随着加密行业的不断成熟,其基础设施日趋完善,技术叙事也向更底层、更细分的方向演进,新的应用、协议与代币层出不穷。与此同时,加密市场仍是波动性最大的市场,在这里我们依旧能见到山寨币单日上涨 1000%或者下跌 90%的情景。这种爆炸式发展又离资金最近的市场,也为身处其中的用户带来了显而易见的挑战:

- 信息壁垒:底层技术与项目机制日益复杂,非专业用户理解的门槛越来越高。

- 资讯过载:市场信息爆炸式增长,真伪难辨、良莠不齐,用户难以快速捕捉到主流叙事,并从中归纳出全局性、客观的判断。

- 需求分化:不同经验水平的用户需求差异显著。新手需要系统性的引导来快速入门甚至帮其进行决策,而老司机们则更需要能提升信息处理与决策效率的专业工具。

近期,各大头部交易所纷纷布局,推出了内嵌于其平台的 AI 产品,旨在为用户提供一站式的信息获取与决策辅助服务。

这些 AI 助手能否提供真实、可靠的信息,能否为用户提供具有 Alpha 价值的洞见?亦或者是仍在初期的概念性试水产品?它们在真实场景中的表现如何?为了验证这一问题,我们选取了三款上线已有一定时间的 AI 助手——币安的小安助手、Bitget 的 GetAgent、Bybit 的 TradeGPT,围绕 10 月 11 日加密市场的暴跌事件进行一轮深度测评,旨在探究其可用性。

信息过载时代的交易新解法

你是否曾有过,早上起来发现比特币大跌 1 万美元、山寨血流成河又一脸懵逼的情况?早期这种情况下,用户通常会查看 Odaily 等媒体或 X 平台上 KOL 写的行情分析及后市展望,而 AI 助手改变了这一局面,用户能够不受限于固定信源,更快地获取回答。但有一点核心差异——媒体的文章来自多重信源并有人工多方审核,质量、准确性和深度具有较高的保障,交易所 Crypto 助手能否达到同等的质量与准确性标准目前仍存疑。

