“如果他(鲍威尔)在我上任时还在,那他将不会留任。”美国总统特朗普的一席话,在全球金融市场激起千层浪。美联储,这个全球金融体系的“心脏”,其主席的独立性一直被视作市场稳定的基石。如今,这块基石被动摇了。这不仅关乎美元和美股,更将深远地重塑加密货币市场的未来格局。

一、从隔空批评到直接“驱逐”

事件源于特朗普在接受采访时的一次明确表态。他不仅重申了让鲍威尔离任的意图,更批评美联储内部存在“死硬派”且当前利率过高,阻碍了经济发展。

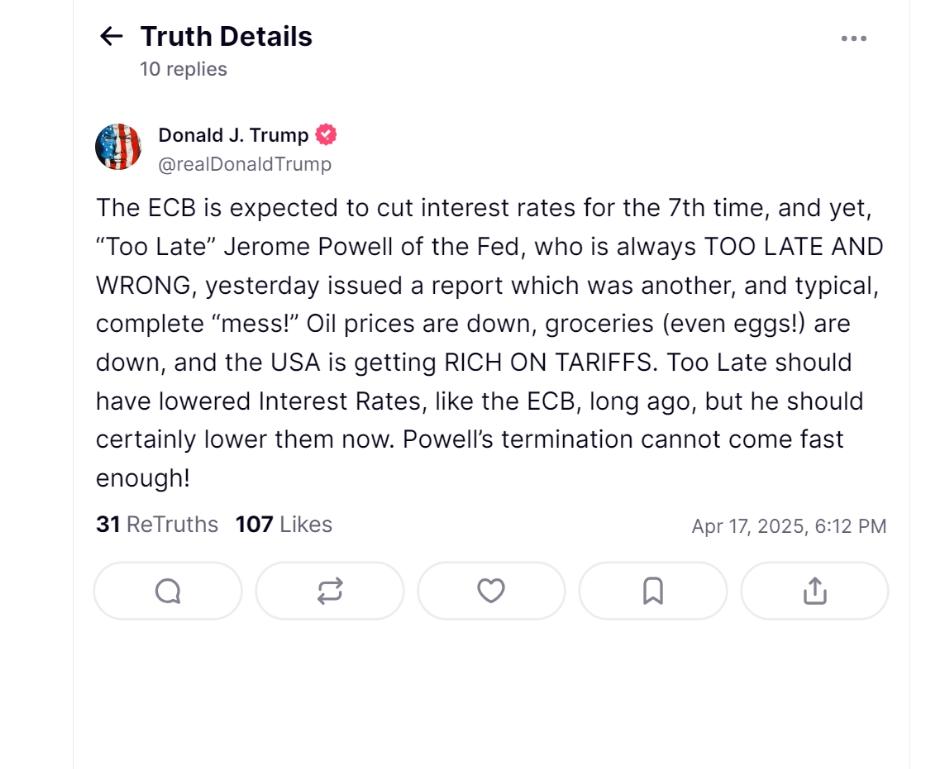

这场风波并非空穴来风。回顾特朗普的首个任期,尽管他亲自提名鲍威尔接替耶伦,但在其后的加息周期中,特朗普曾多次在社交媒体上公开抨击鲍威尔,称其“疯狂”、“荒谬”,是“经济的最大威胁”。如今的表态,是这场持续数年矛盾的终极爆发。早在今年4月17日,特朗普曾连发3 文怒斥鲍威尔,情绪更是一层层递交,先是指责“鲍威尔 16 日发布的报告又是一团糟。他早就应该像欧洲央行一样降低利率,然而他总是太迟又犯错”,第二条直言“鲍威尔应该尽早下台”,第三条直接上升到威胁层面“如果我想让他离开,他很快就会离开的。我对他不满意。”

总统能否随意解雇美联储主席?这在美国法律和实践中存在巨大争议。根据《联邦储备法》,美联储理事的任期受到严格保护,总统仅可“因故”将其免职。历史上,从未有总统成功罢免过美联储主席。因此,这场风波更可能是一场高强度的政治施压,旨在影响未来的货币政策方向。一位不愿具名的前美联储官员对彭博社表示,“这是对美联储独立性前所未有的公开挑战,其目的是为了塑造一个更听话的中央银行。”

