I. Introduction

The sharp drop on October 11 taught the market a very direct lesson: prices are not pierced by a "single sell order," but are consumed by a liquidity vacuum. As multiple market makers paused their market-making activities to reduce risk exposure, traders lost their counterparties, exacerbating margin calls and deleveraging. The market price was instantly breached, amplifying price declines and slippage, becoming a significant accelerator of the "waterfall" crash. In the crypto market, token prices are not simply generated by the natural collision of buy and sell orders, but are supported by the continuous quotes and deep supply from market makers. Market makers are not only the lubricants of matching but also the central nervous system of price discovery. Once this "invisible hand" retracts, the market loses its gravitational balance point. So, how does this invisible hand stabilize price discovery, and why is it "absent" in extreme moments, thereby changing the path and speed of market trends?

This article will use simple language to break down the role and profit model of market makers in the crypto world, systematically review the backgrounds, styles, and representative tokens of seven leading market makers, discuss the controversies faced by market makers, and provide suggestions for rebuilding trust, opening the black box of market-making mechanisms for readers to better understand "market-making behavior."

II. Understanding the Functions and Roles of Market Makers

Market makers are both price stabilizers in the market and risk buffers for the system. When they operate efficiently, the market is stable, deep, and has low slippage; when they are absent or malfunctioning, the entire system can become unbalanced in an instant.

1. Functions and Roles of Market Makers

Market Makers (MM) are the "invisible hand" of the crypto market, bearing important functions:

Continuous Bid-Ask Quotes and Depth Maintenance: Continuously posting buy/sell prices in CEX order books, DEX RFQs, and AMM pools, dynamically adjusting spreads and order sizes based on flow and risk thresholds, maintaining 1%/2% depth and order-filling speed, reducing slippage and impact costs (including AMM position rebalancing and concentrated liquidity range management).

Price Discovery and Cross-Scenario Linkage: Quickly aligning dispersed market prices through arbitrage trading across exchanges/chains/spot-futures/cross-periods and stablecoins/anchored assets; connecting ETF/ETP/RFQ networks to promote OTC-on-chain and on-chain-off-chain linkages and basis repair.

Inventory Management and Risk Absorption: Short-term absorption of buy-sell imbalances, "packaging" dispersed trading demands; using perpetuals/futures/options/borrowing tools to neutralize inventory, bringing funding rates and spot-futures basis back to normal ranges.

New Listings and Cold Start Liquidity: Providing minimum depth and market-making quotas at TGE/new listing stages, using token lending/inventory pledging and market-making rebate agreements to smooth opening volatility; accommodating institutional/whale large orders, reducing explicit spreads and implicit impact costs, helping assets quickly enter a "tradable state."

It is evident that the social attribute of market makers lies between public goods and competitive games. On one hand, they enhance market efficiency with capital, algorithms, and expertise, allowing everyone to complete transactions at reasonable costs; on the other hand, they also possess significant structural information and decision-making power. Once incentives are misaligned or risk controls fail, they can transform from "market stabilizers" into "volatility amplifiers."

2. Main Types of Market Makers

Market makers of different scales, strategies, and positions play different roles in the crypto market. The following are the three main types:

Professional Market Makers: These market makers use advanced algorithms and high-speed matching to fill order book liquidity, narrow spreads, and improve trading execution experiences. These institutions have large capital, algorithm-driven operations, cross-scenario coverage (CEX, DEX, OTC, ETF/ETP), and mature risk control systems. They often provide continuous quotes and depth for mainstream assets (such as BTC, ETH, SOL) and deploy market-making algorithms and hedging mechanisms across multiple exchanges/chains.

Advisory/Project Market Makers: Referring to market makers that enter in the form of "new listing support + liquidity packages," usually signing market-making agreements with project parties to provide token lending, initial orders, rebate incentives, etc. Once a project is listed, they are responsible for early quotes and matching to maintain the minimum tradable state. Although these institutions may not have the capital scale of large professional market makers, they are more active in "new coin cold starts vs. long-tail tokens." Market-making contracts often include terms for "token lending," "market-making rebates," and "minimum liquidity guarantees."

Algorithmic Market Makers or AMM LPs: Including liquidity providers (LPs) in AMM models, some algorithmic and low-human-intervention quoting systems, as well as small market-making institutions or bot services. These participants are characterized by smaller or medium capital scales, primarily participating in on-chain AMM pools or customized matching agreements; their risk control and hedging capabilities may be weaker than those of professional market makers, making them prone to liquidity withdrawal or depth shrinkage in extreme market conditions; they are more fragmented in the market, providing "thin liquidity" support for long-tail tokens or multi-chain protocols.

3. Market-Making Mechanisms and Profit Models

Although outsiders often imagine market makers as "the house in the system," in reality, their profit model resembles a "high-frequency fee factory," accumulating profits through small but stable spreads.

Spread Capture: This is the foundation of all market-making activities. Market makers maintain stable bid-ask quotes between the buy and sell prices, and when market transactions occur, they profit from the difference between the buy and sell prices. For example, if BTC has a buy order at $64,000 and a sell order at $64,010, when a user sells at the sell price, the market maker earns a $10 spread profit. Although the profit per transaction is small, at a transaction frequency in the millions, the annualized returns can be substantial.

Fee Rebates and Incentives: Most exchanges adopt a maker-taker fee structure: the maker enjoys lower fees or rebates for providing liquidity, while the taker pays higher fees. Market makers can maintain positive rebate income over the long term due to large transaction volumes and algorithmic automation capabilities. Additionally, exchanges or project parties often provide extra market-making incentives, such as returning a certain percentage of fees, distributing token incentives, or establishing market-making subsidy pools in the early stages.

Hedging and Basis Trading: The inventory held by market makers inevitably bears the risk of price fluctuations. To maintain a "neutral position," they hedge through perpetual contracts, futures, options, or borrowing. For instance, when there is an excess of ETH in inventory, they may short an equivalent amount of ETH in the futures market to lock in risk exposure. Meanwhile, if there is a discrepancy between spot and futures prices (i.e., basis), market makers may also engage in arbitrage through "buy low, sell high" to earn risk-free profits.

