本文来自:Green Dots 创始人 Stacy Muur

编译|Odaily 星球日报(@OdailyChina);译者|Azuma(@azuma_eth)

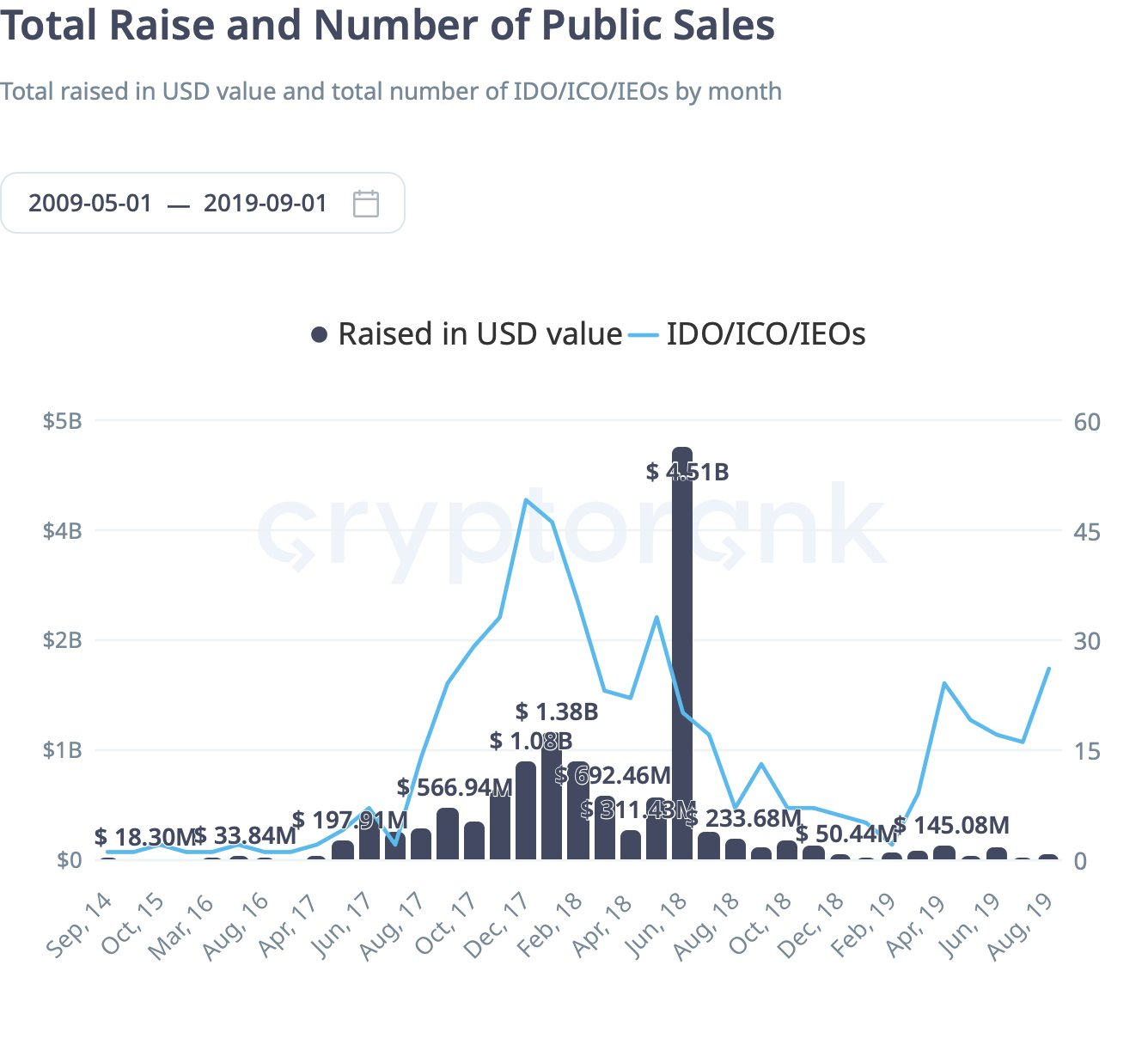

自 2017 年那场疯狂浪潮以来,IC0 正在首次实现真正的回归 —— 但这一次,它的运作方式与当年的“Gas 大战”完全不同。

这并不是一次怀旧巡演,而是一场结构性的市场重塑,由全新基础设施、更精细的分配设计以及更清晰的合规框架共同驱动。

在2017年,只要有人能写个以太坊合约、配上份白皮书,就能在几分钟内筹集数百万美元。那时没有标准化的合规流程、没有结构化的分配模型,更没有后续流动性框架。

大多数投资者盲目冲入,结果代币上线后往往以暴跌收场。之后,监管迅速介入,IC0 在接下来的几年中消退,取而代之的是VC 轮融资、SAFT 协议、交易所 IEO,以及后来流行的追溯空投(Retrodrop)。