二、市场瞬间反应:恐慌、机遇与不确定性的交织

1. 传统市场:美元与美债首当其冲

美元指数应声下跌0.5%,显示出市场对美元未来信心的动摇。与此同时,作为全球资产定价之锚的美国10年期国债收益率波动率显著上升,表明债券市场正在为未来的政策不确定性进行重新定价。

2. 加密货币:短期恐慌与长期叙事强化

比特币在消息传出后经历了短暂的剧烈波动,先是快速下挫试探支撑,随后又迅速反弹。这种“V型”走势完美诠释了市场的矛盾心态:短期恐慌性抛售与长期价值买入并存。

链上数据方面,据报告,在消息发酵的24小时内,中心化交易所的比特币净流出量达到了约1.2万枚。这意味着,大量的投资者正选择将资产转移到私人钱包中进行囤积,而非进行短线交易。

三、加密市场或迎来命运转折点

| 影响维度 | 潜在机遇 | 潜在风险 |

| 价格与交易 | 政策不确定性推高比特币的“避险”需求 | 或导致高杠杆头寸被大规模清算 |

| 资金与流动性 | 若继任者推行宽松货币政策,将为市场带来海量流动性 | 美元信用受损可能引发全球流动性危机 |

| 行业与监管 | DeFi 的“不依赖银行”叙事得到强化,吸引新用户和资金 | 新任主席可能对加密行业持更强硬的监管立场,为机构准入设置障碍 |

| 市场情绪 | “FOMO” 情绪可能蔓延,推动资金大举涌入,催生牛市 | 不确定性导致市场主流情绪转为“观望”,交易量萎缩,行情陷入僵局 |

四、市场如何解读这场风暴?

市场上的分析师和机构观点出现了显著分歧,主要分为以下几派:

1. “独立性质疑”派

“这不仅仅是一次人事变动,它动摇了现代央行体系的根基。若美联储的决策被政治化,全球对美元资产的信任将大打折扣。比特币作为非主权储值工具的长期价值将在这种环境下被无限放大。”

2. “政策鸽派”派

“市场应关注谁将是继任者。一个被政治任命的鸽派主席,意味着更低的利率和更庞大的资产负债表。这将是加密货币,乃至所有风险资产梦寐已久的完美宏观环境。”

3. “现实约束”派

“市场反应过度了。在法律和制度约束下,直接罢免鲍威尔几乎是不可能完成的任务。这更可能是一场政治秀,最终会演变为一场漫长的拉锯战,其对货币政策的实际影响可能远小于市场目前的定价。”

五、投资者的行动指南

需要警惕的潜在风险:

* 政策路径的极度不确定性:未来的利率路径已无法用传统模型预测,市场可能进入一个持续的“消息市”状态,波动将成为常态。

* 监管立场转向风险:鲍威尔领导下的美联储对加密货币持相对开放的研究态度。新任主席的立场是一个完全的未知数,可能对正在寻求合规的加密机构造成致命打击。

后期需追踪的核心动态:

1. 白宫的官方行动与美联储的回应:紧密关注白宫是否会正式向国会提交新任主席的提名,以及被提名人的政策背景。同时,鲍威尔及其他美联储官员的任何公开回应,都将是判断事态严重性的关键。