Statistical Arbitrage and Structured Opportunities: In addition to conventional spread profits, market makers also seek various micro-structural opportunities:

Inter-Period Arbitrage: Price differences between different expiration contracts of the same asset;

Cross-Asset Arbitrage: Price deviations between correlated assets (e.g., stETH and ETH);

Volatility Arbitrage: Utilizing differences between implied volatility from options and historical volatility;

Funding Rate Arbitrage: Balancing funding costs across different markets through borrowing or hedging;

These strategies collectively form the "profit matrix" of market makers. They do not bet on direction like speculators but rely on scale, speed, risk control, and algorithms to win. In a market with an average daily trading volume of over $10 billion, even an average spread of just 0.02% is sufficient to support a massive profit system.

III. Overview of Mainstream Market Makers

The existence of market makers has transformed the crypto market from "disordered quoting" to a "sustainable matching" system. The most mainstream market makers currently include Jump Trading, Wintermute, B2C2, GSR, DWF Labs, Amber Group, and Flow Traders. This chapter will analyze the backgrounds, styles, scales, and token holding structures of these market makers.

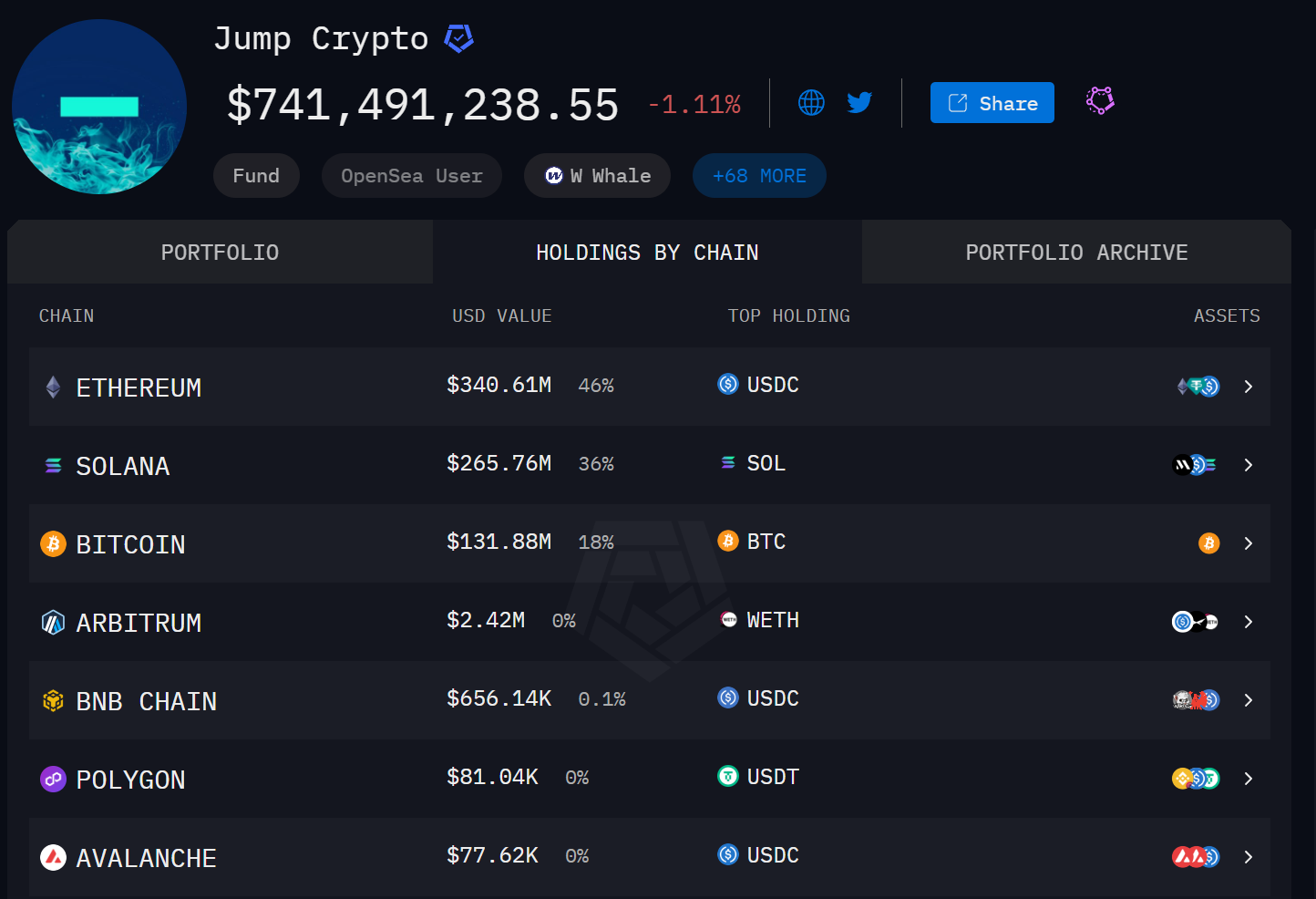

1. Jump Trading

Source: https://intel.arkm.com/explorer/entity/jump-trading

Introduction: A traditional high-frequency quant firm, in addition to market-making, it also invests in research infrastructure. According to Arkham data, as of October 23, 2025, Jump Trading's holding scale is approximately $740 million.

Market-Making Style: The portfolio is more inclined towards "capital management + low to medium beta positions": a high proportion of stablecoins and staking derivatives; during significant market fluctuations, it dynamically adjusts staking/re-staking positions and engages in large redemptions and exchanges.

Representative Holding Tokens

Top Five Holding Assets: SOL, BTC, USDC, USDT, ETH

Hot Holding Assets: USD1, WLFI, W, SHIB, JUP, etc.