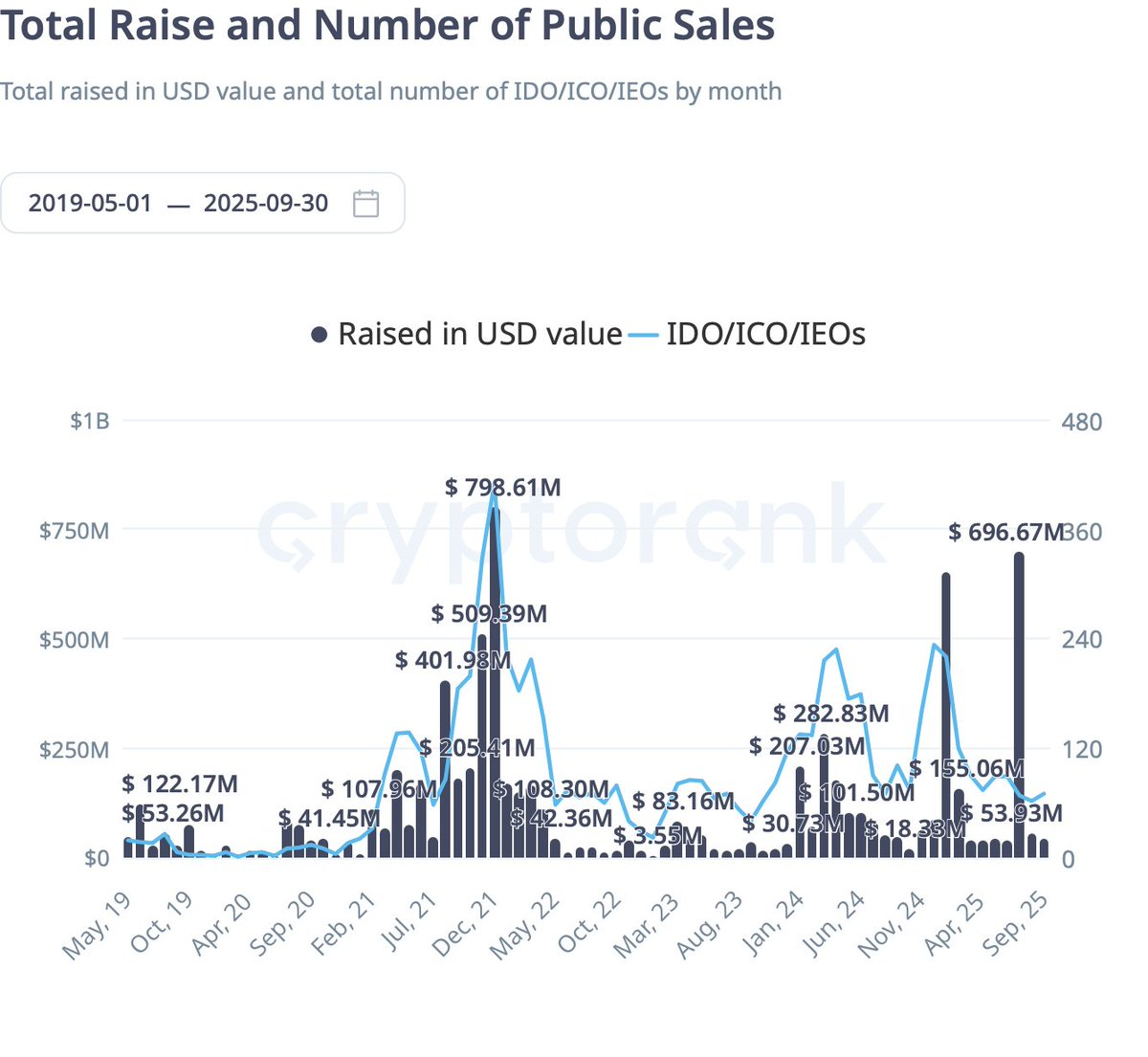

而到了2025 年,钟摆已再次摆回。

这次的改变,并不是项目以更低的估值启动 —— 事实上,许多项目的 FDV(完全稀释估值)甚至比过去还高。真正不同的是 ——获取途径的结构化重塑。

如今的Launchpad 早已不再依赖于拼手速或 Gas 大战。取而代之的,是通过KYC认证、信誉积分或社交影响力筛选参与者,并用小额分配(micro-tickets)代替巨鲸级额度,让更多的用户共享配售。

