Written by: Eric, Foresight News

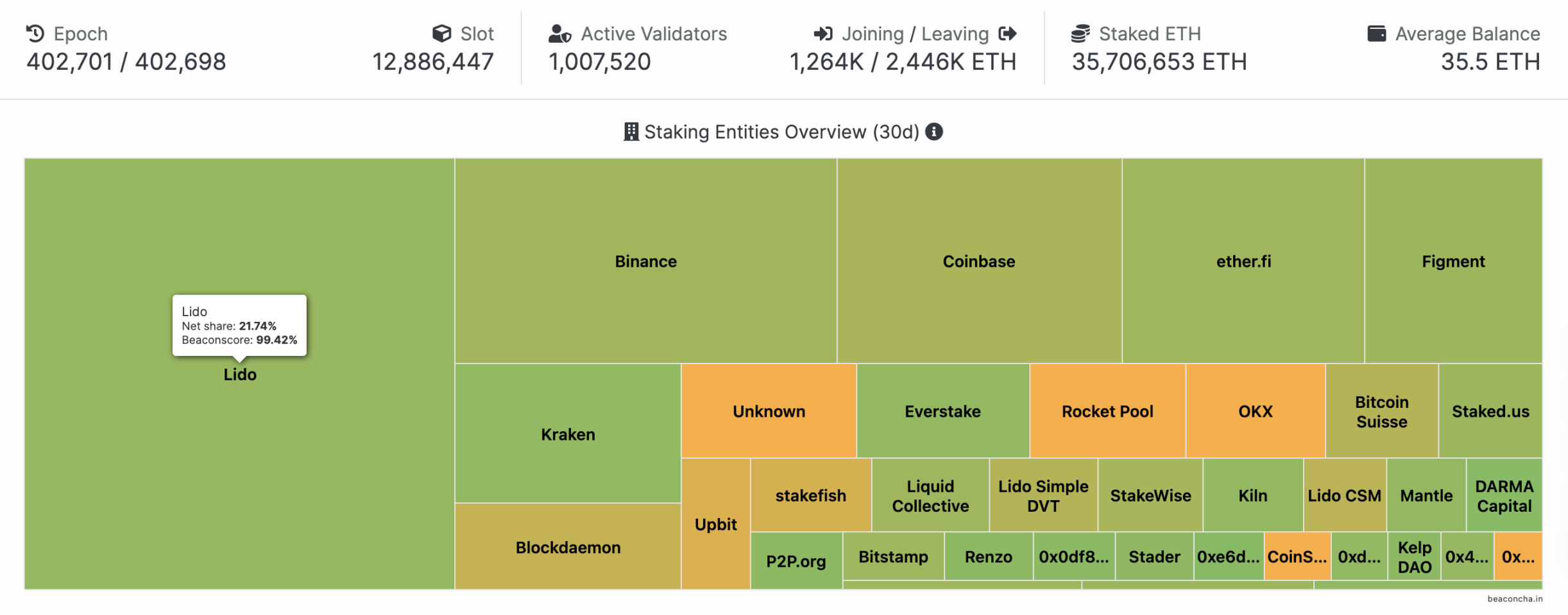

Unknowingly, the total amount of Ethereum staked has reached around 35 million ETH (there may be some discrepancies among different data statistics websites). It took about a year for this number to grow from 15 million to 25 million, but it took twice as long to increase from 25 million to 35 million. It can be anticipated that, over time, the amount of Ethereum staked may enter a period of dynamic balance between staking and unstaking after reaching a certain upper limit.

The above image comes from the open-source browser beaconcha.in launched by BitFly, the developer of the once largest Ethereum PoW mining pool, EtherMine. This Ethereum ecosystem development company based in Austria has developed several browsers, one of which is ethernodes.org, a data website related to Ethereum execution layer and consensus layer node information. The data cited regarding a large number of Ethereum nodes being hosted on AWS comes from this website.

Two years ago, over 60% of the hosted nodes were based on AWS. Today, both the distribution of nodes and the cloud service providers used have changed significantly. (All data below is as of the time of writing and excludes unsynchronized nodes.)