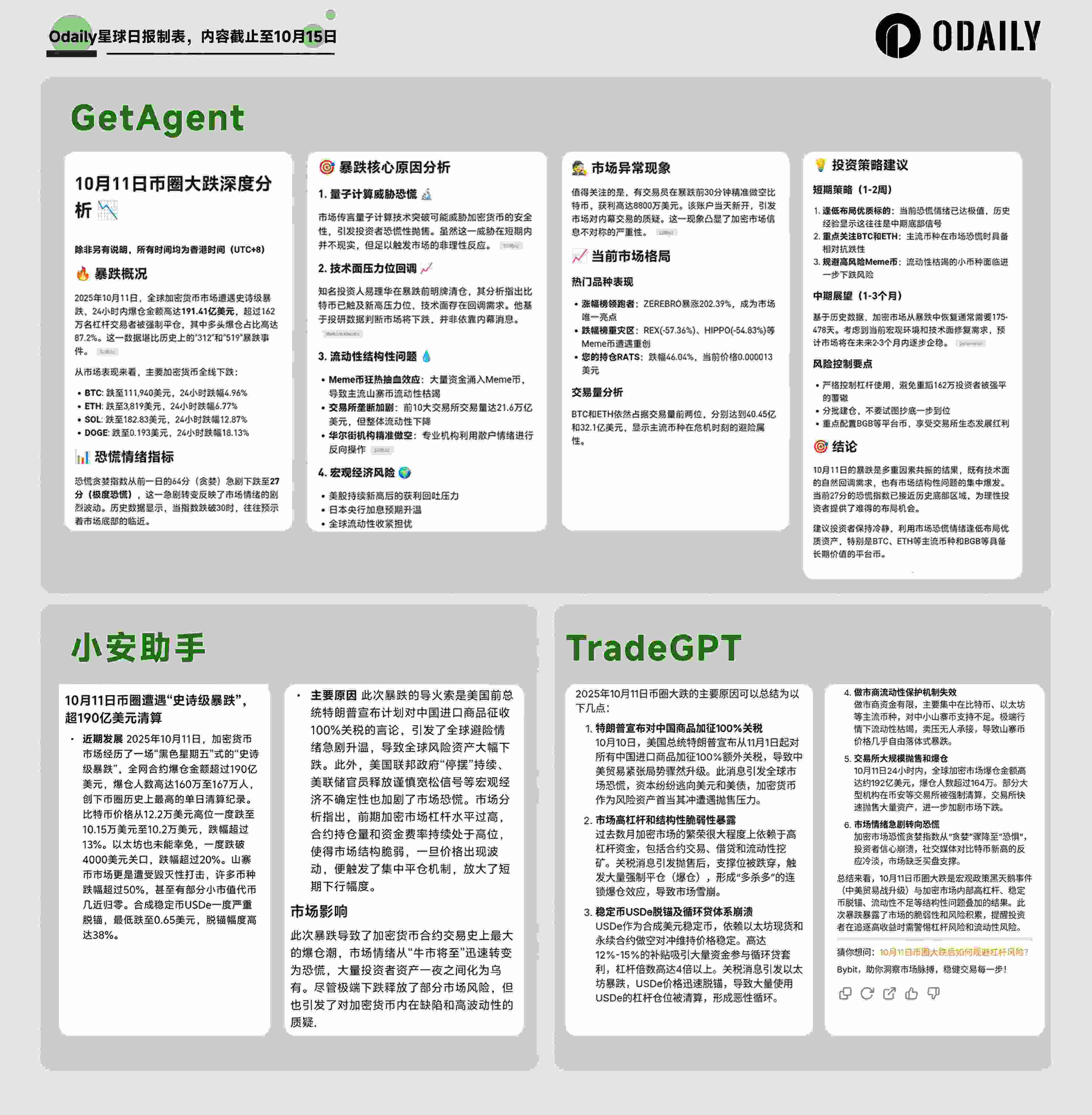

对此,首先我们先向三个 AI 抛出一个比较粗略的问题“10/11 币圈大跌的原因”进行测试,其回答如下图所示。

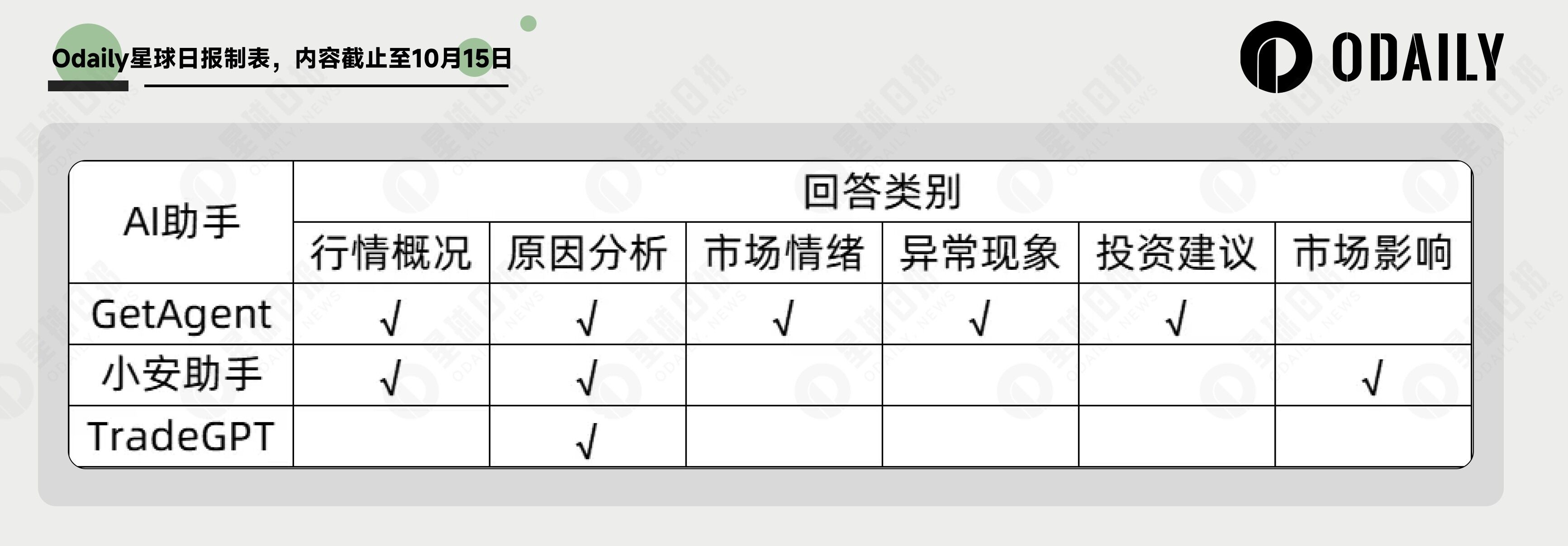

我们按照类别进行梳理,各 AI 回答类型如下

可见从类别上而言,三者从底层设计上就呈现出了巨大差异,GetAgent 为“召回导向型(Recall-oriented)”,其回答最为全面,自主发挥出了大量远超于用户要求的解答,对于想要一次性获取全部信息的用户最为便捷;而 TradeGPT 则完全符合“精确导向型(Precision-oriented)”,更倾向于在具体问题上进行深度的挖掘;小安助手则介于二者之间。

信息深度与差异化洞察

GetAgent 提出了一个其余 AI 没有提及的关键因素——”某内幕巨鲸在暴跌前 30 分钟精准做空 BTC,获利 8800 万美元“,该巨鲸精准的、疑似最核心的内幕操作,使其成为后市最应当关注的对象,对用户而言属于至关重要的信息,体现出 GetAgent 的巨鲸追踪和差异化洞察能力。

进一步地,我们向小安助手和 TradeGPT 提问 GetAgent 所提供的标题“当日是否有什么市场异常现象”,小安助手在回答中提及了该内幕巨鲸,而 TradeGPT 在该回答下没有提及,仅有当指向性明确地提问“是否有疑似内幕的操作”,它才指明了该巨鲸的存在。

综上,各 AI 在提供信息方面存在非常明显的差异化:

GetAgent 旨在成为一站式助手,完成从是什么、为什么到怎么做的全链路闭环,交由用户根据需要选择对应的信息和方案;而 TradeGPT 则最为聚焦,只回答用户问题最核心的部分,绝不会进行二次延伸,需要用户有能够精准判断关键问题的能力,而小安助手则介于二者之间。

从“是什么”到“如何交易”:Alpha 洞见评测

明确发生了什么之后,用户更关心的是后市如何操作,在 GetAgent 大而全的第一版回答中已经提供了短期和中期的操作指南:

短期策略(1-2 周) 逢低布局优质标的:当前恐慌情绪已达极值,历史经验显示这往往是中期底部信号 重点关注 BTC 和 ETH:主流币种在市场恐慌时具备相对抗跌性 规避高风险 Meme 币:流动性枯竭的小币种面临进一步下跌风险。中期展望(1-3 个月) 基于历史数据,加密市场从暴跌中恢复通常需要 175-478 天。考虑到当前宏观环境和技术面修复需求,预计市场将在未来 2-3 个月内逐步企稳。

同样地,向小安助手和 TradeGPT 提问“分析短期和中期操作策略”,得到答案如下:

小安助手: 当前市场情绪处于“恐惧”状态,市场广度极差,多数币种下跌。机构资金方面,比特币 ETF 在经历连续多日的大额流入后,于 10 月 10 日出现小幅流出,而以太坊 ETF 则出现显著净流出。这表明市场短期内可能面临下行压力,机构资金的谨慎态度值得关注。投资者在制定中期和短期策略时,应充分考虑当前的市场情绪和机构资金流向,警惕潜在的市场回调风险。

