Master Discusses Hot Topics:

There's no need to elaborate on tonight's CPI; I've covered everything that needs to be said in the past few days. As for the current market, those who understand it naturally do, while those who don't are still guessing the direction chaotically.

Let's get straight to the point. From the URPD data, the range from 104K to 112K is the densest segment of the entire Bitcoin chip structure, with 2.92 million coins stacked here. Especially at 112K, there are a full 600,000 Bitcoins at this price level. Therefore, if there is a drop, this area will serve as a natural liquidity pool.

Looking at 112K and 117K, the chips at these two positions have hardly moved. Last week’s numbers are still the same, which indicates what? Those who cut losses have already done so, and what's left are the stubborn holders. These people have long been numbed by the market; they won't sell when it drops, nor will they chase when it rises.

It is precisely this group of stubborn holders that supports this defensive wall. In simple terms, even if the buying pressure is not strong, as long as the selling pressure decreases, the support in this range will become increasingly solid. Don’t be fooled by the current silence in the market; this kind of quiet structural accumulation often precedes an explosion.

The most interesting aspect of the market right now is here. On the surface, it seems calm, but in reality, there are undercurrents. The market behaves like an old trickster, subtly causing trouble without giving you a chance to breathe. After one or two stop losses, do you still want to add positions? Just when you finish adding, you get hit back.

This is how retail investors get ground down, but just when they feel disheartened and dare not enter, the market quietly pulls up. Those who understand know that this rhythm is not something retail investors can control; it’s the main force playing with your mindset. Licking blood on the blade, hiding a knife in honey.

Although the current Bitcoin pattern is relatively stable, with no major ups and downs, just a steady rise, it’s difficult for both bulls and bears to operate. This position is the most awkward. Should you go up or down? If you say there’s a major reversal, I believe the trend is still dominated by bears.

However, it can't drop too harshly either; the main force knows that if all the retail investors are wiped out, they can't play anymore. So, the recent trend is a typical false gentleness, first pulling steadily to deceive you into regaining confidence, and once retail investors step in, they deliver a surprise blow.

In the short term, this rebound is definitely not over; it can still rise in the short term, but don’t get too ambitious. In the stage of the end of a bull market and the beginning of a bear market, those who are ambitious will be harvested.

Now let’s talk about Ethereum. The recent trend has been quite frustrating, with 5-minute and 15-minute levels full of spikes and washouts, playing the door game to the extreme. Those doing short-term trades must be getting dizzy; just after stopping losses, they look back and see the price back where it started, a typical squeezing toothpaste trend.

But don’t be fooled by appearances; the 4-hour level is still stable above 3820, and the structure is relatively healthy. At least in the short term, it still needs to test the 4000 level. As for whether it can touch 4100, that depends on whether tonight's CPI at 8:30 PM cooperates.

Master Looks at Trends:

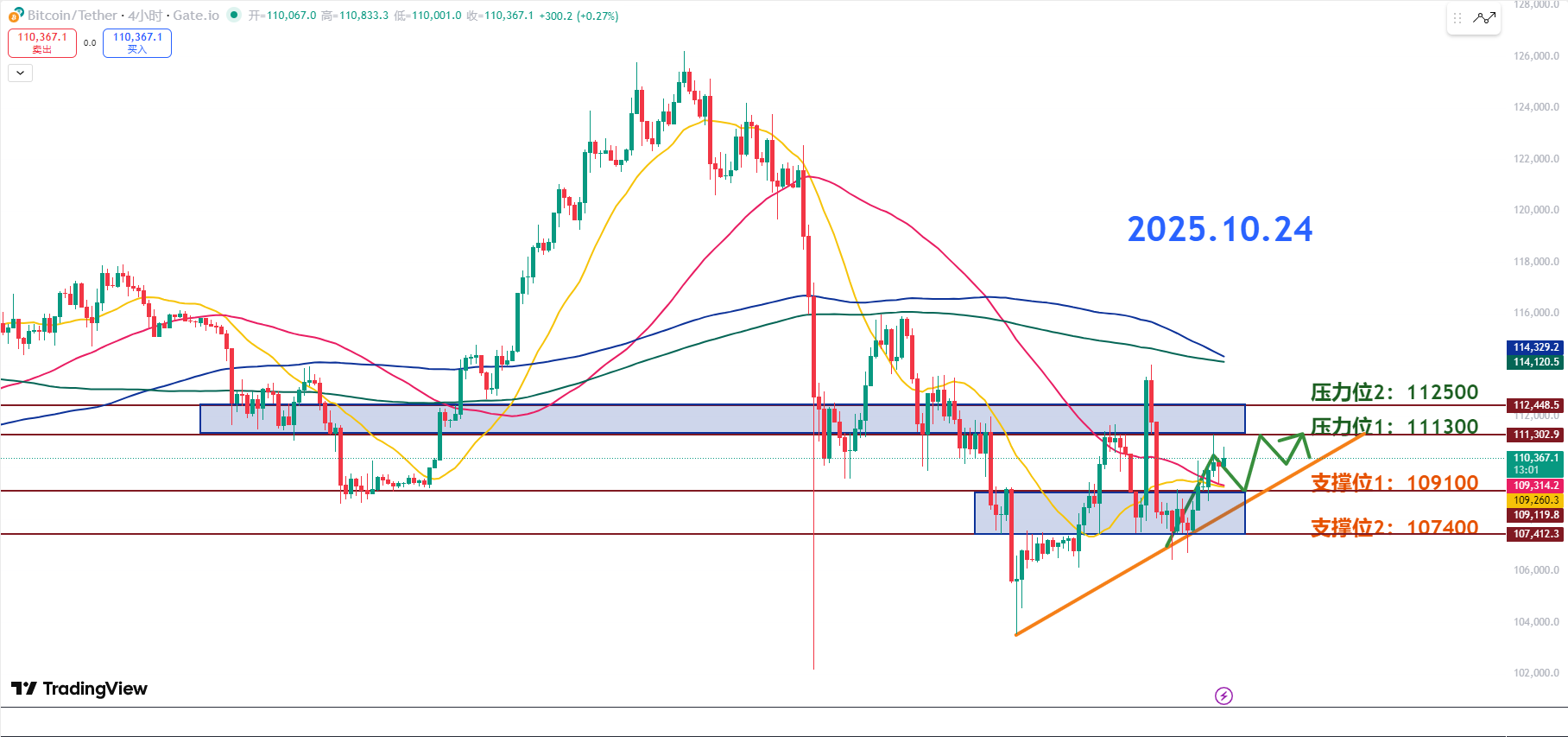

Resistance Level Reference:

Second Resistance Level: 112500

First Resistance Level: 111300

Support Level Reference:

First Support Level: 109100

Second Support Level: 107400

From the 4-hour level, the market has directly broken through 110K and stabilized, maintaining a rebound pattern in the short term. The next focus should be on whether the low points during the pullback can be raised. As long as the lows are moving up, the rebound is not over.

Technically, the first support is at 109.1K. As long as this position holds, it’s a healthy pullback. The 20 and 60 moving averages also coincide with this position, so today we can treat this area as the core defense zone. As long as this area is defended, the bulls still have confidence.

The upper resistance first looks at 111.3K, which is a relatively strong wall in the short term. There’s a high probability it will test this position today. If it can withstand the pullback and then rise again, there’s a chance to further challenge the upper 112.5K.

But be aware that the 112.5K area is not to be taken lightly; it overlaps with long-term moving averages (60, 120, 20-day lines) and is a super strong pressure zone. Unless there’s external news to stimulate it, it’s likely a profit-taking point.

On the support side, 109.1K is the key observation area for short-term trading today. If the price pulls back to around 109.3K to 109.4K, consider gradually buying in. As long as this area is not broken, the rebound logic still holds.

If it really can’t hold, then 107.4K is the last line of defense and the short-term bottom line. If this is broken, it’s not just a pullback; it’s going to accelerate downwards. Don’t hesitate, just run.

In terms of operation strategy, the market has already rebounded for a while today; don’t chase high. Wait for the pullback to confirm support before entering. The CPI will be announced tonight at 8:30 PM, and whether the market will explode is uncertain. If you want to be safe, just hold steady for now.

10.23 Master’s Wave Strategy:

Long Entry Reference: Buy in batches in the 109100-109400 range. Target: 111300-112500

Short Entry Reference: If the entity breaks below 108700, short in the direction of the trend. Target: 107400

If you truly want to learn something from a blogger, you need to keep following them, rather than making hasty conclusions after just a few market observations. This market is filled with performers; today they screenshot long positions, tomorrow they summarize short positions, making it seem like they "catch every top and bottom," but in reality, it’s all hindsight. A truly worthy blogger will have a trading logic that is consistent, coherent, and withstands scrutiny, rather than jumping in only when the market moves. Don’t be blinded by flashy data and out-of-context screenshots; long-term observation and deep understanding are necessary to discern who is a thinker and who is a dreamer!

This content is exclusively planned and published by Master Chen (WeChat: Coin Master Chen). For more real-time investment strategies, solutions, spot trading, short, medium, and long-term contract trading methods, operational skills, and knowledge about candlesticks, you can add Master Chen for learning and communication. A free experience group for fans has been opened, along with community live broadcasts and other quality experience projects!

Warm reminder: This article is only written by the official account (as shown above) of Master Chen. Any advertisements at the end of the article or in the comments section are unrelated to the author! Please be cautious in distinguishing between true and false, and thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。