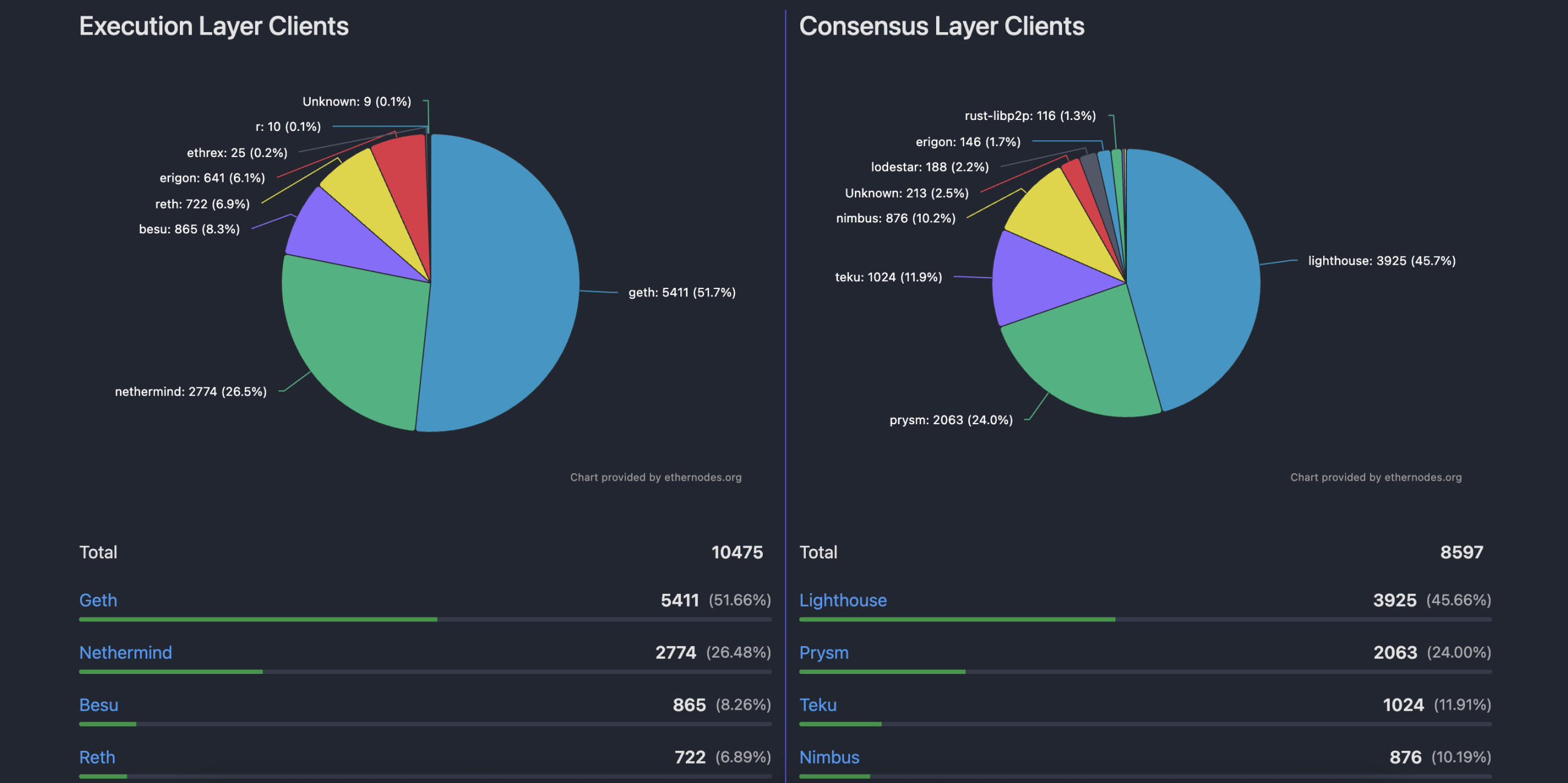

What clients are the nodes using?

Among the 10,475 execution layer nodes counted, Geth accounts for 51.66%, which still presents a problem of excessive concentration. The client Nethermind, developed under the leadership of Tomasz Stańczak, the newly appointed executive director of the Ethereum Foundation, follows closely with a share of 26.48%. The client Besu, originally developed by ConsenSys and later migrated to the Hyperledger Foundation GitHub repository in 2019, accounts for 8.26%. Erigon, originally known as Turbo-Geth and led by UK developer Alexey Akhunov, has a share of 6.1% and has been surpassed by Reth, launched by Paradigm, which accounts for 6.89%.

Reth has always been controversial in the Ethereum community. Yearn core developer Banteg has stated that Reth heavily borrows from Akula (a Rust implementation client) and replicates the Erigon architecture, but Paradigm has not supported these developers. Although Paradigm CTO Georgios Konstantopoulos responded that Reth "stands on the shoulders of giants," the community did not buy it, viewing it as a form of VC-style resource plundering. This incident also led the Akula developers to announce they would no longer maintain the project, believing they could not compete with Paradigm.

Just a week ago, Ethereum core developer Federico Carrone also warned on X that Paradigm's expansion as a profit-driven company (such as hiring key researchers, funding open-source libraries, leading EIPs, and Reth) poses a threat to Ethereum's decentralization, but Ethrex, which he leads, has only a 0.2% share among execution layer clients.

As for the consensus layer clients, among the 8,597 consensus layer nodes counted, the highest share is held by Lighthouse, founded and continuously maintained by the Australian security company Sigma Prime, reaching 45.66%. Prysm, which was initially developed and maintained by the blockchain infrastructure company Prysmatic Labs and acquired by Arbitrum developer Offchain Labs in 2022, accounts for about 24%. The third-ranked Teku has an 11.91% share and is developed by the same team as Besu. Nimbus, which relies solely on funding from the Ethereum Foundation and others, accounts for 10.19% and aims to improve resource efficiency, allowing node operators to easily run Ethereum client software on resource-constrained devices (such as mobile phones and laptops).

In the Ethereum network, the top four execution layer and consensus layer clients account for 93.29% and 91.76%, respectively, still showing a strong concentration. However, compared to the more exaggerated levels of concentration two or three years ago, the Ethereum Foundation's efforts to promote client diversification have had some effect.