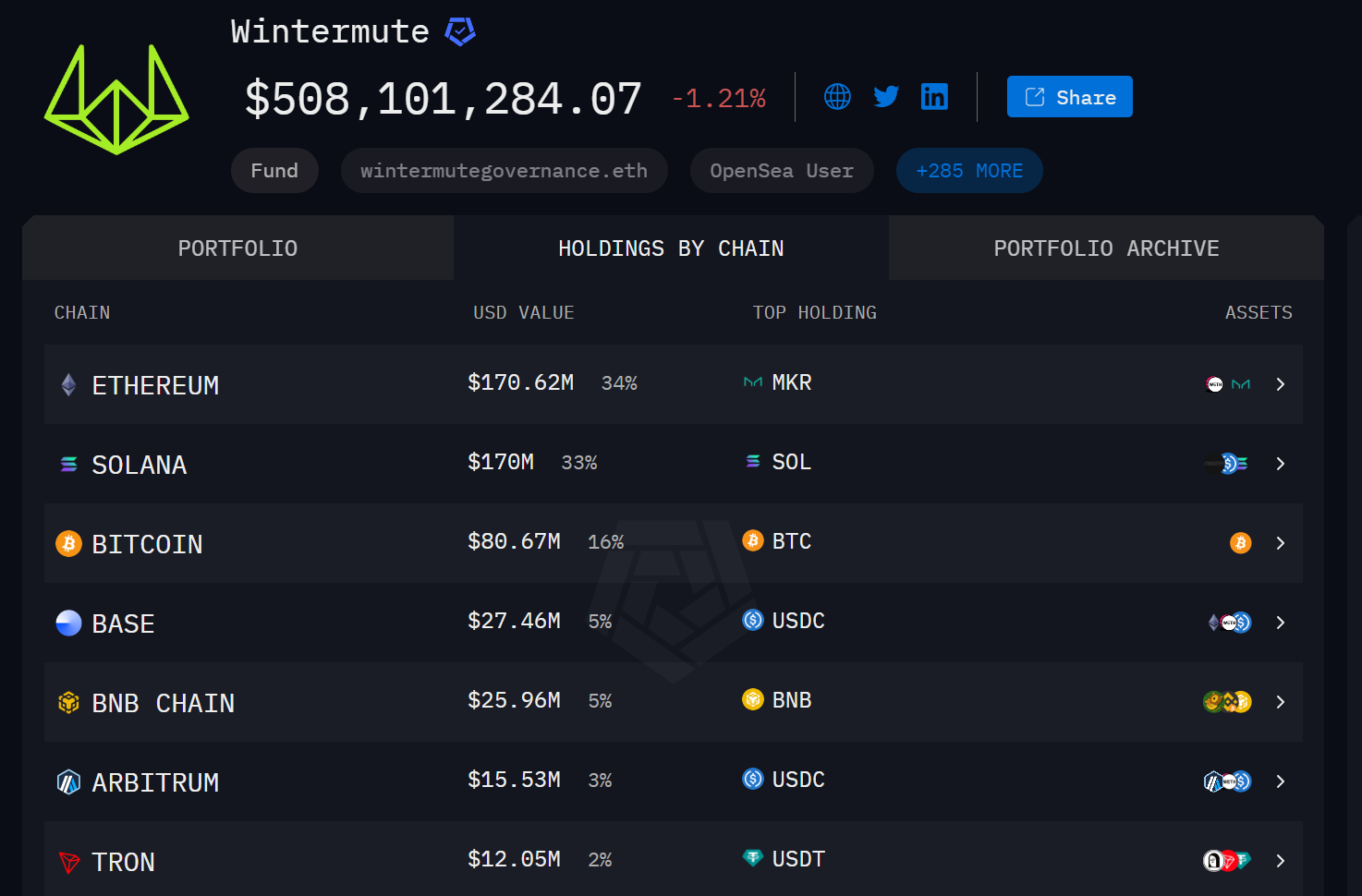

2. Wintermute

Source: https://intel.arkm.com/explorer/entity/wintermute

Introduction: An established quantitative market maker covering both centralized and decentralized scenarios; in addition to mainstream coins, it has been very active in hot new coins and meme sectors over the past two years, playing a liquidity supply role for multiple project launches. According to Arkham data, as of October 23, 2025, Wintermute's holding scale is approximately $500 million.

Market-Making Style: Cross-market, cross-asset market-making + event-driven (new coins/TGE) + high-frequency and grid strategies combined; during the cold start phase of new assets, it typically allocates or accepts loans to provide bid-ask quotes. It has been publicly disclosed as one of the market makers for Ethena (ENA).

Representative Holding Tokens

Top Five Holding Assets: SOL, BTC, USDC, MKR, RSTETH

Hot Holding Assets: LINK, ENA, PENGU, FARTCOIN, Binance Life, etc.

