撰文:张烽

历史性的美联储闭门会议,悄然改变了加密货币在全球金融体系中的位置。10月21日,美联储理事克里斯托弗·沃勒在美联储总部举行的首届「支付创新大会」上明确表示,「DeFi行业不再被视为可疑或受到嘲笑,美联储将积极拥抱支付创新。」这场被称为「历史性」的会议不同寻常——它不再将加密货币视为金融体系的边缘威胁,而是作为未来支付体系的关键组成部分进行探讨。

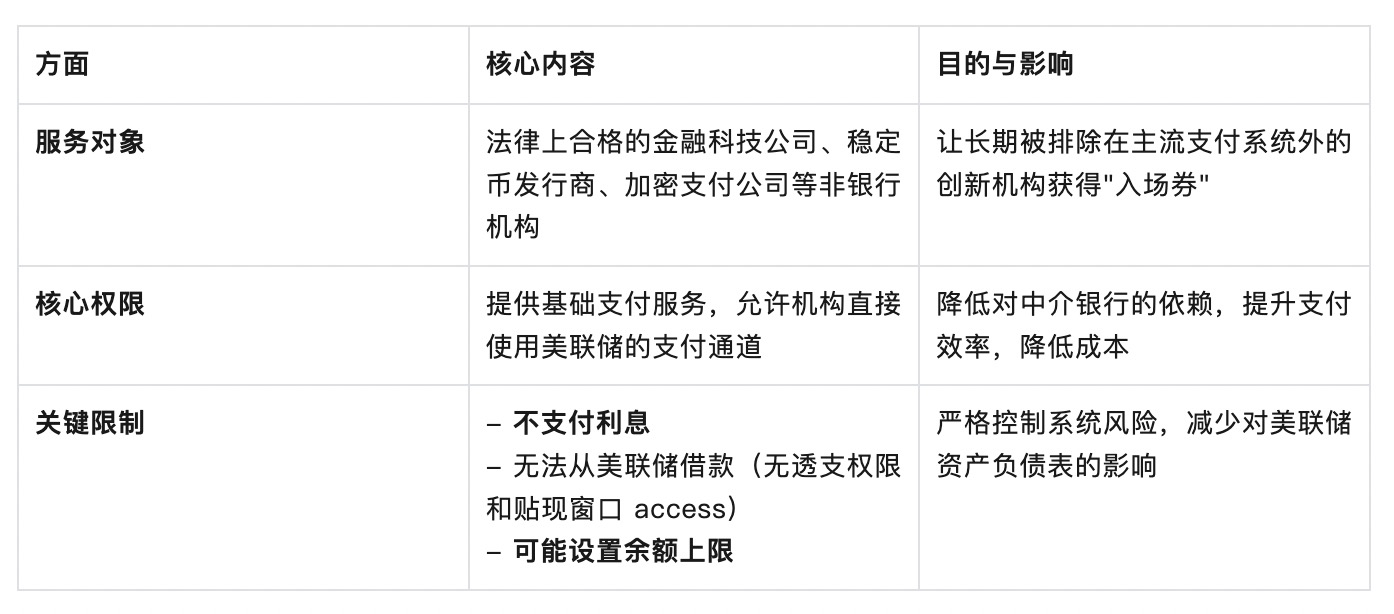

更为引人注目的是,美联储提出了具体的「精简版主账户」概念,为非银行支付公司提供基础支付服务,这意味着稳定币发行商和加密支付公司有望直接接入美联储支付系统,摆脱对传统银行的依赖。

一、从怀疑到拥抱,美联储的态度巨变

全球支付创新已进入加速期,稳定币跨境应用、传统资产代币化及AI驱动的支付安全技术成为行业焦点。在这一背景下,美联储的选择不是抵制,而是积极参与并引导创新方向。这场会议标志着美国监管层对加密资产和AI支付的态度发生根本转变。美联储的立场从过去的警惕与怀疑,转变为当前的开放与接纳,彰显了其对金融创新趋势的认可。

理事沃勒在讲话中阐述了美联储在支付创新中的双重角色:一是充当召集人解决协调问题,二是运营核心支付和结算基础设施。他强调,美联储正在「展望未来,对代币化、智能合约以及人工智能与支付的交叉领域进行实际研究」。这一态度转变的背后,是美联储对当前支付革命形势的清醒认识。

二、AI与资产代币化的金融新纪元

本次会议围绕传统金融与数字资产融合、稳定币商业模式、AI在支付中的应用、代币化产品四大核心议题展开讨论,勾勒出未来支付生态系统的清晰轮廓。

在AI应用方面,ARK Invest首席执行官Cathie Wood提出,AI驱动的「代理支付系统」将开启「Agent商业」时代。她认为,AI不仅能「知道」,更能「执行」,代表用户自主做出金融决策。Wood预计,AI与区块链共同释放的巨大生产力,有望推动未来五年美国实际GDP增速达到7%。

