最近在美国看到的情况形成了鲜明对比:

“欧洲预先设定了明确的边界,为技术发展规划了可行的路径,而美国则往往是在有人越界之后才做出反应。不过,我们看到美国在这一方面正在发生显著的转变。”

什么是未来的秩序?

谈到全球项目进入欧洲市场,他的建议很务实:

“无论你在哪个司法区,都能利用行业标准来构建新产品——那是全球通用的语言。”

在他看来,每笔交易、每个产品其实都由组件组成,如果大家都用同样的术语描述这些组件,它们就能跨越不同的监管体系与市场边界自然衔接。

“当所有人都用同一种标准描述交易、资产和数据时,监管、机构和市场之间的鸿沟就会缩小。”

他轻声补了一句:“那时,规则不再只是欧洲的规则,而是全球的语言。”

会场外,人们仍在热烈讨论“RWA”“Tokenization”“AI Trading”;

而从 Rowan 的角度来看,真正的未来,或许写在标准文件的文件里——那些定义字段长度、数据类型与验证逻辑的冷静文字。

四、投资方—— 加密市场的欧洲节奏

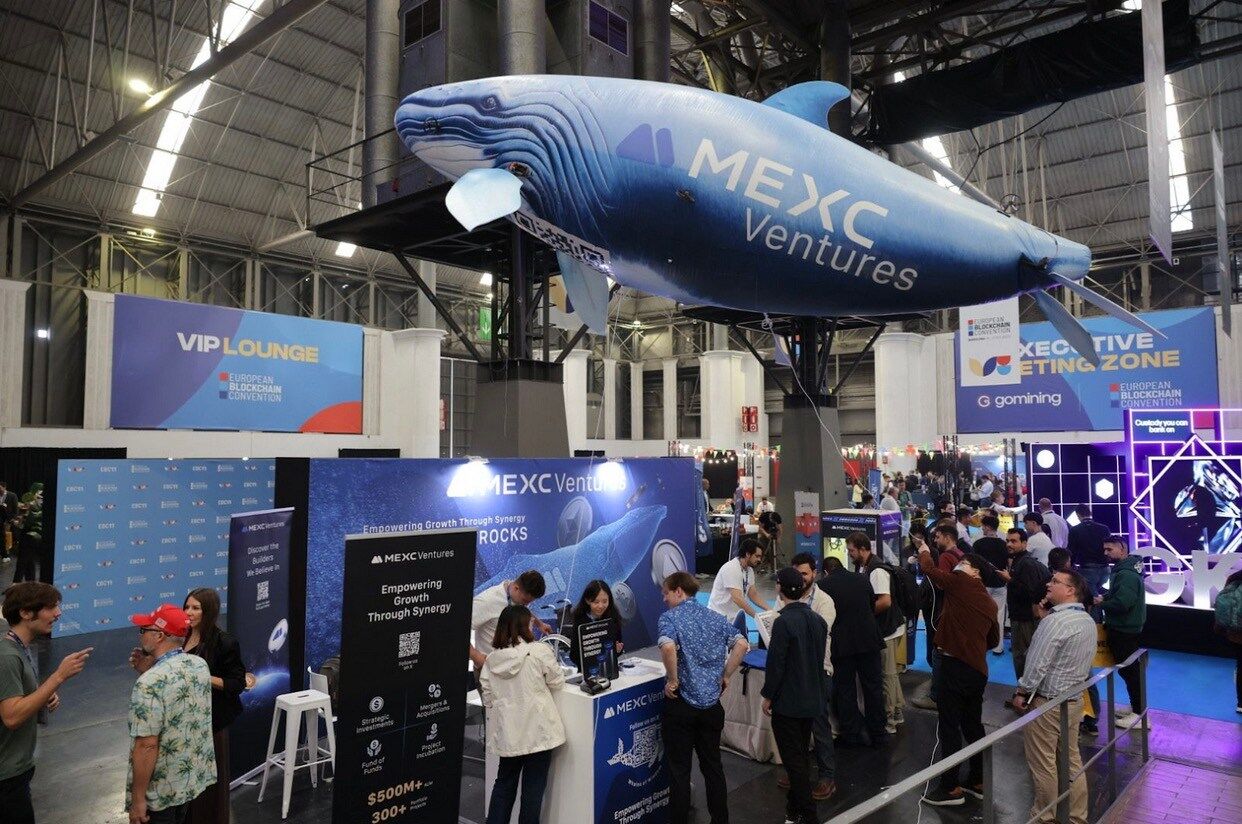

来源:摄于欧洲区块链 2025 大会现场

会展的最后一天下午,室内依旧人声鼎沸。

我来到某知名交易所旗下的 Ventures 展位前——那里立着一个巨大的蓝色气球,造型像一头跃起的鲸鱼,印着他们的机构 Logo,在灯光下闪着金属般的反光,吸引了无数目光。

几位初创团队代表正排队等候推介。就在这时,我遇到了他们的欧洲团队成员 Timul——一位充满热情的欧洲年轻人,正在与项目方交流。他语速快、笑容真,言谈中带着一股特有的“加密气息”。

我问他:“你在看欧洲项目时,最在意什么?”

他想了想,没有提到估值、代币结构或融资额度,而是直接回答:“社区。”

“社区?”

“对,”他点头,“真正的增长来自用户,不是投资人。你可以有一两个大投资人,但那不会带来真正的 adoption。社区用户才是会去参与、去传播、去留下的人。”

我问他:“所以你判断一个项目的核心标准之一,是社区活跃度吗?”

他点点头:“是的,但不是表面的数字。很多人都在谈 narrative,但叙事如果没有真实用户去相信、去参与,就只是一场表演。”

他作为西班牙本土化的运营负责人,语气中带着一种本地的自信。“在欧洲,KOL 更有自己的判断,不太会为了钱去发内容;在亚洲,合作更高效,也更商业化。每个市场都有流量,但信任才是稀缺的资源。”

我们聊到了市场波动与用户教育,他笑着说:“加密市场有它自己的节奏。他顿了顿,语气变得认真:“我希望项目方也能明白,市场不会一直热,但真实的用户会留下来。”

也许,这正是欧洲市场的另一种力量——从稳健的机构,到理想主义的年轻人,从监管的确定性,到社区的自发性。

“这里的市场在奖励耐心,只是方式不同。”Timul 说道。

“不求快,但在时间里赢。”

结语:航线已定,风向可测

在巴塞罗那的落日下,EBC 2025 的人群缓缓散去,展厅的喧嚣逐渐退去,但这座加密新大陆的秩序感仍在延续。两年前,规则还是呼声;两年后,规则成为通行证。欧洲市场告诉我们一个现实——创新不必反叛秩序,秩序也可以孕育创新。

在这里,信任可量化,风险可预测,创新在共识与标准之上生长。无论是律师、交易所高管,还是标准制定者,他们都在用不同的方式诠释同一个理念:加密世界的欧洲新大陆,不是野蛮生长的自由港,而是一片经过理性雕琢、可航行的海域。

也许,这正是欧洲加密的浪漫:不是无拘无束,而是理性与秩序的共舞,是野心在规则之内自由延展。航线已定,风向可测,未来的探索才刚刚开始。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。