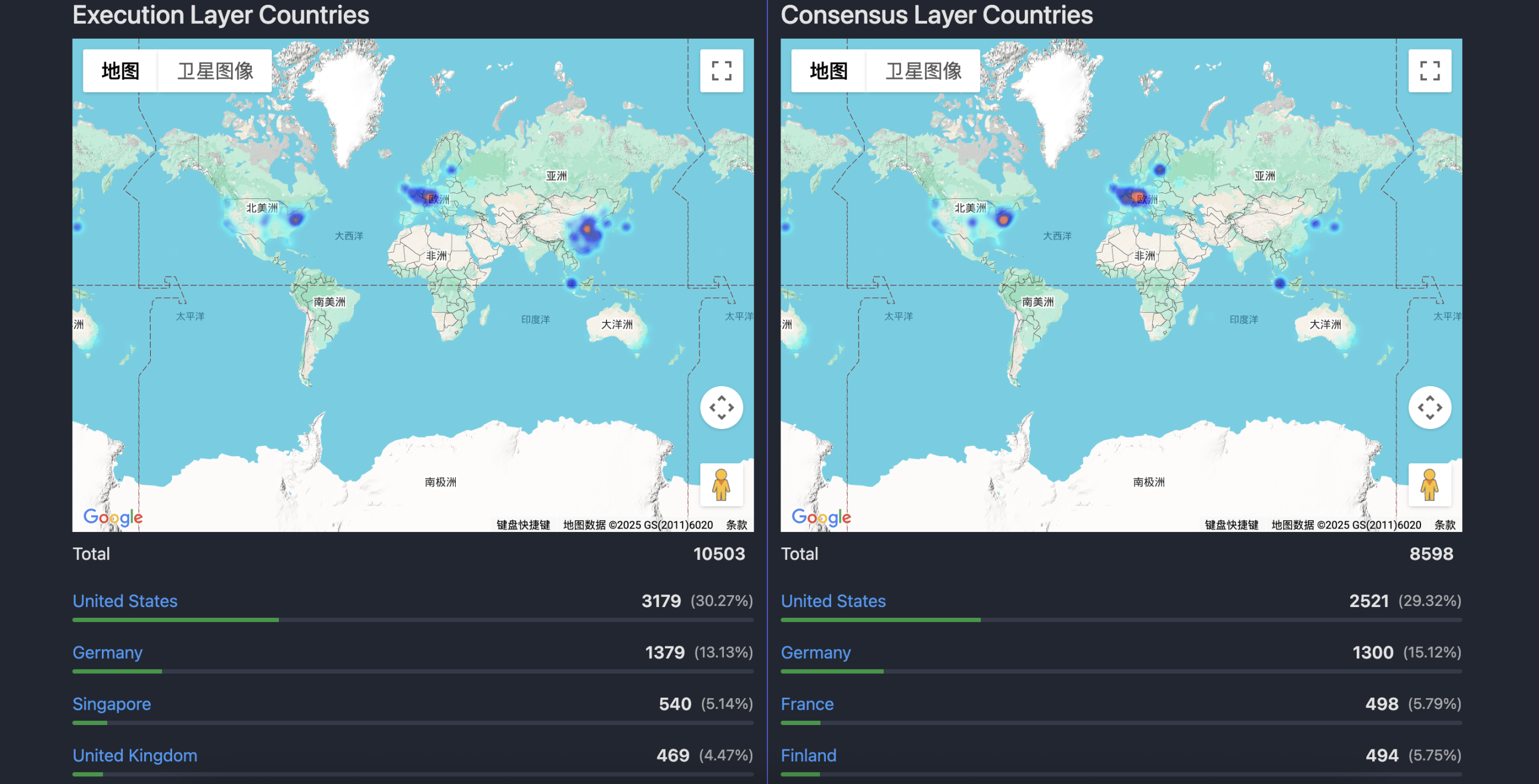

Where are the nodes located?

The location of Ethereum execution layer and consensus layer nodes is very difficult to accurately identify. The website likely determines the location through IP analysis, which may not be very precise, but it does provide a rough outline of the distribution.