谷歌云的Web3策略主管Richard Widmann则指出了AI与稳定币的天作之合,「AI代理无法像人类一样开设传统银行账户,但可以拥有加密钱包,稳定币的可编程性使其完美契合AI驱动的自动化微交易和机器对机器结算场景。」

资产代币化是另一大焦点。传统金融机构正在这一领域加速布局。截至2025年,全球代币化资产市场规模约280亿美元,尽管增长迅速,但仍远低于美国ETF行业总量。

三、「精简版主账户」打通最后一公里

本次会议最引人注实的政策创新,是美联储提出的「精简版主账户」概念。这一举措有望为非银行支付公司直接接入美联储支付系统铺平道路,从根本上降低运营成本、提升效率。

「精简版账户」的提议,标志着美联储对金融科技,特别是加密资产的态度发生了根本性转变——从过去的怀疑与审视,转向积极的接纳与融合。正如美联储理事沃勒明确表示,DeFi行业不再受到怀疑或嘲笑,美联储将「拥抱颠覆,而非逃避破坏」。这一举措有望解决像Custodia Bank和Kraken这类公司多年来一直寻求主账户而不得的困境,并为Ripple等已提交申请的公司加速审批进程。从长远看,这不仅是技术接入,更是金融体系结构的一次演变。它预示着传统银行在支付领域的「管道」特权将被削弱,金融科技公司获得了与央行直接对话的渠道,这有望极大地推动支付领域的创新与竞争。

对加密行业而言,这一举措意义深远。加密记者Eleanor Terrett指出,此举对Custodia Bank和Kraken等公司意义重大,这些公司多年来一直试图获得美联储主账户,Custodia甚至将美联储告上法庭。今年申请的Ripple和Anchorage等公司也可能因此加速获得准入资格。

四、香港与内地的机遇与挑战

与会机构包括银行、资产管理公司、零售支付公司、科技公司以及加密原生金融科技公司,反映出分布式账本和加密资产已不再处于边缘地位,而是日益融入支付和金融体系的架构中。美联储的这一系列动作为传统金融与加密资产的进一步融合提供了强有力的背书。

总体来看,美联储支付创新会议为香港和内地指明了金融数字化的大方向。香港的关键在于如何在开放中平衡风险,而内地的重点则在于如何结合自身实际进行创新应用。在AI与区块链融合催生新金融基础设施的背景下,两地应发挥各自优势,将能更好地参与塑造未来的全球金融格局。

对香港而言,一方面,香港可巩固金融枢纽地位。香港在资产代币化领域已有实践基础,例如汇丰控股已完成了跨境美元代币化存款交易。美联储的动向将进一步推动全球金融数字化进程,香港可以借此机遇,积极发展代币化市场,并探索与AI结合的支付创新,吸引更多国际资本和项目,巩固其国际金融中心的地位。

另一方面,香港面临竞争与监管压力,作为国际自由港,香港在积极引入创新业务的同时,也面临如何在鼓励创新与防控金融风险之间取得平衡的挑战。美联储对稳定币监管框架的探讨,意味着香港也需建立相应的监管体系,以应对可能出现的跨境风险传导。

对内地而言,一方面可借势发展自身技术。内地已在金融认证和支付安全领域建立了技术规范。可以此为基础,加速区块链与AI技术在支付、身份认证及供应链金融等场景的深度融合。同时,美联储的探索也为内地提供了在风险可控的前提下,推进技术应用的宝贵经验。

另一方面,内地需应对技术竞争与差距。美联储的举措可能加速全球金融基础设施的数字化竞争。如果香港和内地不能跟上步伐,可能在跨境支付、数字资产定价权等领域面临落后风险。此外,技术路线的差异也可能导致未来不同数字金融生态互联互通的挑战。

美联储这场会议只是一个开端。随着「精简版主账户」从概念走向现实,稳定币发行商和加密支付公司将直接接入美联储支付系统,传统银行为主导的金融堡垒正在出现结构性裂缝。而AI与区块链的融合,可能将这场变革推向更深处。谷歌云Web3策略主管Richard Widmann指出,AI代理无法像人类一样开设传统银行账户,但可以拥有加密钱包。未来的金融交易可能不再由人类主导,而是在AI代理之间通过加密钱包自动完成。

站在历史转折点,各国监管机构不得不做出选择——是筑起更高的围墙,还是拥抱不可逆的趋势。美联储已经做出了它的选择。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。