昨天我们讲到,行情步入震荡,通过我们的观察,今天依旧保持震荡行情的看法,因为下跌趋势被破坏了。虽然下跌趋势被破坏了,但是我们开的两单空单都盈利了。

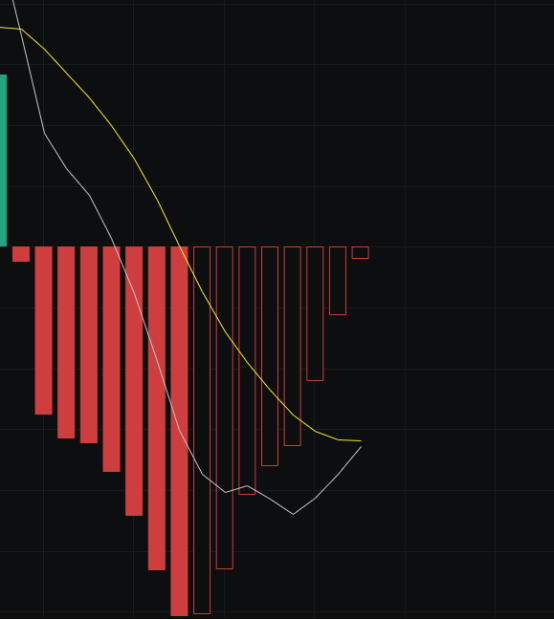

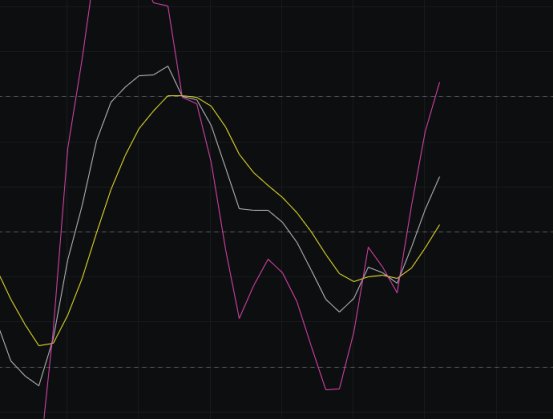

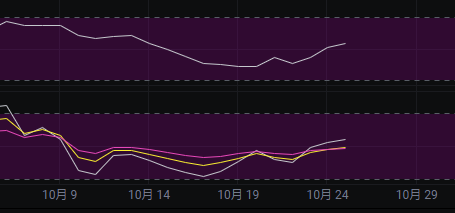

Macd上看,能量柱回升到了零轴附近,快线和慢线即将金叉。不过这里也有不确定性,能量柱能否站上零轴,快线和慢线金叉后能否继续上攻,如果不能那行情还会在这里下跌。

Cci上看,前两天我们都提到,cci要想靠近零轴,就需要连阳或者大阳线才行,今天看连续3天阳线了,cci也逐渐靠近零轴了,这里走势利于多军,但还是要看能否站上零轴。

Obv上看,随着连续3天的阳线,obv有了一定上涨,同时慢线也趋向于走平了,但要想看多还需要快线和慢线形成金叉才行。

Kdj上看,kdj金叉后继续向上,前两天我们就提示了kdj的走势,让做空的一定要带好止损,现在看是正确的,毕竟行情已经连续3天阳线了。

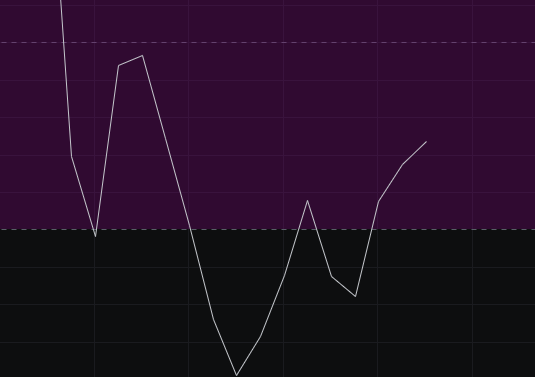

Mfi和rsi上看,两个指标同时向上走,这里多头趋势明显,做空的一定要带好止损。

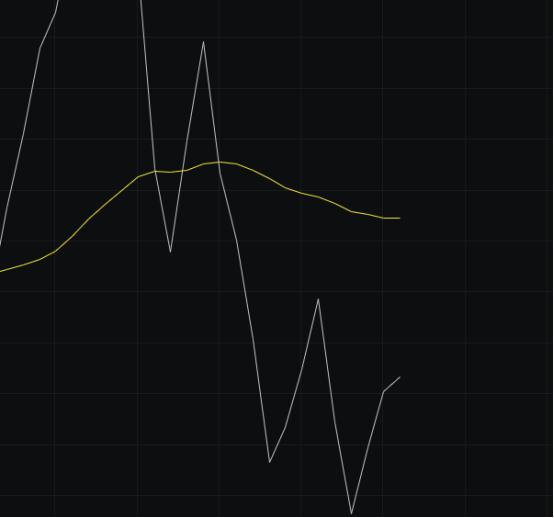

均线上看,目前价格已经站上了bbi,同时30和120死叉后30又开始向上走,如果这里30继续向上和120发生金叉,那我们就要改变看法了,这里我们就看30和120能否金叉。

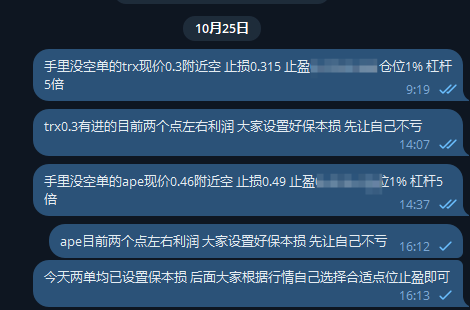

Boll上看,boll由下跌通道过渡到了宽幅震荡,所以价格打至中轨是符合逻辑的,到了中轨我们再看价格是收到中轨压制还是突破中轨继续向上,如果收到压制可以继续拿空,如果突破中轨向上空单就要及时离场了。

综上:由于boll进入了宽幅震荡,所以后续两天我们保持震荡行情的看法,主要看价格能不能站上中轨。压力看113000-115000,支撑看110000-107500.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。