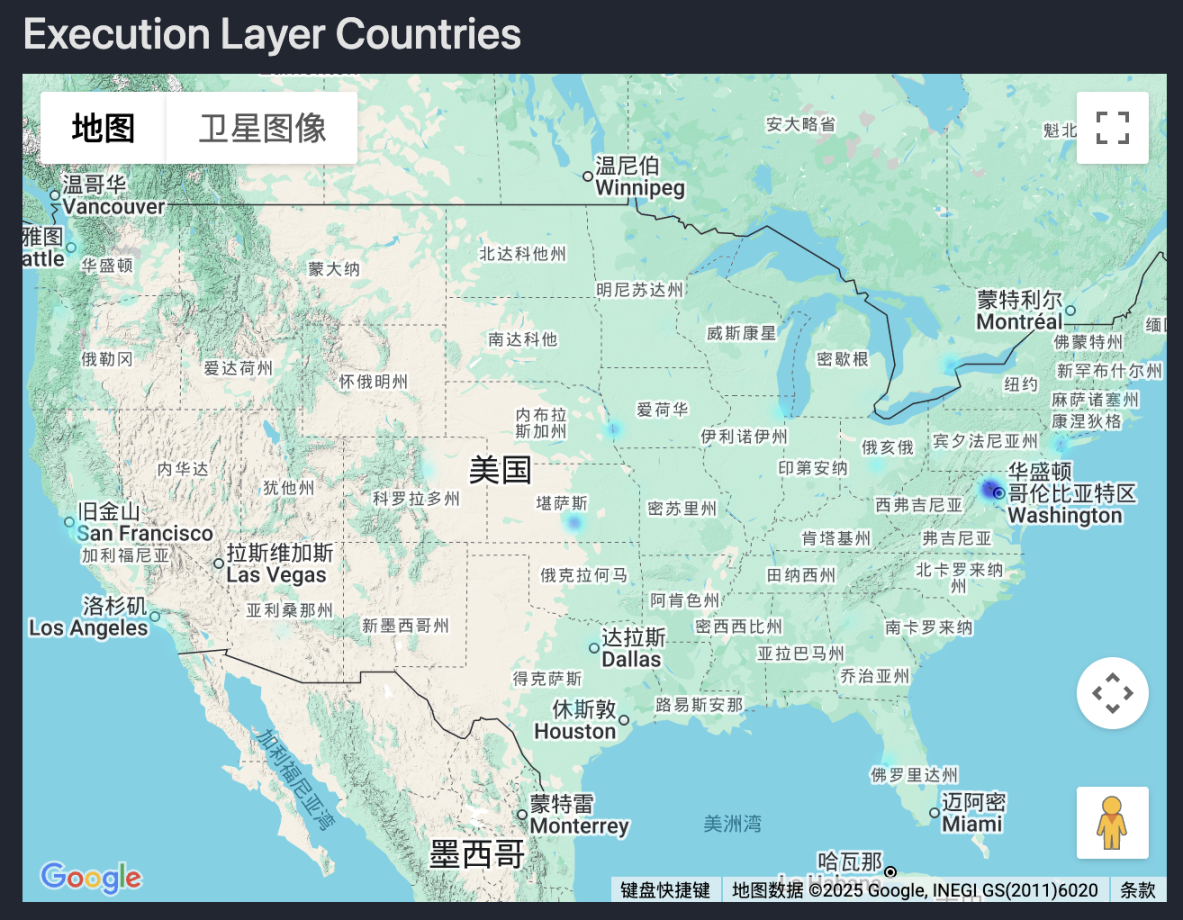

Among the nodes running execution layer clients, over 30% of IPs are located in the United States, with the densest distribution near Washington, D.C. Additionally, there are some distributions in cities like San Francisco, Los Angeles, and New York, while the remaining nodes are scattered across Kansas, Iowa, Texas, Florida, Massachusetts, and other areas.

