Yesterday we discussed that the bulls and bears are vying for a key position. Since we couldn't break above the BBI yesterday and with today's current bearish close, we believe the bears have the advantage in this round of contention. We also hit our first take-profit target on the short positions we set up.

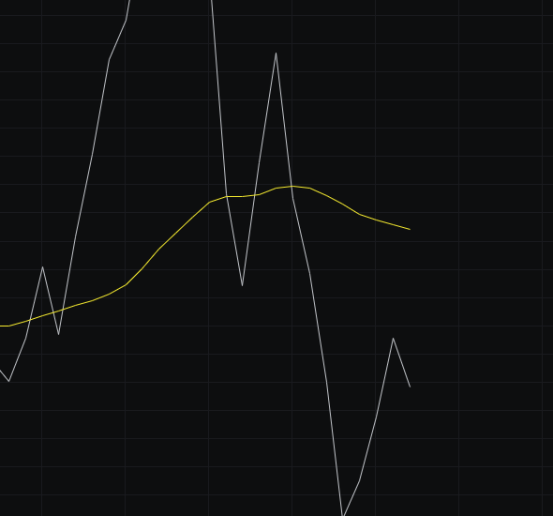

From the MACD perspective, the energy bars continue to retract, and both the fast and slow lines are still under pressure, so we continue to view the MACD as bearish.

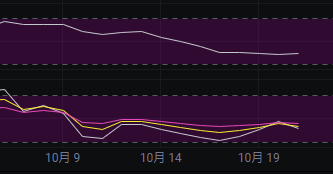

Looking at the CCI, it is below -100, and the bulls have no power to fight back, remaining under the control of the bears.

From the OBV perspective, it has turned downward, and the slow line continues to press down, indicating a bearish trend.

In terms of KDJ, it formed a golden cross yesterday, and today it has entered a consolidation phase, soon to choose a direction again, so we will continue to observe the trend.

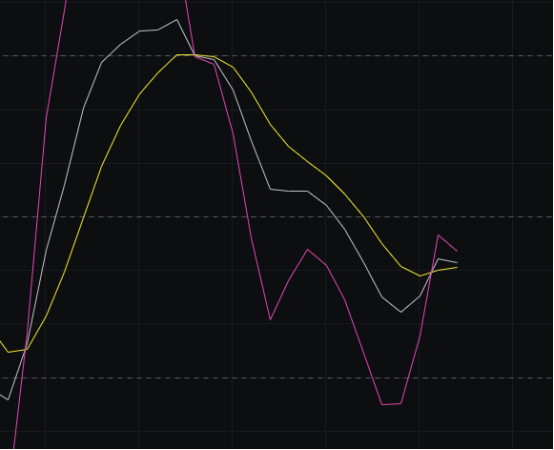

Looking at the MFI and RSI, both indicators are in a weak zone, which can be seen as a consolidation, but it is easier to move downward in a weak zone.

From the moving averages perspective, since yesterday's rise failed to break above the key level, the market is currently under pressure, so we maintain a bearish outlook.

Regarding Bollinger Bands, the upper band is flattening with a slight downward trend, combined with the lower band moving down, this can be seen as a downward channel. Whether it can form will depend on the next two days' movements. However, there is currently a trend, so we will consider it as a downward channel for now.

In summary: As the coin price failed to break above the key level and with signs of a downward channel in Bollinger Bands, along with other indicators, the market is increasingly favorable for the bears. Therefore, the subsequent strategy is to short on rallies. Today's resistance is seen at 111,000-113,000, and support is at 107,500-105,000.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。