Author: Martin

1. The Current State of Memes on Ethereum and Solana: Prosperity and Bottlenecks Coexist

As a pioneer of smart contracts, Ethereum's meme ecosystem has always been centered around community-driven and financial narratives. In 2025, with the Pectra upgrade and the advancement of spot ETFs, memes on Ethereum are experiencing a revival. However, they are constrained by high gas fees and the fragmentation of Layer 2 ecosystems, leading to long project incubation cycles and high user entry barriers. Although established projects are quite popular, the overall trend is characterized by "elitism," making explosive growth difficult.

Solana, on the other hand, has become a "testing ground" for meme coins due to its low gas fees and high transactions per second (TPS). Tokens like BONK and PENGU saw their market values soar significantly, and on-chain transaction frequencies far exceeded those of traditional Layer 1s. However, Solana's "meme chain" label also brings concerns: the ecosystem is overly reliant on speculation, with a prevalence of player versus player (PVP) dynamics; technical stability is insufficient, leading to frequent outages, among other issues.

2. The Meme Ecosystem of BSC: From Grassroots Celebration to Institutional Rise

1. User Scale and Trading Activity: A Natural Entry into the Mass Market

BSC has attracted over 630 million on-chain addresses due to its extremely low fees, sub-second confirmations, and EVM compatibility, with an average daily transaction volume exceeding 15 million. Its users are primarily retail investors from emerging markets in Asia and Latin America, who have a strong demand for small, high-frequency trades, aligning perfectly with the "viral spread" characteristic of meme coins. The explosion of memes like "Binance Life" and Giggle in October 2025 is a concentrated reflection of BSC's user base and liquidity advantages.

2. Binance's Ecological Empowerment: From Bottom-Level Support to Top-Level Design

Binance has reshaped BSC's meme ecosystem through three major actions:

Infrastructure Upgrade: Launching a Web 3 wallet and Alpha platform to convert centralized users into on-chain participants. Alpha serves as a project incubator, providing early memes with traffic exposure and liquidity support.

Regulated Issuance: The Meme Rush platform incorporates permissionless token issuance into a regulatory framework, reducing fraud risks and enhancing compliance through KYC verification, liquidity locking, and a three-phase migration mechanism.