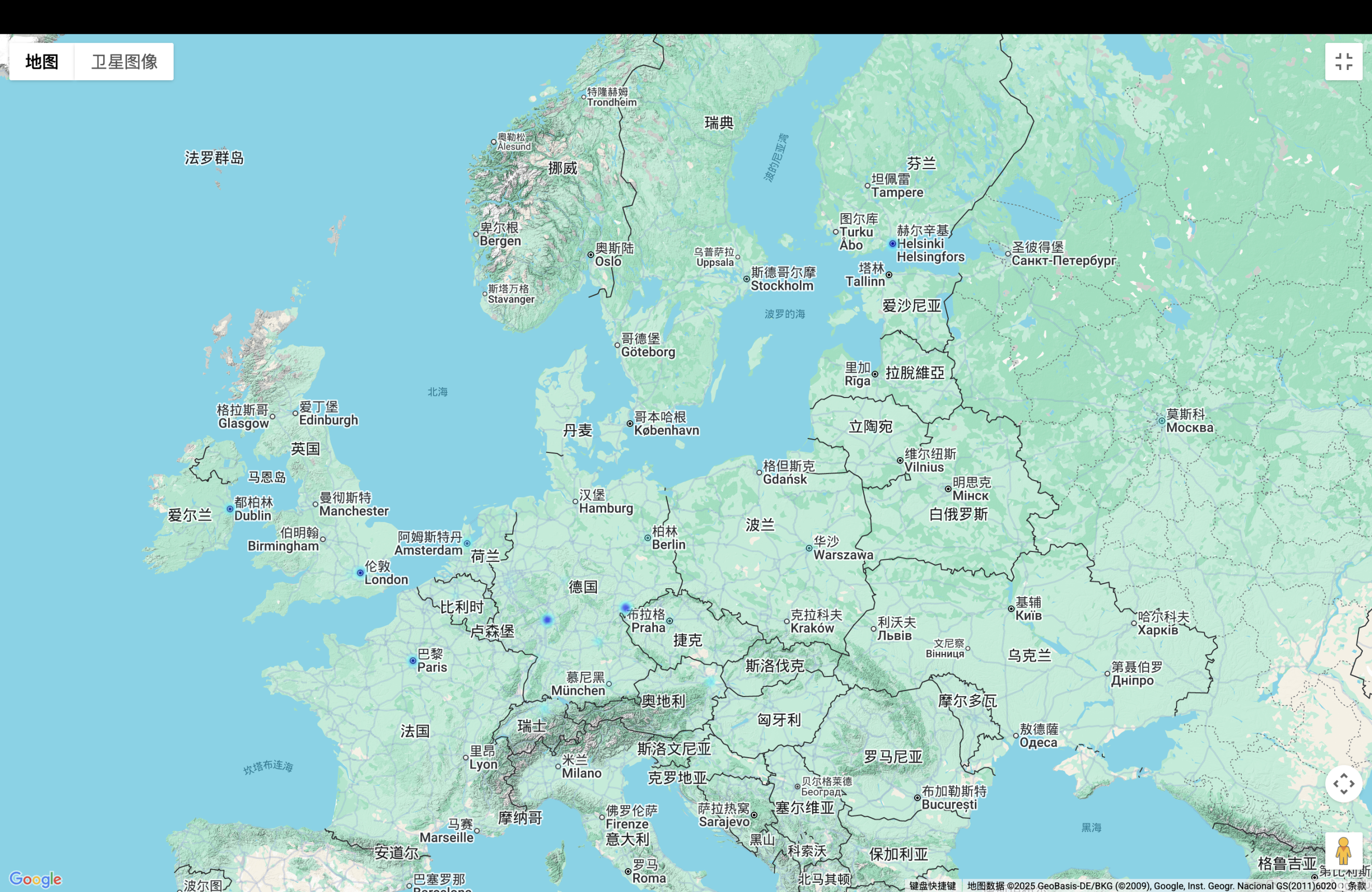

In Europe, data shows that Germany accounts for 13.13%, the UK for 4.47%, France for 4.28%, and Finland for 3.78%. On the map, nodes are also primarily distributed in the core cities of various countries, including Dublin in Ireland, Paris in France, Frankfurt in Germany, and Helsinki in Finland.