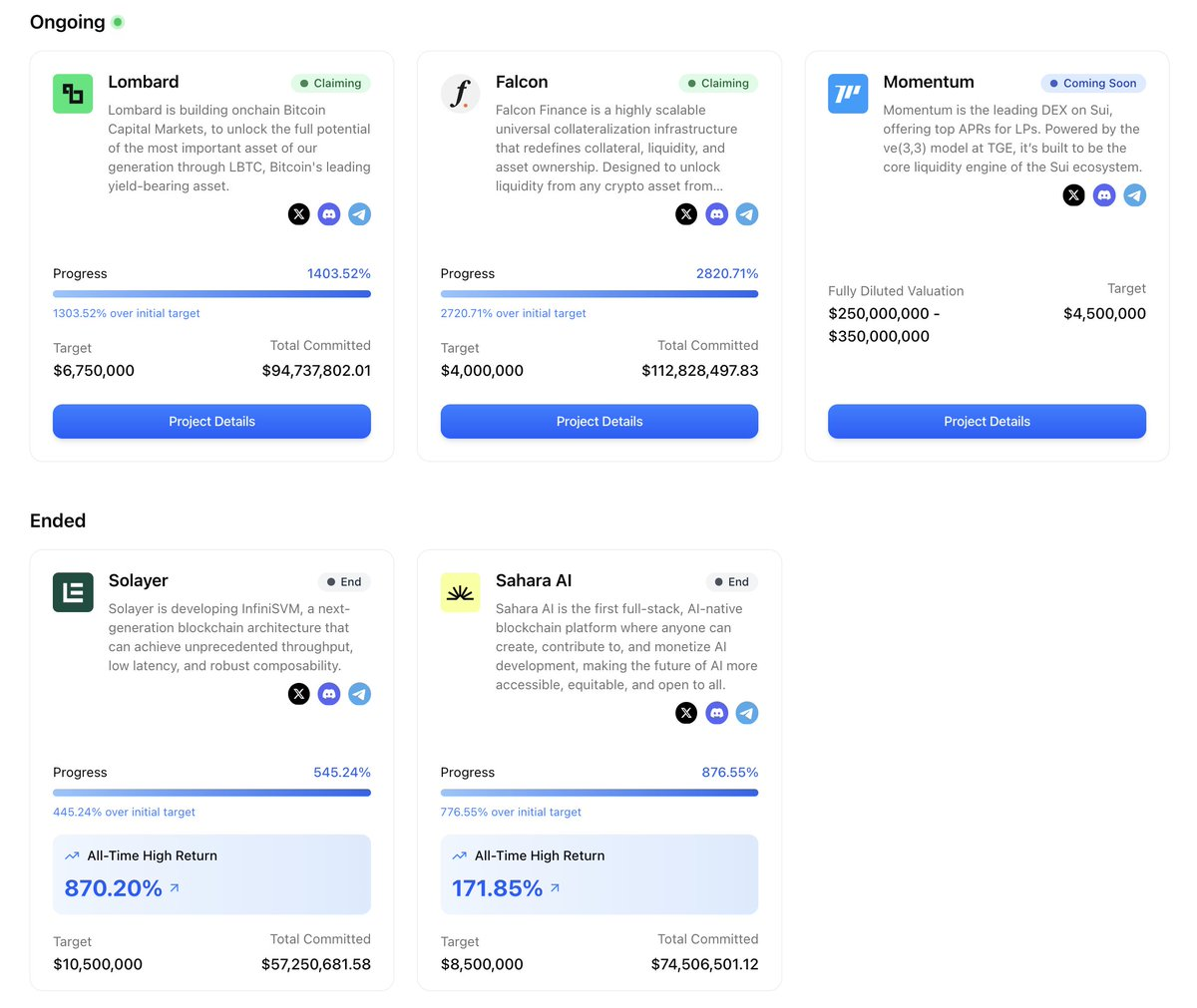

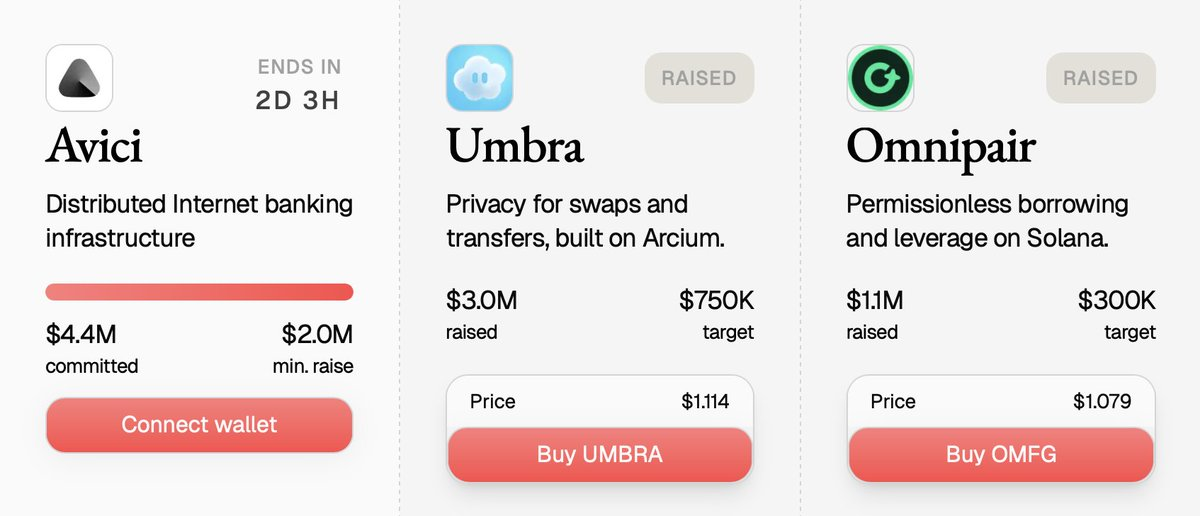

例如,在 Buidlpad 平台上,我申购了 Falcon Finance 的 5000 美元公售额度,但最终只获得了 270美元的配额 —— 其余部分因超额认购而被退回。类似情况也曾出现在Sahara AI,我申购了 5000 美元,最终仅获 600 美元配额。

这种超额认购机制并不会压低价格,反而可通过缩小个人额度来维持高估值、扩大分配范围。

监管也终于跟上了节奏。例如欧洲的MiCA 法规已为合规的散户参与提供了清晰路径。各大Launchpad将KYC、地域限制、资格审查等功能做成了可配置选项,开发者只需几次点击即可启用。