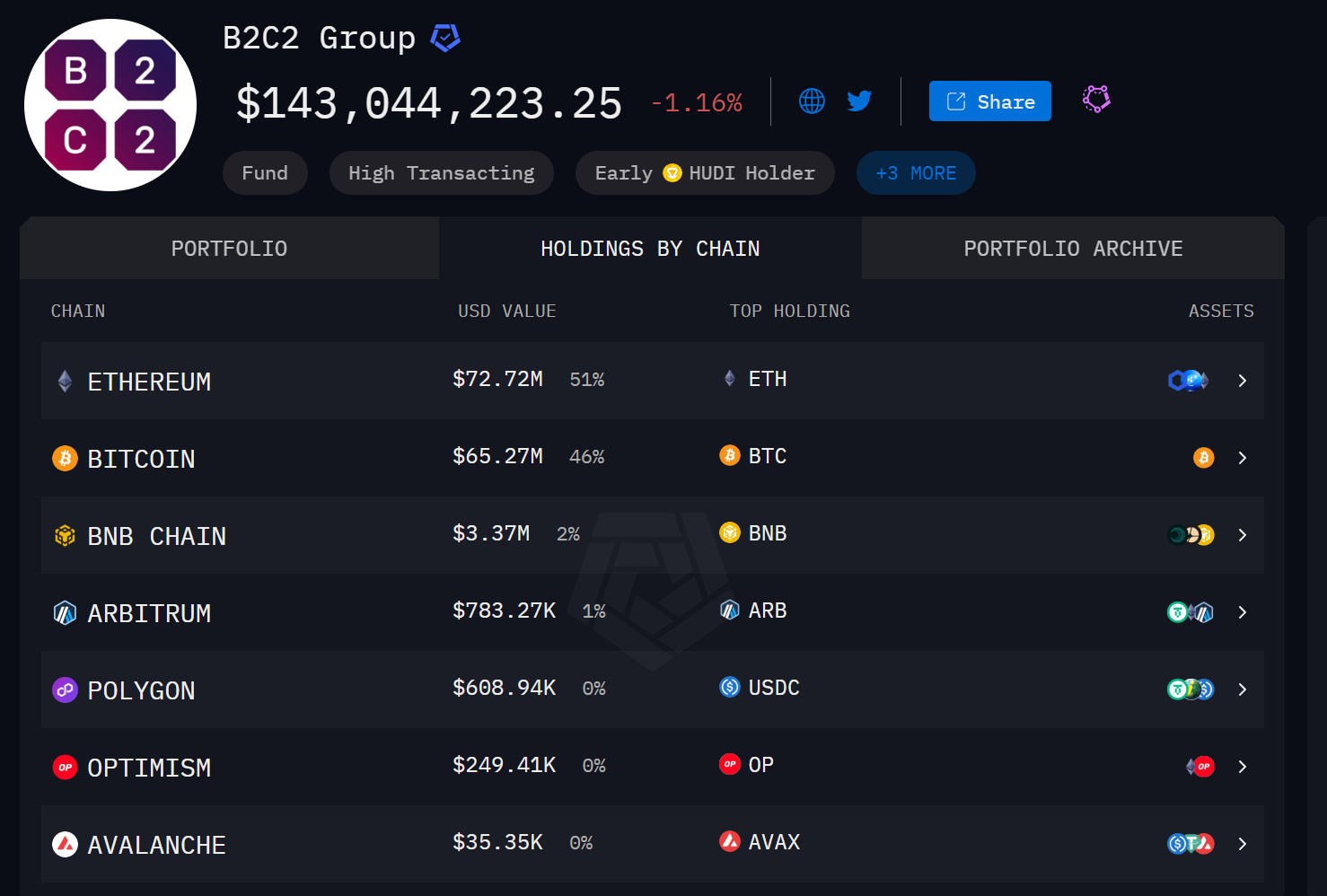

3. B2C2

Source: https://intel.arkm.com/explorer/entity/b2c2

Introduction: A well-established institutional market maker and OTC liquidity provider, controlled by the Japanese financial group SBI; deeply collaborates with several large trading platforms and compliant scenarios. According to Arkham data, as of October 23, 2025, the holding scale is approximately $140 million.

Market-Making Style: Clearly characterized by "institutional prime brokerage + liquidity outsourcing"; provides stable coverage for both mainstream coins and long-tail high liquidity coins, with market commentary disclosing transaction volumes and buy/sell directions by coin type.

Representative Holding Tokens

Top Five Holding Assets: BTC, ETH, RLUSD, LINK, AAVE

Hot Holding Assets: LINK, BNB, UNI, FDUSD, ASTER, etc.

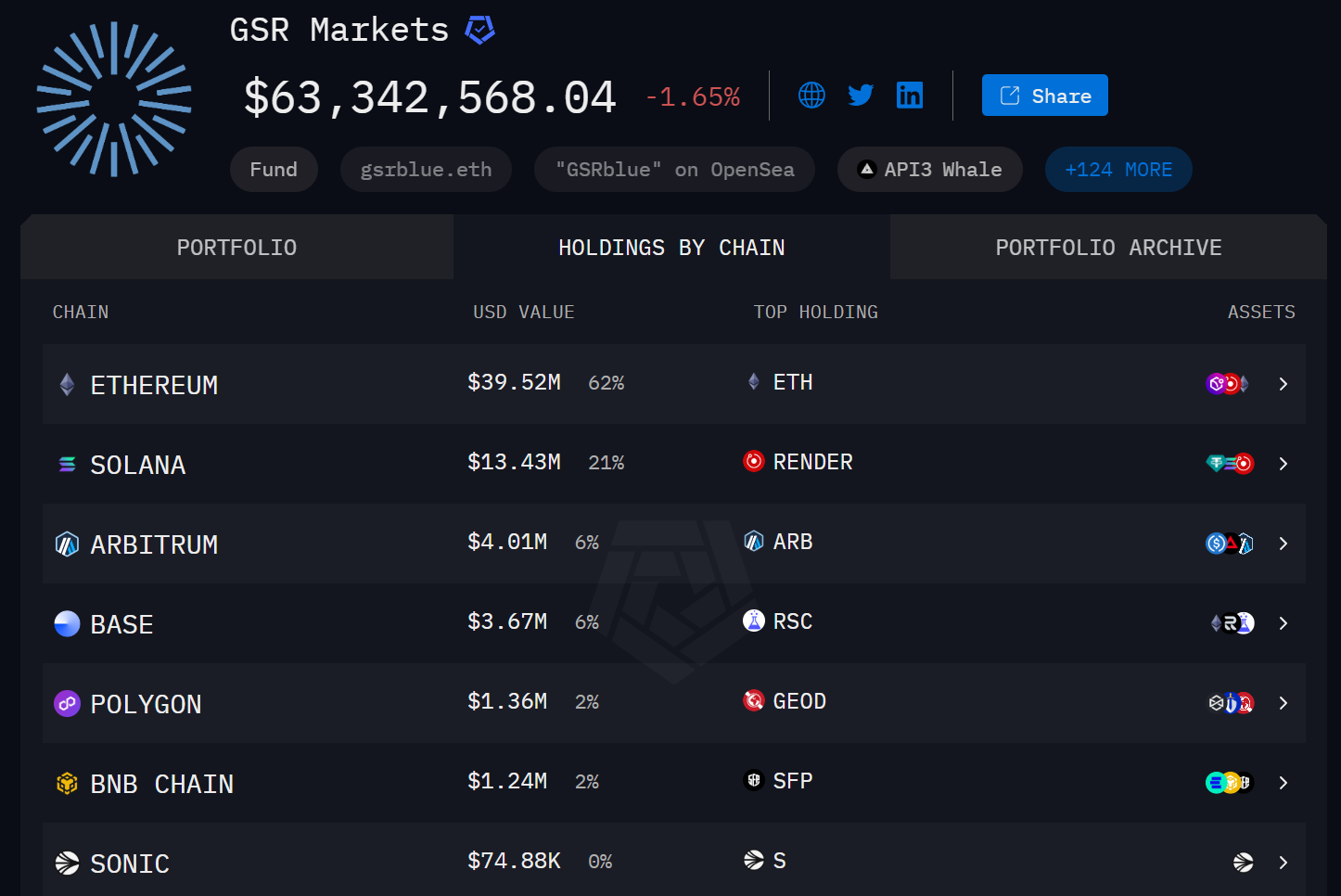

4. GSR Markets

Source: https://intel.arkm.com/explorer/entity/gsr-markets

Introduction: Established in 2013, with comprehensive compliance qualifications (including a Singapore license), it is one of the earliest professional crypto market makers. According to Arkham data, as of October 23, 2025, the holding scale is approximately $60 million.