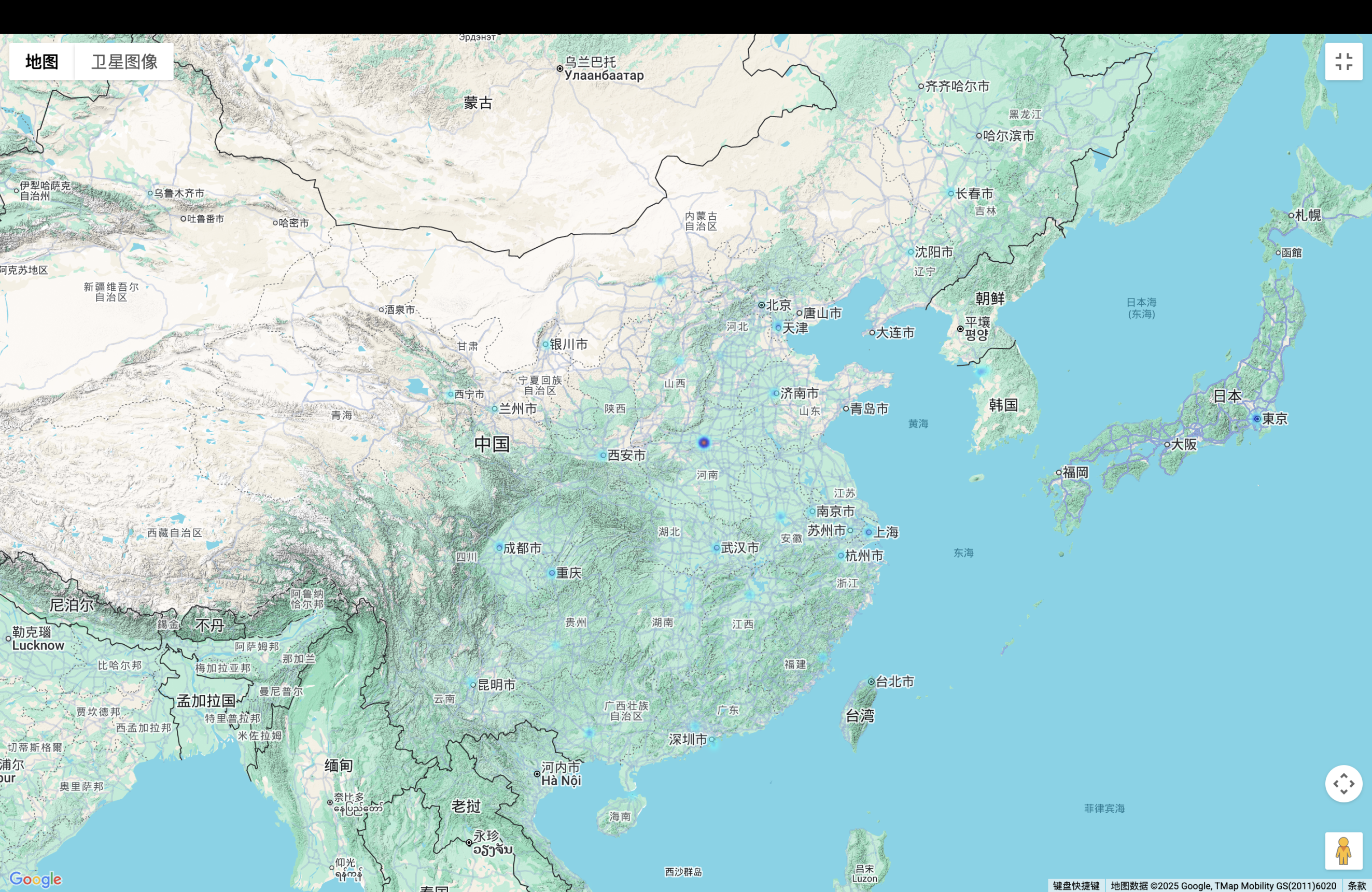

Nodes located in China account for less than 4%, but are widely distributed, from Changchun in Jilin Province in the north to Hainan in the south, from Xining in Qinghai Province in the west to coastal cities like Shanghai and Taiwan in the east. Notably, according to IP addresses, there are 103 nodes in Hong Kong and 97 in Taiwan, while other regions in China total only 204 nodes. The most concentrated distribution is in the darkest point on the map, located in Zhengzhou, Henan Province.

As for the distribution of consensus layer client nodes in North America and Europe, it is basically similar to that of execution layer client nodes. In China, although there are still dozens of nodes according to the data, there is no significant display on the map. In terms of regional distribution, the United States and Germany rank first and second in both execution layer and consensus layer nodes, but Ethereum nodes exist globally, including in small countries like Guatemala, Kuwait, and Montenegro, and even in the far north in Iceland.

What cloud services are the nodes using?

"The half of Ethereum nodes are using AWS" has become a well-known joke in the industry. While there may have been a significant number of nodes hosted on cloud services a few years ago, this situation has greatly improved.

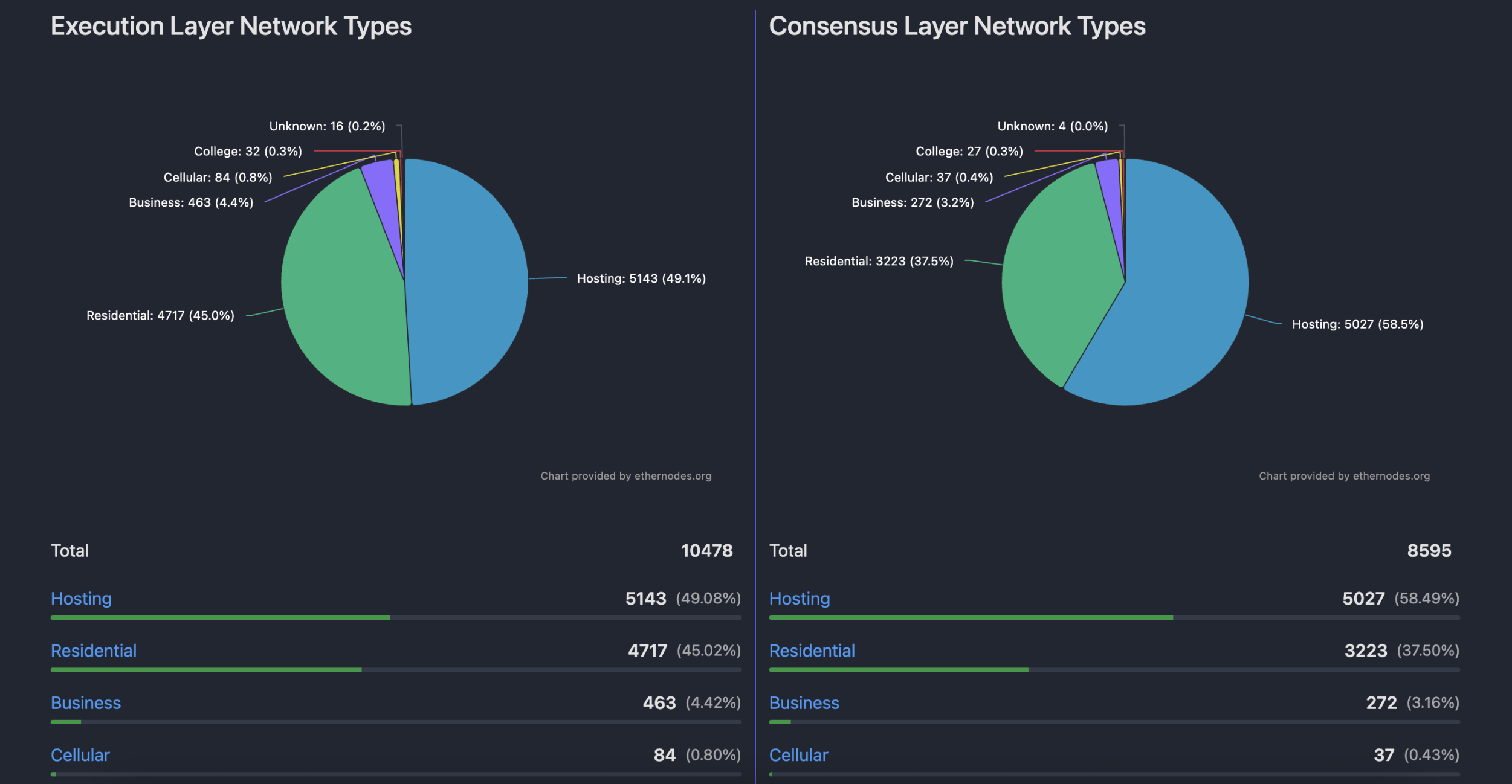

Among the nodes running execution layer clients, 49.1% are hosted, while 45% are self-built; consensus layer client nodes may have a higher hosting percentage of 58.5% due to the need for stability to prevent penalties, but self-built nodes closely follow at 37.5%. Besides the nature of the nodes, there are many interesting detailed data points.