在流动性层面,一些平台则更进一步 —— 他们将售后流动性政策直接写入智能合约,在销售结束后自动注入流动性池(LP),或使用“低买高卖”的价格带来稳定早期交易。

截至 2025 年,IC0 已占所有代币销售总量的约 20%,相比两年前微不足道的占比,这是一场显著的回温。更关键的是,这次复兴并非由单一平台推动,而是源自一整代新的发布系统,每一个都在解决不同的痛点:

- Echo 的 Sonar支持跨链自托管销售,且合规功能可灵活开关。

- Legion 与 Kraken 合作,将基于信誉的分配机制融入了交易所体系。

- MetaDAO将国库管控和流动性区间直接嵌入了发行环节。

- Buidlpad专注于 KYC 准入的社区优先分发模式,并引入了结构化退款机制。

这些平台共同将 IC0 从一种混乱的筹资手段,转变为一种有意设计的市场结构 ——在这里,发行准入、销售定价与流动性维护等等不再是事后的即兴发挥,而是在机制层面被精密规划。

每个平台都在试图解决上一次 IC0 浪潮中遗留的不同痛点。如今,它们共同构成了一个更有结构、更透明、也更具投资吸引力的环境。

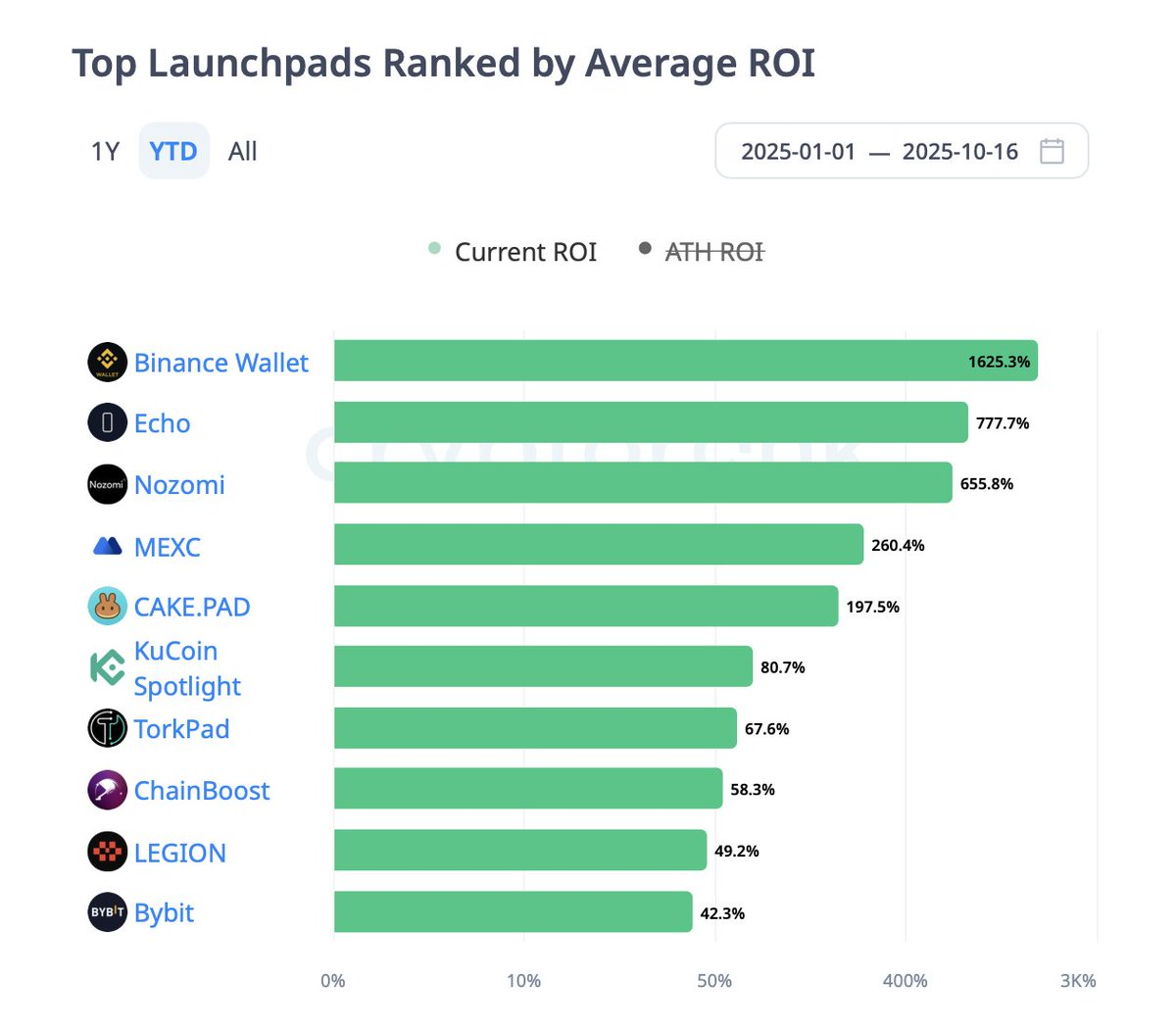

爆火的 Echo:自托管、合规模式可切换

由Cobie 创立的 Echo,凭借其自托管公募工具 Sonar,成为 2025 年最具爆发力的代币发射基础设施之一。

与中心化 Launchpad 或交易所 IEO 不同,Echo 提供的是基础设施,而非“发行市场”。项目团队可以自主选择发售模式(固定价格、拍卖、金库/信用模型),通过 Echo Passport 自定义 KYC、投资者认证、地理封锁(geofencing) 等规则,并自行分发销售链接——同时可在Solana、Base、Hyperliquid、Cardano 等多条链上同步发售。

