昨天我们在110000附近的时候,说了市场上很多认为这里是在做双底,而我们坚定认为这里不是双底,还有继续向下的可能,今天看价格也的确继续向下跌了,我们又一次猜对了。而今天我们再次观察行情,发现有向趋势下跌发展的迹象,具体能不能形成,还需要后续几天的行情来验证。我们做的几个空单也都盈利了。

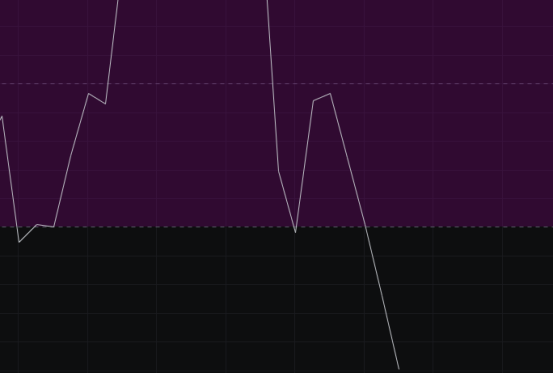

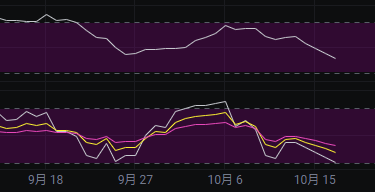

Macd上看,目前能量柱继续下移,且达到了近期行情以来的最低点,快线和慢线也在下压,这样的情况下是没办法看止跌的。

Cci上看,随着连续4天的下跌,cci已经远离零轴了,短时间内是难以回到零轴,这里还不是看涨的时候。

Obv上看,随着连续4天的下跌,obv有了明显的下跌,慢线也拐头向下,下跌趋势在逐渐形成,所以技术上这里没办法看上涨。

Kdj上看,前两天跌破了50,所以下一步应该就是去摸20了,至于能不能摸到,到了20附近再看,我们也会在那个时候重新评估行情是会继续下跌还是止跌。

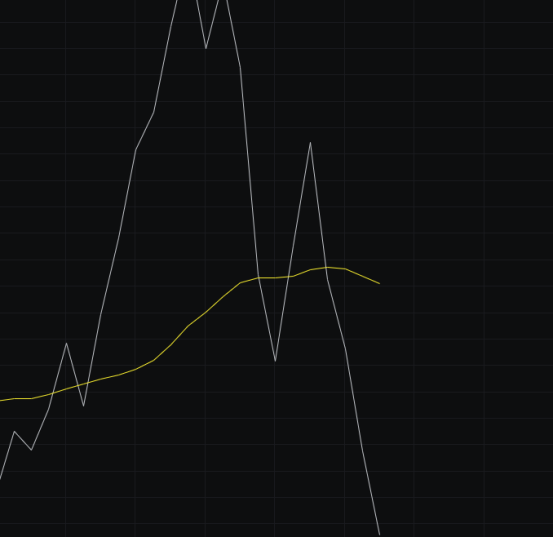

Mfi和rsi上看,两个指标都在弱势区域,且方向都在向下发展,妥妥的空头走势,所以这里还不能看涨。

均线上看,几条均线都在开始向下掉头,所以我们认为有向趋势下跌发展的迹象。

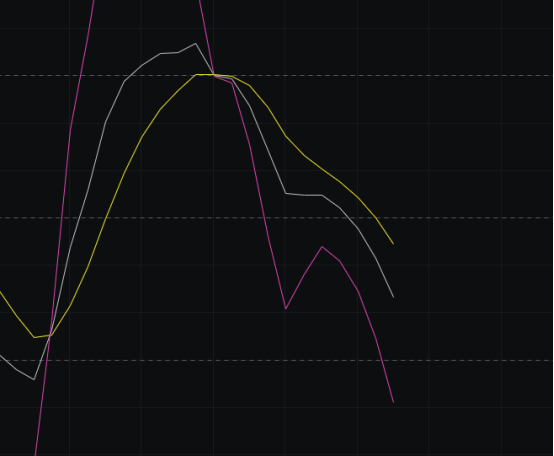

Boll上看,昨天我们在做分析的时候,boll还在走收口的动作,可今天再看,boll居然开口了,在宽幅上没经历窄幅就直接开口,在历史上还是很少见的。这里要么是诱空要么就是趋势下跌,大家留意今明两天的收线情况,如果两天都连续收出阴线,那趋势下跌的可能性更大,如果是趋势下跌,大家看反弹能不能破bbi,不破bbi就可以放心空。

综上:几个指标都有了趋势向下的走势,所以这里我们认为有向趋势下跌发展的迹象,具体能不能形成,还需要后续几天的行情来验证。这里给空军的第一目标是不站上107500,第二目标是不站上106000,第三目标是收线于105000下方,压力看107500-109000,支撑看105000-101500.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。