Market-Making Style: "Institutional temperament + full-stack trading"—simultaneously engaging in market-making, structured products, and programmatic execution; often acts as the official market maker for projects, participating in liquidity management during TGE/circulation periods.

Representative Holding Tokens

Top Five Holding Assets: ETH, RNDR, ARB, SOL, SXT

Hot Holding Assets: AAVE, FET, RSC, SKY, SHIB, etc.

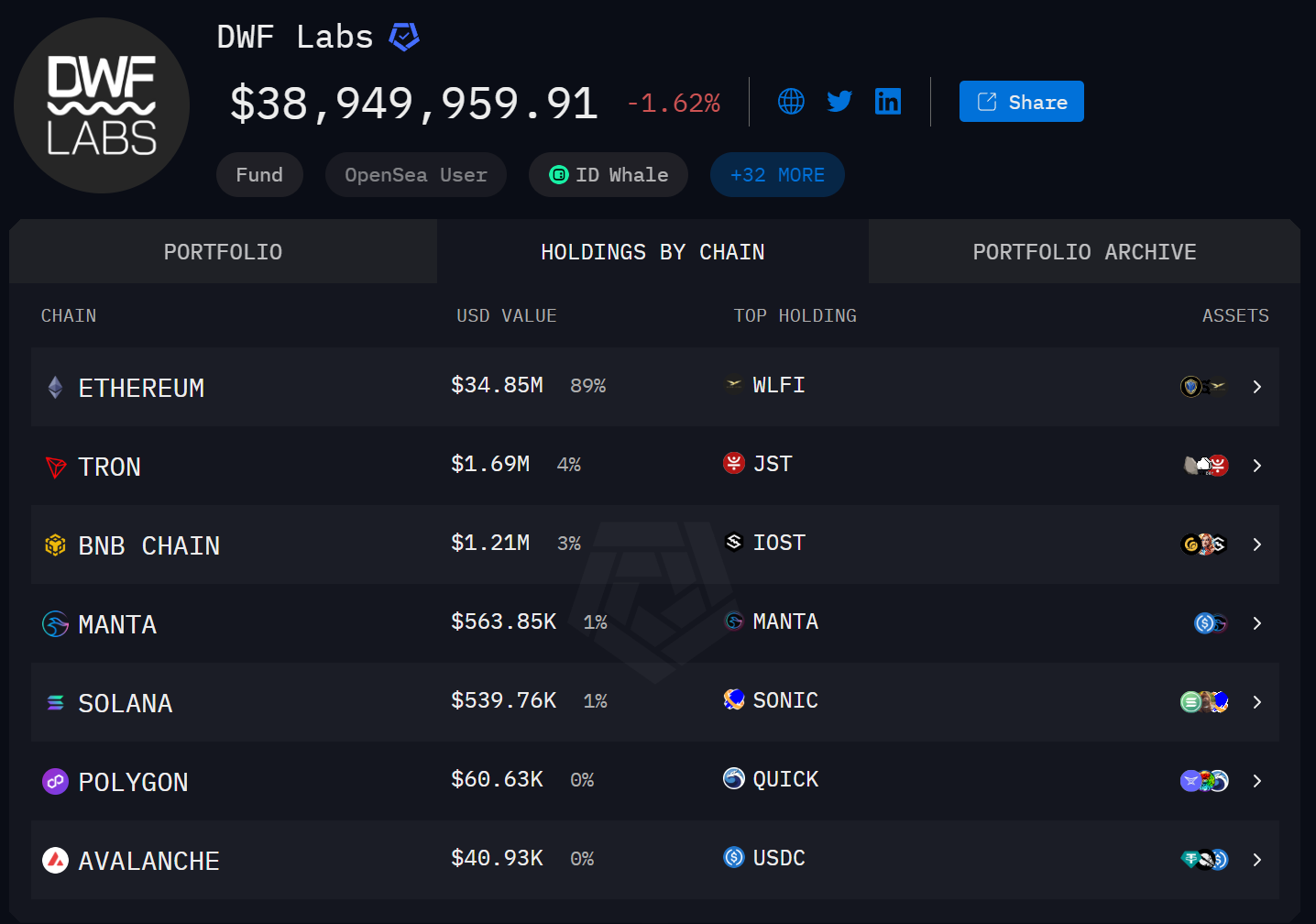

5. DWF Labs

Source: https://intel.arkm.com/explorer/entity/dwf-labs

Introduction: Driven by a dual engine of "investment + market-making," frequently active with a wide coverage of tokens. According to Arkham data, as of October 23, 2025, DWF Labs' holding scale is approximately $40 million.

Market-Making Style: Parallel strategies of new asset cold starts + secondary market-making, adept at utilizing broad coverage across exchanges and multi-chain scenarios for spread and inventory management; portfolio style balances "Beta + long-tail."

Representative Holding Tokens

Top Five Holding Assets: WLFI, JST, FXS, YGG, GALA

Hot Holding Assets: SONIC, JST, PEPE, SIREN, AUCTION, etc.