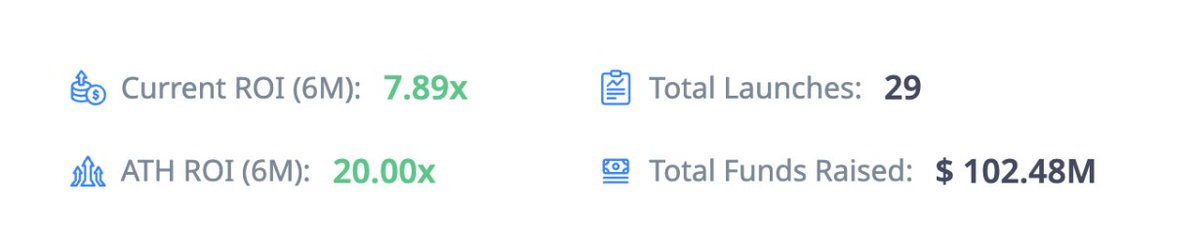

该平台核心数据表现如下。

Echo 最具代表性的成功案例是Plasma。该项目于 7 月以时间加权金库模型(time-weighted vault model)出售了 10% 的代币供应,定价为 0.05 美元,共吸引了超过 5000 万美元的认购资金。Plasma 上线后峰值达到了33.78 倍的历史最高ROI(投资回报率),成为年度表现最强的 IC0 之一。

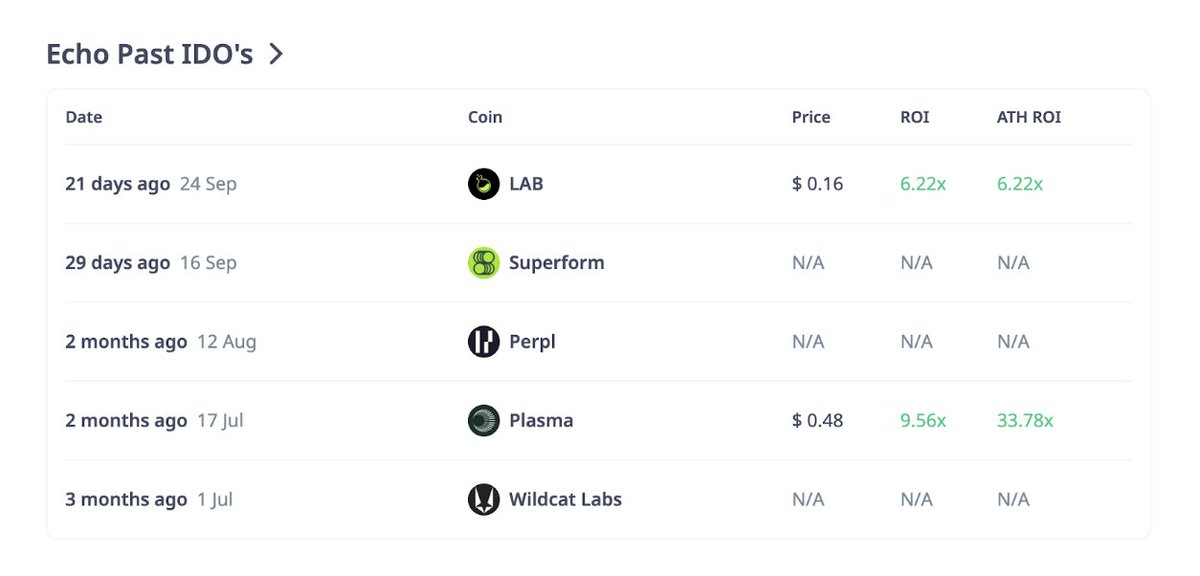

紧随其后的是LAB,在上线时实现了 6.22 倍 ROI 的表现。以下是 Echo 近期发售项目的快照数据:

这些结果同时展示了Echo平台的巨大潜力与结果差异性。虽然Plasma 和 LAB 取得了亮眼回报,但其他项目(如 Superform 或 Perpl)尚未上线或尚未公布绩效数据。

Echo 本身并不强制执行任何售后流动性框架——例如流动性池注入(LP seeding)、做市商参与要求或解锁时间表等,这些都由发行方自行定义,而非平台标准化规定。

对于投资者而言,Echo 的灵活性虽然使其成为本轮周期中 ROI 最高的发射基础设施,但同时也意味着投资者需要自行尽职调查(due diligence),参与前应重点核查以下几点:

- 合规切换选项(Compliance toggles):包括 KYC 与投资者认证要求;

- 销售模式(Sale format):是金库模式、拍卖模式还是固定价格模式;

- 发行方的流动性计划(Liquidity plan):因为 Echo 不提供统一的流动性标准。

Legion & Kraken:声誉与监管的融合

如果说Echo 代表着由创始人主导的灵活性,那么 Legion 则走向完全相反的方向——

一个结构化、基于声誉门槛(reputation-gated)的公募渠道。

今年9月,由 Legion 独家提供基础设施支持的Kraken Launch正式上线。这是代币销售首次直接嵌入Kraken账户体系内进行,在符合MiCA法规的框架下,由信誉评分决定用户的认购优先级。