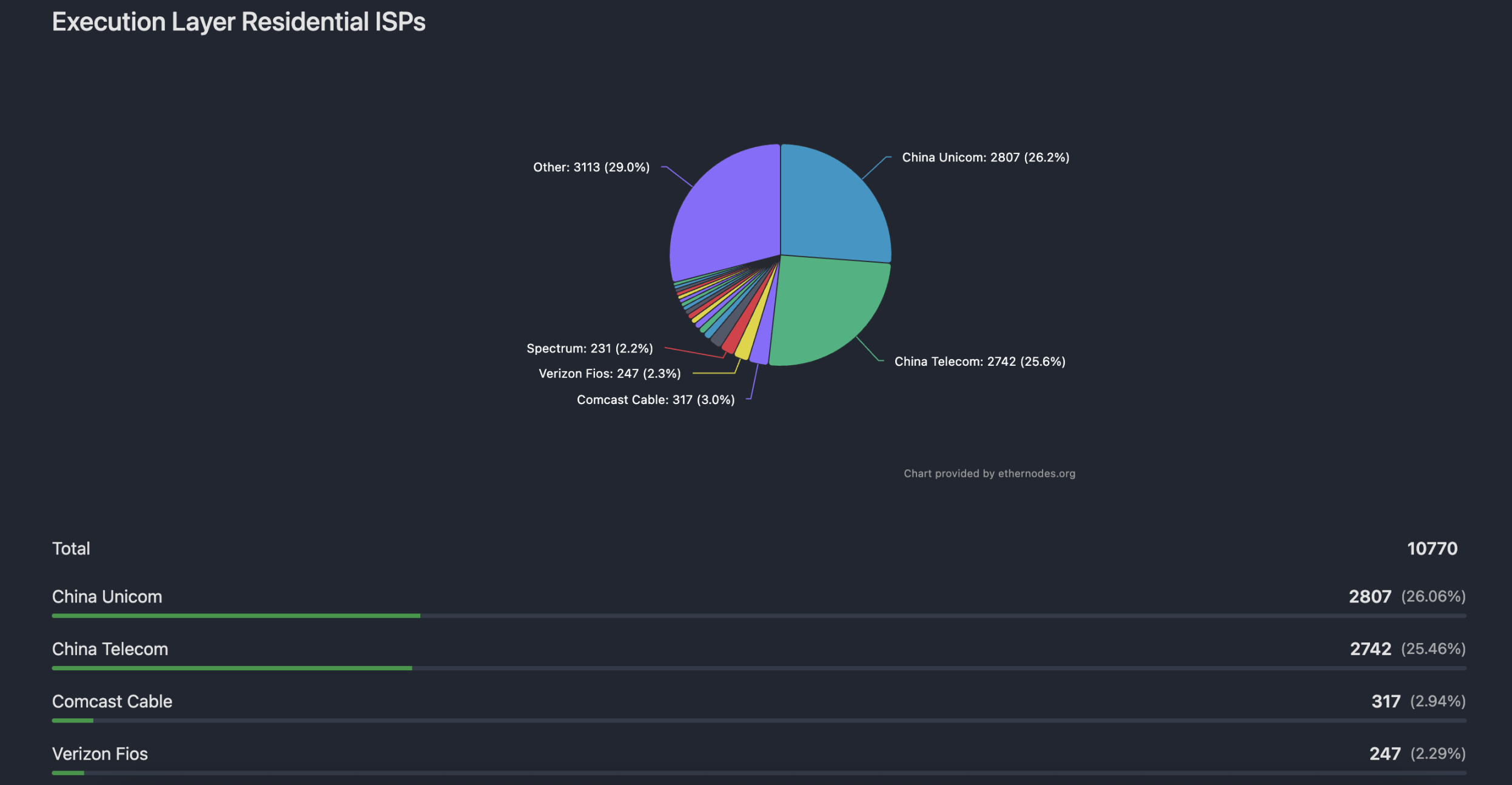

First, among the internet service providers for self-built nodes running execution layer clients, China Unicom and China Telecom together account for 51.52%. This also includes China Unicom's Industrial Internet backbone network, China Mobile, the China Education and Research Network, China Unicom (Shenzhen), China Telecom's Yunnan IDC1 network, China Telecom Group, and Beijing Baidu Netcom Technology Co., Ltd.

Thus, it appears that over 20% of execution layer client nodes are running domestically, but may be using overseas IP addresses. In contrast, very few execution layer client nodes use domestic network operators. Given that operating execution clients does not yield stable income, I speculate that the high proportion is mainly used to meet the needs of RPC nodes, development, on-chain high-frequency trading, or strategy trading that require quick transaction broadcasting, indicating that the domestic market remains an important area for on-chain activities.