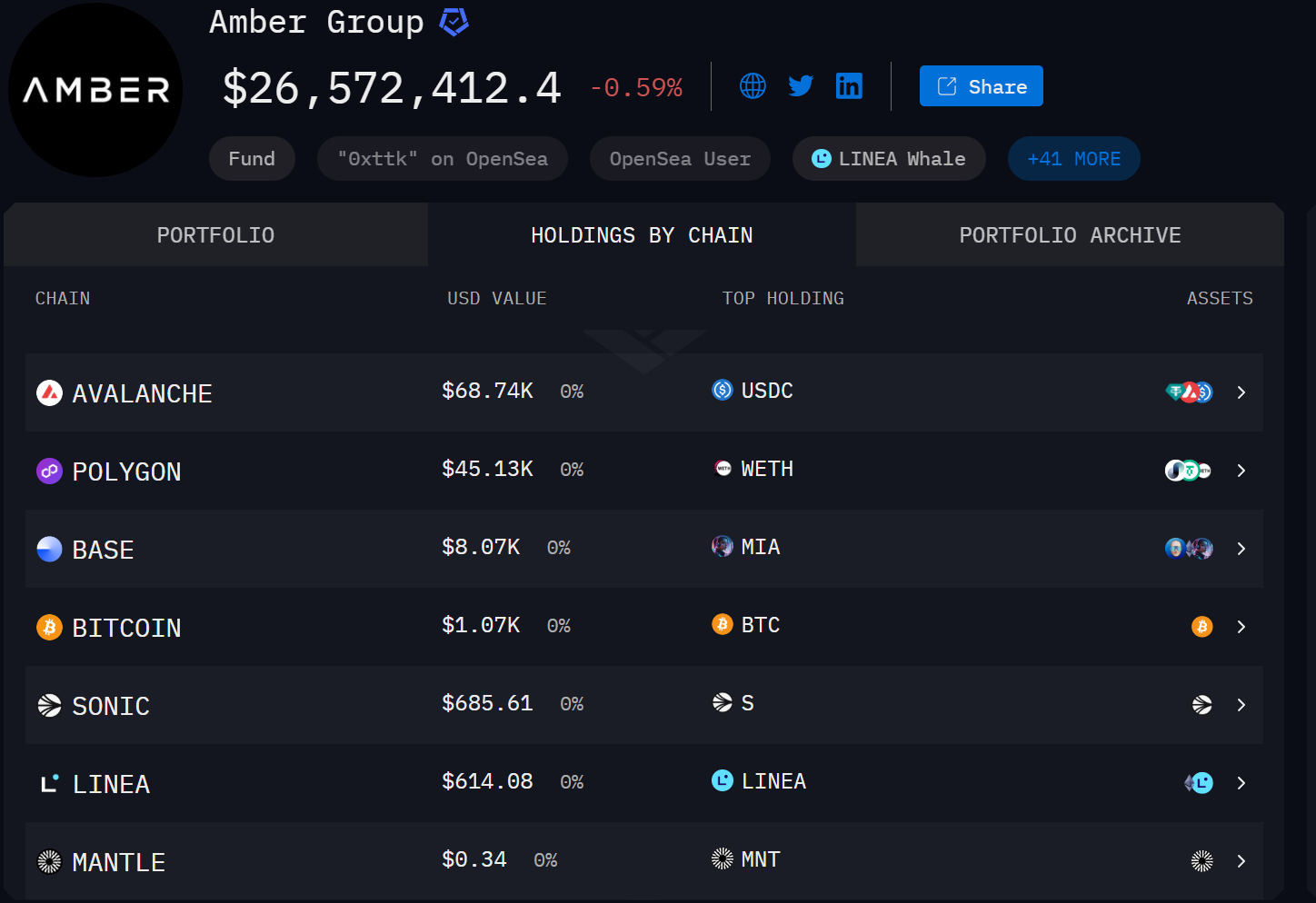

6. Amber Group

Source: https://intel.arkm.com/explorer/entity/amber

Introduction: A full-stack trading and liquidity provision institution originating in Asia with a global layout; offers market-making, derivatives, and custody/infrastructure services. According to Arkham data, as of October 23, 2025, the holding scale is approximately $26 million.

Market-Making Style: Primarily focused on "institutional market-making + project cold starts," supplemented by research-driven and event-driven strategies; often stabilizes order books and depth during TGE/initial launch phases through token lending/limits.

Representative Holding Tokens

Top Five Holding Assets: USDC, USDT, G, ETH, ENA

Hot Holding Assets: G, ENA, MNT, LINEA, YB, etc.