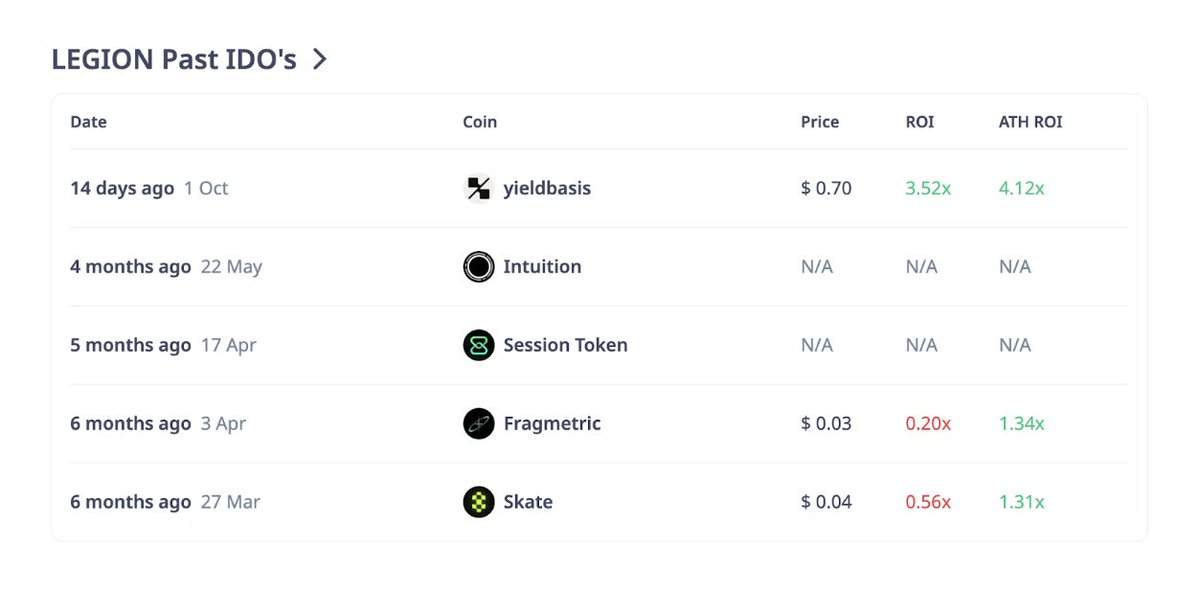

该平台核心数据表现如下。

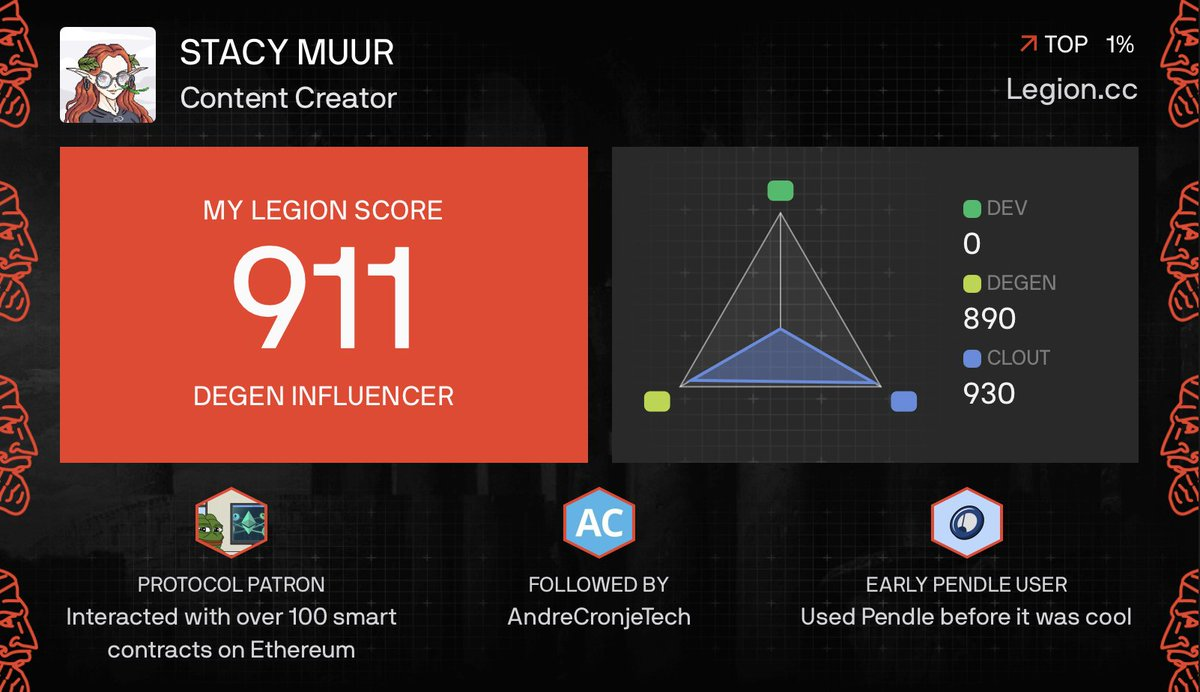

Legion 的核心是其 0-1000 分的信誉评分体系,该指标会综合评估用户链上活动、技术贡献(如GitHub)、社交媒体参与度及他人背书等多维数据。

项目方可以将其代币分配额度的 20%-40% 预留给高信誉评分用户,再将剩余部分开放给先到先得或抽签环节。这彻底颠覆了传统 IC0 分配模式 —— 不再奖励使用程序实现最快点击的用户,而是奖励真正的建设者、贡献者和有影响力的社区成员。