TradeGPT: 1.控制仓位,降低杠杆:当前市场波动剧烈,建议降低杠杆倍数,避免高杠杆带来的爆仓风险。Bybit 支持多档风险限额,合理控制仓位规模,防止被强制平仓。2.关注关键支撑位和阻力位技术面上,关注比特币 10 万美元、以太坊 3000 美元等关键支撑位,若价格企稳可考虑低吸;若跌破则谨慎观望或做空。 3.避免追涨杀跌

GetAgent 的特色主要在于其严格遵循”普适规律-对应策略“给到用户操作建议,交易期望为正,更给出了不同时间周期下的方案,帮助不同交易风格的读者明确对应时间下的操作方向,具备不模糊、意见非常明确的特点。

小安助手的回答更多停留在信息复述层面。它详细罗列了 ETF 流向与市场广度等往期数据,但这些历史资讯更多地是”下跌“的伴生数据,只要大幅下跌则必然发生,往往不能作为市场的前瞻基准。

TradeGPT 则回复了一种模糊的双向答案,给出涨了做多跌了做空的策略,属于中规中矩但价值不足的“安全回答”。

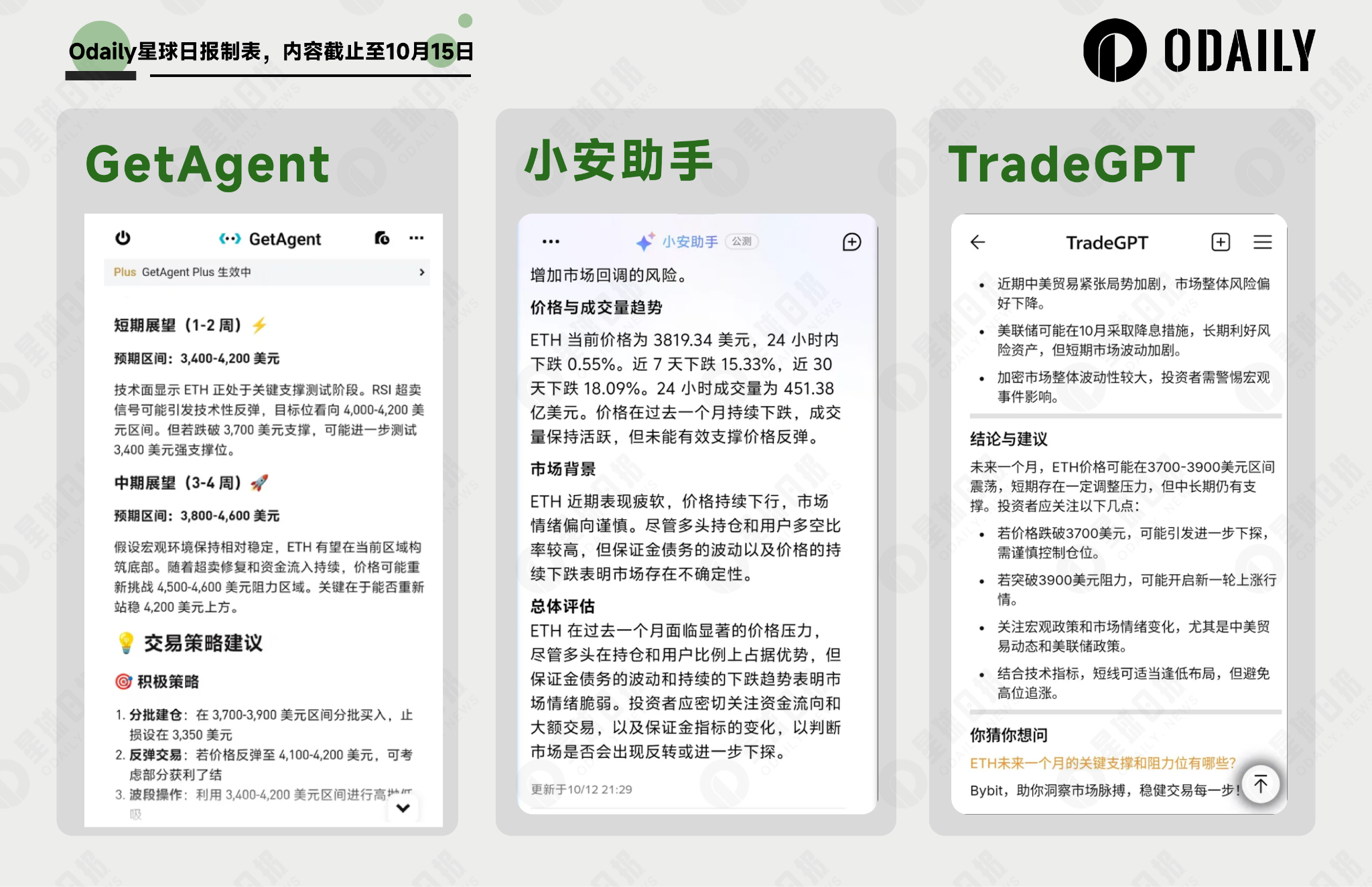

二次测试:ETH 后市如何?

为了进一步探究三个 AI 的回答风格,我们向其提问“预测 ETH 未来一个月的走势”,三个 AI 的回复如下图所示。

GetAgent 再次给出了明确的点位,但判断基准由普适规律变为了技术分析,并且同样转变为双向方案,但差异在于 GetAgent 给出了更为明确的交易指引,包括分批抄底区间、明确的止盈区间等详细方案;小安助手则再次复述了大量历史数据,但没有具体的操作指引;而 TradeGPT 则再次给到了“压力位-支撑位”的多空双向方案。

以上问题的提问在 10 月 12 日反弹之前所进行,彼时 ETH 价格约为 3820 美元,截至发文时 ETH 最高触及 4280 美元后回落,并在 4000 美元-4200 美元价格之间来回震荡,已有 10%左右正向收益,验证了 GetAgent 策略的可靠性。

