🧐四年周期或许已经死了,但是周期肯定没有死!因为“人性的周期”从未停止。

很多人又开始怀疑熊市来了,1011大爆仓对市场造成的影响是不可修复的,是不是从此开始就又要进入漫长的熊市,

当然也有部分人对现在还是牛市信心慢慢,因为按照四年周期,现在并未走完,至少要到2026年才算基本模型。

那么到底哪个观点对?

按下不表!

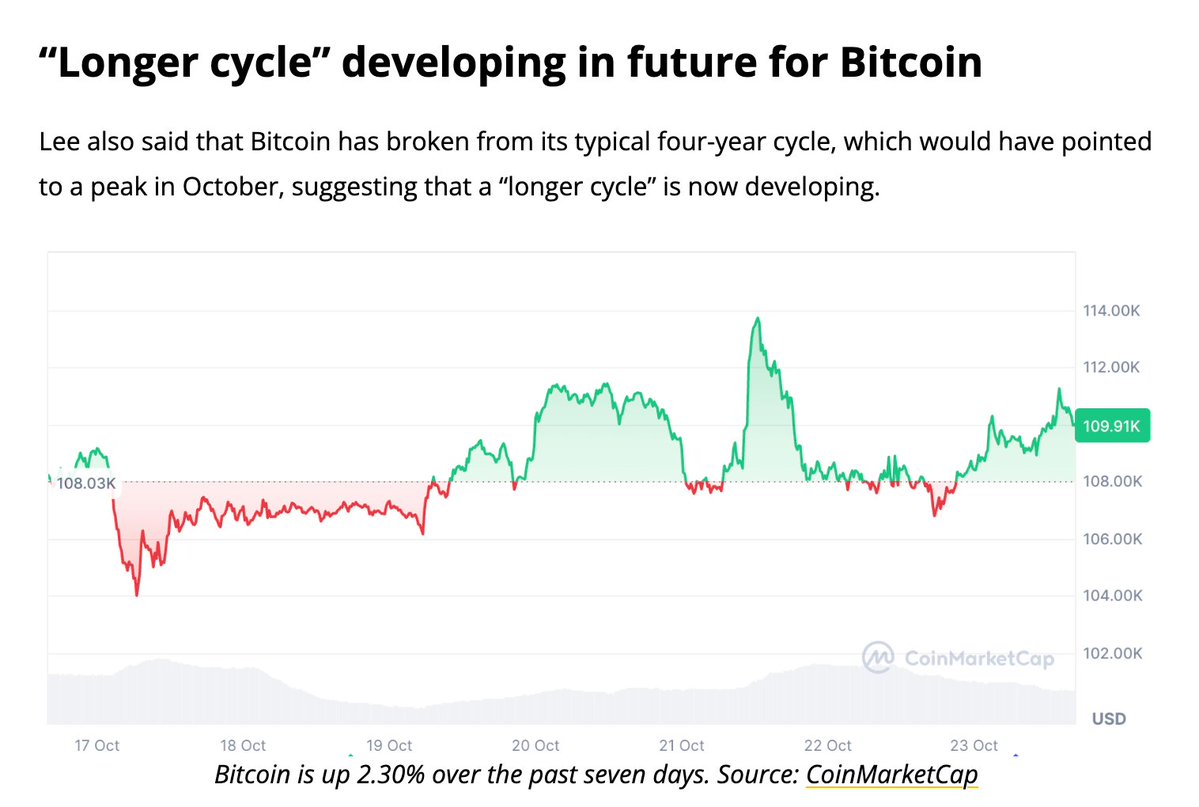

Tom Lee 最近的一句话挺刺耳的:

“即使华尔街爱上了比特币,它依然可能暴跌 50%。”

这句话来自他和 Pompliano 的对话。

这里不可避免再次提到 CRYPTO 圈子的四年周期,我保持之前的观点:周期还在,只是不是四年,只是换了形式,因为人性就在我那里,市场再怎么变也是人性驱动!

1️⃣我们曾经的执念——

过去十年,我们几乎被“四年周期”驯化了。

2013、2017、2021:每一轮都像提前写好的剧本:减半、暴涨、高潮、崩塌。

人们总结出所谓规律:

减半 → 供应收缩;

市场情绪升温 → 新资金进场;

顶部 FOMO → 80% 回撤;

然后等待下一次救赎。

这套逻辑如此完美,以至于它成了信仰,过去我们习惯了:“减半 → 起飞”,

但注意:现在,我说的是现在,市场已经发生了质的改变,特别是这个周期!

驱动力不再是散户信念,而是 流动性与机构节奏。

但是机构的节奏就不再有周期了吗?

2️⃣这个周期的巨变:

这个周期我们看到的更多的是 ETF、是机构主导定价、筹码结构重构、日内波动降低,这个判断非常准确,符合现阶段 ETF + MSTR + 宏观资金配置潮的现实。

简单来说 $BTC 已不再是“散户炒作工具”,而是“机构配置资产”:MicroStrategy、ETF、华尔街主导的资金结构,正在压平波动、拉长周期。

ETF、做市商、算法基金,它们的资金周期不是四年,而可能是八年、十年,甚至是宏观利率周期的一部分。

当资本结构变了,周期的呼吸节奏也就变了。

另外个层面,很多人以为“机构化”会让波动消失,

但事实恰好相反——

波动不会消失,只是被延迟、被放大、被重构。

ETF 并不能抹平贪婪,只是把贪婪包在合规外衣下。

当 BTC 上了华尔街的餐桌,它就不再是“对抗系统的反叛者”,而成了系统本身的一部分。

所以 Lee 说:“我确定未来还会有 50% 的回撤。”我是认可的,不是因为比特币变弱,而是因为它终于成为真正的资产。

真正的资产,都会有回调——

只是周期不同、代价不同。

有人说,这轮周期最特别的地方在于:

“大家都知道它会有周期。”

于是,泡沫更谨慎、贪婪更隐蔽、信仰更理性。

但市场的悖论是——

当所有人都觉醒,周期反而更难预测。

我们也许已经进入了一个“缓慢牛、快速熊”的时代,

一个波动不再是情绪爆发,而是流动性脉冲的时代。

我觉得:“周期不是消失了,而是长大了。”

过去四年一个轮回,现在可能要八年甚至十年;

过去暴涨暴跌,现在可能是长坡厚雪;

过去靠信仰驱动,现在靠资金结构驱动。

但最难改变的从来不是市场结构,而是人心。

我们依然在重复:

涨时高估自己、跌时怀疑世界。

Saylor 说:“冬天不会再来。”

我不确定。

也许冬天真的不会再那么冷,

但人心依旧会在贪婪与恐惧之间结冰。

最后我想说的是——

四年周期或许已经死了,

但是周期肯定没有死!

因为“人性的周期”从未停止。

市场的每一次暴涨,

都在提醒我们:

看似宏大的周期,

其实只是群体心智的脉搏。

真正的成熟,不是预测下一轮,

而是理解自己身处哪一轮。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。