以下是 Legion 近期销售数据概览。

与 Kraken 的整合为 Legion 带来了另一重保障:交易所级别的 KYC/反洗钱审核与初始流动性。你可以把它看作一种带有社区分配机制的“加密版IPO”。早期案例如YieldBasis 和 Bitcoin Hyper,在声誉分配阶段(Merit Phase)出现严重超额认购,而低分用户则被引导进入受限额度的公众轮。

当然,这一体系也并非完美。部分早期用户指出,Legion 评分可能过度加权社交媒体影响力,导致 X 上的超级用户反超真实建设者。此外,其权重系统的透明度也有待提升。但相较过去的抽签狂欢机制,这已是意义重大的升级。

对于投资者而言,最重要的无疑是 Legion 评分。若想获得顶级项目的分配额度,请尽早构建你的链上足迹与贡献档案。同时务必关注每个项目在发售时的“Merit/Public” 分配比例与机制,因为不同项目往往会根据策略调整这一公式。

MetaDAO:以机制取代营销

MetaDAO正在尝试其他ICO平台从未涉足的领域:将售后市场政策直接编码至协议层。

MetaDAO 的运作机制如下:若MetaDAO上的销售成功,所有募集的USDC将进入一个由市场治理的资金库,代币铸造权限也随之转移至该资金库。其中 20% 的 USDC 加上500万枚代币将作为初始流动性注入 Solana 上去中心化交易所的流动性池。该资金库被预设编程为在 IC0 价格以下自动买入代币,在 IC0 价格以上自动卖出,从而从第一天起就在锚定价格周围形成软性价格区间。

这听起来简单,却彻底改变了早期交易动态。在常规 IC0 中,若流动性匮乏或内部人士抛售,二级市场价格可能崩溃。而在 MetaDAO 的价格带机制下,早期价格走势往往围绕一个明确区间波动,下跌幅度(wick-down)更浅,上涨泡沫(blow-off)也被限制在合理范围内。这是一种机制(mechanism),而不是承诺(promise)——如果市场需求不足,金库的储备最终仍会耗尽,但它能在最关键的初期几天内有效地塑造交易行为与市场预期。

最具代表性的案例是 Solana 隐私协议 Umbra。Umbra 的公募吸引了超过 10000 名参与者,该项目的销售吸引了超 1 万名参与者,认购金额突破 1.5 亿美元,销售页面实时公示了透明的大额认购数据,实现了完全透明的分配过程。这种实时透明、链上执行、机制驱动的分发体验,让人得以一窥更结构化的 IC0 未来。

对于所有参与 MetaDAO 发售的投资者而言,需要注意的是:

- 记下 IC0 价格,并了解对应的价格带范围。

- 当你在略高于 IC0 价位进行买入时,你的对手方可能就是资金库的卖方挂单;