As for the data on hosted nodes using various cloud services, it aligns relatively well with the regional distribution.

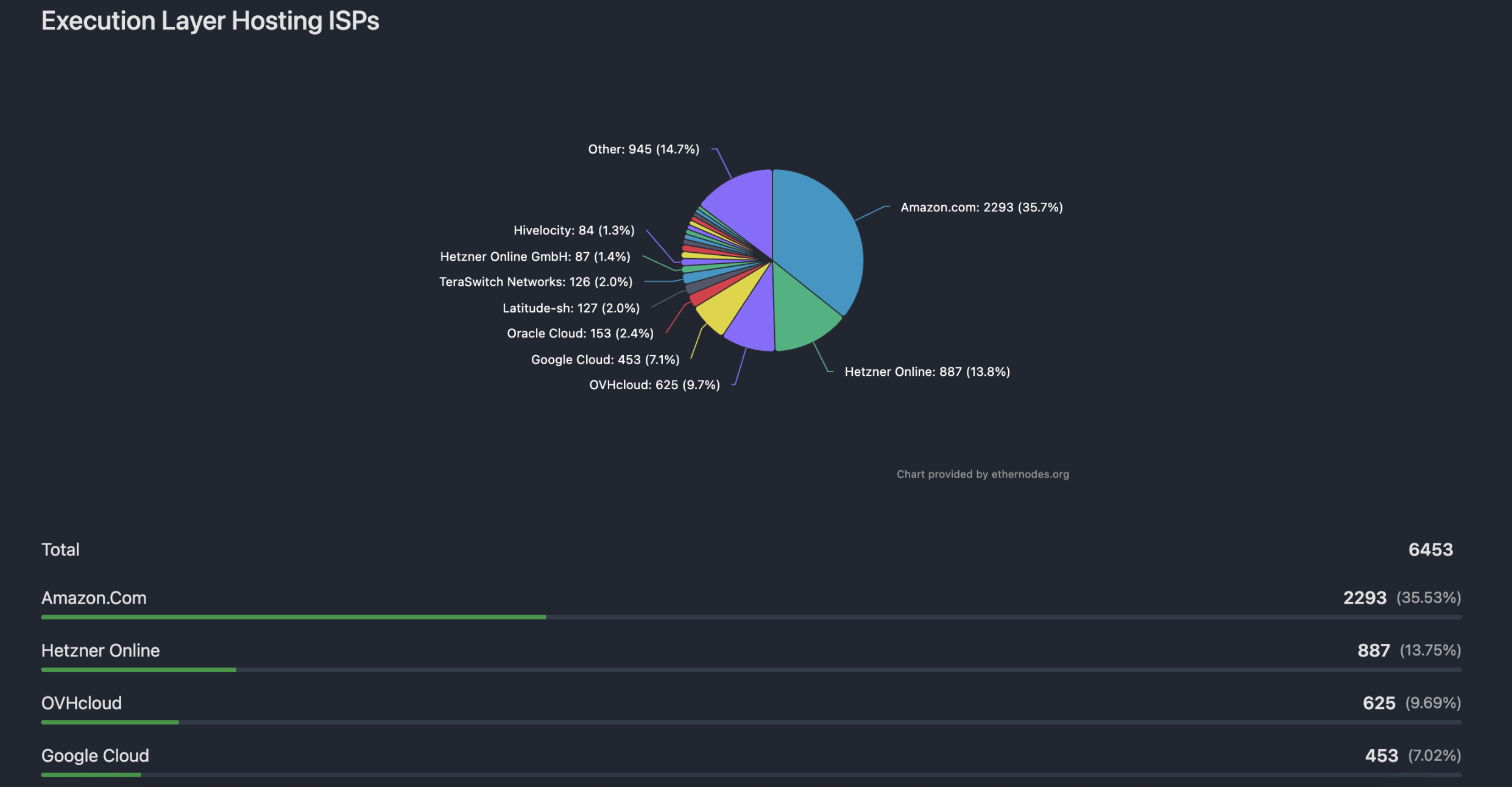

Among the hosted execution client nodes, 35.53% chose AWS, 13.75% chose the German hosting provider Hetzner Online, 9.69% chose the French cloud service provider OVHcloud, and Google Cloud (7.02%) and Oracle Cloud (2.37%) ranked fourth and fifth, respectively, which corresponds with the regional distribution primarily concentrated in the United States and Europe. The distribution of consensus layer client nodes is similar, with these five service providers also occupying the top five spots. Additionally, Alibaba Cloud, Tencent Cloud, and Huawei Cloud are also included, but their proportions are very small.

Based on this calculation, the proportion of nodes hosted on AWS is roughly around 20%, which is a reasonable figure.

Overall, the more than 10,000 nodes running execution layer clients and nearly 9,000 nodes running consensus layer clients show no excessive dominance in terms of regional distribution, network services, or hosting service providers. The only area of concern is the high concentration in client selection, but the proportion of leading clients is gradually decreasing, and Ethereum's dream of being a "world computer" is gradually being realized under the foundation's efforts to promote decentralization.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。