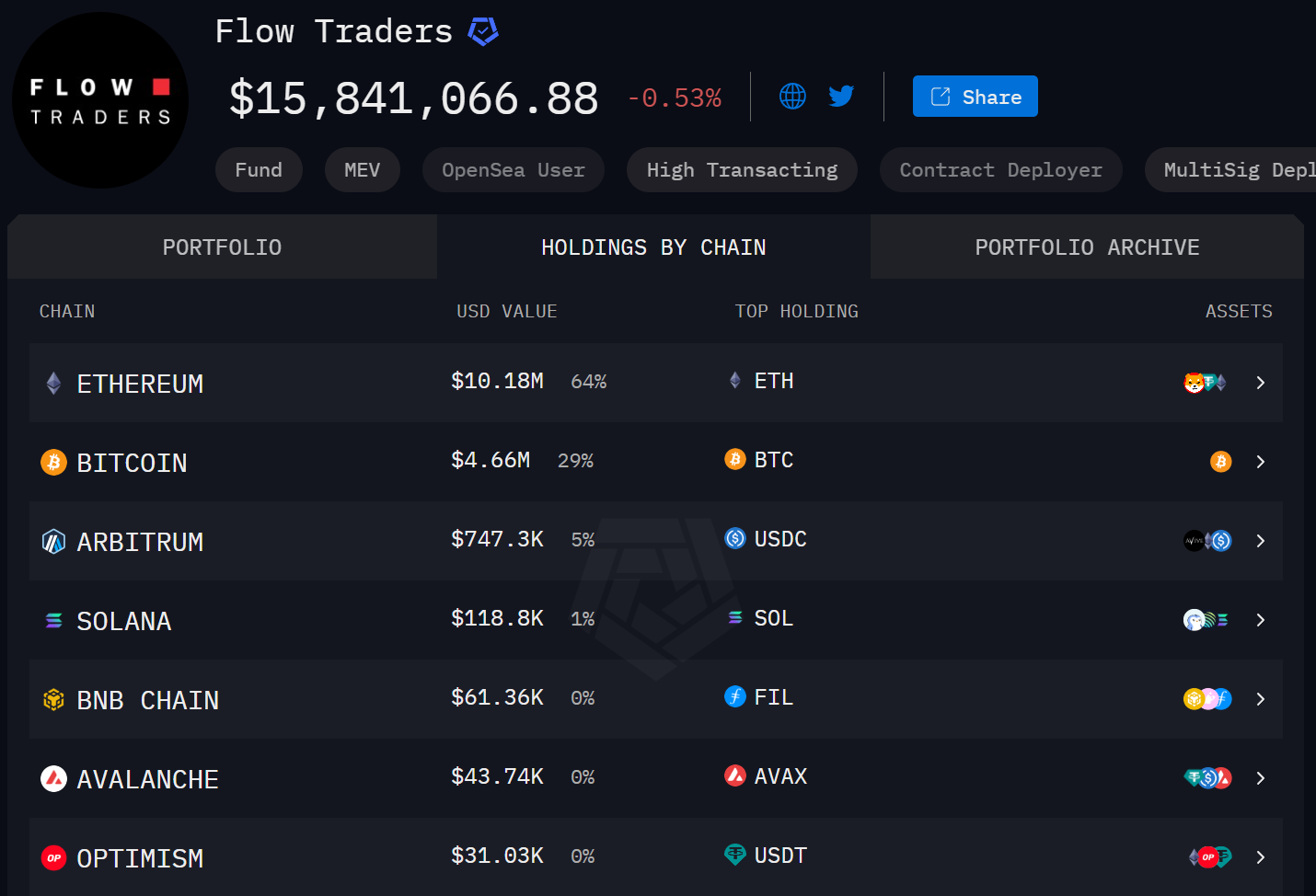

7. Flow Traders

Source: https://intel.arkm.com/explorer/entity/flow-traders

Introduction: A leading ETP/ETF market maker based in Europe, entered the crypto space in 2017, and is now one of the core market makers and risk hedgers for crypto ETPs. According to Arkham data, as of October 23, 2025, the holding scale is approximately $15 million.

Market-Making Style: Centered around on-exchange ETPs, providing continuous quotes and redemption connections for passive/active products to secondary market investors; covers over 200 crypto ETPs, with underlying assets extending to over 300 coins.

Representative Holding Tokens

Top Five Holding Assets: ETH, BTC, USDT, USDC, SOL

Hot Holding Assets: FIL, AVAX, SHIB, WLFI, DYDX, etc.

These seven market makers collectively manage and operate on-chain visible assets exceeding $1.5 billion, playing roles in depth provision, price discovery, and risk absorption across multiple exchanges and on-chain protocols. From high-frequency quant to institutional market-making, from new coin cold starts to ETF hedging, from Asia to Europe and America, these seven market makers cover nearly all mainstream and hot tokens ranked in the top 500 by market capitalization, forming the core framework of global crypto liquidity.

IV. Controversies and Conflicts Faced by Market Makers

Due to factors such as information asymmetry, misaligned incentives, and opaque contract terms, market-making can shift from a public good to a private interest game. The conflicts faced by market makers include price manipulation versus liquidity provision, rational risk control versus market volatility, and public good attributes versus profit-driven motives.

1. Conflict Between Price Manipulation and Liquidity Provision

In the early days of the crypto market, the role of market makers as "spontaneous quoting + investment + consulting" was quite common. However, this overlapping role also means that liquidity providers may face conflicts of interest: on one hand, they are responsible for providing quotes and stabilizing liquidity for projects, while on the other hand, they may hold or be allocated large amounts of tokens for sale, creating an incentive to push prices up and then cash out at lower prices. For example, the contract between Movement Labs and its designated market maker sparked serious controversy: approximately 66 million MOVE tokens (about 5% of the public circulation) were transferred to a dedicated market-making entity, and the market-making agreement included a clause allowing for sale once the market cap reached a certain level, resulting in a profit of about $38 million within a day of the token's launch.

It is evident that market makers can be both liquidity providers and tools for price manipulation; thus, any lack of transparency in market-making arrangements may be viewed as "gray area trading," eroding the trust foundation of the entire market.

2. Conflict Between Rational Risk Control and Market Volatility

Market makers' profits primarily come from spreads, rebates, and hedging gains, while risks can spike during extreme volatility. Rational profit maximization may drive market makers to prioritize self-preservation over "maintaining depth." In extreme market conditions, market makers may collectively withdraw liquidity, becoming accelerators of market collapse. The crash on October 10-11, 2025, is a typical scenario. When a risk event suddenly triggers in the market, multiple market makers' risk models (such as single-coin exposure, VaR, hedging failures, liquidity pressure thresholds, etc.) are triggered simultaneously, forcing them to choose "active exit" or "temporary reduction of orders."

Although this behavior results from rational risk control by market makers, from a macro market perspective, when liquidity providers withdraw simultaneously, the market becomes a situation with only "sell orders" and no "effective buy orders," leading to a "drained" depth, making ordinary market orders easily consumed, and transaction prices deteriorate instantly. The forced liquidation system triggers more position liquidations, creating a second-level chain reaction, further driving prices down, and market makers' risk control thresholds are triggered again, resulting in a vicious cycle that ultimately leads to a waterfall decline. In other words, the market collapse is not due to "excessive selling," but rather "weak buying."

3. Conflict Between Business Expansion and Depth

As the total number of crypto tokens grows exponentially and the narrative lifecycle shortens, market makers face unprecedented structural challenges. The past high-frequency market-making model centered around mainstream coins and a few exchanges now has to cope with a multi-chain, multi-asset, and fragmented trading ecosystem. Although leading institutions have advantages in algorithms and capital scale, their models are often designed around high liquidity coins like BTC and ETH, making it difficult to quickly replicate to hundreds or thousands of new tokens. For market makers, the biggest challenge is no longer "can they be profitable," but "how to expand service boundaries without sacrificing depth."

Market-making essentially requires a triad of investment in capital, computing power, and data, but these resources become scarce during rapid market expansion. To cover more assets, market makers must enhance automation and strategy reuse rates—improving response speed when new assets are listed through unified market-making engines, cross-chain algorithm routing, and AI parameter scheduling. However, this scale expansion inevitably comes with risk spillover: delayed strategy migration leads to distorted quotes, amplified volatility in low liquidity coins, and increased difficulty in position management.

4. Conflict Between "Public Good" and Profit-Driven Motives

Market-making is essentially private capital providing public liquidity: it reduces friction for all traders and enhances price discovery, yet individual institutions bear inventory and tail risks. Project and market-making contracts often include terms for borrowing tokens, rebates, and exit thresholds, and KPIs may focus on "price/market cap" rather than "sustainable depth," inducing "push price—dump" behavior.

When there is insufficient disclosure and constraints, market-making may deviate from the role of liquidity providers, degrading from a public good to a timing-based supply. They can stabilize the market, but they can also become points of liquidity fracture.