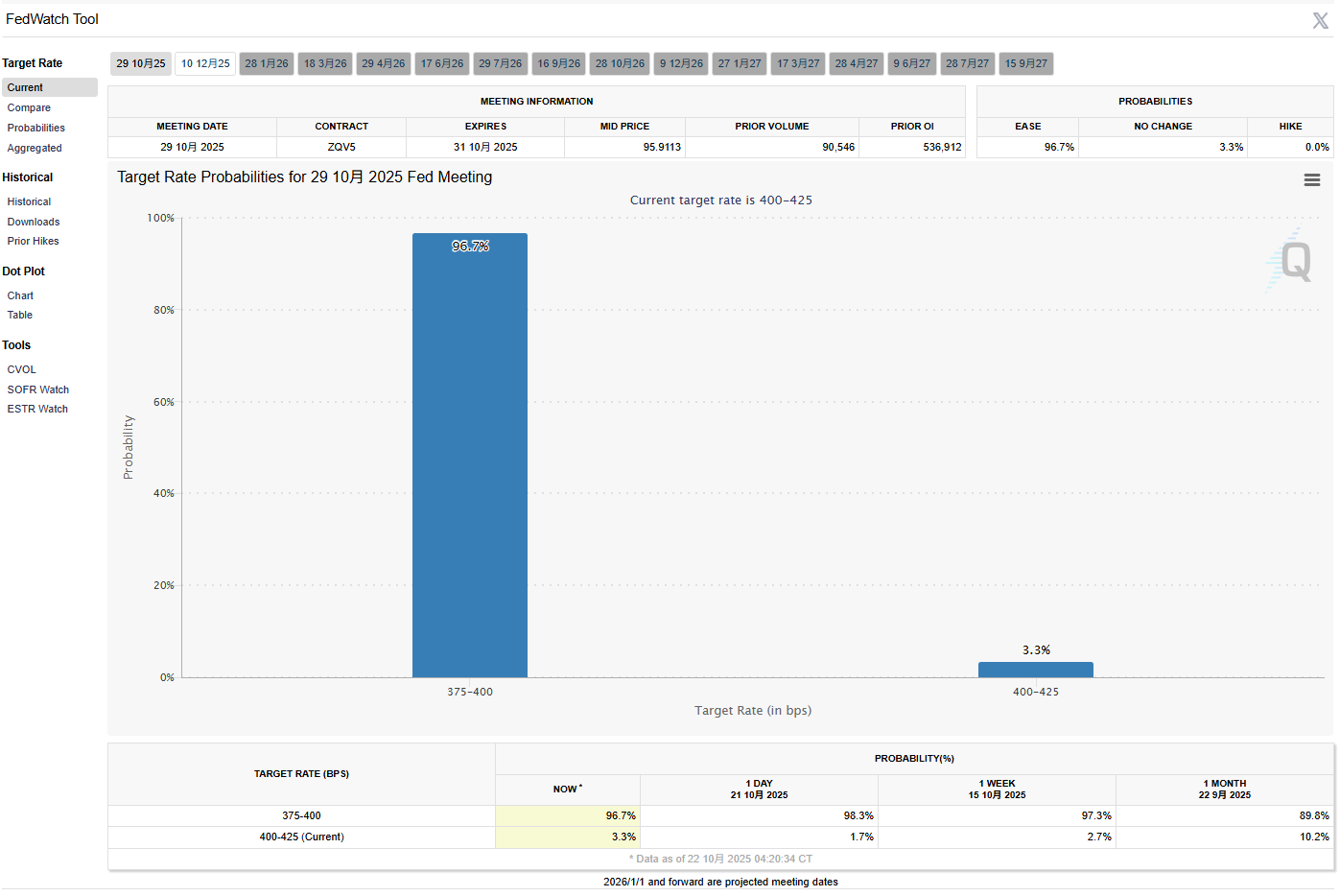

2.利率预期与美元指数的走势:使用工具监控市场对降息概率的预测,并紧盯美元指数(DXY)。美元指数的走向,是判断资金是否会从传统体系流向加密市场的核心风向标。

对于加密货币世界而言,这既是前所未有的考验,也是一个证明其作为传统金融体系替代方案的历史性机遇。在风暴中,唯一确定的就是不确定性本身,而能够穿越周期的,永远是那些聚焦于长期价值、并做好了充分风险管理的投资者。

加入我们的社区,一起来讨论,一起变得更强吧!

官方电报(Telegram)社群:https://t.me/aicoincn

AiCoin中文推特:https://x.com/AiCoinzh

OKX 福利群:https://aicoin.com/link/chat?cid=l61eM4owQ

币安福利群:https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。