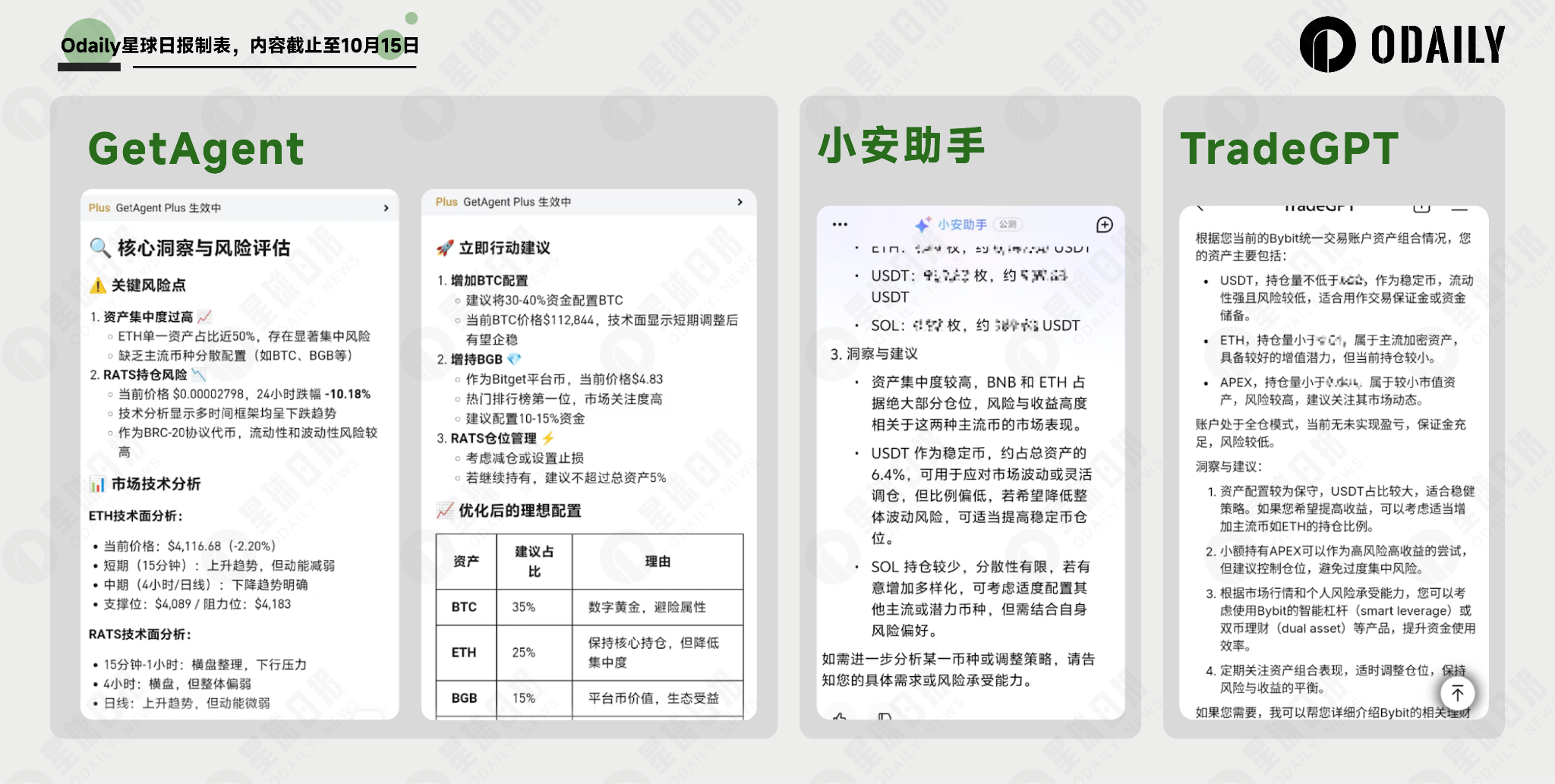

“我”该怎么做

交易策略不止在客观角度存在差异,例如交易周期长短、止盈止损策略,在主观视角上也“千人千面”,每个人都有其风险偏好和不同的仓位配置需求。在价位策略的基础上若能根据个人账户情况给出建议,则能进一步地实证 AI 助手的可用性与可靠性。对此,我们向 AI 提问“分析我当前资产组合,提出洞察和建议”:

GetAgent 分析出了账户配置不平衡、哪些代币为弱势代币已不建议持有等问题,从而给出明确且可执行的操作指令,并在最后附上了配置理由,为用户提供了清晰的长期调仓目标。

小安助手的回复则更多停留在观察层面。 它同样识别出了资产集中的问题,但给出的建议却相对笼统,建议虽然正确,但缺乏具体的指导,用户仍需自行判断“适当”是多少以及该配置哪些“潜力币种”,未能有效降低用户的决策门槛。

TradeGPT 在交易层面依旧呈现出了“打太极”的风格,“ETH 有潜力”、“想赚钱得把 USDT 换成 ETH”属于正确的废话,在当下用户自然明确 ETH 仍具有长期增值潜力,但用户更希望了解当前还能不能买、应该买多少,而非给“我”一个长期一定对但永远不知道何时兑现的内容。

结论

我们可以得出结论:交易所内置的 AI 助手在信息处理和提供 Alpha 洞见方面具备了相当的可用性。

对于入门用户而言,这些工具能够快速整合复杂事件的多方资讯,并给出结构化的分析,极大地降低了信息获取与理解的门槛。而对于经验丰富的交易者,AI 助手能够帮助其快速发现巨鲸异常动向、提供有价值的交易参考方案,进一步提升其效率与 Alpha 水准。

无论是希望快速跟上市场节奏的新手,还是寻求高效工具的老手,这些日益成熟的 AI 助手都值得一试,它们已成为辅助交易决策的有力工具。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。