- 当你在略低于 IC0 价位进行买入时,则可能会被资金库的买方机制自动接走。

总而言之,MetaDAO 奖励的是理解机制的理性参与者,而非追逐炒作的投机者。

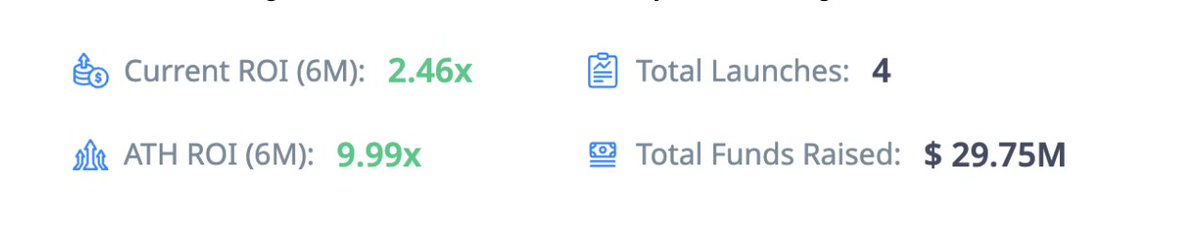

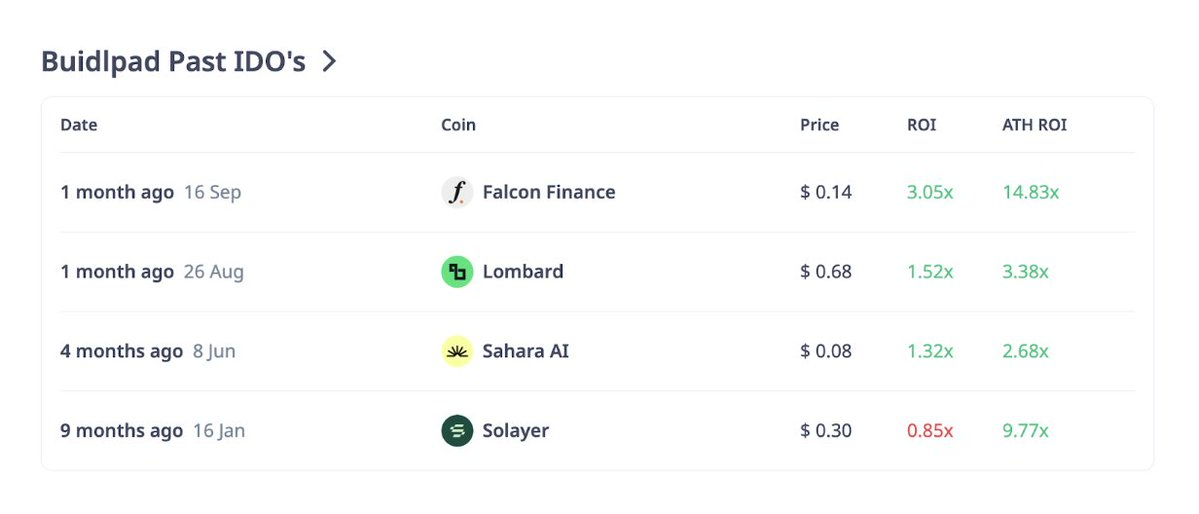

Buidlpad:面向大规模散户的 KYC 门槛式合规通道

Buidlpad 专注于一件简单却极具影响力的事情:为合规散户投资者(compliant retail)提供一个清晰、安全、透明的途径,参与社区轮(community rounds)代币发售。

Buidlpad 成立于 2024 年,其运作采用两阶段流程:首先用户完成KYC注册与认购登记;随后在注资窗口期内完成资金投入,若出现超额认购,超额部分将自动退款。部分发售会采用“分层 FDV”模型来调节市场需求:早期轮次拥有较低的 FDV(估值),后期轮次 FDV 会逐步提升。

Buidlpad 的里程碑时刻是今年 9 月的Falcon Finance(FF)发售。该场发售的目标融资金额为 400 万美元,最终获得 1.128 亿美元认购,超额认购倍数高达28倍。KYC审核在9月16日至19日进行,注资窗口为22日至23日,退款于26日前全部完成。整个流程顺畅透明,完全由散户力量驱动。

Buidlpad的核心优势在于其简洁性。它不采用复杂的评分机制或动态资金库模型,而是专注于为通过合规审核的社区提供结构化的参与通道。需要注意的是,流动性仍完全依赖发行方规划,碎片化的多链募集偶尔会导致售后交易量分散。

对于投资者,你需要注意的是:

- 严格关注时间节点:KYC/认购窗口是硬性门槛,错过即失去分配资格;

- 仔细阅读分层结构:早期层级通常能获得显著更优的估值起点。

跨平台模式与风险

纵览这些平台,可发现若干共同模式。

超额认购已成常态,但热度未必持久。Falcon 实现 28 倍超募、Plasma 获得了九位数资金热捧、Umbra 认购需求旺盛 —— 这些数据固然亮眼,但若缺乏持续用例,高企的FDV 往往在发售光环消退后出现价格回落。

机制设计塑造波动形态。MetaDAO 的买卖区间有效抑制了市场混乱,但同时也限制了价格在卖出区间附近的上涨空间;Echo 和 Buidlpad 完全依赖发行方自律;而 Legion 则依托交易所上市来提供流动性深度。

信誉体系重构分配规则。在 Legion 上,提前构建信誉评分可能决定你能否获得可观配额,还是只能在限额公售池中挣扎。

合规漏斗成为特色而非缺陷。KYC 窗口、合规资质切换与声誉评分机制筛选出了合格参与者。这使得销售过程更有序,但同时也加剧了阶层分化。

在这些现象背后,风险依然存在:评分系统可能被操纵,资金库管理可能失当,巨鲸仍可通过多钱包主导市场,监管执法也常落后于营销宣传。这些机制都不是万能解药,它们只是改变了博弈战场。

2025 年的精明投资者策略

若要在这波新的 IC0 浪潮中游刃有余,需要建立系统性思维。

- 在盲目追涨前厘清机制:固定价格还是拍卖?声誉优先还是纯先到先得?资金库护盘还是完全交由市场?

- 标记参与资格窗口期:KYC/认购截止时间、合规资质要求与地区限制 —— 错过时限将导致完全失去配额。

- 理解流动性设计:是 MetaDAO 的内嵌 LP 价格带机制?还是Kraken 的交易所级上线?或者是Echo Sonar 上发行方自定义的流动性策略?要记住,流动性往往会决定早期价格走势。

- 针对性布局:在 MetaDAO 上掌握价格区间;在 Legion 提前构建声誉;在 Buidlpad 瞄准早期层级;

- 保持头寸理性:超额认购不等于二级市场的强势 —— 应将其视为结构化投资机会,而非稳赚不赔的暴利交易。

作者观点

2025 年的 IC0 复兴不是怀旧情绪作祟,而是新基础设施、新规则与更自律市场共同作用的结果。

Echo、Legion、MetaDAO 和 Buidlpad 等平台各自修补了 2017 年模式的不同缺陷:有的专注合规框架,有的改进了分配机制,有的实现了流动性创新……它们共同推动着公开代币销售从投机踩踏事件转向“结构化资本形成”的进程。

对投资者而言,优势不再仅取决于“早期入场”,更取决于对运行机制的理解深度。因为在2025年,IC0 没有走向衰亡 —— 它们正在走向成熟。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。