V. Future Direction: From "Invisible Depth" to "Institutionalized Liquidity"

The true vulnerability of the crypto market lies not in the scale of funds or volatility itself, but in the uncertainty of "who provides liquidity and when they will withdraw." As the number of tokens surges and narratives accelerate, the role of market makers is being forced to evolve: from quantitative teams serving only mainstream assets to a distributed liquidity network covering thousands of tokens, cross-chain assets, and stablecoins. The future challenge is not only "how to do more," but also "how to do it more steadily, transparently, and compliantly."

1. Information Symmetry and Disclosure Transparency

For the market-making ecosystem to be truly healthy, information transparency is the baseline. The collaboration between project parties and market makers should not remain at the vague slogan of "liquidity support," but should achieve institutionalized contract disclosure:

Disclose the core terms of market-making contracts, including limits, token lending quantities, rebate ratios, and exit conditions;

Disclose the list of main market makers and address whitelists, allowing the public to verify the true source of orders;

Regularly publish depth data, spread changes, and market-making efficiency indicators (such as order response time, cancellation rate, and fill rate).

For exchanges, market maker behavior should also be included in routine monitoring: monitoring for abnormal spreads, concentrated positions, and unusual cancellation speeds; if signs of manipulation such as "fake orders," "self-trading," or "circular trading among related accounts" are found, they should have the power to suspend or downgrade. In the future, blockchain explorers and analysis platforms can further standardize these indicators, forming a publicly assessable "liquidity quality score." When market participants can visually see which market maker "provides the most stable depth and fastest response," market-making will no longer be a black box, but a competitive and auditable service.

2. Circuit Breaker and Recovery Mechanism

In extreme market conditions, self-preservation by market makers is a rational choice, but the market needs "system-level buffering devices." Therefore, circuit breaker and recovery mechanisms will become an important direction for institutionalization in the crypto market.

When major market makers trigger risk control exits, exchanges or protocol layers should automatically initiate a "backup market maker access mechanism," where a pre-registered pool of market makers sequentially replaces the exiting ones, ensuring that depth does not evaporate instantly; at the same time, combined with the depth replenishment plan of the matching engine, smooth transitions at critical price points can be achieved through algorithmic limit orders or virtual orders.

Additionally, a layered liquidity circuit breaker similar to traditional finance can be introduced:

Mild Stage: When spreads become excessively wide or depth falls to a warning threshold, pause matching for 3-5 seconds and restrict market orders;

Moderate Stage: When multiple market makers exit and market depth falls below 30% of historical averages, suspend transactions and broadcast risk control announcements;

Severe Stage: The platform or on-chain governance contract temporarily takes over the support orders until new market makers are restored.

The goal of this multi-layered protective design is not to "force market makers to stay," but to prevent the market from falling into a vacuum the moment they withdraw.

3. Balancing Efficiency and Risk Control

As the total number of tokens in the crypto market grows exponentially and the narrative half-life continues to shorten, traditional high-frequency market-making models clearly cannot cover all assets. For market makers, the biggest challenge is how to expand the range of quotes without distorting risk control.

One of the future solutions is RFQ 2.0 and intent-based matching. Such systems allow users to issue "intents," which different market makers or "solvers" then compete to respond to, greatly enhancing the matching efficiency of long-tail assets. For example, intent-based matching protocols like CowSwap and UniswapX have already provided the infrastructure for "distributed market-making" at the technical level.

On the other hand, the relationship between project parties and market makers must also shift from implicit incentives to transparent cooperation. Currently, many new tokens still rely on gray arrangements of "token lending + market-making rebates," which provide short-term liquidity convenience but also harbor risks of price manipulation. In the future, both parties should replace hidden subsidies with on-chain contract-based inventory incentives: every token lending, order placement, and recovery should be recorded on-chain, clearly stating terms and time windows to avoid the perception of "subsidy—pump—dump."

4. Multi-Dimensional Regulation and Self-Discipline: Professionalization and Accountability of Market Making

As the crypto market integrates with traditional finance, market makers will gradually fall under clearer regulatory frameworks. Regulation should not only focus on "manipulation" or "insider trading," but also establish a "market-making license + behavior record" system.

After obtaining a market-making license issued by exchanges or regulators, institutions must sign liability clauses and accept regular reviews;

Market-making behavior records (including cancellation rates, abnormal spreads, and triggered circuit breaker counts) should be archived on-chain and be auditable;

Non-compliant or high-risk behaviors (such as abusing rebates or failing to disclose self-trading) will trigger "gray lists" and suspension mechanisms.

Additionally, the industry should also promote self-discipline: establish a market-making industry association or alliance to unify SLA standards and disclosure templates; introduce third-party data audits, publish quarterly "market-making performance rankings," and incentivize transparency and robust operations. Only when market-making is viewed as a "profession that can be assessed and held accountable" will liquidity no longer depend on trust, but truly become a regulated infrastructure.

Conclusion

Over the past decade, the liquidity of the crypto market has mainly relied on a small group of algorithm teams; in the next decade, it will be supported by institutions, data, and trust. The boundaries of market makers are also being reshaped—they are no longer just operators of "invisible depth," but co-builders of transparency, robustness, and accountability. When on-chain data platforms make market-making behavior "visible," when circuit breaker mechanisms teach the market to self-heal, and when disclosure systems and regulatory frameworks hold liquidity providers to greater obligations, the crypto market can truly transition from "flash depth" to "institutionalized liquidity." At that time, prices will no longer be driven by isolated trades, but will be supported by a transparent liquidity network; and market makers will evolve from being questioned as "behind-the-scenes manipulators" to trusted "market infrastructure operators."

About Us

Hotcoin Research, as the core research institution of Hotcoin Exchange, is dedicated to transforming professional analysis into your practical tools. Through "Weekly Insights" and "In-Depth Reports," we analyze market trends for you; leveraging our exclusive column "Hotcoin Selection" (AI + expert dual screening), we help you identify potential assets and reduce trial-and-error costs. Every week, our researchers also engage with you face-to-face through live broadcasts, interpreting hot topics and predicting trends. We believe that warm companionship and professional guidance can help more investors navigate cycles and seize the value opportunities of Web3.

Risk Warning

The cryptocurrency market is highly volatile, and investment itself carries risks. We strongly recommend that investors conduct investments based on a full understanding of these risks and within a strict risk management framework to ensure the safety of funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

[Mail: labs@hotcoin.com](mailto:Mail: labs@hotcoin.com)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。