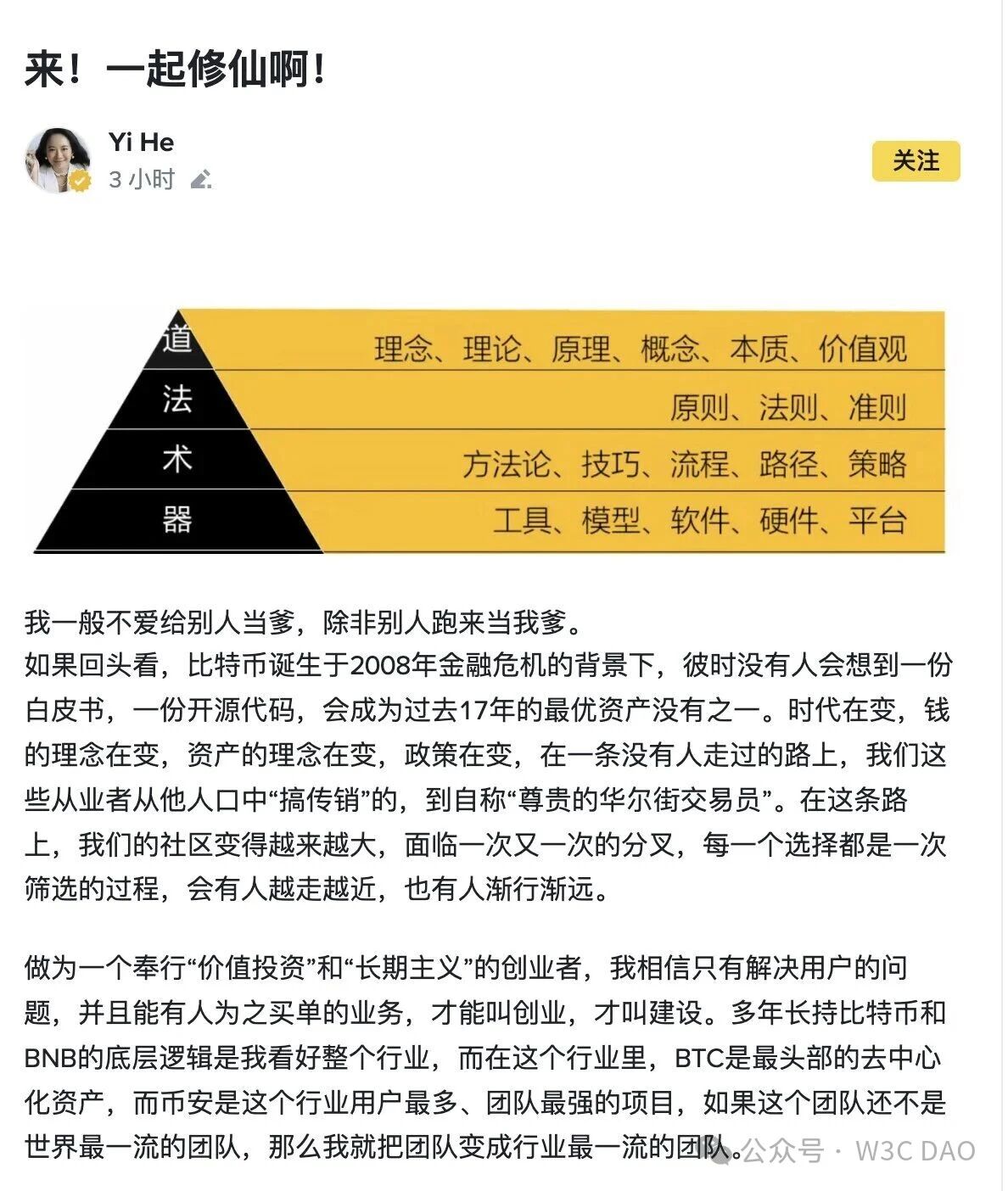

Cultural Resonance: Proactive interactions from senior officials (such as tweets from CZ and He Yi) inject "cultural narrative + capital consensus" dual momentum into memes, for example, "Binance Life" directly activates the community through Chinese blessings.

3. Technological Iteration and Scenario Expansion: Transitioning from Speculation to Practicality

In recent years, BSC has optimized user experience through technological upgrades like the Maxwell hard fork and the Goodwill Alliance anti-MEV mechanism. At the same time, the ecosystem has expanded into scenarios like RWA and GameFi, providing richer application contexts for meme coins. For instance, Giggle donates 5% of transaction taxes to CZ's educational projects, creating a sustainable model of "meme + public welfare."

3. The Birth Logic of the Next Billion-Dollar Meme: BSC's "Favorable Timing, Location, and Human Harmony"

1. Timing: Market Cycles and Narrative Dividends

The crypto market has entered the "post-BTC $120,000" era, with funds shifting from "institutional assets" to "consumer scenarios." BSC, with its more aggressive speculative attributes and lower participation thresholds, has become the preferred target for capital rotation. Historical data shows that the average return rate of meme projects on BSC far exceeds that of similar projects on Ethereum and Solana.

2. Location: Ecological Synergy and Compliance Dividends

BSC's "populist" user structure naturally matches the dissemination characteristics of memes. Its on-chain stablecoin circulation exceeds $11 billion, providing a liquidity foundation for high-frequency trading; at the same time, platforms like Four.meme reduce token issuance costs, attracting developers to quickly experiment.

3. Human Harmony: Community Consensus and Capital Boost

BSC's meme ecosystem has formed a positive cycle of "platform - project - user":

The platform provides a fair launch mechanism and liquidity incentives;

Projects build moats through IP binding and community operations;

Users drive market capitalization surges through "social fission + short-term arbitrage."

The capital backing from giants like Binance further amplifies market confidence, creating a spiral rise of "narrative - price - liquidity."

4. Introduction to Representative Meme Projects on BSC

- $Binance Life: Originating from the Chinese blessing meme.

- $4: Originating from CZ's classic hand gesture.

- $BAB: Inspired by Binance's soul-binding token $BABT, inheriting the "Build And Build" community spirit advocated by CZ.

- $Giggle: Originating from CZ's educational charity work.

- $Customer Service Xiao He: Originating from He Yi's frequent frontline customer service and self-identification as "Customer Service Xiao He."

- $Cultivation: Originating from He Yi's post in Binance Square stating "Let's cultivate together."

5. Conclusion: Can BSC Break the "Meme Cycle Curse"?

Historical experience shows that the billion-dollar market value of meme coins is often accompanied by a dual resonance of ecological explosion and capital consensus. With its user scale, technological iteration, and institutional innovation, BSC is breaking through the shackles of "ephemeral" existence. If it can continue to attract quality developers, improve compliance frameworks, and transform meme momentum into long-cycle scenarios like DeFi and SocialFi, the soil for the next billion-dollar project is already ripe. Of course, the boundary between speculation and innovation still needs careful balancing, but at least in 2025, BSC's meme ecosystem has shown the potential to rewrite the industry landscape.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。