On October 29, 2025, the cryptocurrency world once again focused on the mysterious "10·11 Short Whale." On-chain data shows that this whale address urgently deposited 200 BTC, worth approximately $22.5 million, into the Kraken exchange today. This marks the 11th time it has transferred assets to various exchanges in October, with a total deposit amount reaching 11,271 BTC, exceeding a total value of $1.28 billion.

The significant divergence among market whales coincides with the Federal Reserve's interest rate decision to be announced today. The market expects a 97.8% probability of a 25 basis point rate cut at this meeting.

1. Whale Movements

The mysterious figure known as the "10·11 Short Whale" derives its name from the precise operation that shocked the market on October 11.

● Before the Trump administration announced a 100% tariff policy on China, this whale established a short position of 3,477 BTC on the Hyperliquid platform. When the policy announcement triggered a market crash, it made nearly $200 million in profit within just one day.

● Even more surprisingly, the whale's operations demonstrated a strong strategic approach. Between October 20 and 21, it continued to increase its short position on Hyperliquid, bringing the total short position to 1,100 BTC. However, a turning point occurred on October 23, when the whale began to close its short positions on a large scale, closing 2,100 BTC in a single day and making a profit of $6.44 million.

| Date | Main Operations | |------------|-----------------------------------------------------------------------------------------------------| | October 10 | Before the announcement of Trump's tariff policy, deposited $80 million into Hyperliquid and opened a 6x leveraged short position of 3,477 BTC (approximately $1.1 billion). | | October 20 | Deposited another 30 million USDC into Hyperliquid, adding 700 BTC to the short position with 10x leverage, with an entry average price of $109,133.1. | | October 21 | Continued to increase the short position on Hyperliquid, reaching a total of 1,100 BTC (approximately $121 million), still using 10x leverage. | | October 23 | A turning point in operations: began to close short positions on a large scale to take profits. Closed 2,100 BTC in short positions that day, making a profit of $6.44 million. Subsequently reduced the 10x leveraged short position to 470.48 BTC. | | October 26 | Deposited 200 BTC into Kraken, worth approximately $22.32 million. |

Source: Compiled by AiCoin

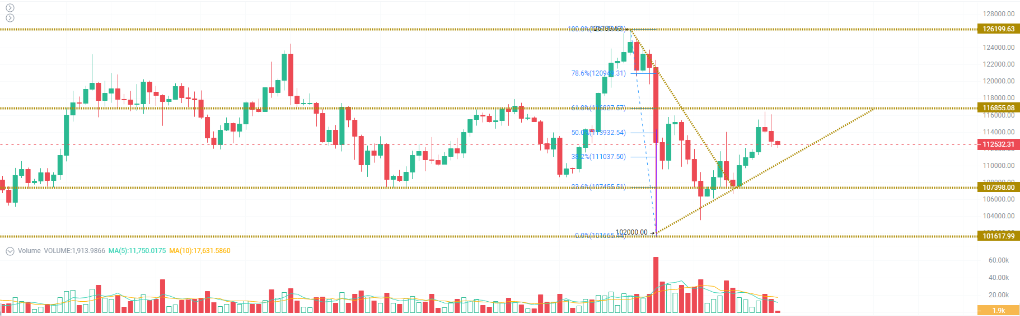

2. Key Technical Levels: The Battle Between Support and Resistance

According to AiCoin data, there is strong support for Bitcoin around $111,000, while there is a significant supply of sell orders around $117,000.

This price range defines the battleground between recent buyers and profit-takers, and a breakout in either direction could set the tone for the next major market trend.

If the Bitcoin price breaks above $114,000, the cumulative short liquidation intensity on mainstream centralized exchanges will reach $956 million. This large-scale liquidation could accelerate price increases, triggering short-term volatility.

Bitcoin Key Price Point Liquidation Analysis

| Price Level | Liquidation Type | Cumulative Liquidation Intensity | Potential Market Impact | |----------------------|----------------------|---------------------------------------|-----------------------------------------------------| | Above $114,000 | Short | $956 million | Short positions liquidated, price may rise quickly | | Below $110,000 | Long | $657 million | Long positions liquidated, price may drop quickly |

Source: Compiled by AiCoin

3. Market Environment Under Super Central Bank Week

This week, global financial markets are welcoming "Super Central Bank Week," with the Federal Reserve, European Central Bank, and Bank of Japan set to announce interest rate decisions on October 30, 8 AM UTC+8. The market generally expects these three central banks to take divergent paths.

● Unlike the Federal Reserve's continuous rate cuts, the European Central Bank and Bank of Japan are likely to choose to "stay put" this time.

● Since starting the rate cut process in June 2024, the European Central Bank has lowered rates eight times and has maintained rates since July this year. The divergence in monetary policies among major central banks has also become a key factor affecting the global foreign exchange market. Last week, the dollar index fluctuated and closed higher, with a cumulative increase of 0.39% for the week.

4. Institutional Layout and Sector Rotation

● In this cycle, institutional funds are increasingly concentrated in BTC, ETH, and SOL, presenting a "winner-takes-all" market structure. Investors are primarily focused on these three assets, indicating that liquidity and trading volume will gravitate towards these mainstream coins, offering better allocation advantages compared to small-cap altcoins.

● Stablecoins have become the main on-chain settlement medium for many liquidity providers. In the past 12 months, the trading volume of original stablecoins reached $46 trillion, with an adjusted figure of $9 trillion. The total supply of stablecoins has now exceeded $300 billion, with monthly adjusted trading volume close to $1.25 trillion in September 2025.

● Meanwhile, a certain whale has withdrawn 8.515 million PROVE from CEX, worth approximately $6.84 million.

5. Key Catalysts and Risk Warnings

Investors need to be cautious of several key risk points.

● First is the uncertainty of macro policies; the upcoming interest rate decision from the Federal Reserve could have a significant impact on the market.

● Second is the structural risk in the market; high-leverage positions could still trigger chain liquidations in extreme market conditions.

Several key signals are worth closely monitoring.

● Will the short whale continue to deposit BTC into exchanges, or will it instead re-establish short positions? Will institutional funds increase their allocations during market adjustments? These will determine the subsequent trend of Bitcoin.

● From a technical analysis perspective, Bitcoin is currently consolidating in the range of $108,000 to $115,000. If it can effectively break through the resistance level of $115,000, it may initiate a new round of upward momentum; conversely, if it falls below the support level of $108,000, it may further test the $100,000 mark.

In the emerging cryptocurrency market, the operations of whales always stir the nerves of every investor.

The series of operations by this "10·11 Short Whale" not only reflects its personal judgment of the market but also mirrors the complex environment currently facing the cryptocurrency market—geopolitical factors, regulatory policies, and macroeconomic conditions are all influencing asset prices to an unprecedented degree.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。